As vaccines are rolling out and social distancing measures are loosening up, the economy is getting back on track. However, we have rarely seen such a quick recovery, and many companies struggle to adapt to the new cruising speed.

Key takeaways

- The demand for good is high, thanks to a global economic recovery, fueled by vaccine rollouts, stimulus packages and important savings.

- Many factories drastically reduced their production capacity, making them unable to face growing demand.

- Semiconductors are still the major global shortage, but the issue is becoming ubiquitous.

- Delivery times lengthen and prices surge.

- Economists believe that this disruption should ease and not affect the global economic recovery.

Rising consumers demand

We can start with good news: markets are recovering, with a demand that is expected to grow, especially from the US. The vaccine campaign is very successful in the US, with well over 100 million shots administered.

At the same time, the $1.9 trillion stimulus package issued by the government, adding to important accumulated savings, has made sure that the average consumer has money to spend and to inject in the real economy, directly or indirectly.

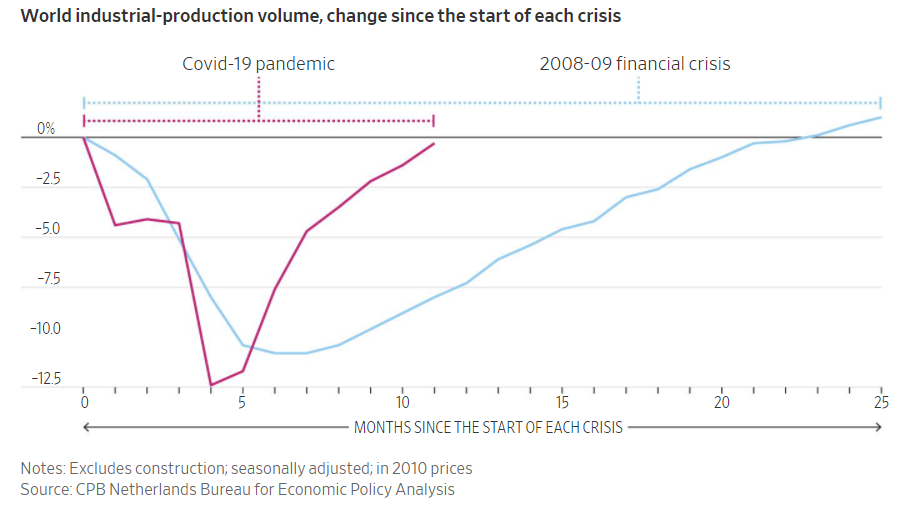

But there is one big issue: companies had to tune down production and deliveries all over the world during the pandemic. And the recovery might not happen as seamlessly as expected. Not because the economic outlook is not promising, but because we are recovering very fast, much faster than after the last major financial crisis, as you can see it on the chart below. Unlike in 2008-2009, the crisis is accompanied by a strong demand for home office equipment and other goods.

The economic recovery from the Covid-19 crisis is much faster than for the 2008 crisis (Source: WSJ, Netherland Bureau of Economics)

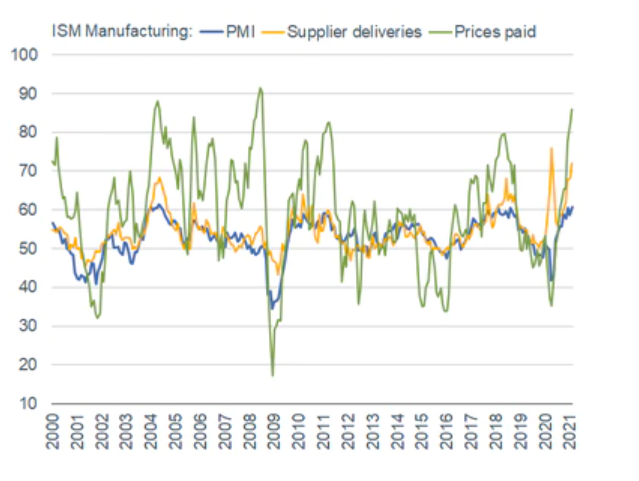

While the Supply Management’s Manufacturing purchasing manager index (PMI) has remained in expansionary territory up until now, Charles Schwab’s analysts believe that we should not see a long-lasting surge in demand, especially for goods – services will be a different subject. To their opinion, the demand is high but should not explode further. It is also likely that consumers adopted more conservative and prudent habits.

Strong manufacturing sentiment, despite supply chain issues (Source: Charles Schwab)

Who cannot keep up the rhythm?

Many orders from Chinese manufactories that were usually delivered in under 30 days can take up to three months. At the same time, shipping companies are overloaded, and shipping costs are rising by as much as 50%.

Indeed, the demand for electronic goods and toys for example, has sharply risen with families staying home, needing supply both to work and entertain kids.

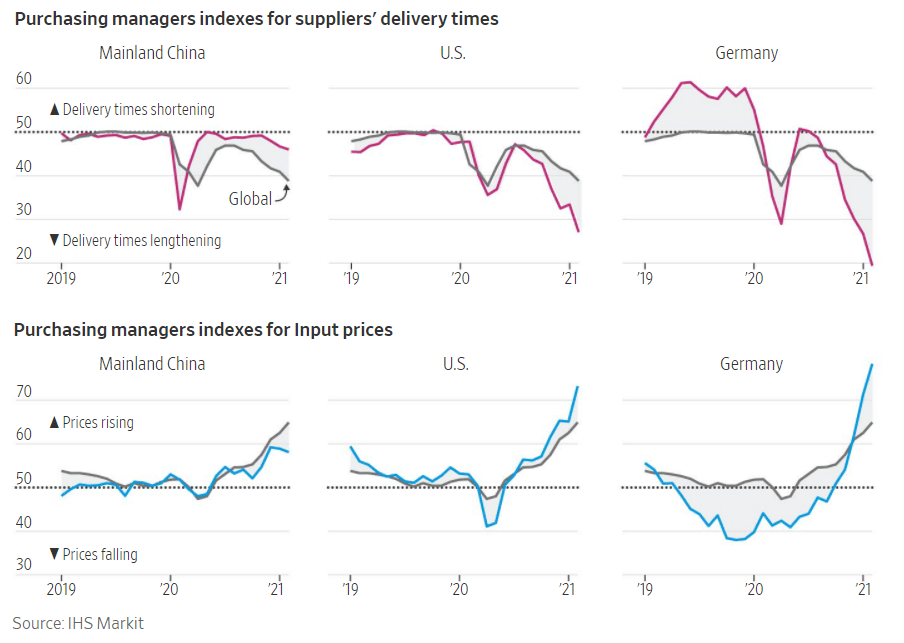

The most affected is the semiconductors industry, which in turn impairs automobile and consumers electronics manufacturers. But today, the lengthened delivery times we experienced in this sector are becoming near ubiquitous, affecting the broader part of the market.

Oil supply is scarce, with a price per barrel ($60) that has reached pre-pandemic level and OPEC deciding to react to rather than to anticipate demand. Copper rose above $9,000 per metric ton, its highest price in 9 years. Both commodity prices are pushed up, as supply is expected to remain at the same level against a rising demand.

There aren't enough commodities for production, companies don’t produce enough goods and fail to ship them fast enough to satisfy consumers demand.

As you can see on the following chart, delivery times are rising, and with them, so do prices,, hence creating a risk of inflation.

Purchasing managers index and their effect on prices and delivery delays (Source: WSJ, IHS Markit)

Consequences of bottlenecks

Policy makers and economists suggest that the supply-chain squeeze might encourage manufacturers to bring back the production of some goods locally, for a better control of their supply chain. However, little of this move has been observed so far, as oversee manufacturing remains a far less costly mean of production.

Thankfully, most economists do not estimate that the shortages will be a major issue for the long-term recovery, as we can already see signs of rebounds, even amongst German car manufacturers. Nevertheless, a strong surge in demand is impairing shorter term operations, during this time of transition from a sleeping economy to a normal one.

The different shortages – especially semiconductors – should ease with time as countries loosen up their pandemic-related restrictions, with people returning to more regular work and education life patterns, which should ease the demand for consumers electronics.

We have seen this with Soosan CMC Co, a South company making disinfectant product such as antibacterial spray. They had always worked with only one bottle spray partner but had to search for new partners abroad as they suddenly did not have enough bottles for the liquid they produced. Today, they are back working with only one supplier. This path back to normality is the one economists and policy makers expect for the largest part of our economy.

In the short term however, some industries might win, others lose:

How to play it

- Freight transport companies and ETF

- Semiconductors companies and ETF

- Commodities