Using a CFD can be of benefit when stock markets are falling? There are two choices: buy something that rises when other markets fall or go short.

Using CFDs to go short

Sometimes When markets are falling, there is just nothing worth buying. An old saying in trading goes “Don’t try to catch a falling knife.” It means stocks that are falling fast can quickly fall below your order to buy.

“Don’t try to catch a falling knife”

Traditionally in the stock market, investors will buy stocks and only make a profit when shares go up, this is known taking a long position. A benefit of trading CFDs is that they allow you to speculate on both rising and falling markets.

Traders can take a short (sell) position where they will sell a CFD with the hopes of making a profit when the price of the CFD falls. The CFD could for a forex pair, equity index commodity or any other asset class.

This provides additional trading opportunities because you can profit both from buying (going long) and from selling financial instruments.

Does it cost more to go short a CFD?

The cost of selling a CFD is almost identical to the cost of buying a CFD. The spread for a CFD is the same whether the trader goes long or short. The cost that will vary is the swap, which the trader will pay or sometimes receive when holding the CFD position overnight.

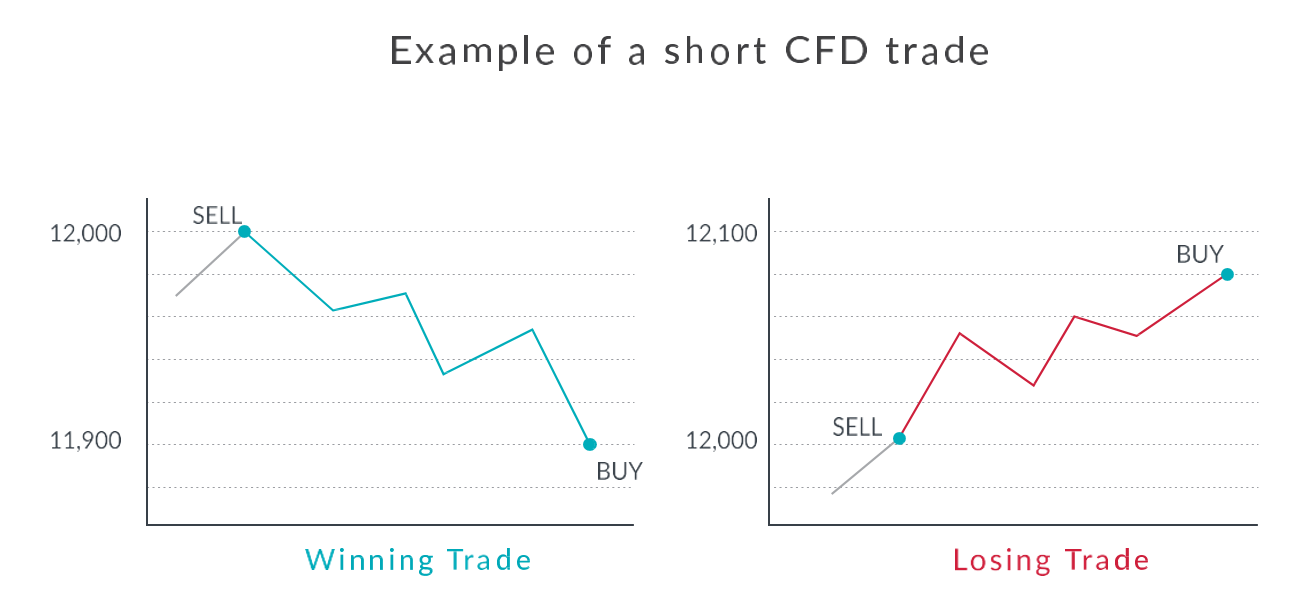

Example short CFD trade

You sell 0.5 CFDs of the ‘Germany 30’ index at €12,000. Each CFD is worth 10 times the index rice so the size of your trade is €60,000. If the price falls €100 to €11,900, and you close the trade, you make €500 in profit. If however, you sell 5 CFDs of ‘Germany 30’ at €12,000 and the price rises by 100 points, once you close the trade, you would lose €500.

Execute orders to go short

A short trade has the same options for a long trade in terms of order types. A short-seller can use a market order to sell but oftentimes the most appropriate is a stop order. This means when the price falls below a certain level on the CFD, the short trade would be automatically executed.

Hedging by shorting a CFD

Another reason to want to go short a CFDs is to hedge against your real stock portfolio going down. Since a short trades makes money by going short - this can offset the losses that would be experienced in the real portfolio.

When the stocks you own are falling - perhaps as the stock market falls into a bear market - then there is the option to go short index CFDs. Indices include things like the Swiss Market Index (SMI) or the S&P 500 Index. Although the index will not perfect match your portfolio of stocks, it will offer a partial hedge. The other more time-consuming choice to hedge your portfolio is to go short stock CFDs. For exmaple if you own Tesla stock, you can go short a Tesla stock CFD.

NOTE: Novice traders should be warry of using hedging because it is a tempting alternative to taking a loss on a losing postion, which is not being a disciplined trader or using proper money management.

What are the risks to going short CFDs?

It’s important to understand that when you buy an investment (go long) the worst thing that can happen is the investment goes to zero - becomes worthless. When you sell something (go short) the value of the investment can in theory go up infinitely, meaning your potential losses are infinite.

There is additional risk when going either long or short a CFD because it is a derrivative that is traded on margin using leverage. Leverage means the trader can use a small deposit to start trading but does not have 100% of the capital to cover the trade. This increases the risk that the trader can lose the entire balance from a smaller balance.

It is for this reason that going short should only be done with sound money management rules including a pre-defined exit strategy.

Read our next article: Palantir IPO & Presidential debate