The forthcoming scary season is not only a favourite time for kids (and many adults), but also for the stock market. That’s because the beginning of Halloween also supposedly coincides with the beginning of a seasonally strong period for market returns, known as the "Halloween effect". But is the Halloween effect real?

There is hardly a year where investors and the media do not refer to the popular market wisdom. It is closely related to the oft-repeated advice to sell in May and go away. This tactic has existed in some form or another for quite some time. Its longer form was something along the lines of Sell in May, go away, come back, St. Leger Day. The timing is also interesting as it includes the “Santa Claus rally”, a 7-trading session during which stock prices have historically risen 76% of the time.

Predictable patterns can be helpful and provide a guide for when to buy and when to sell. Investors seeking a crystal ball to aid with investment decisions could integrate these seasonality effects into their trading strategies.

What Is the Halloween Strategy?

The Halloween strategy, also referred to as the Halloween effect, is a market timing strategy that holds that stocks perform better from October 31 (Halloween) to May 1 than they do from the beginning of May through the end of October. It is based on seasonality and cyclicality in markets.

Some investors find this strategy more rewarding than staying in the equity markets throughout the year. They hold the opinion that as the warmer weather arrives, low volume and an absence of market participants (due to holidays) can result in a riskier, if not altogether lacklustre, period.

Halloween investing strategy vs buy & hold

The strategy does have evidence worthy of consideration. Historical stock returns indicate that the Halloween strategy's central tenet has been largely correct, at least throughout the last half-century. November through April has provided investors with stronger capital gains.

The findings also lend credence to the idea that buying in November and selling in May is a successful way to beat the market more frequently than 80% of the time over a five-year horizon and more frequently than 90% of the time over a ten-year horizon.

The graph below displays the average monthly returns for the S&P 500 over the past two decades. Indeed, on average, returns are much higher from November to April than for the other half of the year, with the months of November and April contributing the most to the overall gains.

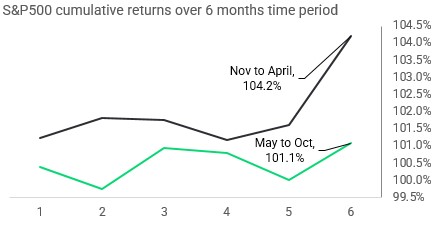

For illustration purposes, the graph below shows the cumulative returns of the average monthly returns for the two periods. And clearly, average total compounded returns over the past 20 years, have significantly been higher from November to April (+4.2%) than the other half (+1.1%).

As the current market decline may seem like a decent entry position, some readers are wondering if it is a good idea to buy stocks over the upcoming Halloween season. The good news is that there are a few more promising events occurring that may strengthen risk asset prices in addition to seasonality effects:

-

The majority of third-quarter earnings reports have so far exceeded expectations, despite underperformance by large tech equities. The US GDP growth rate of 2.6% for the third quarter, which is higher than projections and represents a turnaround from the decline experienced in the first half of the year, indicates that the overall economy is doing well.

-

The decline in bond yields is noteworthy; 10-year Treasury yields have dropped 26 basis points since Monday. Both the Reserve Bank of Australia and the Bank of Canada raised interest rates earlier this month, albeit by less than the markets had anticipated. The European Central Bank also advocated slowing the tightening process. This means that as "insurance" against global headwinds, the Federal Reserve may start to weigh the benefits of joining other central banks in hiking rates less aggressively after November Fed’s FOMC meeting

-

Lastly, institutional investors are holding historically high amounts of cash and the general market sentiment is still very cautious, suggesting equities could profit from new inflows should investors return to the market.

So, is the Halloween strategy real?

Yes, it is real. And yes, it is fascinating. It is a puzzle, and nobody has been able to conclusively pinpoint the cause of this seasonal effect. While the effect appears to work most of the time, it is not a foolproof method. As a result, for investors that decide to capitalize on this strategy, it is always sage to keep in mind the right risk management strategies.