Switzerland has a well-deserved reputation as being one of the world’s safest places to store your money. Investing in Switzerland can be done through Swiss stocks, ETFs, bonds, gold and more.

Contents: Investing in Switzerland

- Why should you invest in Switzerland?

- Can foreigners invest in Switzerland?

- How to invest your money in Switzerland

- Swiss stocks, ADRs, CFDs, ETFs

- What is the risk of investing in Switzerland?

- What is the best investment in Switzerland?

Why should you invest in Switzerland?

There are no perfectly safe investments but is generally understood among investors that Switzerland is one of the ‘safest’ places to invest.

Does that mean investments in Switzerland always go up in value? Of course not. It means that the investing environment, including the stable Swiss economy with low unemployment and low national debt alongside the rule of law and Switzerland’s tradition of neutrality makes it ‘safer’ than most places to invest.

If you are Swiss you are well-placed to invest in your home country and for overseas investors, Switzerland provides a stable way to diversify your portfolio.

Can foreigners invest in Switzerland?

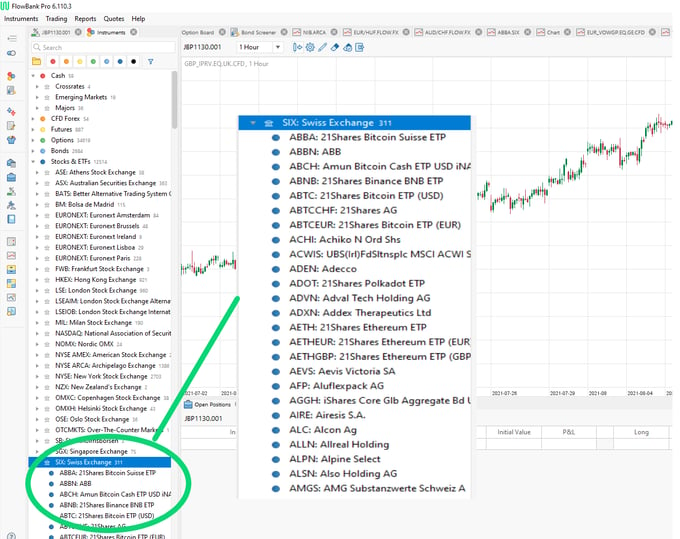

It’s now easier than ever to invest directly into Swiss stocks from overseas. Investors can register for the Swiss-based investing app from FlowBank. FlowBank offers a multi-asset trading platform so alongside Swiss stocks, there are also Swiss ETFs, foreign stocks as well as other asset classes like bonds and commodities.

For example:

Source: FlowBank Pro desktop trading platform

Traditionally the most popular instruments for foreigners to invest in Switzerland have been through Exchange-Trade Funds (ETFs) or ADRs of Swiss stocks listed on foreign stock markets like the New York Stock Exchange.

How to invest your money in Switzerland

1 How to buy Swiss Stocks - direct

A Swiss stock is simply the stock of any company that has its headquarters in Switzerland and is listed in Swiss public markets. The main Swiss stock exchange is the SIX Swiss Exchange, where all the biggest stocks in Switzerland tend to be listed. To find publicly-traded small to medium sized Swiss companies to invest in, you would look to the BX Swiss (formerly known as the Berne exchange).

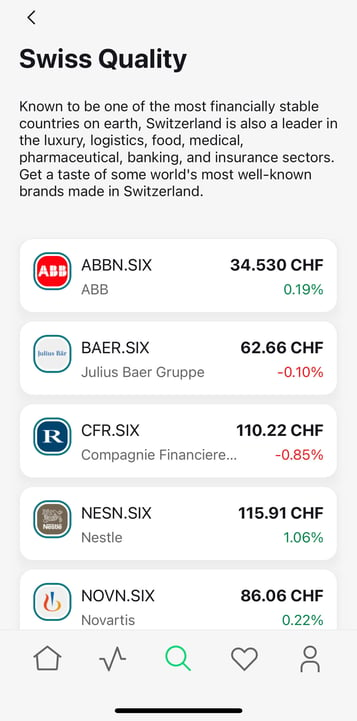

FlowBank offers trading in all Swiss stocks listed on the SMI because they are the largest, most liquid, and so most suitable for low-commission stock trading.

On the FlowBank app, there is a dedicated section to find ‘Swiss quality’ stocks.

2 How to invest in Swiss stock market - ADRs

The most widely-bought Swiss stocks by foreigners (mostly Americans) are:

- Nestle SA (NSRGY)

- Novartis (NVS)

- Roche (RHHBY)

These stocks are mostly listed on the New York Stock Exchange (NYSE) or sometimes the Nasdaq.

3. Switzerland index CFD trading

The benchmark stock index in Switzerland is the Swiss Market Index (SMI). It contains 20 of the largest Swiss company stocks, including the ADRs mentioned above.

You can buy the Swiss index as a Contract for Difference (CFD), or alternatively if you think the Swiss index will go down, you can go short the SMI index CFD.

The CFD for the SMI is called the ‘Switzerland 20’ (code SMI_U.IN.EU.CFD) - which can easily be searched for in the FlowBank app.

4 How to invest in Switzerland ETFs

The Swiss stock market tends to be more concentrated than in other developed countries, meaning there are large Swiss conglomerates that tend to dominate specific industries. These companies are the Swiss blue chip stocks that are the backbone of most Swiss stock portfolios.

This concentration is then compounded by the make-up of Switzerland ETFs that tend to have heavy weightings in two or three large Swiss multinationals. Most of the large Swiss index funds contain 20-30 large cap stocks. The main exception is the ‘SPI’ which contains 200 stocks so is much more diversified but contains many smaller riskier companies.

The best known Switzerland ETFs are:

- iShares core SPI ETF (CHSPI)

- Lyxor Dow Jones Switzerland Titans 30 ETF (CBCH30)

- iShares MSCI Switzerland Index Fund ETF (EWL)

- Invesco CurrencyShares Swiss Franc Trust (FXF)

What is the risk of investing in Switzerland?

Ironically the biggest risk to investing in Switzerland comes from its haven appeal. That’s because of the impact that ‘haven flows’ - that’s flows of money- have on the Swiss currency, the Swiss franc (CHF). When international investors are nervous, they prefer to park their money in safe assets - one of which is the Swiss franc.

These occasional bouts of currency volatility can make investing Switzerland for foreigners more challenging. One of the best ways around this problem is to use a currency hedge.

For example, when somebody in the European Union buys a Swiss stock with euros, they in effect converting their euros into Swiss francs. If the franc goes up in value, they will get more euros back when they sell the stock than if the euro-franc (EUR/CHF) exchange rate had stayed the same. Likewise if the franc drops in value, they would get less euros back than if the exchange rate had remained constant.

The hedge trade is simply to buy Swiss stock and then short the Swiss franc, ie buy EUR/CHF. This can easily done, alongside other forex trading inside the FlowBank app.

What is the best investment in Switzerland?

What you define as the ‘best investment in Switzerland’ depends on your personal investment objectives, including your risk tolerance and investing time horizon. As such, we offer some ideas for an income investing strategy and a long-term growth investment strategy.

Income investing Switzerland

There are certain geographical hubs that make Swiss stocks strong: For example Watch Making (Swatch Group), Banks (UBS and Credit Suisse), Pharma (Lonza, Novartis, Roche), Financial Services (Swiss Re, Zurich Insurance, Partners Group) and Engineering (ABB). Past performance is no guarantee of future returns but Switzerland has been a leader across these industries for decades, and as such they provide some of the highest dividends for income investors.

Growth stocks Switzerland

Switzerland has many up-and-coming industries that are worth considering for long-term growth investing opportunities in Switzerland. These include sustainable equities in Switzerland as well as new areas of technology like cryptocurrency and blockchain-based firms, many of whom have clustered in Swiss cities such as Frankfurt, Geneva and Lausanne.

To read more about these opportunities, check out the blogs on our Swiss Series