General Motors stock has hit a record high after the automaker revealed its BrightDrop project, seen as an important moment in the pivot to electric vehicles.

General Motor's move towards Electric Vehicles

General motors announced on Tuesday that they would introduce a new delivery a logistics service called BrightDrop. The first products in the line will be an electrified pallet and a delivery van. Both products should come out later this year and will be powered by GM's Ultium battery platform.

GM did not rebrand with a new modern logo for nothing. They are working on a $27 billion pivot towards the design and manufacturing of electrical vehicles. BrightDrop is to be one of the key parts of this pivot, as GM plans to produce hundreds of thousands of delivery vehicles under its name. The final goal is to build a one-stop shop, a complete ecosystem for electric-powered delivery, including vehicles, software, and other services, according to Pamela Fletcher, Vice President of GM's global EV program.

The plan has expanded: Initially, GM wanted to spend $20 billion and launch 20 different models. Now, with additional budget, they are planning to put out 30 vehicles globally. With these first prototypes, the company is targeting a delivery and logistics market estimated at around $850 billion by 2025.

Project BrightDrop

EP1 is the name of the first vehicle to be produced. The pallet transporter will move at a top speed of 3 mph and will come with a capacity of 23 cubic feet with a maximum load of 200 pounds. The main problem they want to solve is packages being strewn on sidewalks in a very random and unsecured way. This machine should help packages reach their destination in a more secure way, while helping the physical strain on postmen and delivery workers. After a partnership with FedEx to test out the first prototypes, GM found that the use of the pallet helped FedEx workers deliver 25% more packages a day.

The EP1 prototype (source: The Verge)

The second prototype is the EV600, a 250-mile range delivery van with 600 cubic feet of cargo capacity that can carry up to 10'000 pounds. Its max speed will reach 170 mph when fully charged. The cargo will be kept secured by motion sensors. It will come with all the necessary features one can desire on a smart vehicle such as sliding pocket doors, blind spots detection, lane keep assist and front/rear parking assists.

The EV600 prototype (source: The Verge)

FedEx has already expressed its interest to buy the vans and there are more customers interested, according to GM. BrightDrop also comes with a wide range of software features, such as parcel tracking, remote locks and monitoring of battery status. The EV600 specifically will feature incident recordings, remote diagnostics, safety alerts and predictive maintenance insights – all you can wish for from an Internet-of-things object.

What is GM’s competition doing?

While GM is making a lot of progress with their EV intelligent fleet, other competitors are also answering the rising demand for efficient delivery solutions. Mercedes-Benz is working on the electric version of its famous Sprinter and Ford recently revealed its $45'000 E-Transit van, that has a 126 miles range. Amazon is also coming in with its own EV van alternative in collaboration with Rivian, an EV start-up. Other start-ups are working towards similar solutions.

Amazon's Electric Delivery Van (source: Detroit News)

Impact on the stock and future outcomes

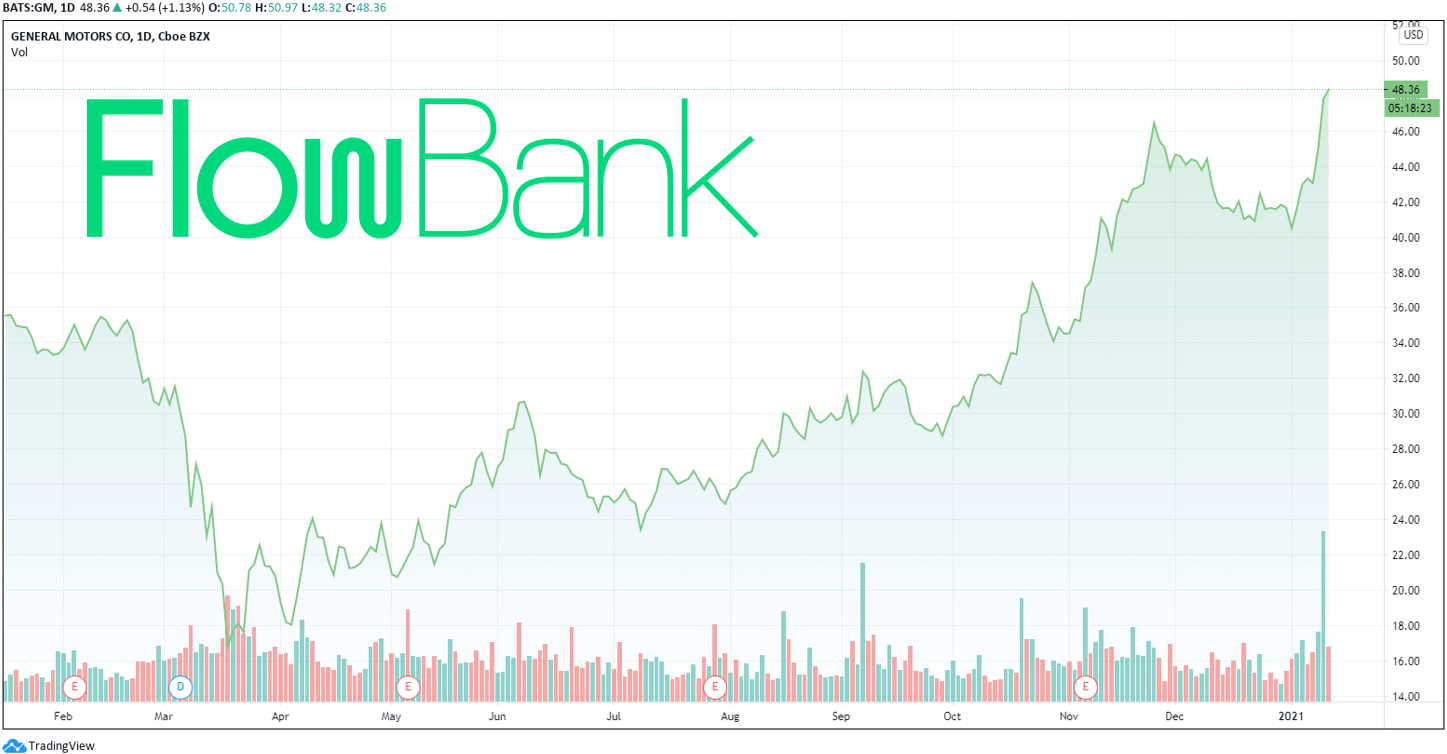

Shares of General Motors gapped up 6.3% on Tuesday following the announcement to $47.82, a record high. For nearly a decade, GM stock pretty much went nowhere, but the stock has accelerated since the reveal of their Hummer EV in the last quarter of 2020. At the market open on January 13th, the stock opened at $49.50. The price to earnings ratio went up from 15.55 in October to 21.44 today, as investors start to pay up for the higher EV growth potential.

General Motors Stock (source: TradingView)

However, the PE of the S&P 500 sits high around 38, so GM's 21.44 feels fair in comparison. The 200-day moving average is $33.88, well below the curent price so the stock is overbought, but may remain so if a new uptrend is emerging. Do we need to mention Tesla’s 1’606 PE ratio?

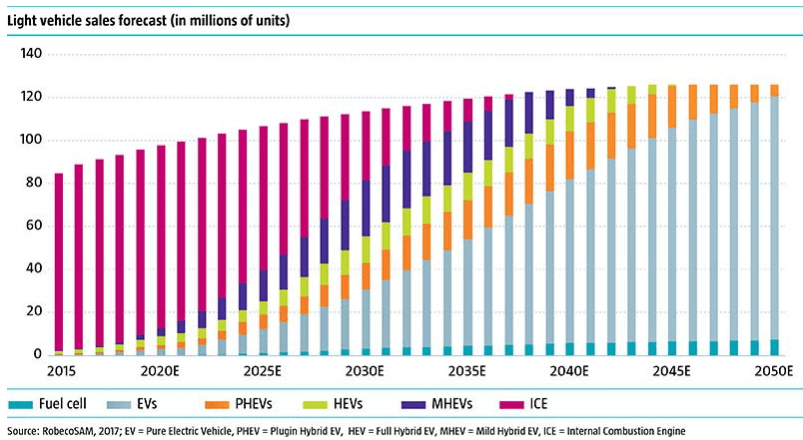

The company's earnings rose in the second half of 2020, which was of great help to finance the transition into EV. GM's market cap at $68.5 billion is double its value from March but is tiny in relation to Tesla's $805 billion, and they still make four times as many sales in Q3 2020. However, we must mention that GM's traditional business of combustion vehicle is "a melting ice cube" according to Morgan Stanley analyst Adam Jonas.

Light vehicle sales forecast by fuel type (source: ROBECO)

GM CEO Mary Barra seems quite confident about the EV transition the company is going through. She said that GM will realize a $2 billion in cost efficiencies from shared engineering manufacturing, marketing, and corporate costs across the planned EV models. The additional $7 billion will accelerate the transition through 2025.

The challenge GM faces is whether the transition will be fast enough to supersede the drop-off in demand for its combustion vehicles.

Sources:

GM unveils electric delivery van with 250 miles of range as part of new spinoff business, in the Verge

GM Stock Soars As Auto Giant Launches New BrightDrop EV Business, Taking On Ford, in Investor's Business Daily

Blogposts, newsletters, podcasts and any other content published by FlowBank SA (hereinafter “FlowBank”) reflect the opinions of the authors only and do not reflect the views of Flowbank or any of its subsidiaries or affiliates. These contents are meant for informational purposes only and aim to offer new ideas and perspectives. They are not intended to serve as a recommendation to buy or sell any type of financial instrument, whether that be through a Flowbank account or any other trading account. They are not to be considered as research reports and are not intended to form the basis of any investment decision. Any third-party opinion expressed, and information provided therein do not reflect the views of Flowbank or of any of its subsidiaries or affiliates. We emphasize that all investments involve risk, and past results are not a guarantee of future performance. While diversification does help to lower and spread the risk, it does not ensure a protection against loss. Investing in securities or other financial products always involve a risk of losing money. Prices fluctuate with the market in sometimes unpredictable ways, and investors should be aware that their losses might exceed their initial deposit. Flowbank SA, a FINMA regulated company.