Staying on top of the $2 trillion plan is important from an investment standpoint as flows of funds dictate market climates. How might the higher taxes affect equities and thus, your portfolio?

Infrastructure plan overview

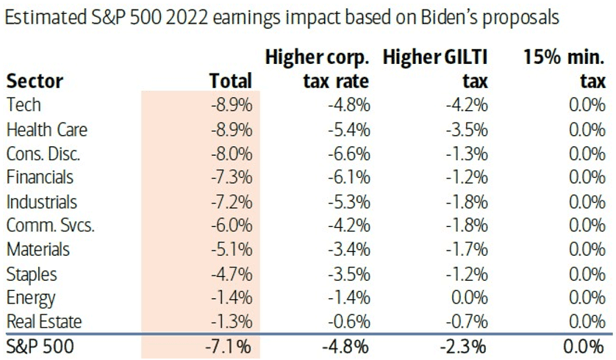

The build back better proposal is a $2 trillion government spending deal outlined in detail in the first graphic below. In order to finance the deal, there will be a tax hike which we explore in more depth below. Overall the plan wants to eliminate tax preferences for fossil fuel groups, and raise the corporate tax rate from 21% to 28%.

The taxation of US mega corporations' overseas earnings, will seize to find tax havens in the US and be prevented from doing ‘’inversions’’. There will be a re-shoring effort and no deductions for firms offshoring jobs.

Mind you that this plan comes after a first stage $1.9 trillion American Rescue Plan which saw the consumer base gain from extra spending power. This is what is called demand side stimulus in economics.

This second stage, the infrastructure plan, now aims to help the supply side i.e. increase the productive potential of the economy by building more things, increasing jobs which could also potentially overheat the economic machine. However, Yellen says that the federal bank should be equipped to cope with the consequences of this plan.

This bill, or stage two, will have long-term effects so getting it right matters. You can find the White House’s fact sheet on the plan here, and the outline directly below.

Figure 1: Biden’s plan broken down by investment

Some specific goals of the bill include modernizing roadways, adding 500,000 charging stations boosting the switch to EV, changing out lead pipes and service lines, improving housing and investing in semiconductor manufacturing.

The Biden administration will hope to pass the bill by this summer, but will surely face some obstacles from moderate democrats and republicans who say the bill is too much despite the overall bipartisan nature of the deal (meaning it is largely in the interest of both Republicans and Democrats).

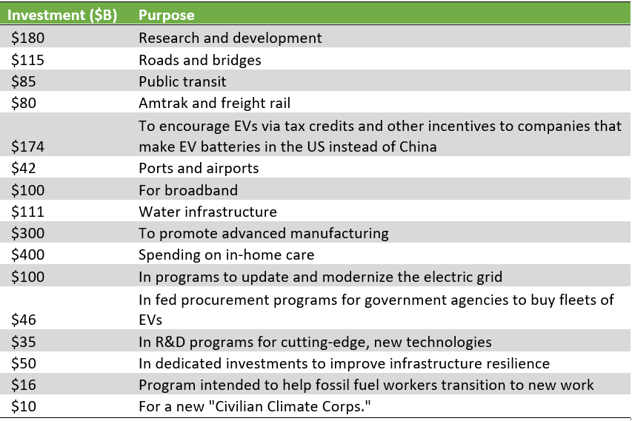

On the other hand, representative Alexandria Ocasio-Cortez said on Twitter that it was not merely enough because of the long execution timeline…

What higher taxes mean…

One of the notable changes to the plan would be to set the minimum tax on US companies’ foreign income at 21%, an increase from the current rate of 10.5%. This tax would apply to profits earned in countries abroad rather than letting companies combine their income globally and pay a relatively lower share to the government.

Strategic take: China spends about three times as much investing in infrastructure compared to the US. This ripples abroad in Africa where Chinese investors are becoming increasingly involved in the continent’s development. In other words, America would become more competitive versus China.

Another side effect to this sort of tax will aim, at least in part, at taxing wealthier citizens in order to re-allocate, and trickle down purchasing power to poorer Americans, thus working towards improving an increasingly unequal American society and impoverished middle class.

The tradeoff: some fear extra taxes and regulations could limit companies’ ability to book larger profits through tax havens. One consequence to this would mean that Americans’ investment accounts would see smaller returns in their Roth IRAs, and other such fixed income retirement portfolios. This is not so good if you live off fixed-income retirement money such as the elderly population.

The new company tax rule aims to prevent firms from reducing their tax base by 10% of their assets situated outside the country. This means companies will have less deductions on taxable income from their foreign assets an incentive to level the playing field and bring work back to the US.

Another con: Kevin Hassett, a Stanford economist, said that this bill is inflation triggering—the stirrings in the bond market could be a warning that capital expenditure and government borrowing of this extent could push the US to an inflation plus high interest rate stagnation climate not favorable to US citizens’ wallets.

Beneficiaries of this plan:

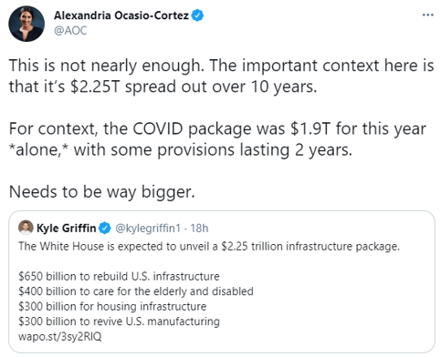

Clear beneficiaries of an infrastructure bill would be sectors in industrials and metals and pretty much all those capital expenditure (capex) sensitive sectors. Energy, utilities and industrials, as shown in figure 2, have historically outperformed in a rising capex climate.

Furthermore, the US GDP forecasts are between 5-7% for 2021 and 2022 period so any GDP-sensitive cyclicals, small caps and value stocks could ride this wave. Small caps are highly correlated with US capital expenditure cycles, at least more so than large caps.

One caveat: this spending deal could cause inflationary pressure as underlined by Professor Hassett. Stocks in the energy and materials sectors have however, seen success in such environments in the past. Higher inflation usually also means higher rates so that equates to financials doing better.

Figure 2: assuming a rising capex, Energy, Utilities and Real Estate could see growth

Also, there will be some re-shoring beneficiaries in the mix of sectors propped up by an increasing capex scenario. This includes companies who have less than 15% of their sales in foreign markets (foreign from the United States).

This makes sense because if more money is circulating and more government spending is boosting domestic markets, than those firms diluted away in foreign markets are missing out on the opportunity to maximize their sales in a dynamic local market setting. Companies like T. Rowe Price group, Charles Schwab, and American Electric Power Company are examples of firms with 0% foreign sales, according to BoA research.

Which sectors will be hindered by the plan?

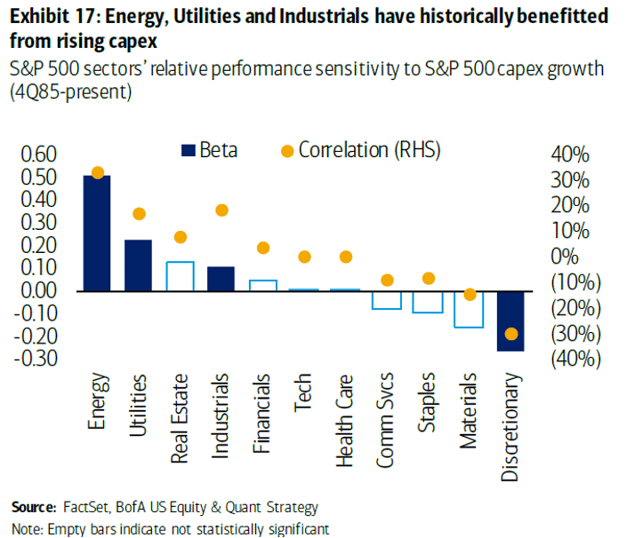

In terms of raising the tax thresholds, some analysts have indicated that this extra cost could hit at company EPS growth over time. Some figures indicate a 7% hit to the S&P 500 earnings in 2022, 5% of which come from the higher statutory rate of 28%, 2% of which comes from higher taxes on foreign income.

Information technology, health care and consumer discretionary would likely see some of the largest dents in their earnings under this scenario. Also, since spending bills of this nature can cause inflationary pressure and that defensive and bond-proxies show some of the worse historical lags in performance under that scenario, maybe avoid dividend firms, or well-established companies like Procter & Gamble, or Coca-cola.

The plan outlined above has a clear green touch to it, which is good for solving climate change issues. Any company blind to this major push should re-consider its strategy. Companies include those who make auto parts, suppliers to the auto industry and the input commodities—they should be mindful that investors will be looking for an alignment towards a green push.

A recent example of a market punishment occurred last Wednesday when Borgwarner fell 9% after announcing reluctance and conservative ambitions for moving out of the traditional world of auto parts, and into the EV future.

Figure 3: Estimated EPS hit from a rising corporate tax