International diversification matters in asset allocation, and doing so in one of the world's most innovative start-up hubs, Israel, is now an option with the upcoming Playtika IPO. This Friday, the online mobile gaming company was listed on the Nasdaq under the symbol PLTK for what is a $1.88 billion raise. The company's business operations and risks are explored in this article:

Playtika business overview

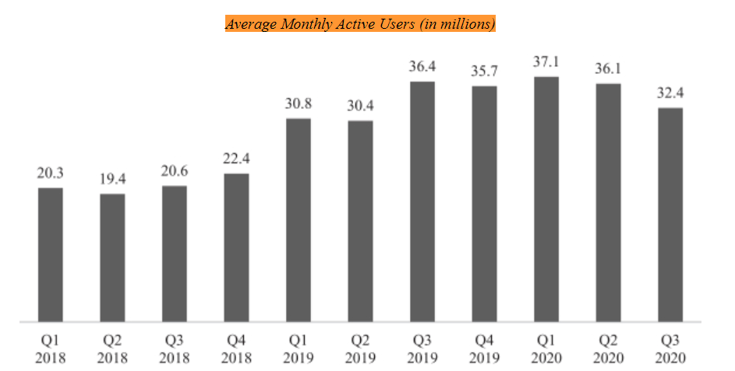

Playtika offers free to play mobile games through its proprietary technological platform. Since its founding in 2010, they have produced nine games that figure in the top 100 highest grossing mobile games in the US (where the number of in-app item purchases defines the ranking). They also own some of the most iconic free to play mobile games in the world which take first poll position in their respective genres such as casino style games. The company is made up of about 4,000 employees and the firm has over 32 million monthly active users.

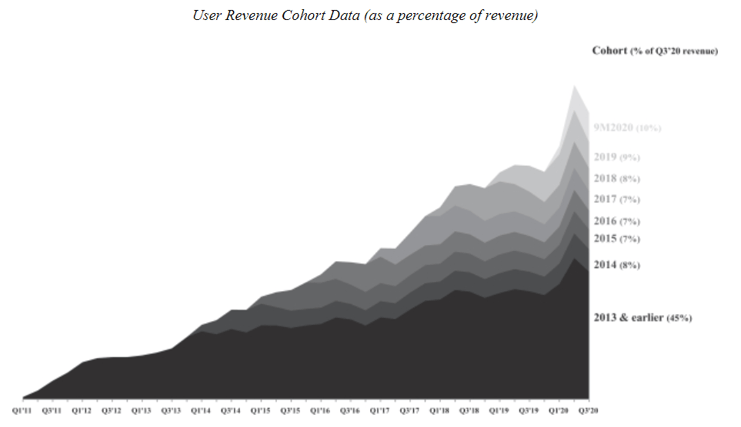

Something special about their games is that they are constantly updated and improved and figures show that about 50% of revenues from the last year stemmed from the same users who downloaded games in 2016. This suggests that users are generally happy with the products and are staying on board for more.

Playtika's special sauce is acquiring games and enhancing their scale and profitability through their technology called the Playtika Boost Platform. They leverage this tech by applying live operations to newly acquired games which makes for a much more stimulating and exciting user experience. Playtika uses data analysis to better understand user trends and demands, in order to develop games that fit those needs over time. Here is what their website looks like though they are more of a mobile app company:

How Playtika makes money and how they've performed

Playtika derives revenue primarily from the sale of virtual items, items that exist within games that improve the gaming experience. In order to gain traction (add users), Playtika depends on companies that offer a customer base namely through the Apple, Google and Facebook stores.

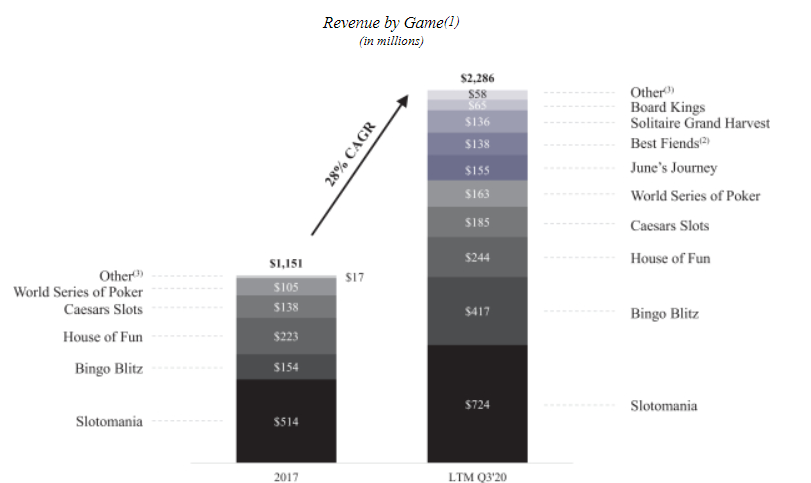

During the first three quarters of 2020, Playtika generated $620M through Apple, $600M through Google and $215M through Facebook. If your are wondering what games they offer and which games make the most revenue see the graph below from their S-1 filling. What is impressive about their top grossing game Slotomania is that it was launched in 2010 and is still the number 1 game worldwide in its social slots genre. It has generated Playtika $724M in the last twelve months ending with the third quarter of 2020, a growth from three years earlier:

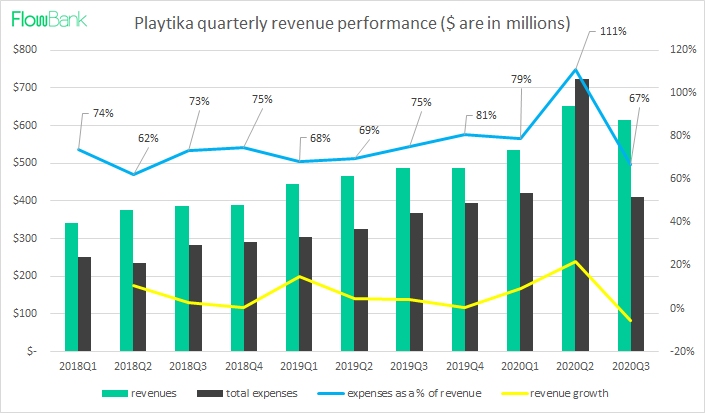

Regarding revenues, we are seeing a steady and positive revenue growth most of the time for Playtika except for a rough second quarter in 2020 where operational expenses surpassed revenues in such a way that net income became negative for the first time in many quarters. This is not the trend that Playtika is used to showcasing so a negative revenue growth from Q2 to Q3 in 2020 is somewhat of a negligible figure in the valuations model. Playtika is fighting against companies that have much longer cashflow histories and that have strongly benefited from the Covid pandemic, but this is also the case for Playtika which has and will continue to grab an audience that works from home, and increasingly uses mobile devices to communicate and play (Gen Z trends). Revenue growth is generally steady and positive, and expenses usually take up around 75% of revenues, something to be improved to increase gross profit margins.

As seen in the graph directly below, monthly active users went from a 19.4 million in Q2 2018 to upwards of 36 million in Q2 2020 which is a solid improvement. These numbers could continue to rise because of the pandemic, because of a next generation of users coming in, and because of more acquisitions and technological developments on the platform. As shown in the previous revenue by game graph, CAGR is at 28% in three years time, and the number of games added to the platform has increased enough to double revenues in just three years.

Daily active users have been increasing since 2018 when the average number was 6.6 million users. Q3 showed slightly less daily users on average as compared to Q2 but together they averaged about 11.3 million, almost doubling in two short years. A similar dynamic occurred with daily paying users. In 2018, the average daily users that paid for in-store virtual items were about 138,000 while half way through 2020 the number was closer to 315,000 more than doubling in size.

The daily payer conversion (DPC) rate on the other hand has not increased by the same levels over the past couple of years roaming around 2-2.5%. The DPC is a metric that shows the relationship between paying users and total active users, or in other words the number of users that actually pay for items.

While Playtika suggests being able to squeeze out larger figures in the future, it remains unclear if that number will be much high than 3% considering ten years of data. This is not a great sign of growth for a tech company going into an IPO. The next point is either good or bad depending on your beliefs in that the average revenue on active users per day has been around $0.60 since 2018 with not much of a growth factor trend to show for positive future results. The upside to this however, is the great steadiness of income per day per user which could be a good measure for fixed income investors if Playtika becomes a dividend company.

Risks Affecting Playtika

Every business is subject to some type of risk either financial or operational or something in between. Playtika needs to balance the competition, demand context for their games, relevancy, and usership.

- Playtika generates a lot of its cash from in-game player purchases, in fact 97.2% of revenues in the past year were subject to in-game purchases. Revenues and growth is thus dependent on Playtika's ability to maintain strong numbers of virtual purchases and also, keep the daily player conversion rate from going down. Bottom line for the developer is to keep the games as entertaining and addictive as possible and to keep pumping out updates and new fun games. It doesn't seem as though advertising is an option for their business model considering ads could deter users from the platform.

- Playtika is known to buy out other companies making cool new games, and this has become their way of staying relevant. According to Crunchbase they have acquired five companies, their latest being Seriously in 2019, a developer of mobile games for iOS and android platforms. Playtika's Boost Platform, its operational services, and scale enable game studios to thrive under its umbrella and continue to produce quality games. This is a way for Playtika to stay up to date on the demand and ride any new video game wave. The company is not limiting its purchases to game studios and has stated its plans to enhance its position by also acquiring marketing, AI and R&D companies. If Playtika is not able to continuously buy out the competition, it could face some serious consequences. Is buying out other companies a sustainable business model ? Google does it all the time so maybe, but the accumulation of talent is probably next on Playtika's list of priorities as a mobile gaming app business.

- Usership; retaining and successfully luring new users to play its games is a major source of concern for Playtika. It's easier to buy companies than customers. Playtika will need to continue offering new features and sales offers to rack up on consumer demand. Building up its brand through user loyalty programs is crucial and also expensive. Playtika spends a lot of money on marketing campaigns in acquisition channels and will need to continue this spending in other areas such as content and technological development to bolster its sales.

- Some more shortcomings include; 1) that Playtika relies on other tech groups like Google Play Store and iOS App Store to distribute their games 2) they have a small number of games that generate most of their revenues 3) a high concentration of revenues are generated by a small but loyal user base 4) security breaches could adversely affect reputation and long term growth prospects and 5) the industry is highly competitive with little barriers to entry.

Key Takeaway

Playtika shows strong revenue figures that have been increasing over time through the acquisition of new and relevant games and studios. Their expenses in Q2 went for a joy ride and damaged its 2020 net income figures, but the company remained profitable, and could remain so for quite some time. Active user figures have not skyrocketed during the pandemic like we would have expected, but monthly active users have soared over the past two years. The company faces stiff competition in mobile and console gaming, and their revenue stream is too concentrated on certain products. The Playtika IPO could go either way, but in terms of growth prospects, Playtika looks stale in comparison with other technology and gaming companies. All in all, Playtika looks like a steady money pumping machine, but innovation both in their gaming products, and in the way they run their expenses could be improved. The price of the IPO is rumored to be around $22

Sources:

https://stockanalysis.com/stocks/pltk/

https://venturebeat.com/2020/12/18/mobile-game-giant-playtika-files-for-an-ipo/

https://www.crunchbase.com/organization/playtika

Blogposts, newsletters, podcasts and any other content published by FlowBank SA (hereinafter “FlowBank”) reflect the opinions of the authors only and do not reflect the views of Flowbank or any of its subsidiaries or affiliates. These contents are meant for informational purposes only and aim to offer new ideas and perspectives. They are not intended to serve as a recommendation to buy or sell any type of financial instrument, whether that be through a Flowbank account or any other trading account. They are not to be considered as research reports and are not intended to form the basis of any investment decision. Any third-party opinion expressed, and information provided therein do not reflect the views of Flowbank or of any of its subsidiaries or affiliates. We emphasize that all investments involve risk, and past results are not a guarantee of future performance. While diversification does help to lower and spread the risk, it does not ensure a protection against loss. Investing in securities or other financial products always involve a risk of losing money. Prices fluctuate with the market in sometimes unpredictable ways, and investors should be aware that their losses might exceed their initial deposit. Flowbank SA, a FINMA regulated company.