Markets have been on a roller coaster ride. Here are our latest forex trading ideas.

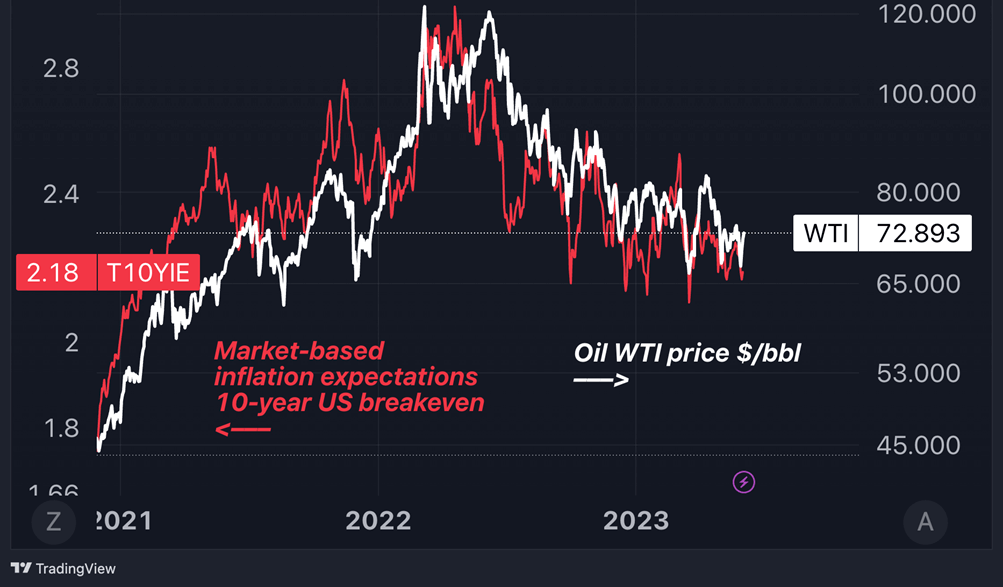

Global markets could be influenced by the recent unexpected cut in oil production by Saudi Arabia, potentially leading to significant implications for asset classes.

Markets overview

Following the settlement of the US debt limit issue, the markets were taken off guard by Saudi Arabia's unexpected oil output reduction, generating a new potential shockwave throughout numerous asset classes.

At the OPEC+ summit in June, Saudi Arabia stated to cut output by an additional million barrels per day beginning in July, bringing the country's output to roughly 9 million barrels per day next month, the lowest in years.

Last week, investor mood was particularly bullish across risky assets, with the Nasdaq 100 index topping April 2022 levels on the back of an AI-driven rally and increased market expectations that the Federal Reserve may halt in June, after some dovish statements lately.

The VIX index, widely seen as the gauge of market volatility or fear, has hit its lowest levels since June 2021.

Investors cheered a mixed report on the US labor market, which showed higher-than-expected payrolls but a surprise rise in unemployment and a slowing in annual wage growth.

Additional oil shocks might drastically alter market dynamics in June. The behavior of oil prices in the next days and weeks will be widely monitored since it will have a significant influence on investor inflation expectations in the future. These expectations, in turn, have far-reaching ramifications for both the FX and equities markets.

Chart of The Week: Oil Prices Can Influence Market Inflation Expectations Going Forward

Open trades from past weeks:

Short EUR/USD: Opened on May 30, at 1.0717; Take Profit 1.05; Stop Loss 1.083; P&L current +0.2%.

- Buy USD/CHF: Open at 0.9030; Take profit at 0.94, Stop loss 0.89; P&L current +0.2% +0.9%

- Long DXY index: Opened on May 23, at 103.5; Target Price 106; Stop Loss 102.17; P&L current +0.7%

- Short AUD/USD: Opened on May 16, at 0.6690; Target Price 0.636; Stop Loss 0.6825; P&L current +1.4%.

- Short XAG/USD: Opened on May 16, at $23.88; Target Price $22; Stop Loss $24.9; P&L current +1.75%.

- Long WTI spot: Opened on May 16 at $70.8; Target Price $80; Stop Loss $66.3;

P&L current +2.7%.

- Short GBP/USD: Opened on May 8, at 1.2654, Target Price 1.227; Stop Loss 1.30; P&L current +1.9%

- Long EUR/JPY: Opened on May 8, at 149.16, Target Price 160; Stop Loss 142; P&L current +0.6%

Orders:

- Order Long XAU/USD: Open at 1,900; Target Price 2,100; Stop Loss 1,830.

- Order Buy USD/JPY: Open at 138.25; Take profit 146.5; Stop Loss 135; Risk-reward-ratio of 2.55

Closed trades:

- Long CAD/JPY: Opened on May 1, at 100.89; Target Price 104.3; Stop Loss 98.05; P&L current +3.5%. Target price hit.

New Trades for the week

Long Brent (XBR/USD): Opened at $77.14; Take Profit $85; Stop Loss $73.6; Risk-reward-ratio of 2.4

We favor starting a tactically long position on Brent, considering both fundamental and technical reasons.

Positive fundamental signs like as Saudi production cuts, OPEC's tightening attitude, and anticipated fiscal or monetary stimulus in China to support a sluggish economic recovery thus far all contribute to a bullish view on oil. Furthermore, positive seasonality in Western countries with resilient demand, as well as a solid US labor market, allays recessionary fears. This combination of restricted supply and robust demand lays the groundwork for possible oil price upside, especially in the short run.

Technically, the $71-71.5 range is a strong support zone for Brent in 2023, recently tested last week and followed by a rebound. Although the 50-day moving average has been a stumbling block for bulls in May, recent efforts have seen improved momentum, with the RSI going above 50. Beyond the 50-day moving average, bulls face the 50% Fibonacci retracement level from the 2022 high-to-low range. A break above this level increases the chance that Brent prices will target the 200-day moving average and the 78.6% Fibonacci level around $85. To limit risk, a suitable stop level of $73 might be set, which corresponds to the 23.6% Fibonacci level.

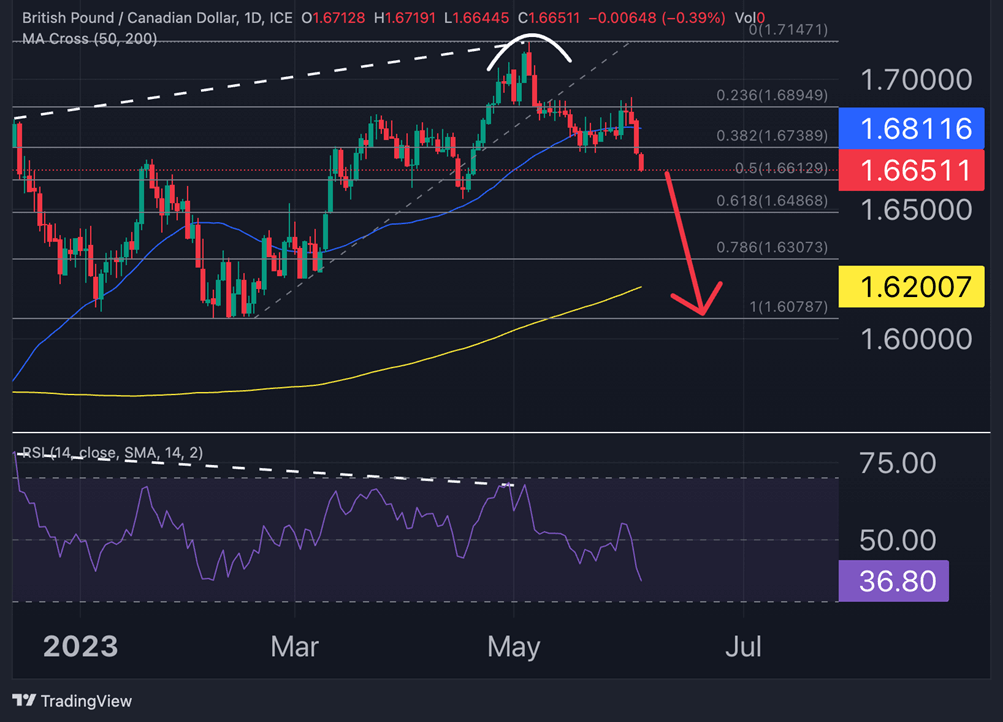

Short GBPCAD: Opened at 1.6645; Take Profit 1.605; Stop Loss 1.693; Risk-reward-ratio of 2.

According to our analysis, the British pound likely peaked in May against both the US dollar and the Canadian dollar. We believe that the Canadian dollar's sensitivity to oil prices could add to the bearish pressure on GBP/CAD.

Fundamentally, the Canadian dollar is currently one of the best plays for gaining from bullish oil market dynamics. Furthermore, the Bank of Canada (BoC) has indicated hawkish attitudes, adding to the Canadian currency's tailwinds. The Bank of Canada is set to make its interest rate decision this week, and while there is uncertainty between keeping the present rate or raising it by 25 basis points, it is highly likely that the central bank will adopt a hawkish tone due to a tight labor market and a strong start to the year for the Canadian economy.

GBP/CAD likely peaked at 1.7145 in May, as suggested by a significant bearish divergence in the RSI indicator. Last week, the pair fell below the 50-day moving average's support and is now approaching the 50% retracement level from the high-to-low range of 2022. If this important support level is breached, it will validate the negative trend predicted by the falling RSI indicator. We anticipate aiming for the 2023 lows of 1.6078, representing a potential 3.5% drop from current levels. To mitigate risk, we recommend setting a stop level at the 1.693 price resistance level.

Given these considerations, we expect the negative momentum for GBP/CAD to continue, with our target set at the 2023 lows, while keeping a risk-reward-ratio of 2 for an appropriate risk management.

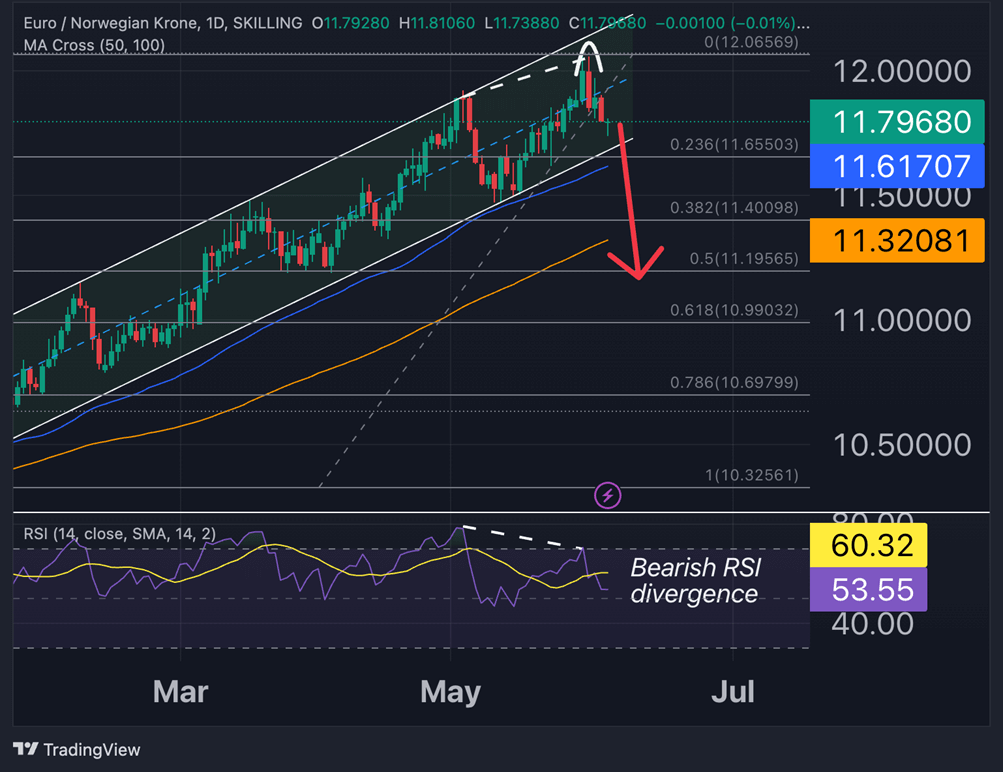

Short EUR/NOK: Opened at 11.79; Take Profit 11.25; Stop Loss 12; Risk-reward-ratio of 2.5.

The euro has gained 14% against the Norwegian krone so far this year, a remarkable increase in just five months. However, unlike previous highs that were supported by strong bullish strength, the recent spike in the exchange rate coincided with a decline in bullish momentum. This divergence suggests that the pair has reached its peak and that bears may have room to move now.

Another factor supporting a tactically bearish outlook is the rising Brent price, which has historically exerted downward pressure on the EUR/NOK pair.

We expect EUR/NOK to break below the bearish channel established in 2023 and soon test the support of the 50-day moving average.

If bears manage to break through the strong support level seen in May at 11.5, we could see a bearish extension towards the range of 11.20-11.25 (50% Fibonacci from 2023 high-to-low range). This price range served as a prior support in late March. This target represents a 5% difference from the current exchange rate, making this trade particularly appealing.

We suggest setting a stop level around 12.00, which represents the high of the May close price, to manage risk. Taking these factors into account, we believe the EUR/NOK has the potential for a bearish move, with attractive profit potential and a defined stop level for risk management.

Main Economic Events Of The Week:

Monday, 5 June 2023

- US: ISM Services PMI for May (previous 51.9, consensus 52.3)

- Euro Area: ECB’s Lagarde Speech

Tuesday, 6 June 2023

- Australia: RBA Interest rate decision (previous 3.85%, consensus 3.85%)

Wednesday, 7 June 2023

- Germany: Industrial production for April (previous -3.4% m/m, consensus 0.5% m/m)

- Canada: BoC Interest rate decision (previous 4.5%, consensus 4.5%)

Thursday, 8 June 2023

- US: Initial jobless claims (previous 232K, consensus 238K)

Friday, 9 June 2023

- Norway: CPI (previous 6.4% y/y, consensus 6.3% y/y)

- Canada: Unemployment Rate (previous 5%).

* Disclaimer: None of this is investment advice.

Profiting from forex trading necessitates not only a strong grasp of its fundamentals but also a commitment to ongoing learning and a well-defined trading approach. Explore further insights on What is Forex Trading and How to Profit from It? to embark on this financial journey.