The US debt limit agreement and worries of another Fed interest rate hike are the main focus of markets.

Markets overview

President Biden and House Speaker Kevin McCarthy struck a preliminary agreement over the debt ceiling raise in a phone conversation over the weekend and expressed optimism that the deal could pass in Congress.

Investors are now preparing for a June interest rate hike by the Federal Reserve. After personal consumption index (PCE) inflation statistics surprised to the upside last week, and after allaying worries of a default in the world's biggest economy, implied probabilities indicate to a 60% likelihood of a further increase from 25 basis points in the fed funds rate in June.

Fed members are once again delivering hawkish comments, indicating a greater likelihood of a June rate hike and the need to keep rates elevated for longer.

In all of this, the US dollar emerged as a major winner in the foreign exchange market, with the DXY index reaching a 10-week high.

We predicted this trend with perfect timing in the trades we initiated in recent weeks, and we feel now is the moment to ride it as uncertainties over the path of interest rates have resumed.

This week's main economic events are as follows:

- US Non Farm payrolls (Friday) - previous 253k, consensus 195k.

- US Unemployment Rate (Friday) - previous 3.4%, consensus 3.5%.

- US ISM Manufacturing PMI (Thursday) – previous 47.1, consensus 47

- Fed’s Bowman, Harker, Jefferson speech (Wednesday)

- Euro Area Inflation Rate (Thursday) - previous 7%, consensus 6.3%.

- Germany Inflation Rate (Wednesday) – previous 7.2%, consensus 6.5%.

- Germany Retail Sales (Thursday) – previous -2.4% m/m, consensus +1%.

- China Caixin Manufacturing PMI (Wednesday) - previous 49.5, consensus 49.5.

- Japan Consumer Confidence (Wednesday) – previous 35.4, consensus 36.1.

Open trades from past weeks:

- Long DXY index: Opened on May 23, at 103.5; Target Price 106; Stop Loss 102.17; P&L current +1%

- Short AUD/USD: Opened on May 16, at 0.6690; Target Price 0.636; Stop Loss 0.6825; P&L current +2.2%.

- Short XAG/USD: Opened on May 16, at $23.88; Target Price $22; Stop Loss $24.9; P&L current +3%.

- Long WTI spot: Opened on May 16 at $70.8; Target Price $80; Stop Loss $66.3;

P&L current +1.6%.

- Short GBP/USD: Opened on May 8, at 1.2654, Target Price 1.227; Stop Loss 1.30; P&L current +2.3%

- Long EUR/JPY: Opened on May 8, at 149.16, Target Price 160; Stop Loss 142; P&L current +0.6%

- Long CAD/JPY: Opened on May 1, at 100.89; Target Price 104.3; Stop Loss 98.05; P&L current +2.4%.

Orders:

- Order Long XAU/USD: Open at 1,900; Target Price 2,100; Stop Loss 1,830

Closed trades:

- Long USD/JPY: Opened on April 24, at 134.35; Target Price 138; Stop Loss 132.5; Profit +2.7%. Reason: Target price hit.

- Short EUR/USD: Opened on April 24, at 1.0982; Target Price 1.07; Stop Loss 1.11; Profit +2.6%. Reason: Target price hit.

- Long CAD/NZD: Opened on May 8, at 1.1803, Target Price 1.215; Stop Loss 1.165; Profit +3.6%. Reason: Target price hit.

New Trades for the week

EUR/USD Trading Strategy: Bears Take Control

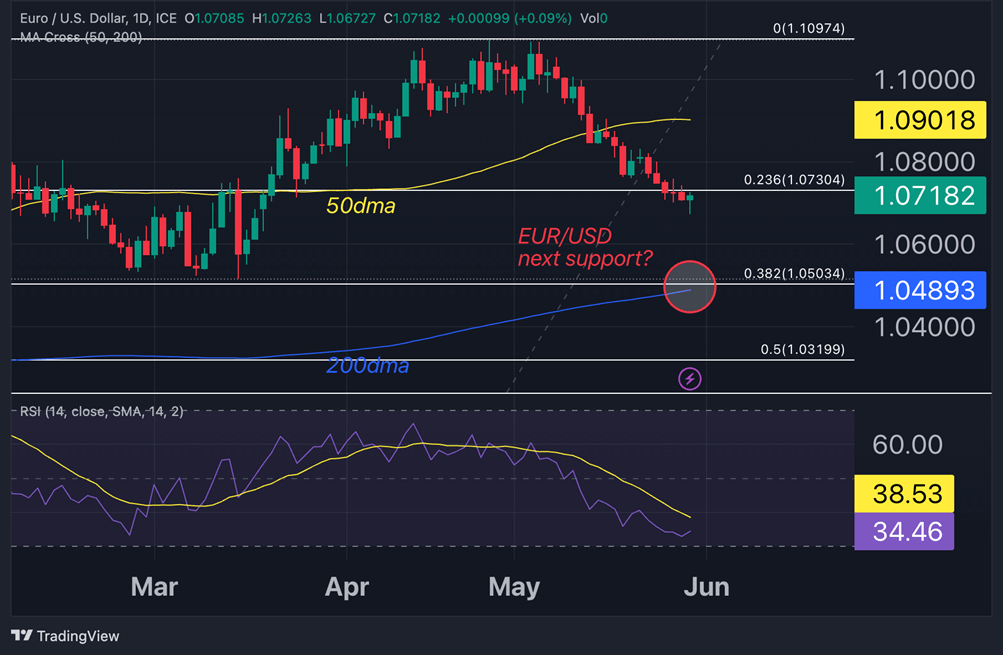

Short EUR/USD: Opened at 1.0717; Take Profit 1.05; Stop Loss 1.083; Risk-reward-ratio of 1.6

EUR/USD is in a short-term downtrend and is on track to fall for its fifth straight session for the first time since February.

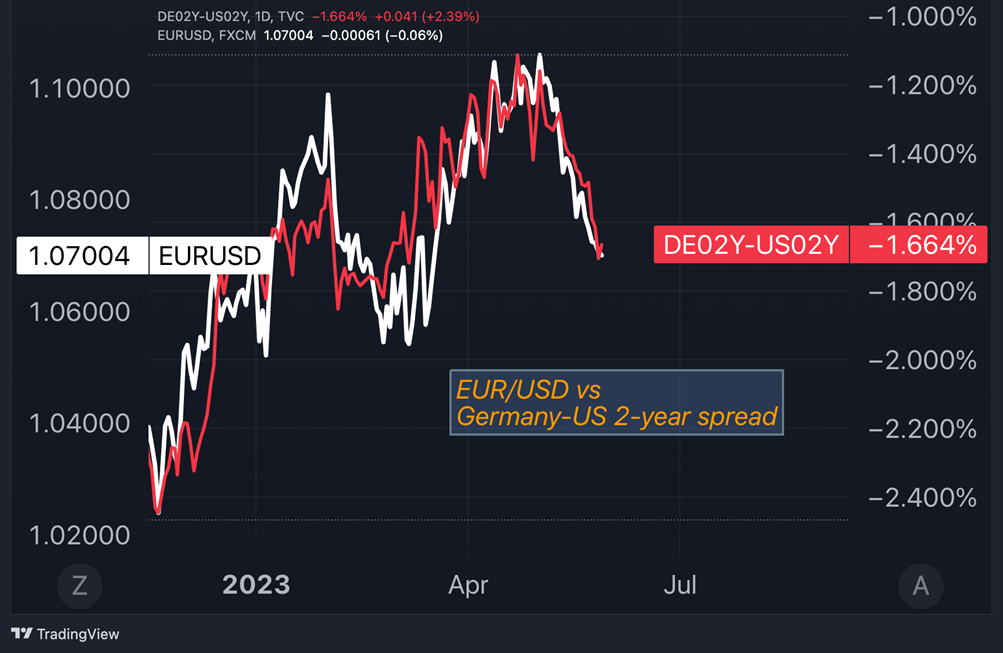

The projected rate differentials between the ECB and the Fed have recently been the key driver for the world's most traded FX pair.

The EUR/USD has had an almost perfect correlation with the 2-year spread or yield gap between Germany and the US.

While German yields are decreasing as a result of a technical recession declared last quarter and risks to economic activity this quarter, 2-year Treasury rates are increasing as prospects for future Fed rate hikes rise.

Technically, the EUR/USD has now retraced 23.6% of its bullish range from September to early May. The 38.2% of that range, which remains at 1.05, may now provide the next level of support.

This hurdle is also close in line with the significant 200-day moving average (1.049). We believe bulls will attack this level as markets continue to solidify expectations for a Fed interest rate rise in June.

A EUR/USD rebound above the prior week's peak of 1.083 would prove the strategy incorrect.

USD/JPY Trading Strategy: Bears Take Control

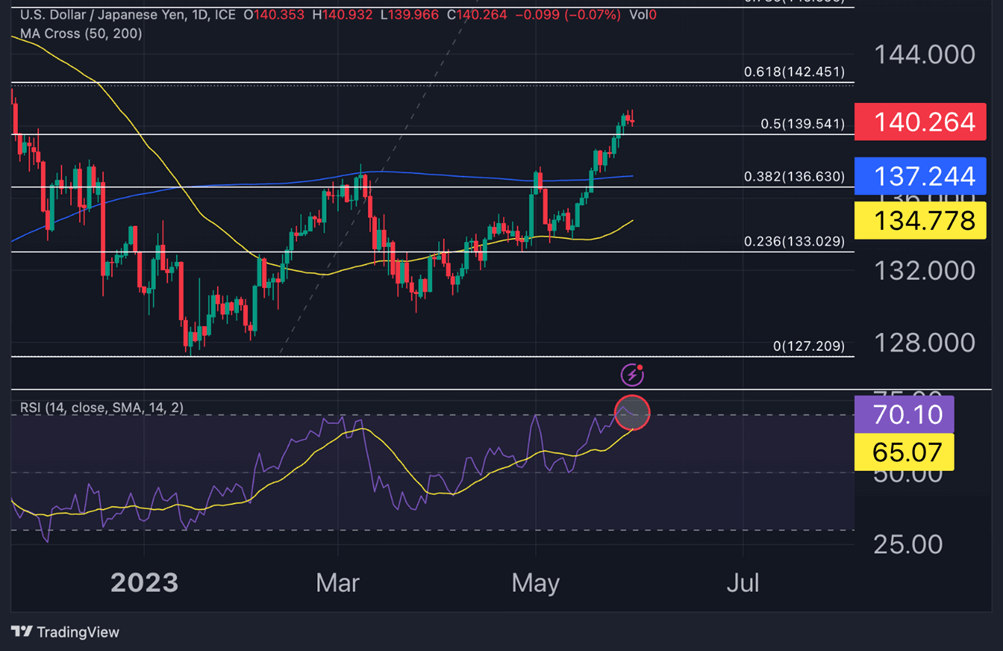

Order Buy USD/JPY: Open at 138.25; Take profit 146.5; Stop Loss 135; Risk-reward-ratio of 2.55

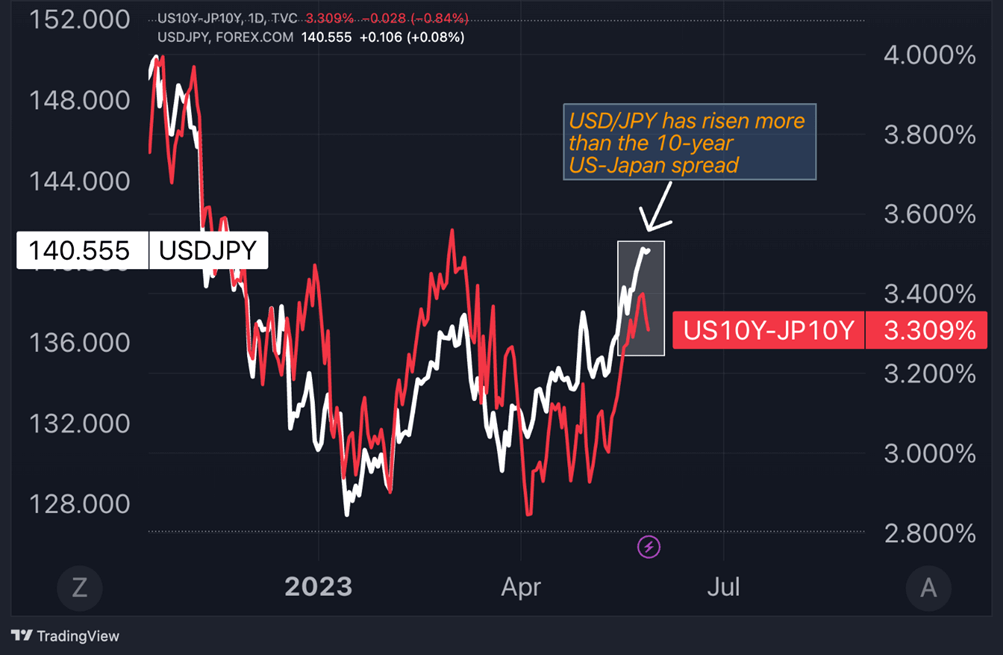

In recent weeks, we had a strong conviction view on a long USD/JPY trade and we took profit when the pair reached the 138 price objective.

Since then, it has overshot beyond 140 levels, possibly a little too far from what fundamentals, as measured by the 10-year yield differential between the US and Japan, would have indicated.

We believe that some take profit behavior may continue to arise at this level, particularly if we see risk aversion rising in global markets.

After gaining 5.3% in the last three weeks, the pair has reached an overbought RSI zone on the daily timeframe.

Overbought USD/JPY conditions haven't been seen since late October 2022, and we believe bulls may find a good excuse to take some profit now.

We continue to believe that the dominant trend has shifted to the upside, as the 50-day moving average is sloping higher and the pair has retraced more than 50% of the bearish range between October 2022 and January 2023.

We'd rather re-enter the long trade after another little drop in the pair towards the 138-138.5 zone, with a stop at 135 (around the 50-dma) and a target at the 78.6% Fibonacci retracement around 146.5.

USD/CHF Trading Strategy: Upside Room

Buy USD/CHF: Open at 0.9030; Take profit at 0.94, Stop loss 0.89;

The franc remains somewhat overvalued relative to the yield differential between the United States and Switzerland on 2-year government bonds. From a macro perspective, Swiss GDP figures for the first quarter came out positively and above forecasts, but current business confidence continues to worsen.

In May 2023, Switzerland's leading KOF economic barometer dropped to 90.2, the lowest level since November 2022, from a downwardly revised 96.1 in the previous month and well below market expectations of 95.3.

In April, the inflation printed 2.6% on an annual basis, the smallest increase in one year and below market expectations of 2.8%, as food and energy prices declined. The significant fall in Swiss inflation is now restricting expectations of a hawkish SNB.

We believe the USD/CHF pair still has capacity to catch up with short-term yield differentials as Fed-SNB interest rate expectations continue to widen.

Technically, the pair broke decisively above the 50-day moving average last week, rebounding firmly after recording a bullish RSI divergence at the beginning of this month.

We believe bullish momentum is on the rise, and USD/CHF may attempt to rally towards the 200-day moving average at 0.938-0.94 region. A drop below 0.89, would prove this strategy wrong.

Becoming an expert in forex trading is a journey that requires dedication, knowledge, and continuous learning. Start your journey to Become an Expert in Forex Trading today and unlock the potential for financial success.