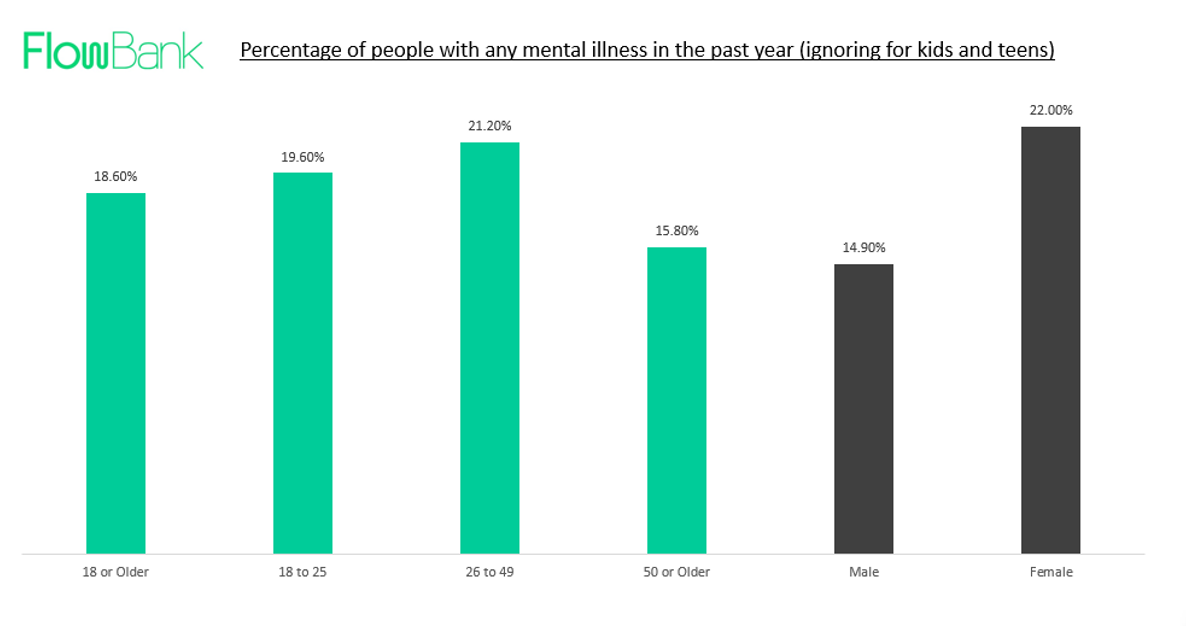

An estimated 20% of working age adults are affected by mild to moderate mental health disorders, and Lyra Health is doing its part in improving this problem. Behavioral health is a large health sector currently being disrupted by data, and care enablement.

Key Takeaways

- Lyra health is a $2 billion behavioral health company that tackles mental health issues at the company level.

- Lyra raised a series E round worth $187 million boosting its worth and spending budget.

- Lyra expects to help more than 2 million people with their mental health problems by the end of this year.

- On average close to 20% of adults in the US have admitted having some type of mental health issue

- CAGR for the entire behavioral health market is just under 3% until 2027, with a TAM of $240 billion.

- Mental health is a large concern and big commercial enterprise that telehealth startups are disrupting.

Why does Lyra Health merit mention?

It has only been 6 months since Lyra Health gained its unicorn status following a $110 million series D round, and now they are back with more with a $187 million series E round. Top investors are Durable Capital Partners, Fidelity Management & Research, and Baillie Gifford. This Series E round pushes the company to $475.1 million in total funding for a post money valuation of over $2 billion. The company has between 500 and 1000 employees and is backed by 20 investors.

Lyra Health is getting attention because of its successful growth and quality product offering. The company has doubled its customers in 2020 and it expects to help more than 2 million active members this year. The cash would be used to improve the company’s technology, diversify their network offering and add on more business partnerships. As of the writing of this article, Lyra Health is looking to hire more than 60 open positions on their website, some of which are remote opportunities in their business operations team, marketing, customer success, partnerships, clinical specialists, and telehealth remote physicians.

Lyra works with top companies including the likes of Genentech, Morgan Stanley, Uber, and eBay to improve employee mental health conditions. For Lyra, mental health is a business concern, and their unique offering enables companies to present their employees with functional telehealth options. Lyra believes that mental health is contributing to higher rates of absenteeism, and lower rates of productivity. They say that without proper mental health treatment companies can expect five times more absenteeism, and five times more disability leaves. They add that employees are also four times more likely to pose higher medical costs, and twice as likely to face the axe.

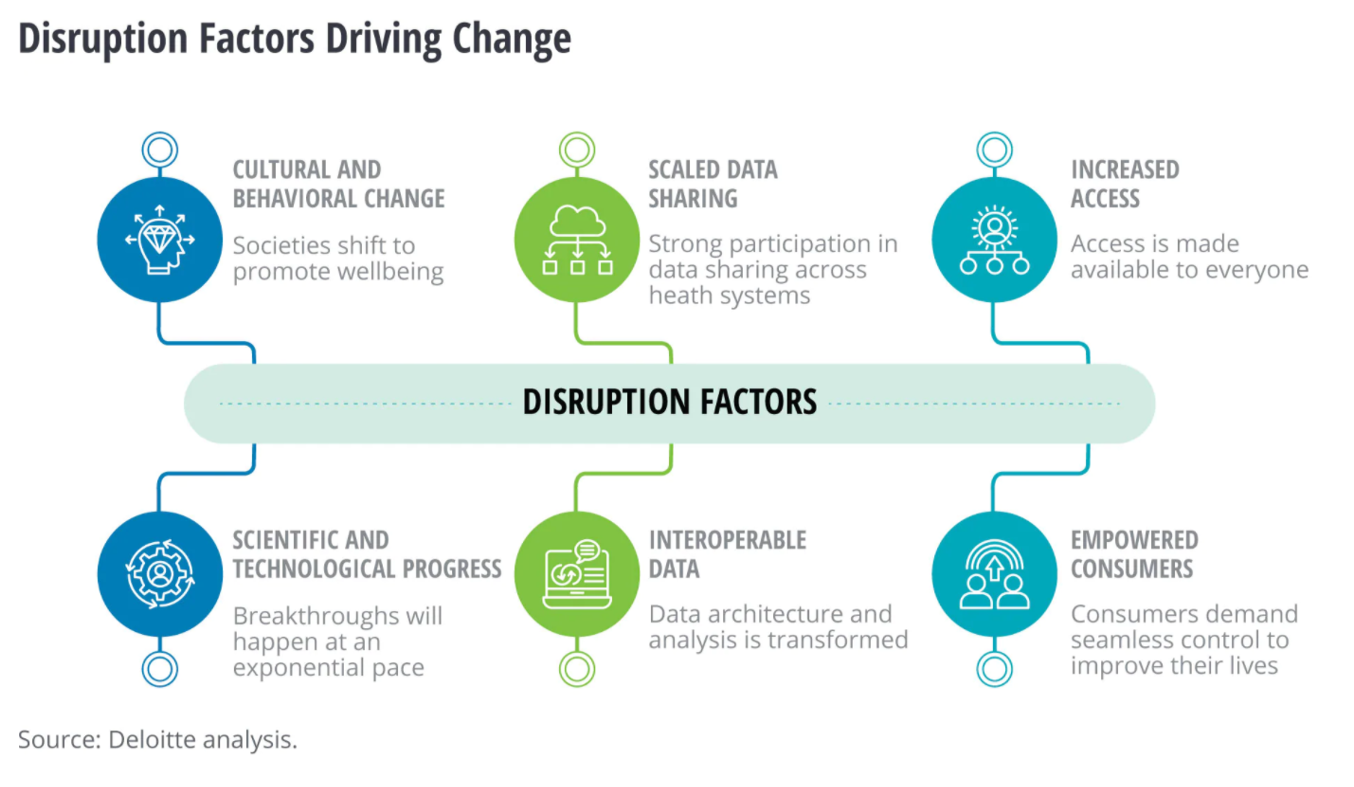

Lyra’s technology is a true disrupting technology and can scale its business as societies begin promoting wellbeing. The generated data and increased access to their health services can spur the behavioral health economy. By empowering consumers to improve their lives and via interoperable data for systems engineering and data analysis in public health, new frontiers are just around the corner.

Some of the barriers to improving behavioral health are the following; gaps in clinical and scientific knowledge pose threats to accurately diagnosing and treating health conditions. Stigma and drivers of health are making consumers unwilling to share their information and seek treatment, and some may have poor diets, and income challenges. Ineffectual and sub scale care systems like unaffordable and inaccessible care, and siloed health care data management which limits health clinicians the insight into clinical decision-making and consumer trends.

61% of employers say they will implement a company-wide behavioral health action plan by the end of 2021 which positions Lyra health in an excellent position to produce more positive results as more companies become aware of health mental barriers to productivity. Lyra’s value add works like a type of insurance against future costs resulting from mental health related medical bills. They curb healthcare costs by helping decrease employee turnover rates by 50%, improving productivity by 70%, decreasing institutional claims by one third and decreasing health plan therapy and pharmacy claims by one fifth.

In comparison to other health plans out there, Lyra employs a method rooted in science and managed through their data platform. They boast that 75% of members report a positive recovery from the trials used through Lyra’s product. Improvement is measured through clinically designed measures such as the PHQ-9 and GAD-7 assessment tests, tests used by actual physicians in clinics. Lyra is very clear about using evidence-based treatments (EBTs) which are methods that have been proven to effectively reduce symptoms of certain mental health issues. In fact, it only works with providers who pride themselves on following such treatment methods. Lyra’s technology is great because in the end it offers a professional medical service to more people who need it anytime of day.

Behavioral health market outlook

We are seeing a turning point in behavioral health services. Startups in this space are gaining momentum and 132 of such firms were venture-backed within the past five years. Investors have poured $1.1 billion into companies like Lyra over this short period of time and the industry is set for an even brighter future. Most of this brightness however does not stem from a glowing place. It is said that neuropsychiatric disorders represent a DALY close to 20%, a number 2% greater than the next largest figure of 16.8% for cardiovascular diseases (the main cause of death in developed countries according to the WHO). The DALY score represents the economic burden of health problems on society. The higher the number, the greater the problem, the greater the commercial opportunity for innovation.

Covid-19 offered some insights into how challenging access to hospitals can be during a pandemic, and how useful telehealth can be. Beyond the pandemic, a report by Harris Williams & co suggests that there is a pent-up demand and shortage of supply for mental health care services. They conducted a survey where 22.8% of participants said the main reason for not getting mental health support was because they did not know where to go for such services—look no more with e-health platforms like Lyra.

The global behavioral health market forecasts a CAGR of around 2.5% to 2.8% to reach a total addressable market of $240-$300 billion by 2027. According to the WHO, there are 800,000 suicidal fatalities each year, a figure that is increasingly growing. These figures represent successful attempts and ignore unsuccessful attempts, a number that would be larger and more pertinent to the real health crisis around mental disorder.

The spectrum of mental disorders is large and covers the following list: alcohol use, schizophrenia, bipolar disorder, depression, anxiety, PTSD, substance abuse and drug addiction, and eating disorders. The mental health social stigma is beginning to implode leaving room for many developments in this industry, with what could be a pivotal change in global public health.

Telepsychiatry and telemedicine increase access to much needed services, to more people. The technology developed to reach more people is offering a world of data and business opportunities in R&D, advertisement, and design. The technologies being developed, at Lyra for example, help health care teams expand their coverage to regions less accessible to their location, and improve their progress tracking through more personal and at arm’s length platforms. In all, the innovation of e-health can improve the lives of millions of people.

Europe has already been a top marketplace for this type of service leading the polls in 2018. However, the marketplace is already saturating with minimal CAGR measures over the next few years which could be because of higher standards of health care provisions in countries like France, Sweden, Denmark, Switzerland, and others. The United States on the other hand and developing nations, are areas promising to generate future cash flows.

Some of the larger players in this industry include Acadia healthcare, UHS, Magellan, and CareTech holdings.

On a related note, read our article on how psychedelics are playing a role in mental health treatment, and how you can capitalize on such companies.

Sources:

https://www.acumenresearchandconsulting.com/behavioral-health-market

https://news.crunchbase.com/news/lyra-health-funding-valuation-series-e/

https://www.harriswilliams.com/de/system/files/industry_update/behavioral_health_industry_update.pdf

https://www2.deloitte.com/us/en/insights/industry/health-care/future-of-behavioral-health.html