US inflation-adjusted bond yields are about to turn positive for the first time since March 2020 in a surge that is adding further pressure on rate-sensitive corners of financial markets. What are the implications for stocks?

The 10-year real Treasury yields, the annualised return US benchmark government bond generates once inflation is taken into account, have soared more than 100 basis points since early March, hitting 0% on Tuesday, April 19, in a sign yields on the 10-yr Treasuries are coming close to exceeding medium-term inflation expectations.

A jump in real yields has been triggered by the Federal Reserve’s intent to curtail price growth by aggressively tightening monetary policy by both lifting yields and shrinking its USD9 trillion balance sheet, money-market traders are already pricing in about 200 basis points of tightening by the Fed's September decision. The move is removing one of the supports that were behind a powerful rally in stocks from the depths of the coronavirus crisis two years ago.

Why do real rates matter?

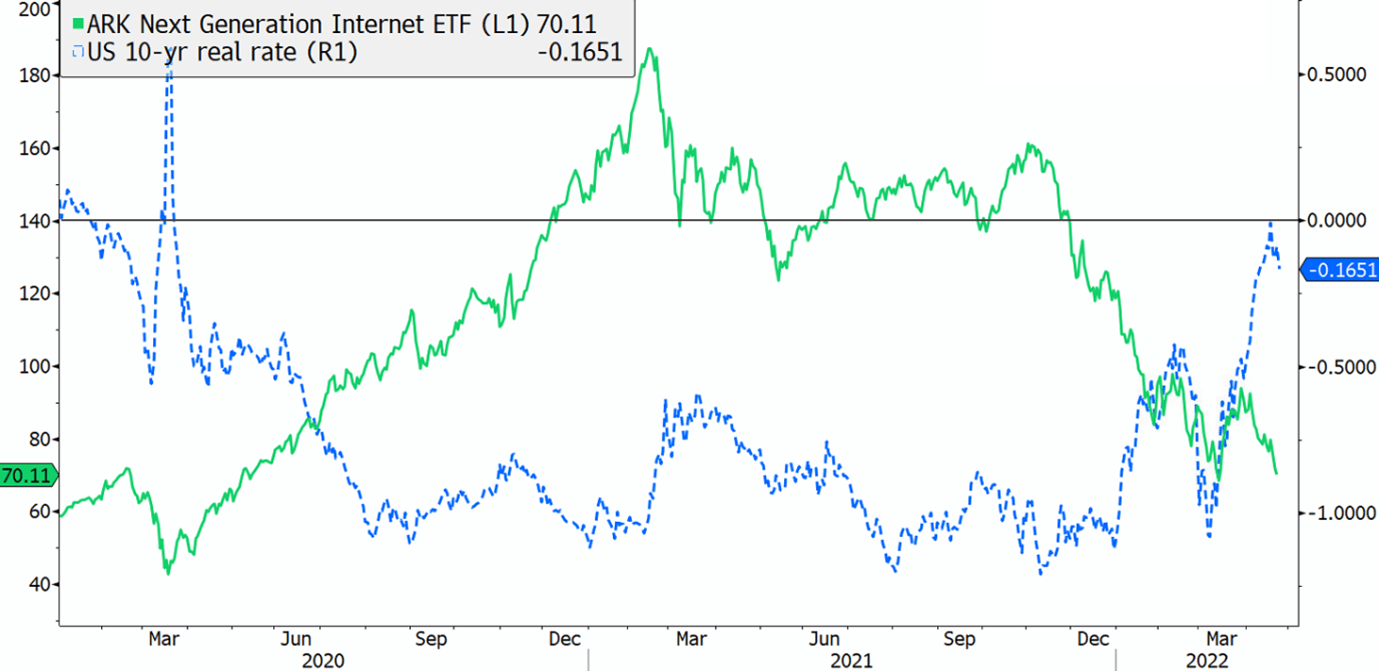

Real rates change risk calculations. The fall in real yields on ultra-low-risk US government bonds deep into negative territory in 2020 spurred investors to hunt for assets that could provide higher returns after factoring in inflation. Prices of lossmaking start-ups and fast-growing technology companies soared in response from the March 2020 lows until late 2021.

The jump in real yields this year has prompted investors to reconsider the value of owning risky money-losing companies that may not generate profits for many years as rising yields increase opportunity costs. Some private start-ups such as Instacart have agreed to cut their valuations, while shares of unprofitable technology groups have dropped more than 30% this year.

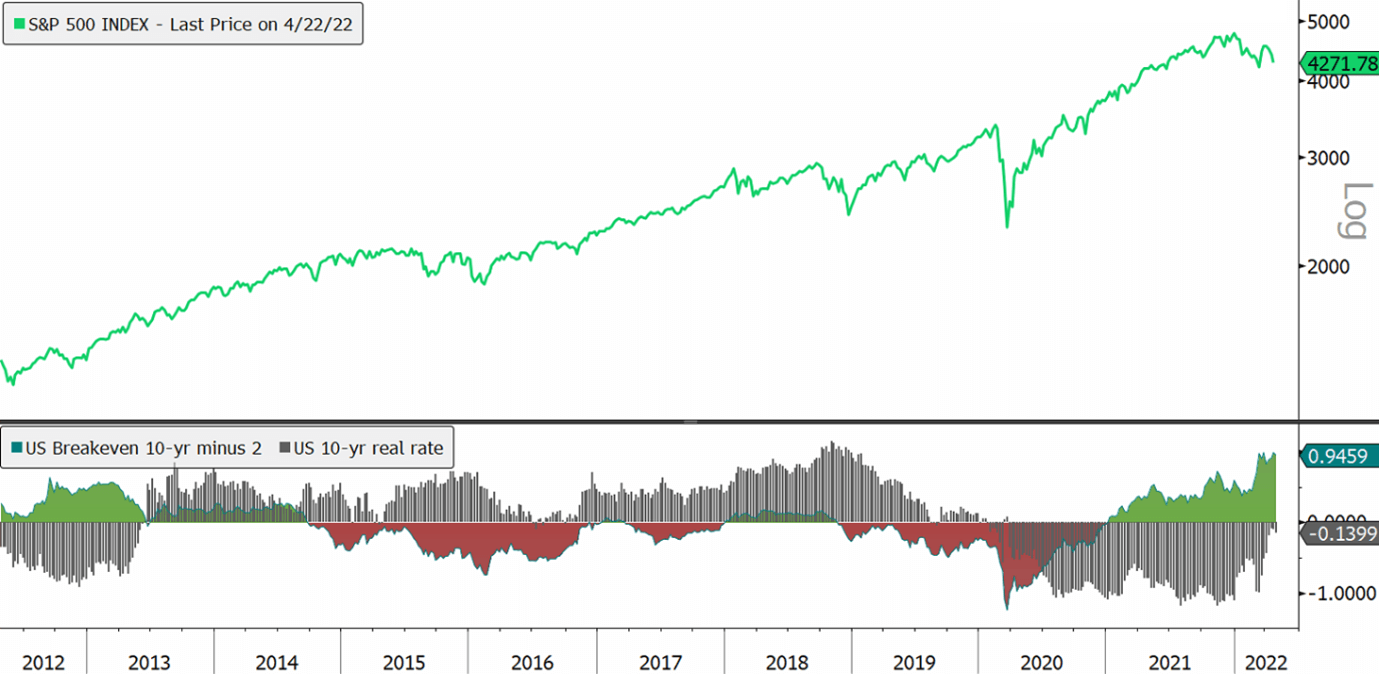

Real rates can also provide a reliable read on future economic growth and monetary policy. To better understand its importance, it’s necessary to look at its relationship with breakeven (BE) inflation – the gap between the yield on a conventional and an inflation-linked debt, and a market-based gauge of investors’ inflation forecasts over the next 10 years.

When BE inflation is rising and is doing so primarily because of a steady drop in real yields, central banks are likely to persist with interest rate cuts for an extended period to support the economy, tolerating the prospect of higher inflation as they do so. A falling real yield materially improves the risk-reward characteristics of risky assets (see chart above).

In contrast, when breakeven inflation is above 2%, followed by an upward move in both nominal and real yields due to a strong economy and labour market, monetary policy is unlikely to loosen any further as interest rates have probably reached their lowest point. In this environment, though long-duration and risky assets take a hit, there is no evidence that the stock market overall will perform poorly. Looking back at periods 2013-2014 and during 2018 when both BE inflation and real rates were rising, the S&P500 advanced, making new highs.

How far can real yields go?

Treasury yields have risen more sharply than inflation expectations, a divergence that indicates investors have confidence in the Fed’s ability to reduce inflation in the years ahead. The 10-year break-even rate has held near 3% so far, much lower than the March 2022 inflation rate of 8.5%.

The uptick in real yields also reflects investors' belief that the Fed will start to tighten financial conditions “expeditiously”, a word used by Federal Reserve Governor Lael Brainard to describe the pace with which the Fed aims to lift rates to neutral. Borrowing costs for companies have shot higher, as have mortgage rates for consumers, which hit 5% for the first time since 2011.

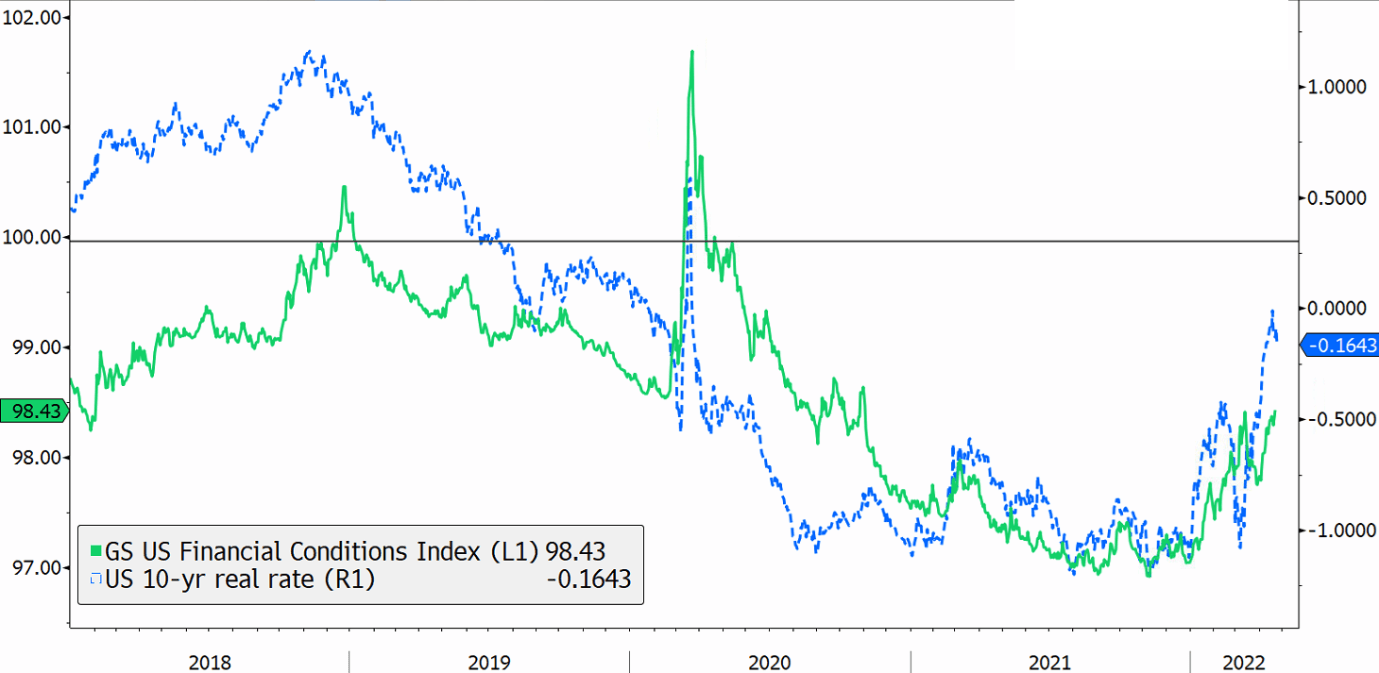

However, economists are divided over how much further real yields could rise given the rapid move that has already taken place. Many analysts believe financial conditions are “still pretty loose”, pointing to Goldman Sach’s US financial Condition Index (GSUSFCI).

GSUSFCI, a measure that incorporates variables like stock prices, credit spreads, interest rates, and the exchange rate, has been rising from a record low in November, but mostly because of the rise in nominal yields. Credit spreads, on the contrary, have barely experienced significant volatility. Yields on US high yield corporate bonds currently stand at 3.9% which is far below 2018 December highs of 5.3% and 2020 March’s 10.5%. This implies that corporate bond investors are, so far, not much worried about credit risks.

Looking ahead

One conclusion to draw is that, while, at the margin, higher real yields would be a headwind for long-duration and risky assets, the full impact is difficult to assess. During past episodes when real yields were climbing, stocks were able to remain resilient as long as rising real rates were a reflection of a strong economy. However, should real yields continue to push higher despite falling mid-term inflation expectations then stocks could come under significant pressure.