While quarantines may have stirred people’s desires to own pets, pet stocks should not be strictly categorized as covid-era stocks—after all, cats and dogs tend to live at least a decade!

Key takeaways

- Seven out of ten households have a pet and the total addressable market is north of $250B

- US households spent $104 billion on pet supplies in 2020

- Pet stocks could flourish after covid because more people now own pets, remote work will be more tolerated, and because of the ‘’premiumization’’ of owning pets.

- Pet stocks could falter after covid on concerns that growth estimates will never catch up to 2020 levels, which could hurt EPS going forward.

- Rover, the Uber of dog walking, is set to go public at a valuation of $1B

The rise of the underdogs

The pandemic was rough to airlines and restaurants, but kind to pet stocks. In fact, the pet stocks index beat out the tech heavy Nasdaq index as more people sought out furry followers. More than 3 million Brits bought pets during the pandemic according to Kantar, which reflected well in UK’s Pets at Home stock who is up 75% from a year earlier.

According to the American Pet Products Association, US households spent $104 billion on pet supplies in 2020. There are two sides to the coin however, and investors are torn about whether or not such stocks will continue to see sky high returns going further into 2021. We explore both sides below.

Go fetch! Playing the pet stocks right

The three stocks in the figure below have been identified as having an average 18.54% upside potential from their analyst price tag.

Trupanion, Heska, and Petco also all belong in the ProShares Pet Care ETF (PAWZ) which saw a 60% return YTD. The ETF is comprised of many pure play and pet related stocks such as Chewy, Zooplus, PetMed Express and Pets at Home. Pets at Home sales rose 18% versus same time last year despite a 7% decline in the number of customer transactions. Chewy’s sales rose by 50% and the group grew its customer base 43%. Chewy is an online pet food retailer and its shares gained 77% YTD, alongside rival Zooplus, its German counterpart, who saw a 125% increase.

You can read more about Chewy here, and Petco here.

Figure 1: HSKA, WOOF, TRUP show 18% average upside

Premiumization and humanization boosts pet stocks

Seven out of ten US households have a pet and increasingly, owners are giving their pets premium foods, luxury care services, health care and insurance policies. This premiumization of pet care works in sync with the humanization of pets explored next which creates market opportunities:

The combined forces of social media and the general way millennials personify their pets, perhaps as a solution to having children later in life, could make for new commercial opportunities. Industry experts call this the Humanization effect i.e., the process by which humans treat their animals like they would regular human beings.

The humanization process is a commercial opportunity in that it requires a special tuning into customer needs:; younger people tend to dress their dogs, paint their nails, video tape them, and basically treat them like children: are pet companies capitalizing on all these revenue streams?

Altogether, societal pressures to work longer hours, the need for dual salaries to build a household and the rising private debt levels from college tuitions in the US, could point to a long-term trend of pet ownership beyond covid.

Why pet stocks could falter

With so many people becoming owners specifically because of the pandemic, some investors are saying that this type of growth in pet ownership could be heavily context dependent. Earnings multipliers could fall and stock valuations could very much take a hit if revenue figures do not hold up. The main questions pet businesses should be asking themselves is how they can maximize wallets via product differentiation, and brand value. It will be very interesting to observe what these pet companies will do with their newly acquired customers and if they will be able maximize their average revenue per customer. Furthermore, the reopening trade will mean pet owners will have new channels by which to spend their money, thus putting pressure on pet stocks.

The Uber of dog-walking is going public

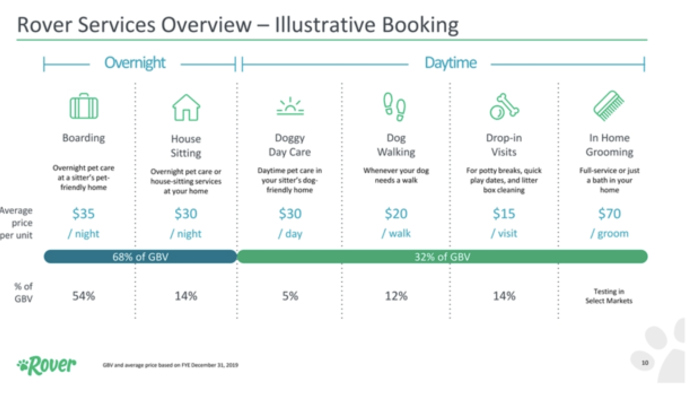

The dog-sitting gig business has been doing well. So well in fact that the Uber of dog-walking is going public in one of the furriest SPAC merger deals of all time. Founded in 2011 in Seattle, Rover is an online pet care peer- to- peer marketplace that connects pet owners with pet sitters.

So far, Rover has raised $310.9M, according to Crunchbase, with the last round, led by T. Rowe Price, equal to $125M. The deal values Rover at $1.3B with its balance sheet showing $48 million in revenue last year with projections of $97 million for 2021 and profitability by 2022. That is a 27X multiple on 2020 revenues. Rover will continue to benefit from the world coming back into place as people start going back to offices and search for dog sitters.

Figure 2: Services Rover provides