Stocks are on course for their worst year since 2008. And strategists have never been so divided in their forecasts for how stocks will perform for the remainder of the year. What are the bull and bear cases?

The year has so far been a bad one for investors, with the main US equity benchmark, the S&P 500 Index, down around 25%, in its worst year since 2008. And strategists didn’t see the market drop coming and are now extremely divided about what’s in store for the remainder of the year.

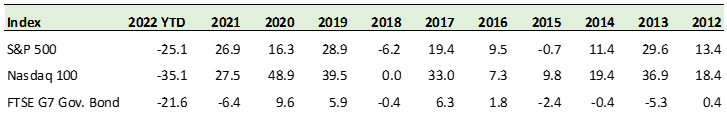

Performance as of 14th October 2022 (%).

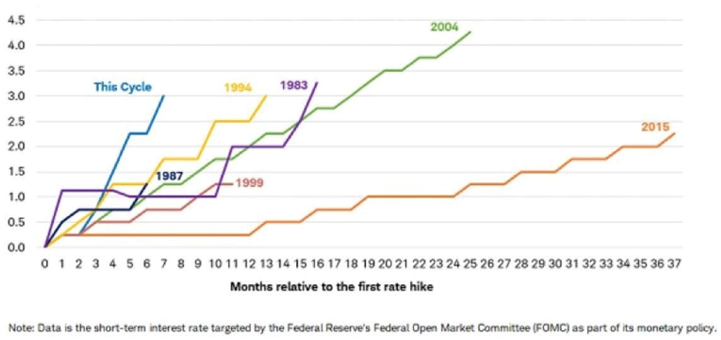

The Fed’s most aggressive monetary tightening since the early 1980s has sent the dollar and interest rates surging, at the expense of plummeting stock and bond prices.

Change in Fed Funds Rate (%)

Source: Bloomberg, Federal Funds Target Rate – Upper Bound (FDTR Index), using monthly data.

It has also increased the odds of a sharp recession and has led to the heads of the IMF and World Bank voicing concerns over the pace of rate hikes.

In the UK, the rise in government bond (gilts) yields because of tax-cut plans created enormous market volatility and is believed to have cost Finance Minister Kwarteng his role, after just six weeks.

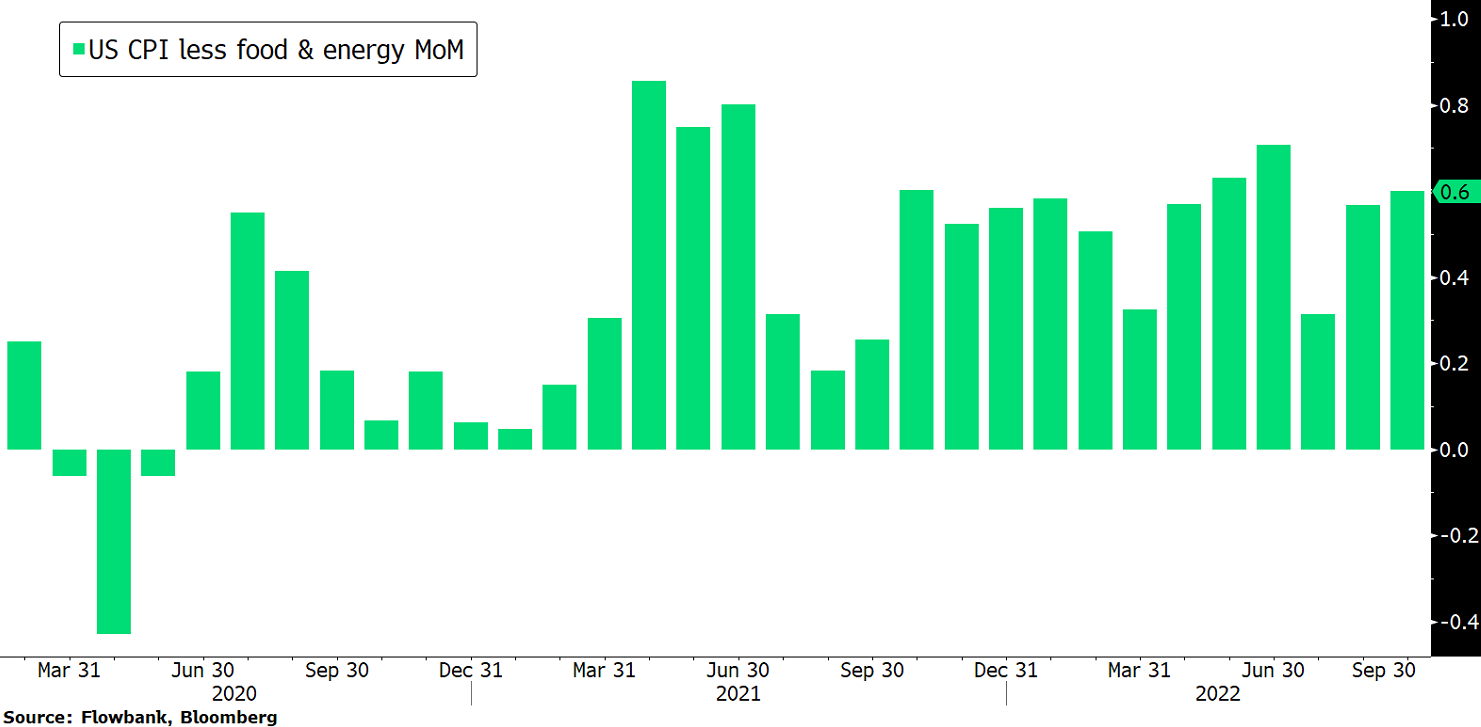

In the US, the hot September consumer price inflation (CPI) report is certainly going to add pressure on the Fed to pursue aggressive rate hikes.

What are the forecasts for stocks?

Last December we published the price targets for the S&P 500 Index of various strategists on Wall Street, which showed the average target at 4’985. The S&P500 was at 4’725 back then, leaving just 5% of upside.

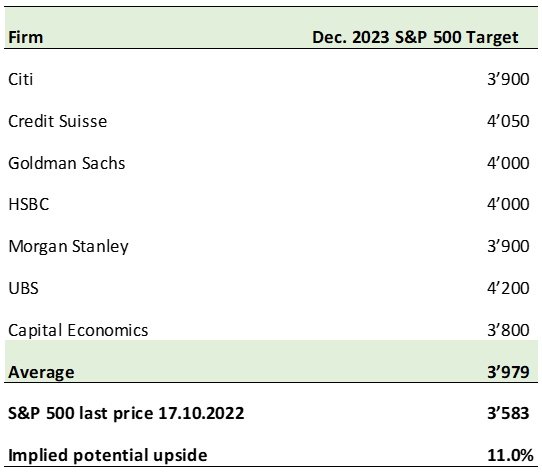

The environment has now changed considerably, with enormous uncertainty and a wide range of market possibilities, leaving experts divided for the year ahead.

Wall Street strategists now see the S&P500 rising 11% on average by December 2023. Strategists are even more divided for the remaining of this year.

The divide can be explained by the macro uncertainties caused by the rapid interest rate hikes to rein in inflation. The adverse effect on consumer demand and the real economy is still unknown, although we are beginning to see rapid changes such as companies reducing their capital expenditures (investments) and reducing headcounts or cancelling expansion plans.

Developing earnings forecasts for multinationals is complex given the macro conditions, supply-chain disruptions, a strong dollar, and China’s Zero-Covid. And, within a year, the growth outlook could change significantly.

What is the bull case?

It is challenging to develop a short-term optimistic outlook when the economic environment is uncertain. But those times historically tend to be when markets bottom. Traders often sell the rumour and buy the (bad) news. In other words, valuations have come down significantly and investor sentiment and positioning are at their lowest in a very long time, helping build the conditions for stocks to potentially climb the wall of worry.

What is the bear case?

The counter-argument rests on the belief that interest rates have further to climb, pressuring stocks. Earnings in the coming quarters could also deteriorate further than markets have so far anticipated.

Conclusion

While it is clear most Wall Street strategists did not see this year’s sell-off coming, the extreme uncertainty has made it even more difficult to make predictions for the end of this year and for 2023. But as Warren Buffet famously said: “buy when there is blood in the street”. For optimistic investors, this means looking at the glass half-full, as buying stocks after large drawdowns and extreme fear has shown to pay off in the long term. For more pessimistic investors (bears), history suggests that it takes time to form a market bottom.