Explain us this: Ten years ago, outdoors company Yeti re-invents the cooler, and during the most ‘’indoorsy’’ period humanity has ever known, saw net sales surge 20%. In this article, we dissect Yeti’s brand value, and its possible future as a dominant ESG stock.

Key Takeaways

- Yeti re-invented the look and feel of beverage and food coolers and built a household name.

- The firm has a strong cult-like consumer following and an exciting marketing angle that generates a sense of missing out in yet to be Yeti followers.

- Bearish arguments exist around its supply chains and supplier dependency and around its slow product cycle turnover constraint.

- Bullish arguments tend to highlight the company’s growth potential in foreign markets, its infant-state e-commerce presence, and its recent efforts to diversify its product offering in the Bags business.

How a cooler became cool...

When two brothers from Texas got tired of their fragile Styrofoam coolers during the summer fishing season, they knew they had to do something about it. Styrofoam coolers are not exactly suited for the adventurous type, they thought, and plastic coolers never fared well against the test of time.

Ten years ago, coolers looked like this:

And like this:

Everyone in the developed world had one of those boxes to go to the beach, to bring to barbecues, and garden parties—it was silently omnipresent, but remained a utilitarian necessity hidden in the shadows, nothing more.

Then, Yeti made this:

They marketed a high quality, high priced cooler the way the US Army runs its recruitment ads; with a bang and a flash.

Suddenly, Yeti coolers seemed to be that missing element to an adventurer's life and what used to be a disposable fisherman’s box became the hallmark symbol of the modern-day hunter.

Yeti marketed its product with inspirational commercials showcasing the interrelationship between the great outdoors, adventure and well, the much-needed cooler. It seemed evident afterwards that the $300 cooler was essential to any self-respecting outdoorsman.

The marketing campaign Yeti sends today is a message as transparent as ice, a cold truth that without a Yeti cooler, you are missing out.

With the heavy use of social media, and expensive commercials, Yeti generated so much excitement that the Yeti consumer base became known as a ‘’cult’’.

''What began with a $300 ice box for hunters ended up becoming a business generating $1 billion in annual revenues''

Much like a Patagonia, Yeti has embraced the ESG values, storyline, and status. Afterall, an outdoors company has a business interest in keeping the outdoors void of pollution. In 2020, their commitment to furthering packaging, sourcing and diversity efforts swelled and ranked Yeti head and shoulders above its peers as a leader of the ESG pack.

Yeti's Financial overview...

''For an ‘’outdoors’’ company, Yeti saw an average 20% growth in net sales during a period of history when people went out the least!''

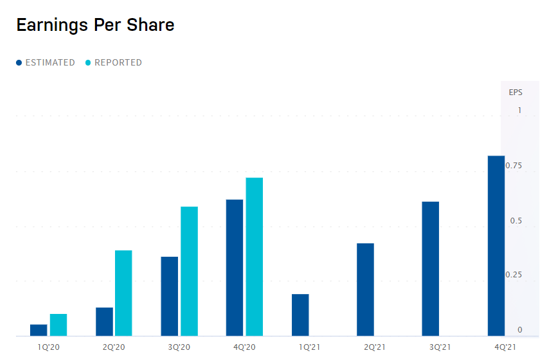

Yeti is nothing short of a success story and this fact is illustrated in its share price growth over time. After joining the NYSE in 2018 at a humble $18 per share, the firm now boasts of roughly $85 per share, a market cap north of $7 billion, and earnings per share that constantly seem to beat out earnings expectations and surprise analysts.

This could explain, in part, why UBS and Bank of America have recently upgraded the stock’s price potential north of its current position. The graph below shows Yeti’s consistent earnings beat and sheds light on the firm’s drastic seasonality.

Seasonality can introduce stock price volatility as sales come in inconsistently and highlight weaknesses in the business model in things like product diversification and seasonal risk.

Since retail tends to be seasonal in general, this is not so much a red flag.

Figure 1: Seasonal Yeti EPS shown systematic earnings beat

In 2020, Yeti saw net sales grow 19%, and profits triple from 2019 to $164 million. Cost of goods sold has remained steady around the $400 million mark for four years while revenues have almost doubled in four years. Its current price to earnings ratio is 41X, falling slightly from last year’s 47X, and its forecasted 12-month forward PEG ratio is around 2.5X earnings.

As of this writing, the share price is floating around its all-time high but do not despair. Peers Fox Factory Holdings, Planet Fitness and Columbia Sportswear, companies that share similar market caps of $7 billion and produce goods in the outdoors business somewhat comparable in value to Yeti, have all seen share price surges so far but none as large as Yeti’s. It is possible that Yeti could see some correction from this high.

Figure 2: Yeti share price versus peers in percentage growth

Bearish take on Yeti...

Ultimately, Yeti is a retail company subject to seasonality which means the share price could fluctuate alongside it earnings—it appears as though we are entering a low earnings phase for the company so one could assume a dip. Yeti is not made in USA so any extra tariffs on Chinese imports could pressure margins and EPS as Yeti manufacturing facilities are based in China. Shipping rates rising could present an obstacle for net income as the company might have a hard time raising already high prices higher still. Coolers, drinkware, and clothing are very competitive categories that rely on strong brand differentiation, something competing firms could easily begin to challenge as they start to offer their loyal customers alternative solutions with lower prices. Supply chain disruptions and reliance on few suppliers are key points that Yeti needs to be mindful of going forwards and counterintuitively, a product as durable as Yeti’s shows a limited turnover cycle meaning that one customer might not by a new cooler every year.

Bullish take on Yeti...

As shown above, Yeti has developed quite the powerful brand and has solidified its grip on the cooler market. Its significant under penetration in direct-to-consumer sales could improve over time as they ramp up e-commerce pathways. Their digital initiatives are said to focus on driving repeat purchasing to tackle the cycle turnover problem underlined above and with their strong margin outlook, they should have no problem scaling up operations online. One of the most exciting opportunities is their plans to expand in Europe and Asia and their long-term product and category expansion in bags and other consumables. Near term revenue and earnings upside has been shown to be significant as sales momentum has been healthy.