You’ve all heard of it. Maybe your kids play it, your little siblings or maybe even yourself: gaming as a sport has become a thing, and the market is growing. Here are some ways to catch the train before it leaves.

What is e-sport?

In order to know what we are talking about and all be on the same page, it would be worth giving you a tour of what e-sports mean. If you think that e-sport is your kids watching streamers or playing video games online, you’re partially right; but you’re missing the bigger picture. The term “e-sport” designate the whole world of competitive, organized videogaming. Competitions are organized by large organizations, opposing the best teams and players in the world, playing in front of stadiums full of over-excited millennials, with cash prizes going up to the millions.

Some gamers likes Faker (League of Legends), Patrick Lindberg (Counter-Strike), Moon (Warcraft 3), Jaedong (Starcraft), Flash (Starcraft) or Dendi (Dota 2) have become world stars, just by doing the one thing their mom told them to stop doing: staying up all night and missing dinner to play video games. Gaming used to be lame and was considered useless by people outside of the geeky community. But now, tables have turned. Gaming has not only become cool and popular, it has also become a way to earn a living.

Faker on the left, with its Korean SK Telecom T1 Team

Faker on the left, with its Korean SK Telecom T1 Team

So what, people watch other people play? Where is the money in that? E-sports cashes in profit from different channels, such as broadcasting licenses, merchandising, live-events ticket sales, advertising, sponsorship and more. Companies also pay to manage or have exclusivity on competitive teams and players, which also generates a lot of publicity for the company and the game title the team is playing on.

How is the e-sport industry doing?

It’s growing, and fast. Although the market is still forming and we’re still unsure of the final stage it will reach, most analysts agree on a rapid growth, with opportunities that would be good to jump on soon.

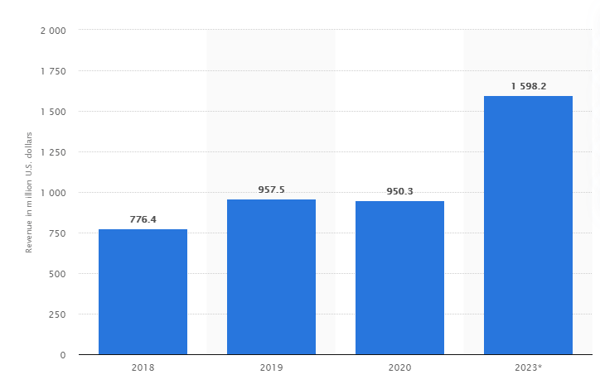

According to Statista, e-sports revenue stayed constant in 2019 and 2020 at around $950 million a year, but they are expected to rise to $1.6 billion by 2023. According to another report, these revenues could reach as much as $7 billion by 2027. And we ought to note that this is purely from e-sports, which excludes betting revenue, also a great revenue driver: according to a study from global consumer agency 2CV, e-sports betting revenues should double from $7 billion to $14 billion in 2020, partially due to Covid-19.

E-sports revenue from 2018 to 2023 (Source: Statista)

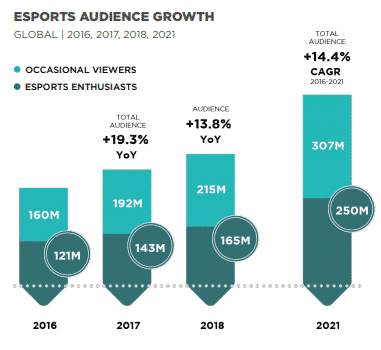

The same growth can be witnessed taking a look at the audience. If 2016 saw 160 million casual viewers and 121 million regular viewers, these numbers will have doubled by 2021, with respectively 307 million casual viewers and 250 million enthusiasts. An insane growth that does seem to see a limit any time soon.

E-sports Audience evolution (Source: Newzoo)

E-sports Audience evolution (Source: Newzoo)

In emerging markets, the drop in smartphone prices led to many more people being able to afford mobile gaming. Reports indicate a 24% growth in Southeast Asia, 20% growth in Japan and 17.9% growth in Latin America in the last few years.

Finally, we must also mention that Covid-19 both helped and impaired the industry. Of course, many events had to be cancelled, leading to losses in terms of events and ticket sales. However, more people started to game seriously as they had more time on their hands to spend at home. Not only that, but many people started to watch streams of videogames, once they had gone through the entire Netflix catalogue and they had enough of socializing on Zoom. This tendency shows clearly on Twitch, the first game streaming platform in the US, with 91.1% of the market: 2019 saw 3.64 million users who watched 660 billion minutes of content; 2020 saw 4.4 billion users with 889 billion minutes of watched content. Quite impressive in a year!

How to get into e-sports?

Now the question is: where to invest my money if I want to enter the hype? I’ll talk to you about 2 ETFs as well as 7 stocks to give you investment ideas and show you what your options are.

Invest in e-sport ETFs

While there are no single benchmark that tracks the entire gaming industry, there are exchange-traded-funds that hold stocks from the e-sports, gaming and betting industry. For those who may not know, ETFs track funds holding a basket of stocks following a certain theme, so that investors can simply choose an area of interest and already have a somewhat diversified investment, rather than struggling to buy individual stocks. As the industry is constantly evolving, many more ETFs may appear, and the ones that exist have not been here for so long. Here are 2 examples:

VanEck Vectors Video Gaming and eSports ETF (ESPO). This is a large fund focusing on companies involved in gaming and e-sports hardware and software. In addition, the ETF also holds some casino stocks. Around a third of the stocks are US-listed, and the rest are from other key countries in the industry such as Japan, China and South Korea. Some stocks names include Nvidia Corp., AMD Inc., and Tencent Holdings. The ETF tracks the MVIS Global Video Gaming and E-sport index, an index made of 30 companies which earn at least 50% of their revenue from gaming and e-sports. The ETF has a 1-year trailing total return of 74.9% and $471.9 million of assets under management.

Roundhill BITKRAFT Esports & Digital Entertainment ETF (NERD). Well, I guess that the first thing worth mentioning is that this ETF has the best ticker symbol ever. That is already something. Jokes aside, NERD is a fund targeting gaming stocks in developing markets. The fund tracks the Roundhill BITKRAFT Esports index, which represents companies involved in gaming in different ways, such as publishing and developments, competitive teams’ ownership and other things. The basket also holds around 30 stocks. Top stocks include DouYun International Holdings, Huya (both Chinese livestreaming service providers) and Modern Times Group, a leading Swedish company in the e-sport market. The ETF has a 1-year trailing revenue of 61.3% and 44.7 million of assets under management.

Invest in e-sport individual stocks

For investors who wish to put their money on individual horses, there are many options to choose from. We will mention seven to give you ideas. Note that these are in no particular order and that we do not recommend any specifically, the aim is only to give you an idea of what is out there.

Activision Blizzard (NASDAQ:ATVI)

You might know the company through some of its videogame names such as Overwatch, StarCraft, or Call of Duty. The company naturally plays an important role in the e-sport industry, as its game titles not only enjoy an outstanding popularity, but they also fit with professional gaming as they have an extremely high skill cap – some say playing StarCraft can be more intense than playing chess! Its games are some of the most watched on Twitch, and they have been really proactive in building the competition world of gaming, organizing major events and sponsoring teams.

Huya (NYSE:HUYA)

Huya combines a gaming streaming platform with the biggest gamer country in the word: China. Now that fundamentals are set, everything should go according to plan. Huya earns a revenue by allowing viewers to tip their favorite streamers, capturing a portion of the donations. The company also organizes events and signs exclusive deals with various e-sports leagues for coverage.

Electronic Arts (NASDAQ:EA)

Many people who enjoy gaming also enjoy watching sports and vice versa. Electronic Arts quickly noticed that and took advantage of the opportunity to convert sports fans into gamers. EA has a strong position in sports, with licenses such as FIFA or Madden that are some of the biggest in the gaming industry. It is also making a real diversification effort with games such as Apex Legends. Instead of focusing on high level competitive play, the company chose to keep a more open and welcoming philosophy, with online tournaments open to everyone wanting to play. This strategy is not only more inclusive, it also encourages more in-game spending. A double win.

Tencent Holdings (OTC:TCEHY)

Tencent Holdings have investments all over the place, making them wildly diversified. They are above all a massive media conglomerate with investments in many e-sport teams and leagues as well as other companies in different areas. They are also famous for some of the most important titles on the market: League of Legends and Honor of Kings (its mobile version). They also use the massive WeChat social media platform as a partner for their in-app payments and services. One of the hottest gaming stocks in China.

Take-Two Interactive (NASDAQ:TTWO)

This one might be a little behind the others mentioned previously, but hear me out. Although they are not really active in the e-sport environment just yet, they are starting to see increasing player engagement on their new GTA V online. For now, most of the online competition they created was through their basketball game, NBA 2K, a franchise working very well. There is still a lot more to be expected from the studio, who has talented artist and developers on their team.

Razer (OTC: RAZFF)

With Razer, it’s all about the gamer’s lifestyle. Their tagline is rather simple and says it all: “for gamers, by gamers.” The company is best known because of its hardware: they make sophisticated gaming computers and accessories (keyboards, mice, headsets and more). In fact, both their computers and gaming keyboards are the best-selling high-end gaming hardware in the US. They also sponsor over 18 e-sport organizations, making them an important player in the competition world.

Logitech (NASDAQ:LOGI)

Last, but certainly not least, let’s introduce one last hardware staple in our top. Despite their older and more traditional look, Logitech still makes high quality hardware that is beneficial to not only gamers, but also working professionals. They make everything from monitors to keyboards, mice, headsets , and many, many more products. One item that worked well this year are webcams, which had a blast during the pandemic. They keep growing and innovating, trying to get themselves a sport in the virtual reality industry, which will most likely be a component of online competitions in the future. Needless to say, if the e-sport industry keeps growing, people will need more hardware, and consequently, Logitech’s sales will increase.

That's it for today. I hope that this article gave you a decent overview of the industry and eventually, some investing ideas. Good luck investing!

Sources:

Investing in Esports Stocks, in the Motley Fool

HOW TO INVEST IN ESPORTS — 10 ESPORTS STOCKS TO KNOW, on Roundhill InvestmentseSports market revenue worldwide from 2018 to 2023, on Statista

Let's Play! 2020, The European esports market, a Deloitte market report

The Incredible Growth of eSports [+ eSports Statistics], in Influencer Marketing Hub

Best Gaming ETFs for Q4 2020, in Investopedia

These Are The 7 Best eSports Stocks To Buy Right Now!, in the Stock Dork

Read our next article: Top 7 Tweets of the day - 11th of November 2020