The ‘Desert Portfolio’ hails from the Gyroscopic investing forum – and is so simple and cost-effective with a history of steady returns and minimal drawdown that it can be used by everyday investors.

What is the Desert Portfolio?

The Desert Portfolio comprises 3 assets – stocks, bonds and gold.

You can find a form dedicated to the portfolio here on the Gyroscopic Investing forum- but the portfolio was first proposed on the forum earlier by a user called ‘Desert’. Funny who we get out investment advice from in the era of the internet! Still better than a clueless salesman on the phone or at your bank! The forum is dedicated to the idea of the Permanent portfolio with various proposals for variations.

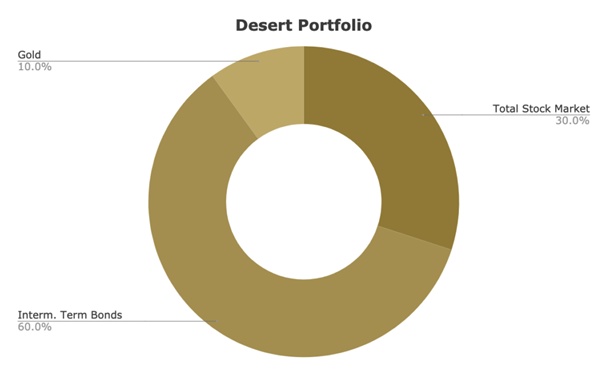

Specifically the breakdown is:

- 30% Total US Stock Market

- 60% Intermediate Term Bonds

- 10% Gold

Source: Optimizedportfolio.com

Desert portfolio described it as a way to combine the simplicity of a classic stock/bond (60/40) portfolio with some blend of the Permanent Portfolio. Harry Brown’s Permanent Portfolio includes is 25/25/25/25 of stocks, bonds, gold and cash. The basic idea of Desert is similar but without the cash and a lower allocation to gold.

Bonds are the heaviest component and are concentrated in the ‘intermediate term’. Equities will typically provide the most upside alongside the yield from the bonds. Gold serves as a diversifier – but a relatively small one with just 10% off the allocation.

How to replicate the Gyroscopic Investing Desert Portfolio

The website www.lazyportfolioetf.com attempts to replicate the Gyroscopic Desert strategy through a 100% ETF asset allocation.

It is a medium risk portfolio that can be replicated with 3 ETFs.

Because it uses ETFs, the portfolio is super liquid – meaning you can shut down the whole investment with a couple of clicks without delay or problems with redemptions associated with traditional mutual funds.

The choice of ETF can be tailored to your individual choice – VTI could be switched out with VOO – representing just the S&P 500 rather than the much wider array of smaller cap companies contained in the ‘Total Stock Market’. The specification for the bond ETF is that the bonds cover a medium term horizon. Short term is considered less than 2 years and long term is considered 10-years and over. The IEI (ishares 3-7 year treasury bond) ETF neatly fits in the middle of this time horizon of 3-7 years. GLD is the biggest gold the ETF and is well known and respected. GLD holds physical bullion through a trust in London and does a pretty good job of tracking the underlying spot price of gold with an error of less than 1%.

How has the Desert Portfolio performed over time?

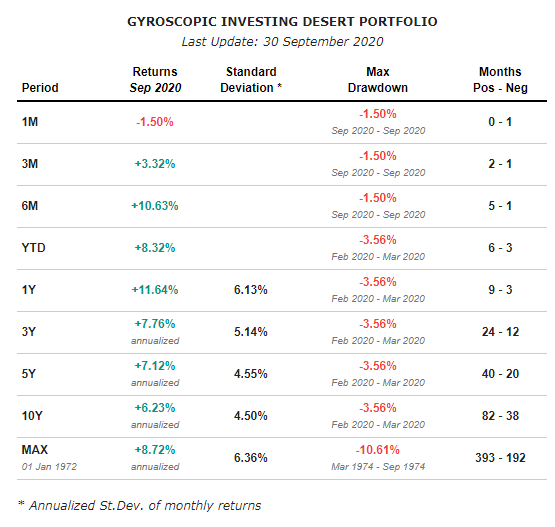

Over the past decade the portfolio has returned a 6.23% compound annual return with a 4.5% standard deviation. As of September this year, the portfolio has gained +8.32% year-to-date with a maximum drawdown -3.56% including six positive months and 3 negative months.

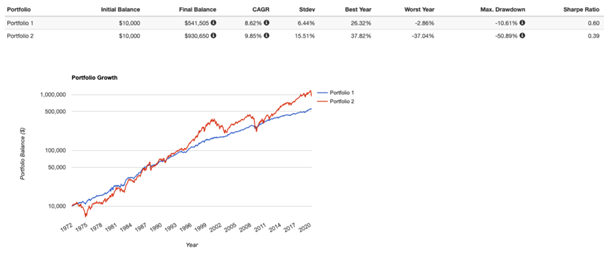

Here you can see the performance of the Gyroscopic Desert portfolio versus the S&P 500. It overall underperforms the index but significantly reduces volatility – making it an easier long term investment to live with. The assumption is that the portfolio is readjusted at the beginning of each year to refit the original 30:60:10 allocations.

Here you can see the returns, standard deviation (risk), maximum drawdown going back from a 1-month to 50 years.

Source: Lazyportfolio.com

(past returns are not indicative of future performance).

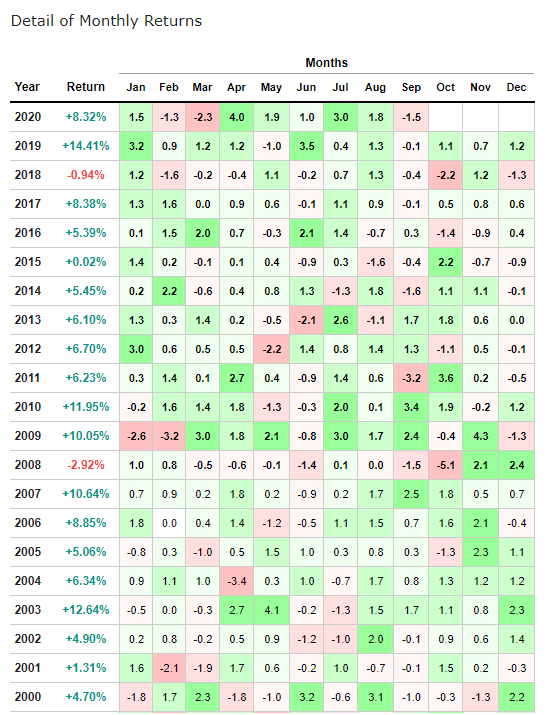

Here you can see the hypothetical monthly returns over the past 20 years. Note that

the returns, up to December 2007, are simulated. They have been calculated using the historical series of equivalent ETFs / Assets, instead of the actual ETFs of the portfolio.

Source: Lazyportfolio.com

(past returns are not indicative of future performance).

Last word

Why if you are a regular investor – and perhaps with a little less time to allocate to your investing – and inclined towards the ‘lazy / low-cost approach’ would you deviate from a common 60/40 or 50/50 stocks to bonds approach?

The issue is that financial assets have become increasingly co-mingled and correlated because of heavy central bank intervention that has pulled bond yields artificially lower and inflated equity valuations. Such Federal Reserve-driven markets often see stocks move in sync with bonds. When the Fed buys bonds in its QE program, it encourages investors to front-run and piggy back the bond purchases but at the same time it forces them out along the risk-scale into equities.

If you accept that equities and bonds still have a part to play in your portfolio but have an inclination towards bonds but need another asset class too to diversify and add inflation protection, then gold is that asset presented in the Desert portfolio.

Thanks for reading and happy Gyroscopic investing!

Sources:

https://portfoliocharts.com/portfolio/desert-portfolio/

http://www.lazyportfolioetf.com/allocation/gyroscopic-investing-desert-portfolio/

https://www.optimizedportfolio.com/desert-portfolio/#taking-the-desert-portfolio-global

https://www.gyroscopicinvesting.com/forum/search.php?search_id=active_topics