The Russian invasion of Ukraine, now in its fourth week, has taken centre-stage as the main focus point for traders – with the extra volatility very much concentrated in commodity markets.

Russia is a major supplier of oil, natural gas, coal, nickel and aluminium - and Ukraine is a significant grain producer and exporter.

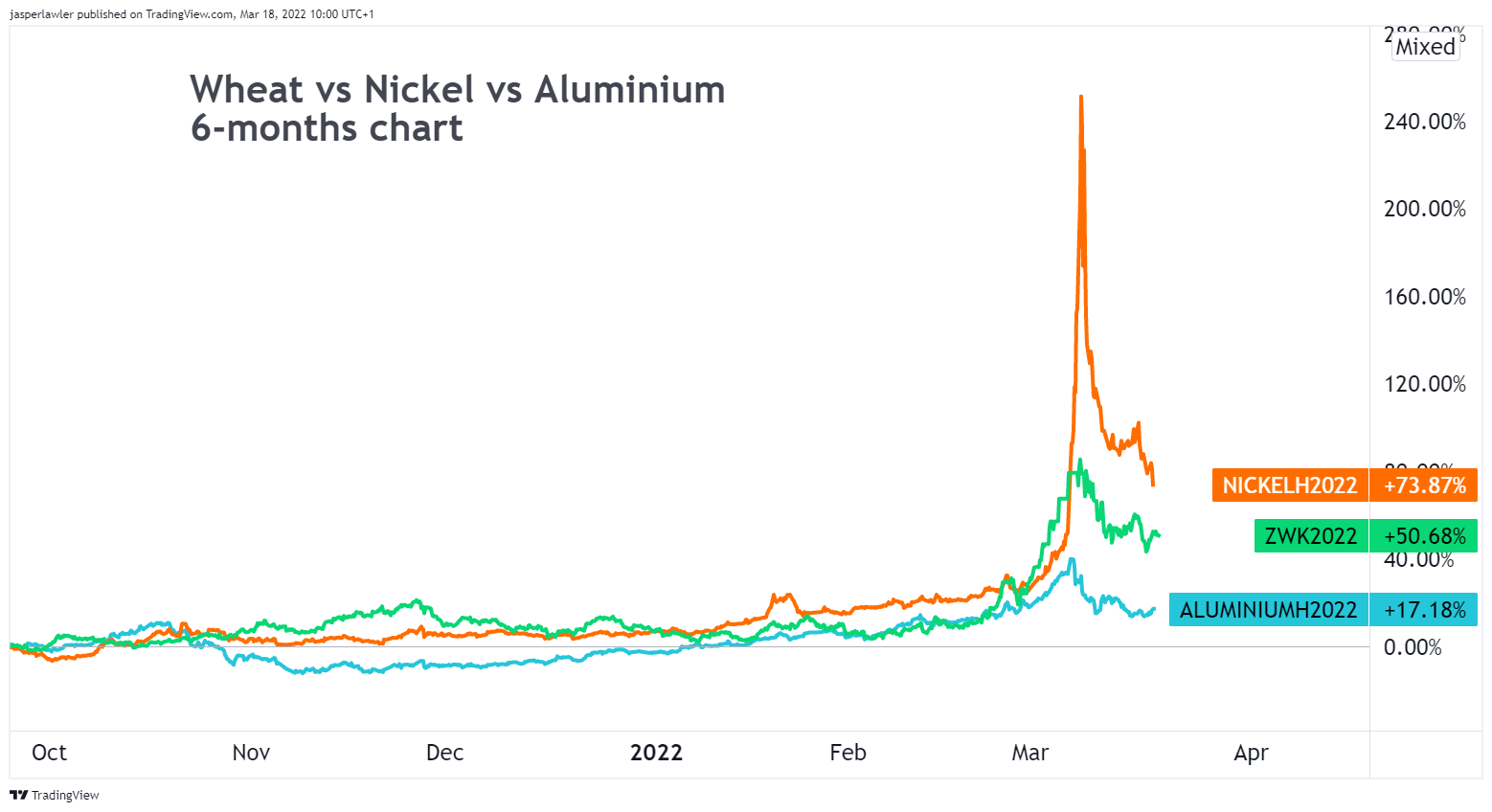

Wheat & Nickel soar on supply fears

In the commodities space in particular, we saw unparalleled moves. The violence has caused significant supply issues out of both Russia and Ukraine alike. From Ukraine because of the direct effect of the conflict on production and harvests, and from Russia because of Western-imposed sanctions.

Source: TradingView / FlowBank

Nickel, of which Russia accounts for almost 10% of global production, more than doubled its value on the day of the invasion, depending the exchange you are looking at. On the LME, nickel futures trading was temporarily suspended as a result of the dramatic price gains which have had a significant impact on global supply chains.

Similarly, wheat, of which Russia and Ukraine account for around 30% of global supply also saw huge topside moves initially (+60%), before reversing sharply as governments relied on strategic reserves around the world.

Commodities as a risky asset

News of the invasion breaking on February 24th caused a seismic shift across asset classes, broadly under the umbrella of sweeping risk aversion. The initial reaction saw commodities turn lower alongside equities and risk-linked currencies. Simultaneously, safe-haven assets such as gold, JPY, USD and bonds, were seen trading firmly higher amidst a broad flight-to-quality.

While commodities typically trade in line with risk trends, certain commodities broke their correlations due to the direct impact on supplies due to the war.

How will markets move from here?

With the initial reaction to the invasion having passed and with the conflict dragging on to almost a month long, the big question for traders now is what will happen next in terms of market action?

Scenario 1: Ceasefire/Peace Deal

One key theme we have seen across the conflict so far, is risk assets rebounding and the specifically-impacted commodities falling amidst any signs of the Russian attack stalling/running into issues or hopes of a ceasefire.

Officials from both sides have been engaged in peace talks alongside the violence and while initially these talks seemed fruitless, recently both sides have expressed hopes that a resolution can be agreed.

So, this tells us that if a ceasefire can be agreed, market reaction is likely to favour a solid rebound across risk assets and a recoiling in safe haven assets. This reaction is likely to be scaled up if a more permanent solution is put in place, such as a deal or full peace accord.

For wheat and nickel, such a scenario would likely mean prices coming lower as traders anticipate reduced supply issues. It may be that commodity supply from these two countries never returns to pre-war levels, implying higher than pre-war prices. However given the huge build up in speculative positions, margin calls could prompt panic selling and a complete reversal of the YTD gains.

Scenario 2: Talks Continue, War Drags On

The second component to be aware of here, is timing. The longer conflict drags on, the higher the risk of escalation from Russia becomes, and the greater the toll on the global economy. If talks drag on, traders will likely become sceptical of any deal being delivered, fearing worse to come from Russia.

In this scenario, risk assets head lower while wheat and nickel will likely stay elevated, Nickel in particular due to the severity of current moves. Arguably an extended war and supply-chain disruptions have already been priced in but under this scenario there would be little reason for commodity bears to appear in great numbers.

Scenario 3: Russia Takes Ukraine

The final situation to consider, which looks to be the outside scenario for now and is also worst case, is that the violence worsens, and Russia takes Ukraine. Now, if this scenario does unfold, the immediate impact will be heavily risk off, with the aforementioned dynamic happening with much greater velocity. In this scenario, the global repercussions are difficult to anticipate fully, but certainly the risk of conflict between Russia and the West becomes elevated.

There is almost no chance of a return to anything close to pre-war Russia/Ukraine commodity supplies. Wheat and nickel could break out to new highs in such an event.

Anticipated Outcome

Broadly speaking, the conflict appears to be heading towards a resolution, though timing is hard to grasp. Given this view, we can expect a broad, though potentially gradual reversal of recent market moves as prices of key commodities normalise.

The key, however, will be what the “new normal” becomes for Russia and Ukraine and how quickly sanctions are removed and (if) relationships are repaired.