Inflation is rising across the globe and precious metals are renowned as a hedge against inflation. Nonetheless the Gold & Silver price action has been muted. What to do?

Latest news on gold & silver

Commodities have been the best-performing asset class of 2021 thanks to the now well-documented supply shortages that have pushed up the price of raw materials and the cost of production. The commodity-gains have been driven by those with closest ties to the economic cycle - namely oil and industrial metals.

The precious metals (gold and silver) have not participated in the commodities rally this year. The possible explanations for this are numerous. Probably top of the list is that markets have priced in the end of quantitative easing by the Federal Reserve and resulting strength of the US dollar.

Moving forwards, the open question is whether the temporary inflation caused by supply shocks becomes something more permanent, creating a need for investors to find an inflation hedge, such as gold and silver.

What’s happening to the gold & silver price?

For lack of a better word, nada! Nothing has been happening to gold and silver prices as they consolidate the big gains made in 2020. Of the two, silver has outperformed gold owing to its industrial properties - leaving the gold-silver ratio potentially over-sold.

Gold Spot #YTD Return = -5.45% (Oct 29)

Silver Spot YTD Return = +1.79% (Oct 29)

The price of gold topped in August 2020 and has made a series of lower peaks since, while holding onto $1700 per oz as support. A breakout of this long-term triangle pattern might be the best indication of where the price heads next.

Silver peaked at the same time as gold and has consolidated since with $22 per oz as support while the old high above 28 has been tested as resistance. Shorter term silver broke out of a 5-month-old falling channel pattern.

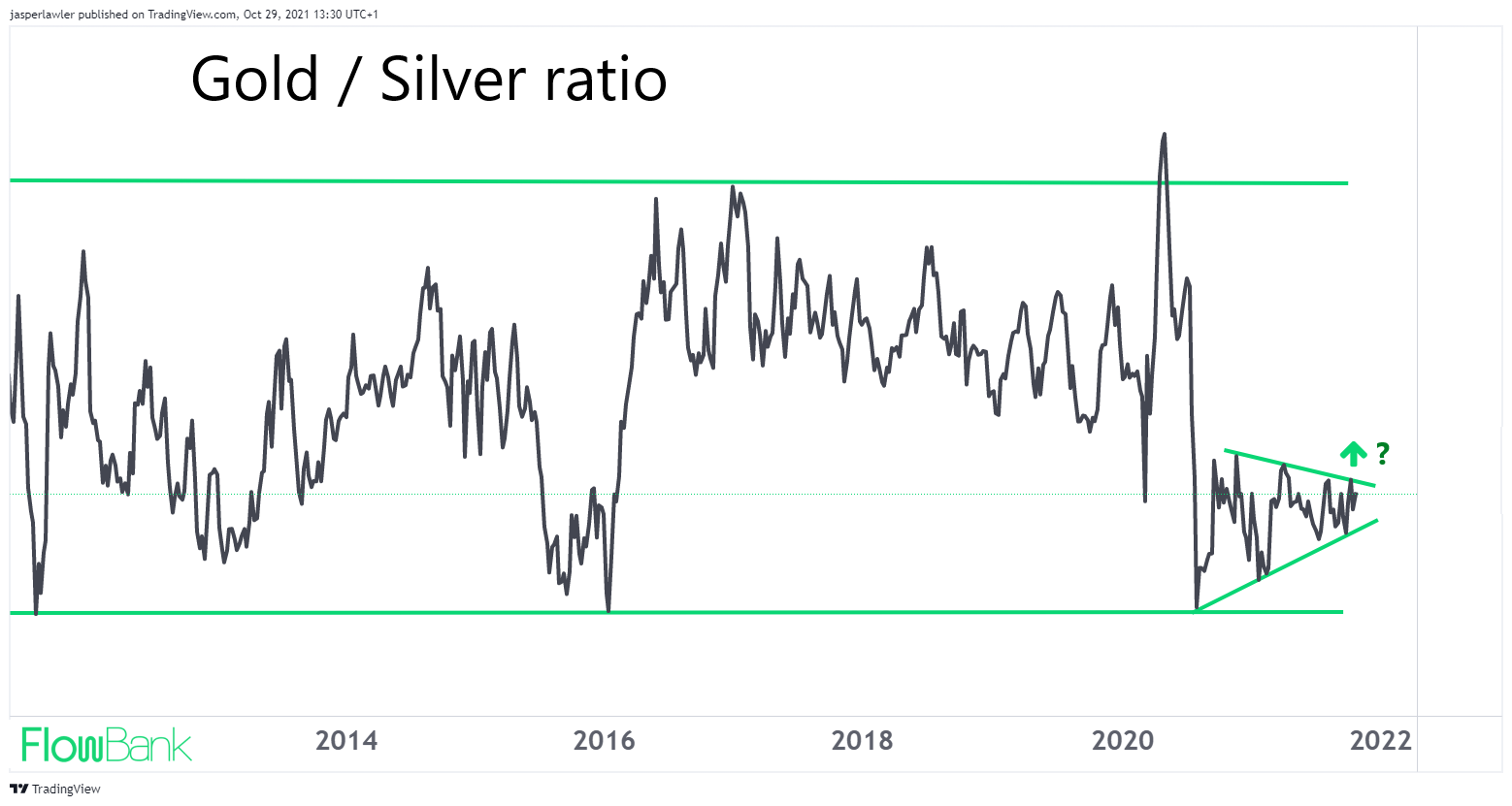

The gold silver ratio

If the gold / silver ratio stays true to its norms of the past decade, then gold looks set for a period of outperformance versus silver. This would imply market conditions become more risk-averse but would likely also need to be accompanied by US-dollar weakness.

Gold and real yields

Let’s remind ourselves of the bigger picture for gold. Gold tends to rise when investors fear ‘out of control’ inflation. It is only under extreme inflationary circumstances that it becomes worth investing in gold as a store of value. The rest of the time, the opportunity cost of not earning a yield is too great. Rarely does this inflationary situation occur - the last time was the 1970s - but the fear of it will move the price of gold.

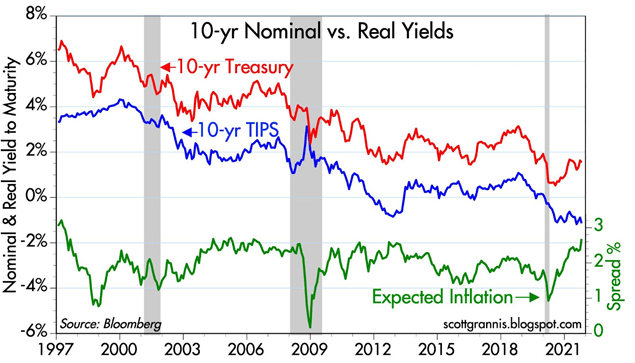

Inflation becomes out of control when interest rates - including government bond yields - are not high enough to compensate for the high inflation. During these periods, real yields - that’s bond yields accounting for inflation - turn negative. As the chart below demonstrates, gold prices rise with real yields (and silver tends to rise with gold!)

Gold and inflation expectations

- Inflation expectations are rising. US breakevens just topped 2% - which has been the ceiling for the past 20 years.

- 10-year Treasury yields are closing back in on 1.7% - the March 2021 high. However the gap between Treasury yields and Consumer price inflation is still wide, keep gold supported at $1700 per oz.

- This might explain why TIPs (treasury inflation protected securities) are now outperforming 10-year Treasuries.

Inflation expectations of 2% are by no means unprecedented - but they are at the top of the range of the last 20 years. The last 20-30 years have been defined by historically low inflation.

We can simplify the outcome for inflation into two possible camps:

- Status quo - It is the assumption of many market participants that the current high inflation is transitory and so while inflation expectations are high now - they are likely close to a peak.

- New era - Another possible interpretation is that we are gradually transitioning from a period when deflation is the driver of the financial system to a period when inflation is the driver of the financial system.

Gold as an inflation hedge

During the last 20-30 years, central banks have embarked on increasingly loose monetary policy, keeping interest rates low to match the low levels of inflation. After each financial crisis, starting with Greenspan in response to dot com bubble to Bernanke and the 2008 financial crisis to Powell in response to COVID-19, interest rates have stayed lower for longer. Added to that, the Fed has been buying US Treasuries in quantitative easing - keeping interest rates - including US Treasury yields - artificially lower.

These policies have all been possible because of deflation. If we are moving into an era of inflation - then these policies (including the current policy) will not be appropriate.

US 10 year Treasury yields rallied at the start of 2021 as signs of inflation began to emerge. Yields then sank back as investors took the Federal Reserve at their word that they would combat inflation when the time came. Now yields are rising again as Fed tapering gets closer.

What next for gold and silver?

If yields continue to rise as the Fed normalises policy and US inflation backs off from over 5%, then that means real yields will move higher and that is likely bearish for gold.

The big opportunity for gold bugs is in the case of a Fed policy mistake. If CPI remains high but the Fed move too slowly, then high inflation expectations could become more embedded, and investors will lose faith in the inflation-fighting credential of the Fed. Here real yields could turn even more negative- acting as a tailwind for gold and silver - and possibly new record highs.

Is there any reason to suspect a Fed policy error? The rule ‘don’t fight the Fed’ is a good one but arguably there is more reason to fear an error than normal. A bloated national debt after the pandemic and huge government spending plans to combat climate change are problematic. With a debt: GDP ratio of 125% according to the St Louis Fed, the US government cannot afford much higher debt servicing costs. Given the choice between combating inflation and causing a default on the US national debt, the Fed would likely choose the latter.