A lot of factors are to be considered when building a portfolio, one of them being a top-down approach. In recent weeks, lots has happened in the markets. Our topic of the day is how someone might think about the current macro events in order to develop a relevant portfolio strategy.

What is the current economic situation?

Being up to date with what is going on in the markets is time-consuming and can be complicated. It is necessary to have a good understanding of how the economic situation impacts certain industries to ensure your portfolio growth. This analysis of the latest major macro events should therefore be of interest to you!

Fed Tapering

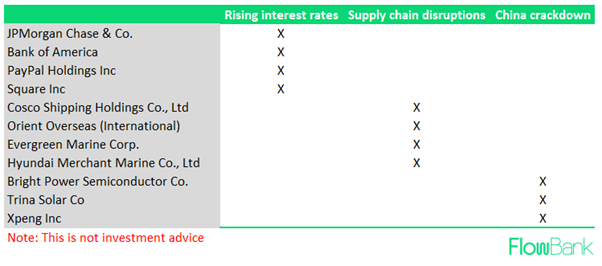

We have all heard of the Fed’s asset purchase program which made the Fed’s balance sheet assets hockey stick to unprecedented levels (see below) during the first phases of the pandemic. The policy aimed to stimulate the economy by holding down long-term interest rates to spur borrowing, spending and employment… However, nobody knew exactly when this program would end, but expectations were betting towards the beginning of 2022. Well, with a strong policy support, people getting vaccinated, indicators of economic activity and employment strengthening, the Fed hinted at a potential tapering (bringing asset purchases to an end) which could happen earlier than expected.

Figure 1: The Fed’s balance sheet assets

Tapering lifts interest rates. It also causes deflation, as money is removed from the system.It lowers the cost of living, but it also raises unemployment. When the money supply is constrained, lenders are more selective about who they lend money to, favoring less risky borrowers. This selective borrowing can cause rates to skyrocket. Rising interest rates can impact investors’ sentiment, which can make them cut back on spending. This will cause earnings to fall and stock prices to drop. Also, it impacts stocks’ present value negatively.

Who benefits from high interest rates?

Banks and Financials! With higher interest rates, the financials’ sector growth should pick up. Thus, cyclicals could continue to offer alpha chances, with Jill Carey Hall, Bank of America's US equity strategist and head of small/mid cap strategy, pointing to record buybacks in Financials. This implies that cyclicals could outperform in the coming months. Moreover, what could be interesting to see are large auto ancillary companies as people have accumulated savings during Covid and look to invest that money into cars. With the chip shortage impacting the auto industry, investing in small parts that go into cars might be a great deal with better opportunities to capitalize on growth.

Disruption of supply chains and transport capacity

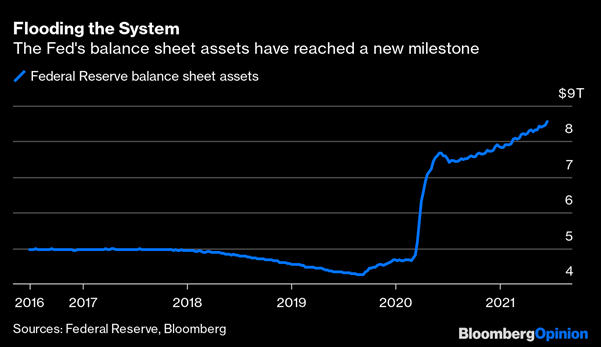

Turning our focus to the spread of the Delta variant around the world we saw confusion in the markets concerning whether this variant would impact the economic rebound. The variant has particularly affected the Asia Pacific region as it is pursuing zero-Covid policies. As a result, several countries in the region have imposed severe restrictions which included temporary factory closures as well as closures of ports where outbreaks occurred. ’The following graph illustrate how increased lockdown measures in Asia were often accompanied by rising supplier delivery slowdowns.

Figure 2: Lockdowns and Supplier delays have worsened in Asia as the Delta variant has spread

A setback in Asia could spill over to the US, Europe, and pretty much everywhere else. It could exacerbate the problem of shortages of key components and goods, thereby causing inflationary pressure in the United States and elsewhere. Plastics, semiconductors, furniture, and textiles are among the sensitive goods China supplies to these countries. Tougher regulations could also stymie output and exports, with negative consequences worldwide.

Inflationary risks are posed by disruptions in supply chains and transportation capabilities. Further reductions in semiconductor output could result in higher prices for a variety of consumer electronics that rely on them. Furthermore, port closures or tighter virus control measures at ports might drive up shipping costs from East Asia to the rest of the world, which are already sky-high due to container shortages and ongoing restrictions on international transportation services. This phenomenon can also have a down growth effect on the global economy.

Who benefits from disruptions of transportation capabilities and supply chain?

Overseas shipping companies and merchants of containers. In fact, it is an offer-demand dilemma: the offer is going down while the demand grows which inevitably makes prices go up, translating into higher margins for those companies. However, this is not set to last for years, and in fact might just be transitory, thus the investing horizon should be thought of in accordance with your personal beliefs.

China tech crackdown

In recent months, the Chinese government has swept through the country's technology, fintech, and for-profit education businesses with regulatory changes… The Chinese government supports industries that help the country meet its green goals and are viewed as critical for boosting the country’s desire to become a self-reliant manufacturing behemoth while also achieving carbon-neutrality goals. Companies that continue to work with the government will most likely see improving momentum in the current context.

Who benefits from the crackdown?

Electric Vehicles are great prospects for the current changes seen in China. The industry contributes to the growth of manufacturing, smart technology, and the carbon neutral agenda, which the government supports. Moreover, with the shortages seen recently, cars’ values have gone up, though this too could be a transitory passage and could see the supply side catch up soon, leading to a glut of supply (see lumber example in recent markets). In sum, companies that operate in the semiconductor, renewable energy, and high-end manufacturing are well positioned to grow in China.

Conclusion

Building a stock portfolio is not an easy task, because lots of competing macroeconomic and microeconomic elements are at play’’. In theory it is always simpler to predict markets movements, but in practice it is not guaranteed that things go as planned –that is where the risk comes from. Here are some risks to consider:

-

The Fed’s tapering can lead to a “taper tantrum” which refers to a panic movement that triggers U.S. Treasury yields to spike and fears of the market crumbling, bringing volatility in stocks. More volatility equals more risk, depending on your investment strategy it might not be ideal.

-

Also, if the contrary happens i.e. the tapering starts later than expected, it could lead to the Fed having to raise rates quickly, which can have an impact on the stock market.

-

In worst case scenarios, tapering can lead to stagflation (which the Fed struggles the most with). Stagflation is when unemployment rates skyrocket, inflation rises and growth slows – not a great combo.

-

In times of stagflation, technology tends to do well which is contrary to what was previously said with the China tech crackdown. This shows that one industry can go one way or the other depending on different factors.

-

If disruptions last too long, it can also have a down growth effect on the global economy.

-

With the Chinese government continuing to make regulatory changes, it leaves less room for tech companies to innovate.

In short, it is important to be able to see opportunities when things go down – when an industry suffers, there is usually another one who sees growth. Keep in mind that expectations are not always met and there is always risk when building a portfolio so keep an eye out and stay alert.

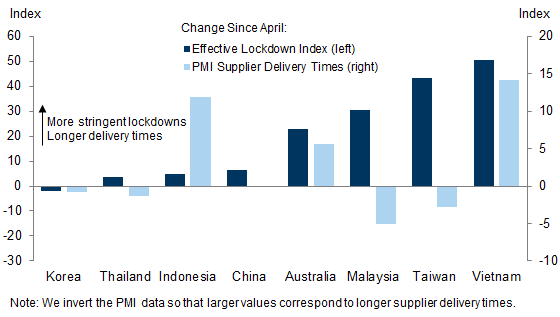

Who could win in the above mentioned macro situations: