A deep-dive into NextEra, the dynamic clean and renewable energy company that became more valuable than Exxon Mobil this year.

In a nutshell

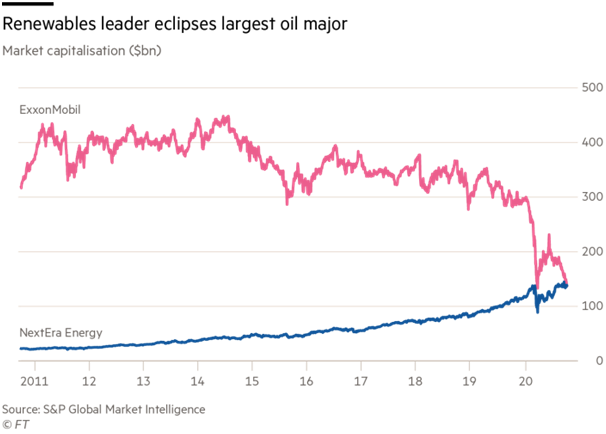

Clean energy and sustainable investing is hot right now. Stocks that qualify have handily outperformed in 2020. NextEra (NEE) – the world’s biggest producer of wind and solar energy - epitomised this when its market cap overtook that of oil major Exxon Mobil (XOM) this year.

Must know

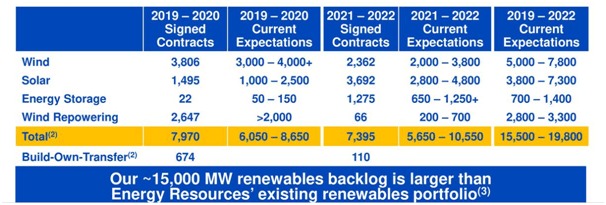

- NextEra is the world’s top generator of wind and solar electricity but is not sitting still. Its pipeline of new renewable projects is larger than its entire existing renewable portfolio

- Unlike many promising high-flyers – NextEra actually makes money! Profits rose 13% year on year in Q3, 2020

- M&A: Rumoured to be sizing up a takeover of Texas utility Duke Energy (DUK)

Who is NextEra?

NextEra is a Florida-based energy and utility holding company. NextEra is the world's largest generator of renewable energy from wind and solar but it also owns and operates electricity-generating plants powered by natural gas, nuclear energy, and oil.

Its stock price outperformance has caught the attention of investors with growth that has far outstripped energy companies, the utilities sector and the S&P 500 index in 2020.

Chart: NEE vs. XLU vs XLE vs SPX (year-to-date)

While NextEra may be on the cutting edge of renewable energy production, its beginnings were almost a century earlier as the Florida Power & Light Company, founded in 1925. In 1984, FPL Group was formed in order that the company might diversify its business and its name was changed to NextEra in 2010. The company was one of the biggest beneficiaries of the Obama-era renewable energy subsidies, using the funds to build up huge wind farms. It had already become America’s largest wind farm owner and producer in 2006.

It has three core divisions:

- Florida Power & Light

FPL serves 5 million customers or an estimated 10 million people in Florida by delivering rate-regulated electricity. It is the largest electric utility in the United States based on how much retail electricity is produced and sold.

- NextEra Energy Resources (also NextEra Energy Partners & NextEra Energy Services)

NextEra Energy Resources was formed in 1998 and operates in 37 states and four Canadian provinces. This is the division that generates the wind and solar energy.

- Gulf Power

The Florida-based utility company it acquired in 2018 to give NextEra coverage of 51% of the Florida population.

The story: Clean tech & sustainability

Big investors are notably parking their money in early-stage ‘sustainable’ investments after a long hiatus. This inevitably works its way down the food chain into investments that the everyday investor can benefit from.

The reasons for the newfound interest in sustainability are twofold: public opinion about the importance of climate change is forcing greener government regulation and the relative cost of producing wind and solar energy has dropped significantly in the past decade.

In America, if Joe Biden wins the presidential election, his quasi 'green new deal' investment plan could usher in a golden era for companies positioned to ride what has been hailed as a ‘sustainability revolution’. Here is a video from Joe Biden’s campaign championing clean energy & environmental justice.

To give some examples of big investments; Blackstone invested $1 billion into Altus Power Generation, a renewable energy developer and NRStor, an energy storage company. The Canadian Pension Plan invested $6.1 billion into Pattern Energy Group, the owner of power project with assets in North America and Japan. Microsoft announced a $1 billion climate change fund and Amazon doubled that with a $2 billion Climate Pledge fund.

NextEra Vital Stats

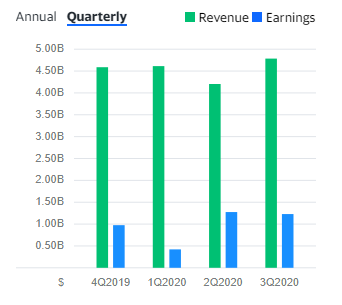

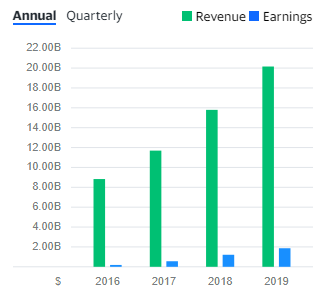

NextEra Energy reported 3rd Quarter September 2020 earnings of $2.66 per share on revenue of $4.8 billion. The consensus earnings estimate was $2.65 per share on revenue of $5.6 billion. Earnings grew 11% while revenue fell 14.1% compared to the same quarter a year ago.

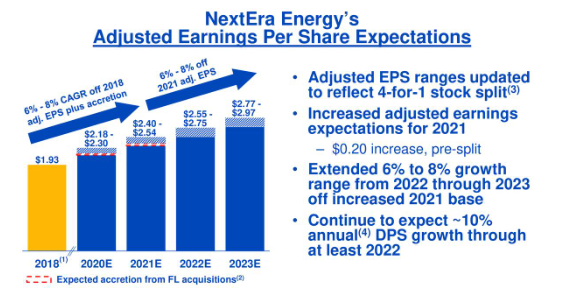

NextEra expects to earn a 6-8% increase in earnings per share over the coming three years according to its latest forecast set out in its Q3 results.

Source: Q3 earnings call presentation

So while earnings are rising at a clip of 6-8% per year – which is very healthy for a utility company and much better than the steep losses being felt in traditional energy companies in 2020, it does not warrant a forward P/E ratio of 30x. The implication is that the shares are trading a bit rich at the current price level.

Source: Yahoo finance

What’s next?

Peeling back the layers, it is the ‘NextEra Energy Resources’ business that is of most interest for future growth with EPS up 23% y/y. It originated a record number of energy generation projects in Q3, which means its 15,000 megawatts renewable backlog of orders is bigger than its entire current book. Just finishing the backlog means NextEra will double what is already the world’s largest energy output from wind and solar.

Specifically, the huge backlog of renewable energy projects should mean the business is on track to maintain the 23% growth shown this quarter, when the unit brought 800 megawatts of renewable energy capacity into the grid. This year an extra 3.2 GW in development should enter service by the end of the year.

Source: Q3 earnings call presentation

Growth and income

On October 26, NextEra executed a 4:1 stock split, which does nothing for real earnings but does make the share more attractive to retail investors, who have already shown a penchant for clean energy tech in Tesla (TSLA).

The performance of NetExtra this year shows a unique characteristic of its business, namely that it can grow and is resilient to an economic shock, by which of course we mean the pandemic. Customer growth is solid at 1.1% and in line with forecasts at the start of the year. The steadiness of the utilities business and overall growth should be a source of confidence that management can follow through on guidance for a 12 to 15% annualised pace of dividend increases.

Thanks for reading and happy investing!

Sources:

https://www.economist.com/business/2020/10/24/meet-nextera-americas-most-valuable-energy-firm

https://seekingalpha.com/article/4380448-nextera-energy-resources-own-this-winner

https://techcrunch.com/2020/10/06/a-clean-energy-company-now-has-a-market-cap-rivaling-exxonmobil