Earnings are out for luxury brands and the quote from LVMH CFO that “luxury is not a proxy for the general economy” is warming the spirits of investors in luxury stocks. Could luxury be an area of growth and stability?

Despite the uncertainties in the broader economy, demand for luxury is buoyant. Affluent consumers are showing resilience to the surge in food and energy prices that are affecting most consumers. And, the number of wealthy consumers swelled during the pandemic, helping boost the demand for luxury items, which is yet to show signs of cooling.

“Growth continues at the same pace”

The world’s largest luxury goods maker LVMH titled its Q3 earnings release “growth continues at the same pace”, highlighting its strong revenue growth of 28% for the first nine months of the year versus the same period in 2021.

Similarly, rival Hermes saw a sharp rise in sales (up 24.3% YoY) over the third quarter with no signs of a slowdown. Hermes said it will hike prices 5-10% and accelerate a hiring drive, after adding 800 people in the first six months of the year. Sales were particularly strong in Asia, despite the health restrictions in China. Gucci-owner French luxury group Kering also delivered strong results with revenue rising 14% year-over-year.

Sportscar maker Ferrari, which reports earnings on the 2nd of November, boosted its sales guidance for the year last August. Interestingly, supercars with plug-in hybrid capabilities of the 75-year-old automaker start at USD322’000, while more expensive models start at around USD600’000, catering to the ultra-rich.

The strong results from luxury leaders come in sharp contrast to retailers such as Walmart and Gap, which have slashed forecasts citing pullbacks in consumer spending. The two retailers will report earnings in November.

What are the potential catalysts for luxury stocks?

Investors should pay attention to changes in China’s Covid policy, prices of financial assets, and seasonal demand.

The long-term demand is also supported by the growth of the number of affluent consumers in emerging markets, particularly in China. In fact, Chinese luxury shoppers are estimated to account for 50% of global luxury spending by 2025. Spending in the US, Italy, Japan, and France is also on the rise.

There are signs China is prepared to ease its Zero-Covid policy. This could help fuel the increasing demand for luxury goods as Chinese can once again travel and spend. It is reported that the reopening of Hong Kong and Macau is a way for China to ‘test’, before easing restrictions on the mainland. Perhaps, once it has fully reopened, Chinese shoppers could once again stimulate demand for luxurious goods.

Demand for higher priced goods such as Hermes Birkin bags or some models of Ferraris is particularly strong because the companies limit the supply. As a result, there is a waitlist to buy them. Nonetheless, a rebound in the price of financial assets from bonds, stocks, and crypto, could help fuel demand for more common luxury items from handbags to entry-price sportscars.

With Christmas sales ahead and the Chinese New Year afterwards, demand could be strong thanks to the seasonality effect. Yet, investors must keep an eye out for signs of softening demand. Lastly, a possible easing of geopolitical tensions such as the war in Ukraine could help fuel consumer spending.

Fallen angels: opportunities in luxury stocks?

There have been only a few major pullbacks in the luxury industry in the last two decades: the tech bubble in 2000, the GFC in 2008, the Chinese anti-corruption campaign in 2013, and the pandemic that crashed financial markets in March 2020.

This year’s many hurdles from the war in Ukraine leading to inflation and sanctions on Russia, and the steep climb in government bond yields have certainly also taken their toll on the valuations of luxury companies. And investors could find long-term buying opportunities in stocks of luxury brands that are coping well with global uncertainties and challenges.

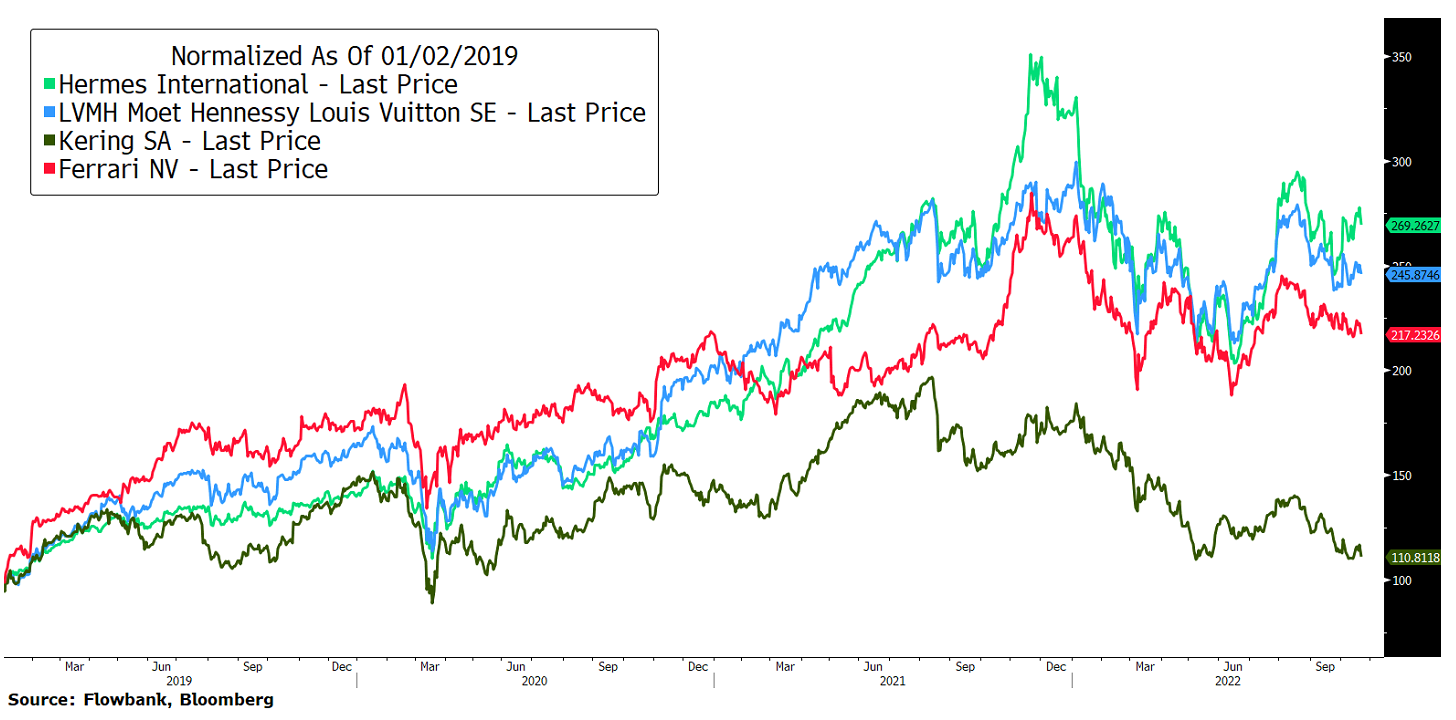

Europe’s « four musketeers »

Illustration to represent luxury as a group. These are not stock recommendations.

Ferrari is the last of these to report earnings, on the 2nd of November. In prior pieces, we have covered the power of brands, introducing several luxury companies.

Conclusion

Luxury brands have demonstrated a strong ability to deliver growth over time, given their structural advantages. Amid the storm that the broad economy has faced this year, luxury brands have shown resilience, and history suggests that they are well-equipped to come out of the crisis stronger.