Professional forecasters and central banks have been surprised by the persistence of rising prices, with the latter rapidly shifting their forward guidance. The Swiss National Bank has just announced a policy normalization. What will this mean for the Swiss franc?

2022 has given investors a lot to chew on. But among many developments of this year, one really stands out; It's inflation and the impact that high inflation has had on central bank policy. The USDCHF, known as the Swissie, rose to multi-month highs, briefly crossing above parity because of rising yields in the US and Switzerland's decision to side with the EU on the war in Ukraine. From a fundamental perspective, the Swiss franc appears expensive versus the euro, and while ECB’s policy normalisation will provide positive support to the euro in the short term, the pair EURCHF is likely to trade in a range, as the risks of an economic slowdown in the Old Continent are rising. And though the war in Ukraine is weighing on the CHF against the USD, we expect the Swissie to ultimately mean revert, pursuing its downward trend since 2000.

What is happening to EURCHF?

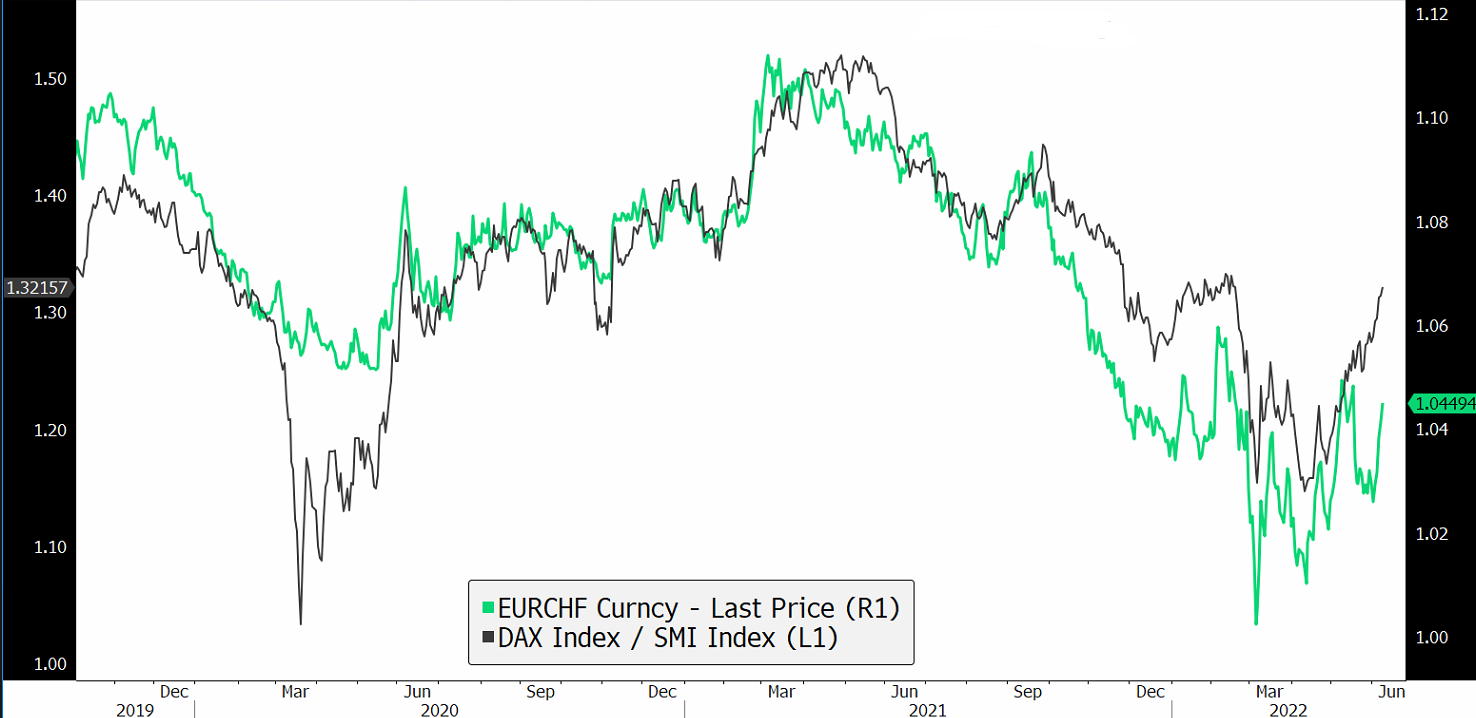

Geopolitical tensions and concerns about stagflation have dominated financial markets this year, pushing investors away from riskier assets. The EURCHF was tracking the underperformance of the German DAX index compared to the more defensive Swiss SMI index for much of the past year, with the pair trading at one point near parity. But the trend is reversing supported by the recent raising rates announcement from the ECB and China’s plans to stimulate its domestic economy.

On one hand, the high level of inflation in the Eurozone, compared to inflation in Switzerland reduces the negative impact of a stronger CHF, taking off pressure on the Swiss National Bank (SNB) to intervene heavily in the FX market. On the other hand, a rapid appreciation of the EUR against the CHF would undermine SNB’s price stability mandate, the reason why the governor of the SNB announced similar plans, challenging speculative bets on a stronger EUR against the CHF.

Nonetheless, the situation around ECB’s tightening is extremely delicate. Now that the war is escalating, with Russia cutting off gas supplies and the EU agreeing on a partial ban on Russian oil imports, the risks of higher for longer EU inflation have increased.

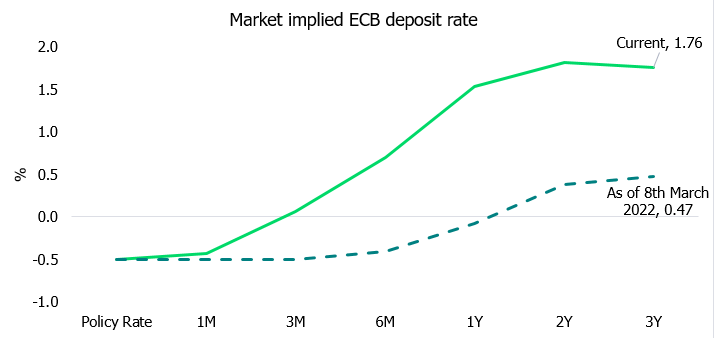

European consumers saw inflation (CPI) increase by 8% in May, and European producers saw input prices surge close to 37% year-over-year. These record numbers put enormous pressure on ECB to pursue policy normalization, if not raise rates significantly to lower the burden of imported inflation. The current market pricing for the ECB terminal rate stands at 1.76%. This implies ECB’s expected tightening policy is around 0.30% above the neutral rate (estimated at 1.5%). Historically, that has not been enough. In the early 90s, the Banque De France pushed 5-year French government bond yields more than 200bps above the prevailing levels of neutral nominal rates to avoid the de-anchoring of inflation expectations. Should the ECB find itself in such a situation, this significantly increases the risk of a recession in the eurozone and consequently the risk of a weaker EUR.

What’s happening to USDCHF?

A terrific chart setup does not always require fancy lines, zones, and indicators. Looking at the USDCHF graph, the market's sentiment is bullish. After a rapid ascent in early 2021, USDCHF briefly broke above parity driven by higher real yields in the US. A pullback was expected, and the catalyst happened to be SNB’s raising rates announcements, which took the pair 4.5% lower. Lately, the price is forming a double bottom on the 0.618 Fibonacci retracement level (0.96), suggesting buyers are in control so far. And considering the recent move, bulls appear to be willing to retest May’s highs.

Longer-term, however, traders need to be cautious of the bearish trend of the dollar. From a longer-term picture, the Swiss franc remains cheap versus the dollar as Switzerland has consistently had a current account surplus of roughly 8% of GDP, way above the level of deficits that the US government has reported for decades.

In addition, after rocketing higher over the past year, economists do expect US inflation to moderate for the rest of 2022. We're seeing encouraging signs that some of the worst disruptions to supply chains are easing, the cost of freight is declining, many retailers are now reporting plenty of inventory, and market-based estimates of future inflation have been declining in the US. If this trend of moderating inflation can hold, this would imply that first, inflation that is high but falling, is much less frightening to the market than inflation that's high, but rising, removing the market's fear of a more extreme 1970s style scenario. Second, it suggests lower expectations of future central bank interest rates could help bond yields stabilize, reducing high financing costs and the likelihood of a contraction in the US economy. Both of which are a net positive for growth and hence risk assets.

SNB rate hike possible in 2023

The ECB is not expected to raise interest rates until the final quarter of 2022, which suggests that the SNB could look ahead to September for the first interest rate hike. The SNB is unlikely to act before the ECB, given that such a move would boost the Swiss franc, hurting the economy. Inflation in Switzerland has risen but is still well below what is observed elsewhere. This is unlikely to create any form of panic at the central bank, which insists its dovish stance is still appropriate. As a result, we do not foresee a sharp rise in interest rates but expect a gradual normalisation of rates towards long-term levels.

Conclusion

Euro-Swiss franc parity seemed an obvious call the day Russia invaded Ukraine. Yet with yield differentials a key driver and Switzerland aligned with the EU on the war, 1.02-1.06 appear to make the most sense for now. Meanwhile, the US dollar hasn't spared the Swiss franc, and that's unlikely to change until sentiment reverses for the greenback, perhaps in 2023, when inflation in the US moderates and the Fed is able to temper its aggressive hike cycle. Until then, dollar-franc near if not above parity may be the norm.