ESG has attracted trillions of dollars in investments. But performances have not quite followed through this year amid the difficult market environment, energy sector outperformance, and tech underperformance. What does this tell us about ESG?

Environmental, social, and governance (ESG) factors are non-financial factors that are applied to the investment analysis process. ESG relevance has increased over recent years with many firms aiming to achieve higher ESG scores, in part to satisfy investors.

Market participants have piled into ESG investments in the last few years, with global ESG assets in the ETF fund industry alone accounting for USD378 billion. And according to Bloomberg Intelligence, total ESG assets including debt markets should reach around USD41 trillion this year.

ESG investors argue that those companies doing well in ESG criteria tend to be leaders and ESG exclusion avoids being caught up invested in companies that have questionable ways of doing business, which could turn into scandals or bankruptcies.

In practice, ESG investors exclude many companies, mostly those in sectors that are damaging to the environment such as oil and gas. But not only. For instance, Tesla; a leader in electric vehicles and whose mission is to accelerate the world's transition to sustainable energy saw itself removed from the S&P 500’s ESG index earlier this year, mostly because of ‘business conduct’. Tesla CEO Elon Musk certainly disagrees and called ESG ‘evil’. In an odd twist for ESG, the oil and gas giant Exxon Mobil replaced Tesla.

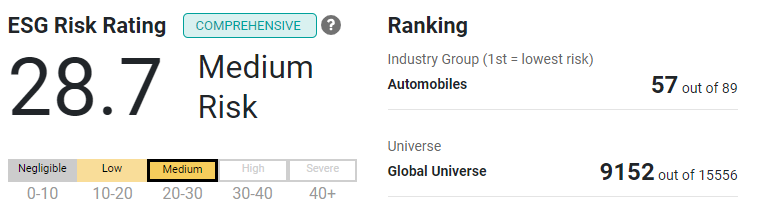

Tesla’s ESG rating, as of 1st December 2022.

Source: www.sustainalytics.com

Penalised by energy sector outperformance

The war in Ukraine has sent energy prices higher this year, helping companies in oil & gas perform very well, much better than the rest of the market.

This sector exclusion, weighing against ESG, is also reinforced by the underperformance of technology names, which are highly represented in ESG. Tech names trading at high valuations have been hit hard this year as they are particularly sensitive to rising interest rates and to a slowing global economy.

Drawbacks of ESG

Furthermore, in addition to charging higher fees, ESG funds often closely ‘mirror’ standard leading indexes. Small caps are often also underrepresented or may miss significant ‘winners’ as smaller companies sometimes do not have sufficient means for ESG reporting.

Another challenge is the potential for "greenwashing," where companies exaggerate or misrepresent their ESG practices to appear more attractive to investors. This can create confusion and make it difficult for investors to differentiate between truly sustainable companies and those that are simply trying to capitalize on the popularity of ESG investing.

While today the leading market-cap-based US indices are largely represented by technology names and less so by energy, ESG introduces the same risks of not being sufficiently diversified. And this year has clearly put ESG in question. Whether scoring high on an ‘ESG’ criteria front makes a company worthy to take a significant part of a portfolio.

While there are no ‘correct’ answers, today ESG answers to investors demanding companies apply certain business standards and reporting, but one cannot change the fact that the transition to lower carbon emissions will take time, and energy companies, amongst others ESG exclusions, could still be worthy investments that could outperform as they are brushed aside by most investors.

Despite these challenges, ESG investing remains a powerful tool for investors who want to align their investments with their values and positively impact the world. By focusing on environmental, social, and governance factors, investors can identify companies that are committed to sustainability and long-term growth, and can potentially earn financial rewards for their efforts.

Going a step further, besides applying ESG filters to investments, strategies that are particularly aimed at investing in companies directly involved in the energy transition area should have more merit from an environmental standpoint. Particularly those companies developing technologies that contribute to significantly reducing carbon emissions.

Conclusion

The spike in energy prices since the start of the war in Ukraine in February 2022 should serve as a wake-up call that ESG criteria may also introduce too much sector concentration risk. Furthermore, ESG investments proceed by ‘excluding’ certain companies and going a step further, picking companies developing technology to fuel the energy transition area away from carbon emissions could be more relevant in making a difference and potentially deliver investment returns.