Fortnite-maker Epic Games decided on Thursday to play hardball against the two Tech giants Apple and Google by adding its own in-app payment system to bypass the "App Tax."

In the blog post below, find out more details about this "epic battle" and what it could mean for Apple (AAPL) stock.

The story

The privately-owned video game maker Epic Games, which is worth over $17 billion after a fresh fundraise this month, is defying the Apple Store Empire and Google’s one at the same occasion.

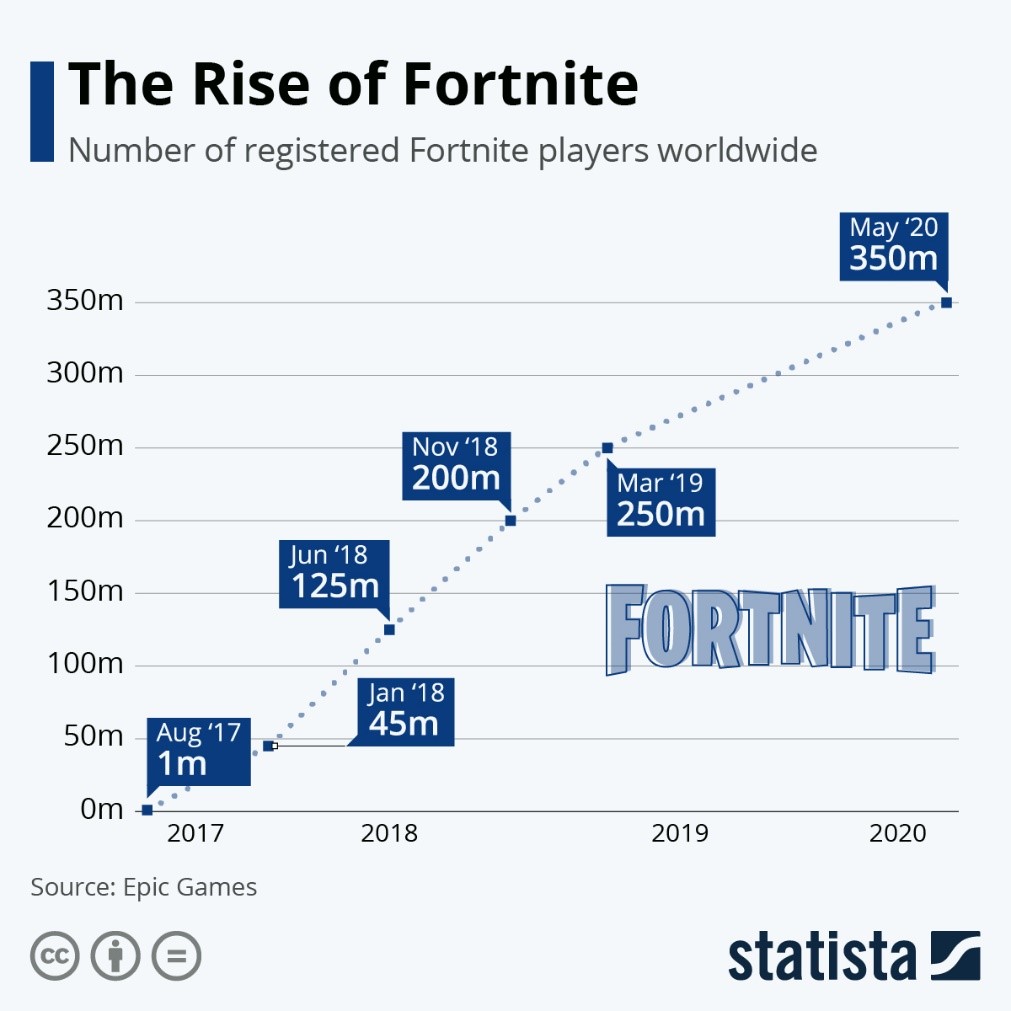

Fortnite is an online video game developed by Epic Games and released in 2017. It is available in three distinct game mode versions including Fortnite Battle Royale, a free-to-play battle royale game where up to 100 players fight to be the last person standing. As of the end of May, Fortnite had 350 million registered players worldwide (see chart below - source: Statista).

As a background information, Apple and Google have created a massive duopoly and ecosystem for the “App business”.

Apple has a dominant position in the App business revenue (see chart below) whereas Google's Android controls 88% of the global operating system market, ahead of Apple's iOS (12%) – see image below (source: Designial)

In a nutshell, every mobile app goes through the stores of these two giants. This enables them to charge developers a heavy tax to get access to the mobile economy.

Epic Games, the Fortnite-maker, decided to by-pass them by adding its own in-app payment option, offering a 20% discount to players who used that instead of Apple/Google’s.

As a retaliation, Apple and Google announced they are expelling Fortnite from their app stores for violating rules (i.e bypassing the 30% fee).

Epic Games is now filing lawsuits against both Apple and Google as competition-crushing monopolies.

Key takeaways

Let’s keep in mind that this is not the first time Apple is getting sued for being a player in a marketplace it also controls. Moreover, Apple store is hugely lucrative business for a very large ecosystem which has not decided to side with Epic Games – at least for now.

However, Epic Game’s lawsuit is drawing more scrutiny than ever on Apple and Google's app store dominance.

It is worth to note that Facebook, Match (the owner of Tinder) and Spotify are joining the battle as a an ally of Epic Games against the two App super giants.

Should Epic Games wins, Apple and Google might have to reduce or remove their fees. Apple made ~$15B in sales from the App Store last year (around 5% of its total sales).

Apple (AAPL) stock stalled last week but the move over the recent weeks has been parabolic (see chart below). As highlighted by Market Ear, sometimes not much is needed to stop such extended moves.

There were 2 negative fundamental news last week on Apple (AAPL): 1/ Microsoft Duo – an Informal TME poll says next tech purchase will be a duo and not a 5th Ipad; 2/ The Epic “Battle Royale” story as highlighted above.

Both of them could become an excuse for some profit taking on Apple stock. Bulls need to keep in mind that the 200-day moving average is at 310, which is a 32% decline from current price…

Chart: Apple (AAPL) parabolic rise

Read our next article: Research investing into esg etfs