As you might have noticed, IPOs are booming everywhere around the globe. Everywhere, aside from Europe.

Not a great year for the old continent

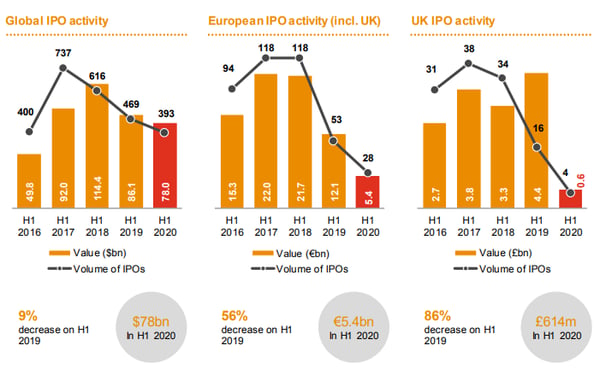

Numbers speak for themselves: the total amount raised by European companies listing on the stock market fell by a third in the first nine months of the year, whereas Asia and the US have had many companies that succeeded in capitalizing on a market change through Covid-19. This fits the predictions from Swetha Gopinath in a Bloomberg article dating from march, where she stated that the Europe IPO market was expected to remain shut for the next 6 months. “The earliest IPO window, as things stand, is in September, if not 2021,” said Fabian de Smet, global head of equity syndicate at Berenberg.

"Recent IPOs in Europe have demonstrated the real scarcity value attached to high quality tech issuers in EMEA: there is a structural underweight in the region," said James Palmer, head of EMEA Equity Capital Markets (ECM) at Bank of America. "The more fundamental issue for the EMEA IPO market versus the U.S. is the latter's appetite for smaller issuers and deal sizes, which is particularly relevant for many tech and biotech issuers," Palmer added.

Source: PWC IPO Watch Europe

The global picture

In total, it is $120 billion that have been raised globally up until yesterday. This is the highest we have seen for the period in two years. This appetite for equities was fuelled by extremely low interest rates as well as various stimulus measures led by the central banks. In terms of fees for bankers, this translated into a little over $8.43 billion. We haven’t seen a better “first nine months” since 2007. Out of these $8.43 billion, almost half can be attributed to the US, who can proudly show off with a good $4.2 billion contribution, their all time high.

The Americas in general have seen a 13% funds increase, while Asia almost doubled as they surged 75%. Europe, however, is barely hitting the $9 billion bar, their lowest amount since 2012 according to Refinitv.

The big stories

As you may have read in some of our previous articles, we’ve talked about many different IPOs, some of which are raising very impressive amounts. Snowflake, a data-warehouse company backed by no other than the famous Warren Buffett, raised over $3 billion, setting itself in first position as the largest US listing of the year. Its value doubled on its market debut.

On the Asian side of the world, Ant Group could potentially steal the record for the largest IPO from Saudi Aramco: their IPO had raised over $26 billion, while Ant Group is currently aiming to raise $35 billion. For those who do not recall, Ant Group is the fintech arm of e-commerce Giant Alibaba, founded by billionaire Jack Ma.

Europe, as stated above, is far behind. There are only a handful of companies who successfully carried out their IPO. The top IPOs for each market were JDE Peet’s NV on Euronext for €2.6 billion; GVS SpA on the Borsa Italia for €571 million; Pexip Holding ASA on the Oslo Bors for €216 million; Calisen plc on the London Stock Exchange for €398 million; Musti Group Oyj on the Nasdaq Nordic for €182 million and Nacon Gaming SA on Euronext for €100 million. “Q1 and Q2 2020 saw 14 deals per period raising a total of €5.4bn compared to €12.2bn in H1 2019, which itself saw a low level of volume compared to previous years,” said PWC in their half year review about European IPOs.

Final words

We need to see if Europe will be able to get up to speed with other continents, but we can hardly expect this before 2021.

"Equity markets have been incredibly supportive of companies that have raised money on the front foot and those who have raised defensively as well, and rewarded proactivity," said Aloke Gupte, co-head of EMEA ECM at JP Morgan. He also said that we could expect even more IPOs and rights issue throughout 2021, despite the potential for a high volatility.

Sources:

https://fese.eu/app/uploads/2020/03/European-IPO-Report-2020.pdf

https://www.investing.com/news/stock-market-news/europe-lags-a-resurgent-global-ipo-market-2312811

https://www.pwc.co.uk/audit-assurance/assets/pdf/ipo-watch-europe-q2-2020.pdf

Read our next article: A Brexit game of chicken