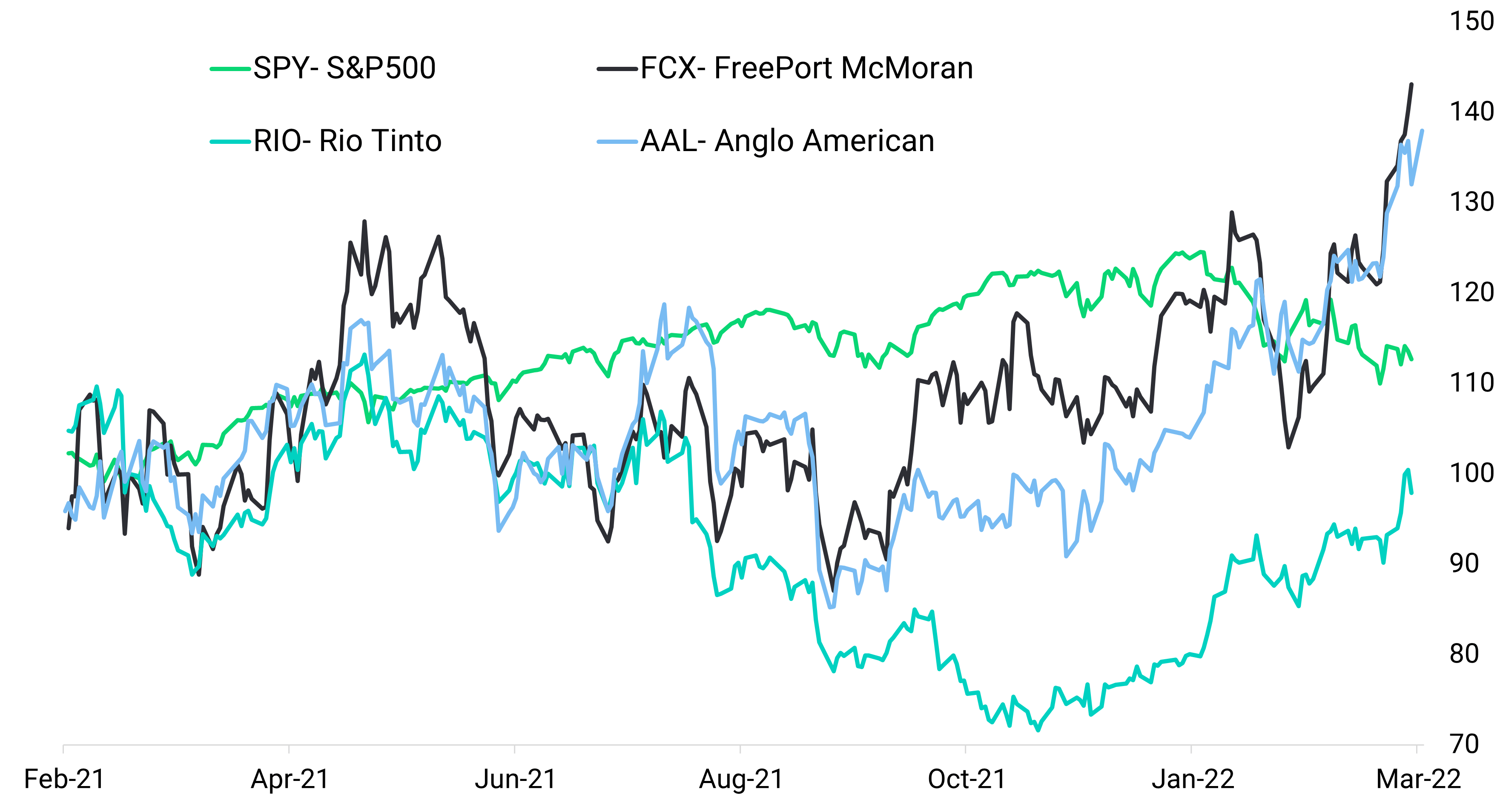

Last year, commodities including copper witnessed one of their best annual rallies since 2009. Last week, the red metal made a new all-time high as geopolitical tensions set a fire under major metals. But has it further room to go?

Commodities super-cycle

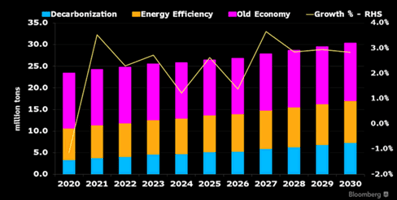

The energy sector is currently going through a full-blown transformation and metals are at the heart of the ecosystem, from the production and transport to the storage of energy, industrial metals are expected to be used through every step. Many believe that we are still only in the early stage of this green super-cycle and that the price of some metals could rise further. At the top of the list of commodities set to enter a super-cycle are copper and nickel, both benefit from secular-demand drivers such as decarbonization and energy efficiency.

Supply & Demand

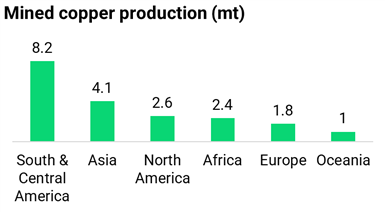

Copper is today the best non-precious metal conductor of electricity and is in the manufacture of electronics and electrical components. To date, roughly 700 million metric tons of copper have been mined in the world. An estimated 2.1 billion tons of identified deposits remain in

the ground, while undiscovered deposits are estimated at

3.5 billion tons. Chile and Peru are the largest exporters of copper ore, while China and Japan are the largest buyers.

Factors expected to positively impact copper prices

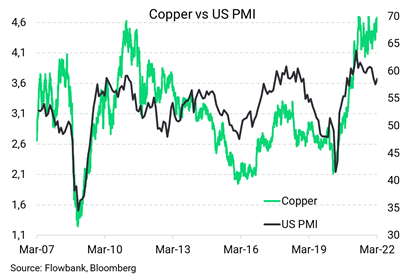

Copper is considered as the bellwether metal for the global economy given its wide use, and when global growth starts showing signs of a peak, the price momentum of the red metal begins to fade. While this has been true historically, we think this time around copper benefits from strong short-and long-term fundamentals that could propel its price higher for longer.

1. Secular growth drivers

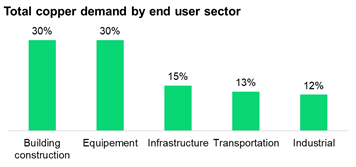

The dynamics behind the copper market

are changing as the demand for copper is being boosted by the vital role it is playing in a few rapidly growing industrial sectors, notably electric vehicles, semiconductors wiring metals, and renewable power generation. Global vehicle sales may still be short of pre-pandemic levels by 2022, but auto-related copper demand could exceed that of 2019 by 400’000 tons, due to the tripling of electric-vehicle (EV) sales. It’s forecasted that EVs alone are set to account for 3.1 million tons of demand, almost 60% of all transport-related usage, and clean-energy capacity additions could boost the subsector appetite for the metal by 5% compounded over the next decade.

are changing as the demand for copper is being boosted by the vital role it is playing in a few rapidly growing industrial sectors, notably electric vehicles, semiconductors wiring metals, and renewable power generation. Global vehicle sales may still be short of pre-pandemic levels by 2022, but auto-related copper demand could exceed that of 2019 by 400’000 tons, due to the tripling of electric-vehicle (EV) sales. It’s forecasted that EVs alone are set to account for 3.1 million tons of demand, almost 60% of all transport-related usage, and clean-energy capacity additions could boost the subsector appetite for the metal by 5% compounded over the next decade.2. Strong Chinese appetite

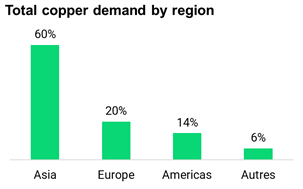

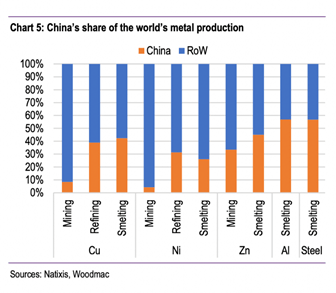

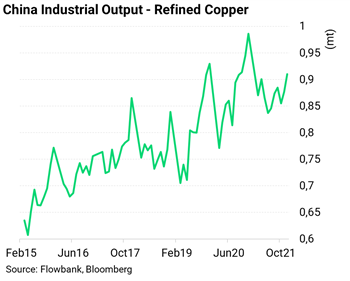

China accounts for almost half of global metal demand, and the country's growth is a fundamental requirement for another metal super-cycle. In the fourth quarter of 2021, China's economy grew 4.0% from a year earlier, its weakest expansion in decades excluding 2020. With the real estate slump expected to drag on through at least the first half of this year, China's central bank has started cutting interest rates and pumping more cash into the financial system to lower borrowing costs. In addition, with Communist Party taking place this place year, policymakers are looking to ward off a sharper slowdown that could undermine job creation. Additionally, China's copper

demand may grow further over the next decade if the country's intensity of use follows that of other developed countries. At just over 8 kilograms per capita, China's intensity is still short of the US peak at 10.5, Japan's 12.5, and Germany's 17. Considering these factors, China's appetite for the red metal is likely to provide a strong backstop to copper prices.

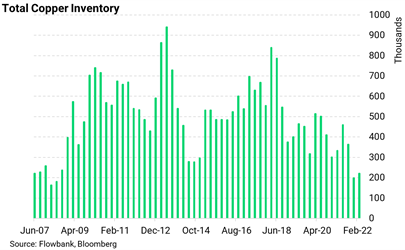

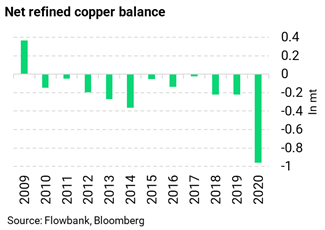

3. Lowest inventory in decades

Almost all base metals traded in London and

Shanghai are currently in ("super")-backwardation, a situation where prices for immediate deliveries are higher than benchmark contracts. The Pandemic of 2020 created major supply chain issues and imbalances in commodity markets. Today, the globally accessible copper stockpile has fallen sharply to levels where it appears consumers are becoming anxious about a shortage. An estimate of producer and consumer stockpiles shows that there are only 4 days of inventory, much below the 14 days average in 2015. Ironically, a keener focus on the environmental impact of mining activities has left the industry unable to respond quickly.

Shanghai are currently in ("super")-backwardation, a situation where prices for immediate deliveries are higher than benchmark contracts. The Pandemic of 2020 created major supply chain issues and imbalances in commodity markets. Today, the globally accessible copper stockpile has fallen sharply to levels where it appears consumers are becoming anxious about a shortage. An estimate of producer and consumer stockpiles shows that there are only 4 days of inventory, much below the 14 days average in 2015. Ironically, a keener focus on the environmental impact of mining activities has left the industry unable to respond quickly.

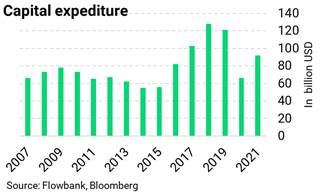

4. Capex is lagging

While capital spending in the copper industry is rising, it may still not be enough to fill the potential deficits in the market toward the end of the decade. Out of the total spendings, just a small proportion, 30% in 2022, may contribute to adding new capacity after accounting for sustaining capital and combating grade decline.

Miners are also facing tougher regulations. The

average lead time from the first discovery to the first metal has increased by an average of four years to nearly 14 years. Increasing social and environmental awareness means that mining companies need to engage with communities and governments very early in project development.

Lastly, copper projects are having to compete with other future-facing metals such as lithium, potash, and polyhalite, which is why we believe the overall proportion allocated to copper may not increase significantly above 40%.

Conclusion

The copper market bears all the signs of a commodity that could trade well above its long-run real average price for coming years. Lower output, robust demand, and growing concerns that an escalation of the Ukraine conflict could disrupt production and exports only add to the attractiveness of the red metal.