Many traders have been caught off guard by the drop in oil prices, which has reversed all year-long gains. What is causing the price drop, and what are some key support levels to keep an eye on?

Only a small minority of investors and traders would have predicted that oil prices would be this low by the end of the year only a few months ago. Brent touched an all-time high for the year in June at USD123pb on fears that Western pressure on Russia will result in a major supply deficit in the global market.

There were two more variables that caused oil traders to anticipate that higher oil prices were here to stay: 1) limited capital spending in the sector because of ESG restraints, and 2) expectations that China will soon lift restrictions and raise the global demand for energy.

The global economic outlook

Fast forward to today, crude oil and gasoline prices have given up their gains and are on the verge of plunging into negative territory. The price drop is mostly due to market fears about global economic development. Tightening liquidity, escalating tensions between the West and Russia, and, to a lesser extent, between the West and China, are lowering risk sentiment and weighing on growth.

We read in the news last week that the US and the EU were considering imposing fresh tariffs on Chinese steel and aluminium in an effort to reduce carbon emissions. The US and EU would take a fresh approach by attempting to advance their climate agenda through tariffs, a tool often used in trade conflicts. The concept originated in President Joe Biden's administration and is still in its infancy and hasn't been properly put out. Quickly objecting to the proposal, China declared that it will "take all necessary measures to safeguard [its] legitimate rights and interests.”

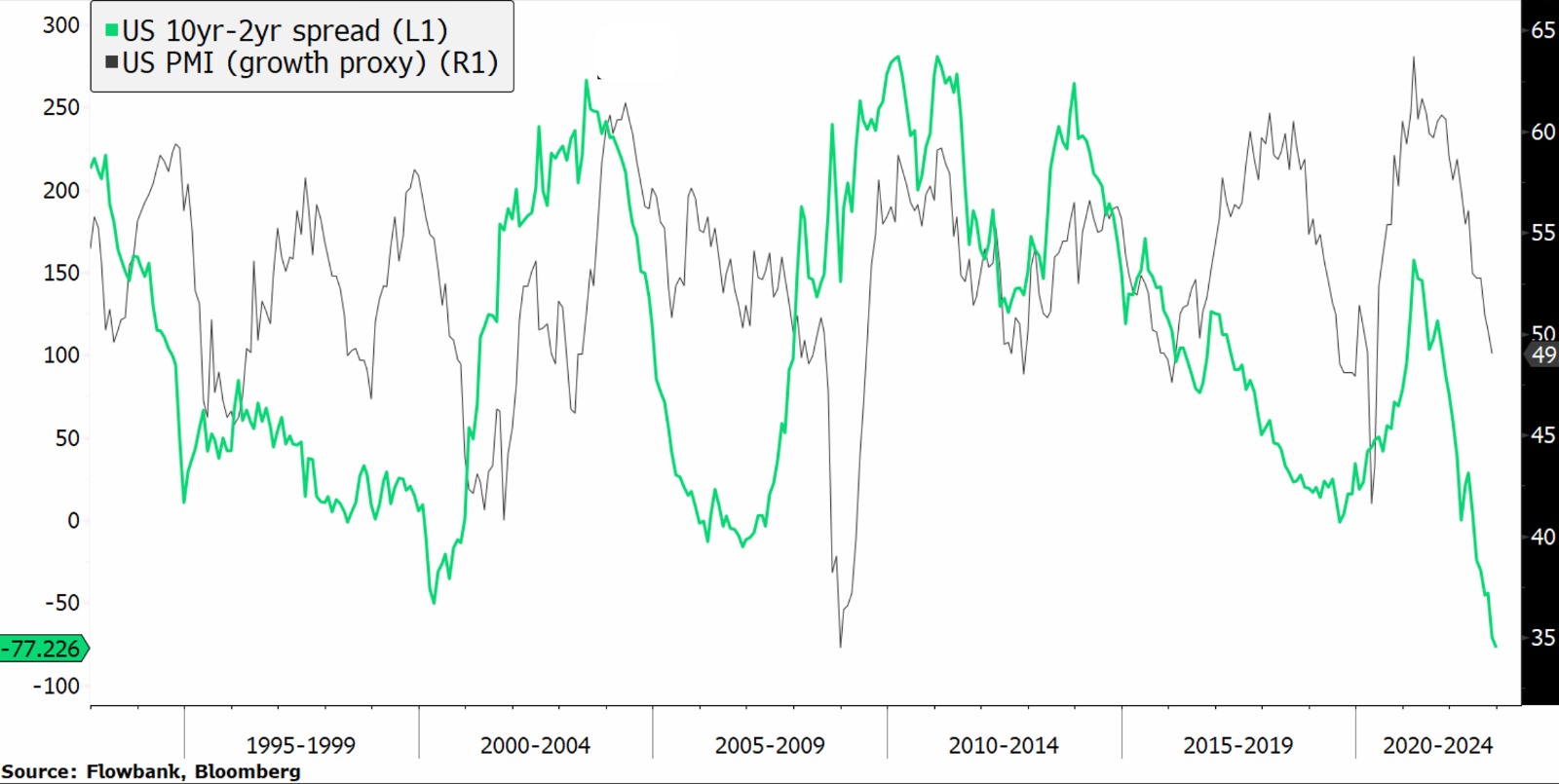

Due to central banks' aggressive tightening policies, investors are also voicing concerns about the future of global growth in the bond market. The difference in US Treasury rates between the 10-year and 2-year securities is now at extraordinarily low levels. Investors actively monitor this indicator since it has consistently anticipated recessions at least a year in advance (since 1955). The depths they have attained this time around signal that there is very little likelihood the Fed will be able to engineer a smooth landing.

Global demand is still strong

Despite recent worries, many think that a tight oil supply forecast shouldn't be obscured by short-term recession problems and oil price weakness:

China easing covid restrictions

Last Monday, China relaxed several Covid regulations. Changes are imminent. The omicron strain of the virus is waning, and more Chinese are receiving vaccinations, according to China's senior official in charge of combating Covid-19, who said that China's efforts to battle the virus are entering a new phase. This is positive for crude because it might increase economic activity, which would enhance China's demand for energy, the world's largest importer of petroleum.

Airline’s optimism about travel demand

Southwest is the first airline to restore its dividend to pre-pandemic levels, reflecting the solid resurgence in air travel demand. According to the management team, it continues to expect a favourable fourth-quarter 2022 outlook and a healthy market condition in 2023.

EIA sees prices near $95 in 2023

In its most recent short-term energy outlook, the US Energy Information Administration (EIA) decreased its Brent oil price projections for 2022 and 2023. However, it expects spot prices to average USD95.33pb a barrel in 2023, which is higher than current levels. Despite the recent dip in crude oil prices, the Agency believes that reducing global oil stocks in early 2023 will bring Brent prices back over USD90pb per barrel by the beginning of the second quarter of 2023.

Sentiment too negative, poised for a rebound

Oil sentiment remains negative, and the effects of Russian actions have yet to be completely realized. Looking at the oil chart, technical analysis implies prices are primed for a comeback at current levels. The Relative Strength Index at 30 suggests prices have reached oversold territory. Furthermore, the USD70 - 72pb range (on WTI) could provide a floor since the Biden administration recently hinted that if the price of oil goes below USD70 per barrel, it may begin purchasing petroleum for the Special Petroleum Reserve. .jpeg?width=1600&height=785&name=WhatsApp%20Image%202022-12-11%20at%2019.18.03%20(1).jpeg)

Conclusion

For several weeks, the trend in oil prices has been negative as prices see some selling pressure due to the less meaningful impact than expected of Russia’s intervention in Ukraine on the global oil supply, and because of forecasted weakening demand. However, amid an uncertain supply outlook and still strong consumer spending appetite, we believe the demand is underestimated and prices are poised for a rebound, especially as technicals suggest prices have been pushed to oversold regions.