BlackSky joins the club of space companies that are going public via SPAC. The service proposes a complete way to monitor operations on Earth, combining satellite imagery, on-land news and data, in order to bring information between the hands of decisions makers as fast as possible.

Key takeaways

- BlackSky, a Seattle-based satellite imagery start-up, will soon begin trading on public markets after a SPAC merger with Osprey Technology, currently trading on the NYSE under the ticker “SFTW”.

- The merged company will trade on the NYSE under the ticker “BKSY”.

- The total addressable market for BlackSky is $40 billion.

- Revenues in 2020 were $22 million with large growth figures forecasting $500 million in 2025.

- Revenue margins are set to grow at a higher rate than competitors, but net income and profit margins will need more time to surpass peers.

- Long term deals and contracts represent $1.7 billion putting BlackSky in shotgun position for more success with the US government and other groups like Virgin, BlueMoon, and SpaceX.

What is BlackSky?

BlackSky is a space start-up that specializes in satellite imagery and on-demand intelligence offering. Their technology combines a global monitoring of Earth’s surface, combining state-of-the-art artificial intelligence, cloud computing, multi-sensor data fusion and autonomous satellite tasking in order to rapidly get crucial information between the hands of decision-makers.

The service combines an intuitive interface that can be used on your desktop or smartphone, with the ability to manage your collection of images and data in a few clicks. For more elaborate requests, BlackSky provides high-quality monitoring augmented with powerful data sets to get a complete view of your area of interest.

The service can be used for multiple applications, like detecting key objects in critical locations such as ports, airports and construction sites. It helps companies quickly detect, identify and measure changes, damages, anomalies and perform stockpile analysis. The imagery is combined with a live analysis of mainstream and local news, financial and industry publications. With the help of artificial intelligence, machine learning and natural language processing, companies can detect meaningful signals and threats, send alerts and automatic warnings.

In other terms, the company gives you a complete vision on your operations, and make sure to process imagery and data so that managers can see and know everything in a timely manner. It has applications in government defence and intelligence; commercial construction and industrial ventures; catastrophe, climate and environmental threats detection and management.

Financials: rocket launch in 3, 2, 1...

Shares of Osprey Technology SPAC rose more than 25% in premarket trading today going from $10.95 to $13.74. The firms said the deal gives a combined equity value of nearly $1.5 billion and will provide $450 million in net proceeds. The companies said BlackSky’s shareholders will own roughly 62.6% of the combined company upon completion of the deal, a deal expected for July. Osprey raised around $300 million in an IPO in October.

For a start-up of 137 employees, revenues of $22 million dollars in 2020 are not bad. Sales are set to double in 2021 and reach half a billion by 2025. The legacy satellite imagery technology has large costs with estimated monthly costs for daily imagery collections of $120,000. BlackSky brings these figures down to $12,000. The group leverages AI and network sensor data tools to generate proprietary applications and small-sat mission software which enables scaling and falling costs. Its AI and machine learning software deliver event detection, computer vision, routing predictions, and time series analysis for a variety of applications and sectors.

Imagery represents the largest share of revenues at 64%, followed by 33% for data and 3% for engineering integrations. So far, revenues have been positive figures, and 2019 saw 21% gross profit margins. Net income is however projected to be negative for a couple more years. 2020 was a year of transformation with more costs incurred from growth, so margins were negative but are now projected to rise again in 2022. Compared to peers, BlackSky shows much more attractive revenue growth prospects putting the likes of Palantir, Datadog, and Splunk to shame in comparison.

Business operations and prospects: the sky is the limit...

The investment thesis as seen the attached SEC 8-K investor presentation includes several points. BlackSky is a high growth technology company disrupting the market for geospatial imagery and space-based data and analysis. The firm is a first mover in a new category with a massive total addressable market of around $40B. Low-cost data capture and on demand delivery analytics unlocks new commercial markets. Near term financial profile is supported by $1.7B in sales from long term contracts.

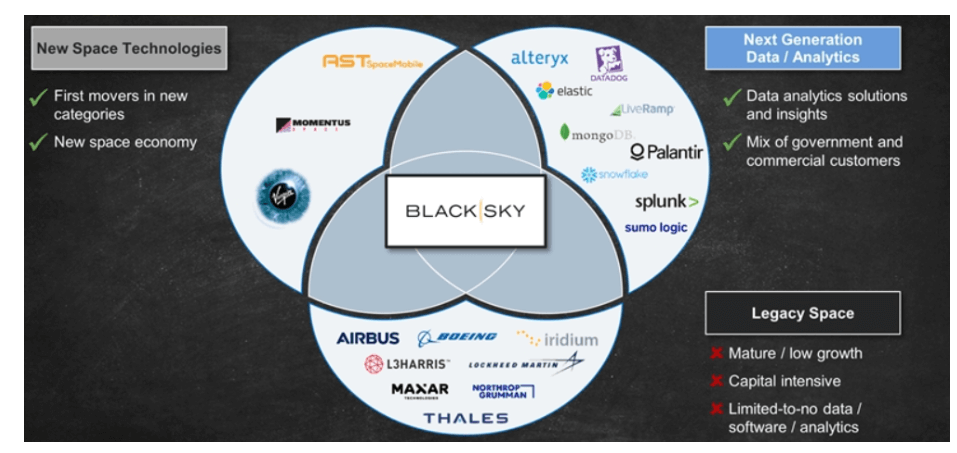

In terms of space data and analytics, Black Sky represents a dominant force in supplying orbital satellite launches and space-based communication sectors. The firm has valuable relationships with the U.S. Government with their imagery technology, the US Air Force with data and the US Army with engineering integrations. But these contracts only represent one piece of the pie. BlackSky is well positioned between legacy and growth programs and can help improve many storefronts as shown in the van diagram below. BlackSky is positioning itself to become a household name that many strong performers will want to associate with.

Final words...

BlackSky is the latest of a series of space companies that have announced an entrance in public markets through a SPAC, such as rocket builder Astra Space, satellite broadband AST & Science and space transportation specialist Momentus.

The company also joins the club of massively data driven services such as Palantir which allow users to have a global overview on their operations without missing a thing. In the end, failures and malfunctions will always happen, but they will be detected and dealt with faster than ever. Yet another step towards ultimately efficient projects.