How to invest in the ageing population trend.

By 2050, the median age will be 36 which in 1810, was the life expectancy in France. This sort of progress in health care shifts socio-economic dynamics and affects your portfolio. Find out how in this article.

Key Takeaways:

- Ageing populations is a two-part discussion; one part is about retirees, the other is about the new working age population and how they will consume differently.

- As people begin to live longer lives the consumer life cycle will stretch more than shrink and consumer preferences will be affected in the long-run.

- Health care, wellness, leisure and financials related stocks will see momentum from an ageing population.

- The iShares Ageing Population UCITS ETF uses the logic seen below to develop a portfolio of stocks.

The dilemma: age pyramid reversals

Human beings have invented many great things to survive over the years—tools, houses, clothes, cooking... we have gotten so much better at surviving that today, the median worldwide age is 31, up from 22 fifty years ago.

By 2050, the median age will be 36! The incontrovertible fact is that human beings are beginning to live well into their 90s. Less wars, better nutrition, and more scientific breakthroughs have contributed to this new reality.

There is however, much more detail to this reality than meets the eye as not all countries exhibit ageing population dynamics. While developed nations see falling fertility rates (average number of kids per woman) the developing world sees the inverse with booming demographics.

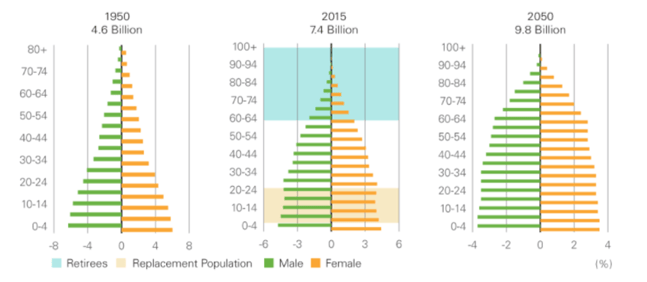

Demographics, the study of populations, teaches us about population through the age pyramids illustrated below. Developed nations tend to have reversed pyramids or Urn-like structure meaning that there are more old people as opposed to young.

While we know that different countries exhibit different growth patterns, the general worldwide pattern is showing a shift from lots of young folks to lots of middle-aged and older people, or retires (seen in the blue shade region).

Figure 1: Illustration of a changing trend in population age structures

Investors beware! This fundamental shift has huge macro-economic consequences. Ageing populations implies a serious consumer preference shift, which in turn means new industries created, and old industries re-invented.

Think about ageing populations as two-part; one part is about retirees, the other is about the new working age population and how they will consume differently. While we focus mainly on the former in this article, both work together in defining an ageing population, and what we care about i.e. a changing consumer landscape. Let us dive in:

Generations: where is the money concentrated?

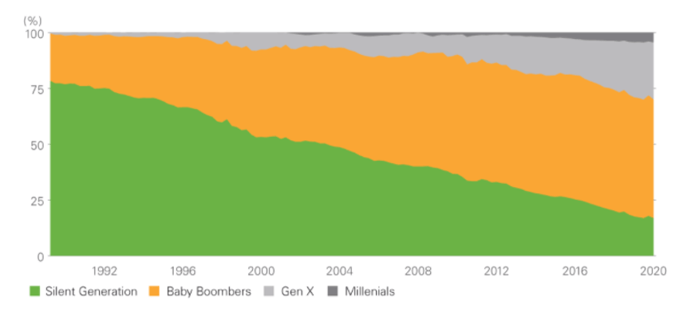

Money is tied up in older generations.As illustrated in Figure 2, most of the world’s assets belong to past generations, and more specifically to baby boomers, now mostly retired. This opens up a whole world of fascinating inquiry into what might happen next. Where will money relocate?

Think about the endless possibilities going forward in real estate for example. Imagine what a float on the housing market might look like as folks decide to finance their retirement homes, or vacations through home sales, or things like reverse mortgages? Most of the companies that will tend to these new markets don’t even exist yet. But there’s more:

As people begin to live longer lives, and as the next generation, Gen Z, continues to make its entry into labor markets, the consumer life cycle will stretch more than shrink.

Figure 2: 75% of the world’s assets are owned by retirees.

Figure 2 hides another piece of evidence used for later investment reflection, mainly that wealth is unsurprisingly held up in developed nations. This tied-up wealth has been predicted by experts to disproportionately effect developed nations in terms of future inflationary concerns. Economists have studied the effect of ageing populations on inflation (when the price of goods rise faster than ones purchasing power) and concluded some of the following remarks:

First, the United States: debt-financed increases in government expenditure (think Biden’s infrastructure deal) produce upward pressure on inflation, and debt-financed spending will also be needed to fund the ageing population’s social security promises later on. Stiff immigration policies from right wing opposition could also prevent continued cheap labor from keeping inflation low.

Now, the Eurozone: the working age population is shrinking, and four out of ten people will be retirees by 2030. A stagnant population accompanied by less people working could weigh down on the growth of supply of goods and services thus adding inflationary pressure. Immigration has been shown to help stagnation issues, but a recent rise in populism curtails efforts to rejuvenate an ageing population via immigration.

Last but not least, China: while the population is still growing, it is aging rapidly thus putting pressure on the next generation in terms of social security nets. More pressing still, the trade conflict with the US could have long term implications for the country’s productive capacities if more factory offshoring occurs. Also, China’s move from a saving to consumption economic model could spur inflation.

Investing according to demographic realities

There are several interconnected themes that can capture some of the dynamics exhibited above namely, around this consumer life cycle extension, and the changing needs of old age.

Beyond the following topics, keep in mind that there are many strategies to invest in aging populations. Since different countries exhibit slightly different trends, make sure to think about your investing time horizon and some other factors related to changing levers (one thing affects the other and so on).

Take the Eurozone—social security measures are already quite widespread in countries like France for example, and so as more folks retire, more taxes could ensue to finance healthcare and debt. This means you might consider assets that have some sort of tax haven modality, but it also implies that French health related companies like Sanofi could get large tax breaks themselves as they become more central to both the country’s health and national security.

Health and care—this bears the largest correlation to an aging population—think assisted living, and medical advances. Health insurance economics will also change and create new ventures.

Personal wellness—are all things concerning spending on lifestyle goods and services. Organic foods and alternative foods, athleisure apparel, spas, exercise-related goods and services, and cosmetics.

Financial wellness—retirees in developed markets will be looking for tailored insurance products, annuity products, and data-driven services both for asset management and new lending/borrowing needs.

How to play ageing population dynamics today

It is never too soon to invest, ‘’a dollar today is better than a dollar tomorrow’’. Perhaps the most important lesson we gathered from this research is that the future is intrinsically tied to right now.

The big ETFs

The iShares Ageing Population UCITS ETF uses the logic seen above to develop a portfolio of stocks that range from health to leisure stocks and everything in between. Because the ageing population theme is set on such a long-term horizon, investing passively in an ETF makes sense just by the virtue of the product’s nature. The downside to this is that if you know your own country well, its economic and political policies, you will have to forego this knowledge and trust the portfolio managers. It is less risky, but more blind.

Health care stocks

The list is far too long but to hit two birds with one stone, one ought to think about technology or forward-looking health or biotechnology groups that can provide both growth and reasonable prospects for future maturity. One such stock is CRISPR Therapeutics, a stock found in some of the best performing funds including Cathie Wood’s ARK invest funds, biomedical company Stryker, and firms like Boston Scientific, Sanofi and swiss giants Novartis and Roche.

Travel and leisure

Think reservations for trips and hotels, and the whole vacation thesis. As demonstrated by the pandemic, this sector is rather cyclical so beware of ups and downs. TripAdvisor, Airbnb, Expedia, Norwegian Cruise Line, Callaway Golf, Lululemon and Beyond Meat.

Financial wellness

From financials to real estate companies, not to skip over REITs, the choices are endless. Some of the most well-known asset managers are Swiss banks like Credit Suisse and UBS in part due to the country’s proven stability, both financially and politically. Other firms of interest exist in peer-to-peer lending such as Lending Club and life insurance giants AXA and Allianz.

Inflation protected assets.

We wrote an article on how to invest in an inflationary environment so click here to learn more about that.