The meme stock phenomenon is visible again this year, with many “hyped” stocks with shaky fundamentals defying gravity. Are meme stocks back, and what could this tell us about recent retail participation in the stock market?

Turbulent trading in meme stocks suggests the mania is showing no signs of stopping. This year, stocks of companies such as struggling home-goods retailer Bed Bath & Beyond (BBBY) showed enormous abnormal volatility and interest from retail investors and a barely profitable Hong Kong-based company called AMTD Digital climbed more than 10’000% just a few days after its IPO in July.

Are meme stocks back?

Last year, the surge in shares of movie-theatre chain AMC Entertainment (AMC) and gaming retailer GameStop (GME) gave birth to the term “meme” stock, where a stock gains a cult-like following online through social media platforms.

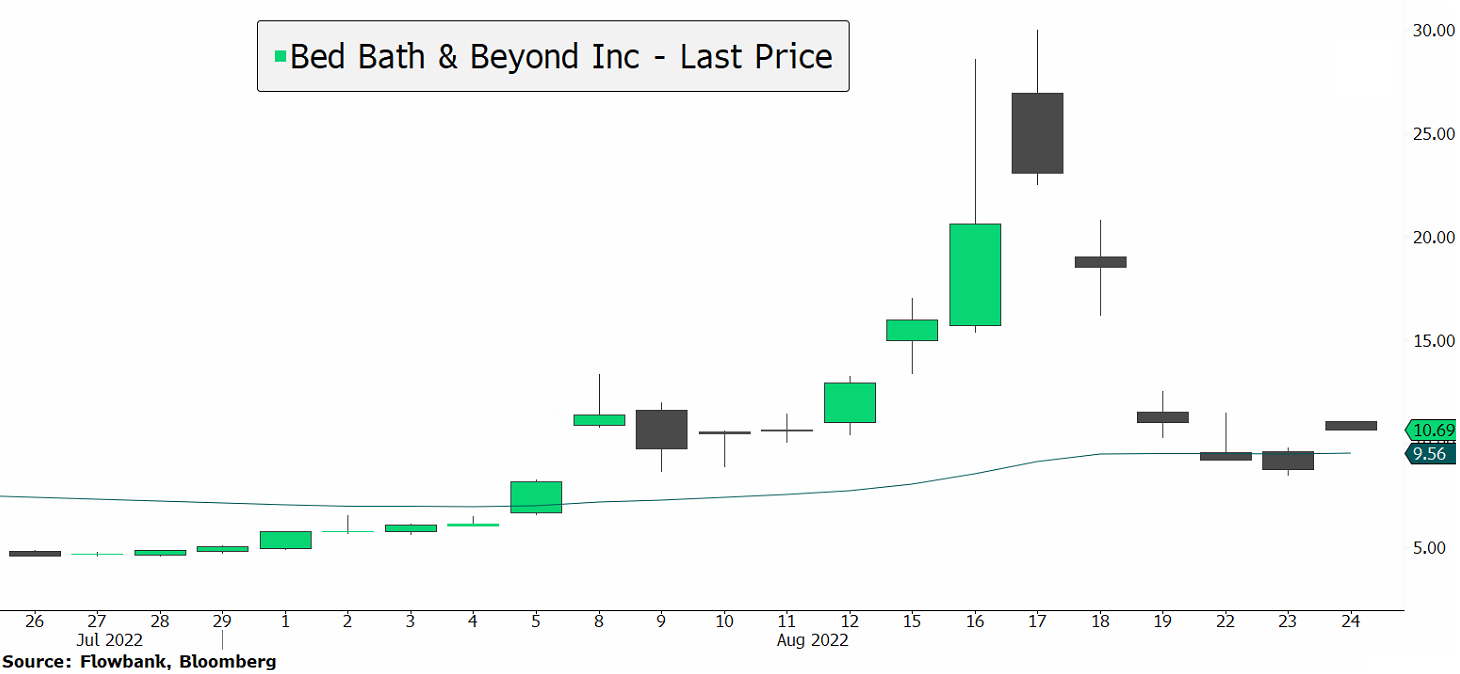

For most of August, Bed Bath & Beyond (BBBY), a company that some analysts are not sure will survive, saw its stock price multiplied by almost six times at one point, all in a matter of weeks. We may say meme stocks are back! But more importantly, could it last?

The frenzy faded after activist investor Ryan Cohen, who co-founded Chewy and is chairman of meme stock GameStop sold his stake in BBBY.

The turnaround story of BBBY is highly speculative. Its cash equivalents were down to just USD108 million, down from USD1.1 billion a year earlier. Investors are now concerned lenders will pressure the company to cut costs and BBBY may have to issue new shares to raise capital. The company just last week hired a restructuring specialist.

The stock’s rapid surge is difficult to explain but things point to retail investors playing a key role, and possibly squeezing short sellers, forcing people betting against the stock to buy it back once the stock surges rapidly. A spike in activity on the popular Reddit page ‘WallStreetBets’ where BBBY has become a well-discussed theme, also suggests retail investors played an important role in the stock’s surge.

Barometer of retail participation?

The resurgence in interest in meme stocks may offer clues about the current retail participation in the stock market. It could be interpreted as a positive and reassuring, that despite the removal of some of the liquidity in the market, retail investors are still there to place speculative bets. However, the resurgence in meme stocks should not be extrapolated too much as the flows are concentrated in meme stocks and not ‘healthy’ as it would be if retail interest in the broad stock market indices or blue-chip stocks jumped by as much.

Conclusion

There are increasing signs that meme stocks could be back, but the stock frenzy is proving short-lived in each instance. Could it be because of the quantitative tightening by central banks? Perhaps, but past mania also points to stocks with high short-interest being vulnerable to a short-squeeze and short-term reversal speculation. Meme stocks are at best to consider for a trade (speculative bets), but the insights that they show about retail investor interest may be of greater value.