Fox Corp stock dropped after US President Trump vented about its election coverage. Will Fox rebound and what other opportunities are there in media?

Must know before investing in the media

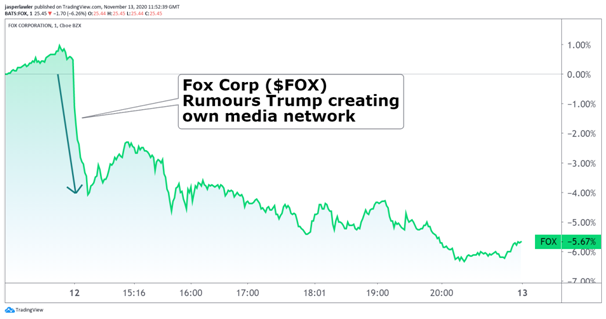

- In a series of tweets, Trump slammed Fox TV (owned by the New York-based parent media company Fox Corp) for calling the state of Arizona for Joe Biden early in the election count, saying in one tweet the TV network "forgot the Golden Goose.”

- Then rumours circulated that Trump was considering starting his own streaming channel on a subscription basis, which would be a direct competitor to Fox streaming service ‘Fox Nation’ otherwise known as “Netflix for conservatives.”

- Stay at home orders during the pandemic have dramatically increased media consumption, increasing the value of media advertising slots

- Disney (DIS) just reported a surge in streaming subscribers in its Q3 earnings

- The performance of media stocks has varied this year with some like Netflix (NFLX) seeing big subscriber increases but some like Disney losing revenues from theme parks and live sports

.@FoxNews daytime ratings have completely collapsed. Weekend daytime even WORSE. Very sad to watch this happen, but they forgot what made them successful, what got them there. They forgot the Golden Goose. The biggest difference between the 2016 Election, and 2020, was @FoxNews!

— Donald J. Trump (@realDonaldTrump) November 12, 2020

Fox Corp

Shares of Fox slumped on Thursday and closed near lows of the day.

Fox Corp stock (1-day)

Source: FlowBank / TradingView (November 12, 2020) investing in the media

It will be a tall ask for Donald Trump to eat into the cable network’s vast business with an online streaming channel. However, as the most famous conservative in the country – and for the last four years – the most famous man on the planet – Trump has a lot of influence on conservative viewers.

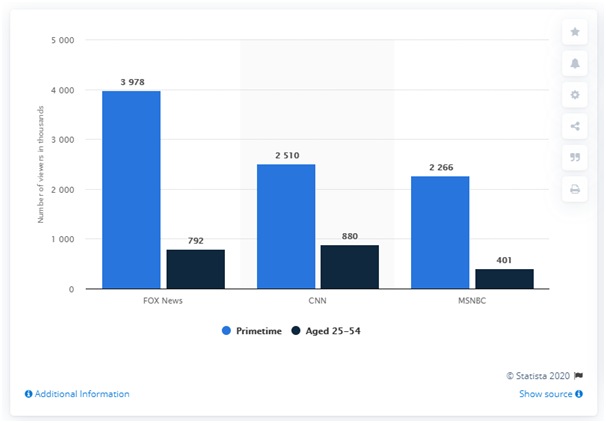

Media companies like Fox negotiate rates with advertisers based on their viewership ratings. If Donald Trump puts enough people off watching Fox, that is a direct hit to the company’s bottom line.

Can the stock bounce back? There are 2 good reasons why it could.

- Firstly it is quite likely the rumours of Trump’s new media empire are unfounded and if he wants to maintain a media presence in the United States, as a conservative – he would default to Fox News as opposed to left-leaning channels like CNN or MSNBC.

- A bizarre part of our human nature is that we tend to put more emphasis on things that enrage us than what satisfies us. CNN has had booming viewing figures for the past four years under Donald Trump – as have newspapers like the New York Times because people who identify to the left in politics have signed up to get mad about Donald Trump. With Joe Biden in the White House, it’s reasonable to assume Fox will get a similar bump in ratings.

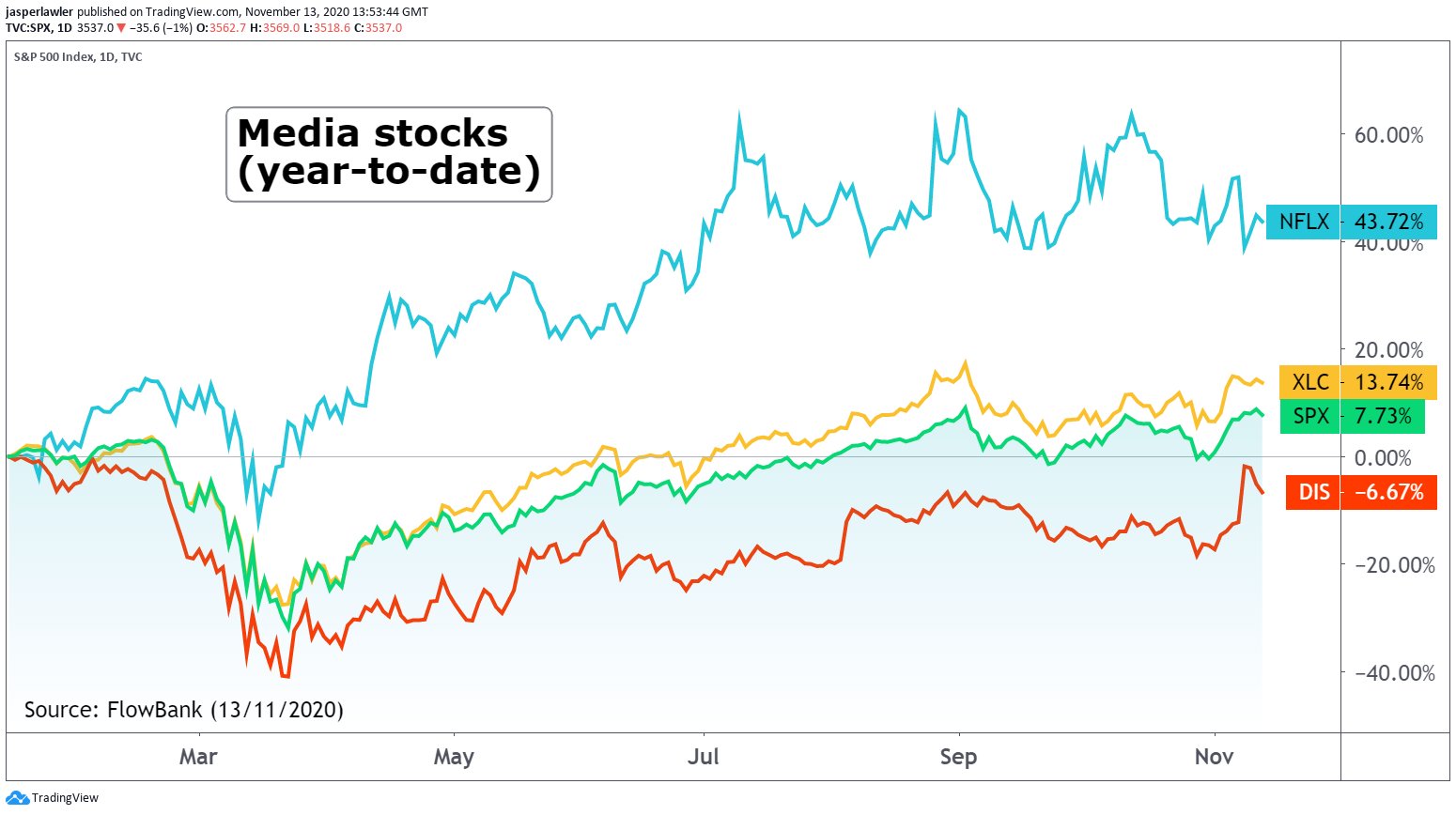

Media stocks

Media as a sector has only slightly outperformed the S&P 500 as an index because as an industry it has been doing relatively well this year but there is large variation between the performances of the individual names. The chart below shows XLC, an ETF for the media industry outstripping the S&P 500 - but Netflix has far outperformed, while Disney has significantly underperformed.

These days media can be split into two categories - legacy media and new media. The growth is very much toward new media - and of course social media via the internet.

There are two principal sources of potential growth in large blue chip legacy media companies.

1. Finding the old media companies that are trying to put themselves in a position to benefit from new media - e.g. Disney moving into streaming with Disney+

2. Old media industry consolidation to take a larger share of a shrinking market - for example AT&T's takeover of Time Warner or Comcast buying out Sky or Disney acquiring 21st Century Fox.

How to play it

Where Investing in the media :

Stocks

NFLX = Netflix

DIS = Walt Disney

Comcast

AT&T

Charter Communications

Sony

Thompson Reuters

ViacomCBS

Fox Corporation

DISH Network

ETFs

XLC – Communication Services Select Sector SPDR Fund

PBS – Invesco Dynamic Media ETF

IEME – iShares Evolved US Media and Entertainment ETF

Read our next article: Top 7 Tweets of the day - 13th of November 2020