Tesla and CEO Elon Musk have captured the hearts and minds of investors who believe in the disruption of EVs but the gains in the stock by many measures are excessive.

Must know about investing in Tesla

- Tesla stock hit a fresh record high again on Monday, rising above $600 for the first time, marking a 600% year-to-date return.

- The latest gains come before Tesla is added to the S&P 500 index which is expected to generate $100 billion in ETF and mutual fund buying

- Tesla did make a fundamental turnaround this year with its consecutive quarterly profits and share issuance to reduced leverage

- Tesla is a proven leader in EV manufacturing but the perception of its leadership in autonomous vehicles is unfounded, calling into question the possibility of it moving into ride hailing with its AV tech

- Idol worship of Elon Musk is likely clouding the minds of many investors who conflate Musk's amazing ideas and ambitions with the reality of Tesla as a battery and carmaker

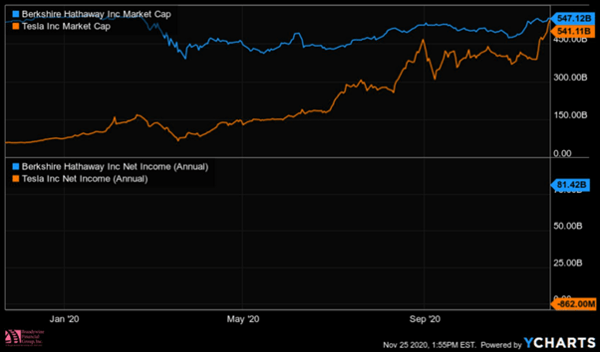

- Tesla stock valuation climbing above the entire European car industry and that of Warren Buffet's Berkshire Hathaway are signs of bubble-like behaviour in markets

What’s happening?

Tesla stock is up BIG that’s what. It has risen over 600% this year to take Tesla stock over $600 and it is approaching a market cap of $600 billion. The share price continues to confound every naysayer who has ever talked the stock down.

As we suggested in our title, there is a war being waged by two schools of thought in Tesla stock; disruptive technology versus stock market excess.

Tesla is the flag-bearer for not just electric vehicles but also a new ‘green agenda’, which promises to overturn the traditional automotive sector and by extension the oil and gas industry. At the same time this ‘belief’ in Tesla means traditional financial metrics, including valuations are being put to the wayside. Then as the price moves higher, it attracts even more stockholders, who do not necessary have a long term positive view on Tesla but are rising the price momentum higher.

Let’s run through the bullish case of disruption versus the bearish case of financial excess. But before that we must discuss its current earnings and growth prospects.

Earnings

It should be said that Tesla earnings are no longer something for the future. Tesla has reported five successive quarterly profits, the first four of which qualified it for the S&P 500 alongside other criteria.

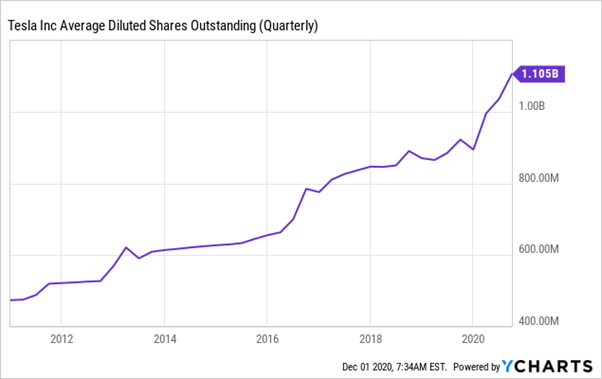

If we want to tell a fundamental story about Tesla in 2020, there are two complimentary components. One is Elon Musk’s stated determination to become a profitable company, end the cash burn and generate free cash flow. The second was the raising of equity capital to reduce the company’s leverage and shore up the balance sheet.

While it has hardly been a problem for the share price, Tesla has been dealing with an issue of scalability. It has not been able to meet huge demand with production from the get-go. From an earnings standpoint, Tesla needs to grow revenues and to do that it needs more factories in which to produce more vehicles.

There has been some real good news for the company in 2020 and it has made progress towards some key production goals despite the coronavirus pandemic. The company introduced the Model Y and has ramped up production in its Shanghai Gigafactory. Shanghai is one of three new facilities where there is a big push to expand vehicle production, the other two being in Berlin, Germany and Austin, Texas. The latter two are much further behind in the production ramp up but should be a 2021 story.

For Tesla, to make the Model 3 a real mass market vehicle, the factories need to be in place ready for when the public is ready to switch to EVs en masse when the charging infrastructure is in place and well before the 2030 deadline that countries like the UK have set for the end of petrol and diesel vehicles.

S&P 500 index inclusion

There is an entire speculative element to Tesla stock surrounding the S&P index inclusion. We detail the key points in our blog Tesla stock pops on S&P 500 index inclusion- sell the news?

Disruption

Tesla is already understood to be at the forefront of electric vehicle innovation as the sole EV-only vehicle maker in America. Tesla has a whole fleet of EVs, while the big automakers are only just entering the fray with one or two models. This will change of course as the whole car industry turns electric.

Tesla needs to continue to innovate to be priced as an innovator. Some of that will come through its role as a battery company after the merger/acquisition of SolarCity to become part of the sub-company of Tesla Energy.

The new frontier is autonomous vehicles, and beyond that the potential for a vertical business model whereby Tesla is also a ride hailing company. In this model, Tesla produces the cars which go straight out into a fleet of autonomously driven taxis run by Tesla.

The Tesla leadership in AVs is not as clear cut as Elon Musk would like to let on and is a potential headwind to future share price growth. Idol-worship of Elon Musk might be a problem for investors if his amazing ambitions for Tesla don’t come to fruition. If even 10% of Musk’s ambition came true, Tesla will be an amazing company but if markets are pricing in 100% of the ambition, then it’s a different story for the stock price.

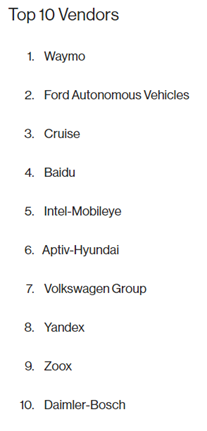

Guidehouse 2020 AV leader board

According to the Guidehouse 2020 AV leader board, Alphabet subsidiary Waymo is way out ahead of Tesla for its autonomous vehicle (AV) tech and has been for a number of years. Tesla is towards the bottom of the rankings, not even in the top 10 (above) and below Ford and GM. In addition, Consumer Reports hands-free tests of several automated driver assistance systems (ADAS) concluded Tesla Autopilot was a "distance second" to GM's Super Cruise system.

Excess

Developing the idea of Tesla as a presumed leader in autonomous vehicles, is a general idea that the public perception of Tesla looks inflated above and beyond reality. Many customers have bought ‘full self-driving capability’ as an extra, which is not yet available.

Tesla famously does little in the way of normal automaker advertising like TV car ads but is very adept via Musk as an influencer to push the perception of its products matching the amazing ambition and ideas that Musk has. Even the Tesla ADAS system being called ‘autopilot’ is potentially problematic - especially under a Biden administration, where regulation could be tighter. There have been a number of reported instances with Tesla drivers relying completely on the Tesla system, assuming the self-driving system is already completely functional, even falling asleep in some cases.

The stock is at the centre of what many are calling a new speculative bubble in financial markets. Having been mostly absent since the ’08 financial crisis, retail traders have entered the market in droved spurred on by stay home orders and huge central bank stimulus that sent share prices up, while the real economy tanked. ‘Big Short’ investor Michel Burry recently announced he is short Tesla stock, while investment manager Jim Chanos trimmed the size of his own “painful” short

Conclusion

To conclude, here are some charts to demonstrate the abnormal gains in the stock, which look detached from the reality of the still very high growth potential of the company.

Here we can see Tesla’s market cap exceeding the entire European car industry, including Volkswagen- the 2nd most valuable car company after Tesla.

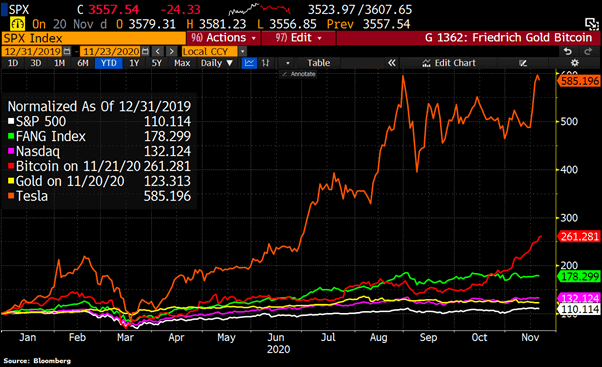

This is Tesla stock year-to-date compared with stock market benchmarks as well as other ‘bubble-like’ assets like FANG stocks and Bitcoin.

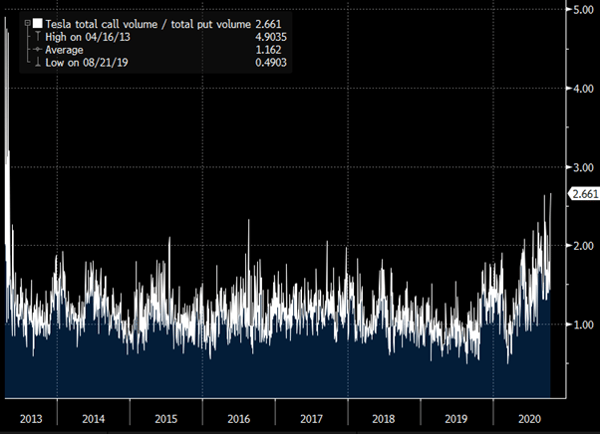

This is the proliferation of options buying pushing Tesla stock higher. Call volumes are highest relative to puts since 2013.

Here we can see Tesla’s market valuation overtaking that of Warren Buffett’s Berkshire Hathaway.

It was about investing in Tesla