Why buy a device and have to keep it for years when you can change it whenever you want? Grover proposes a solution to never be stuck with your laptop or smartphone, let alone the debt that often comes with it.

Key takeaways on Grover

- Grover enables customers to rent technology monthly instead of buying it.

- The service gives more flexibility than an outright purchase or financing plan, allowing access to the tech customers want, fitting both their lifestyle and their wallet.

- The start-up just raised € 71 million in its Series B, which they plan to use for international expansion into the US and Spain, as well as to extend their product offering.

- The biggest challenge will be twofold: facing increasing competition adopting this model and managing to establish quality-execution on a larger scale.

The era of upgrades

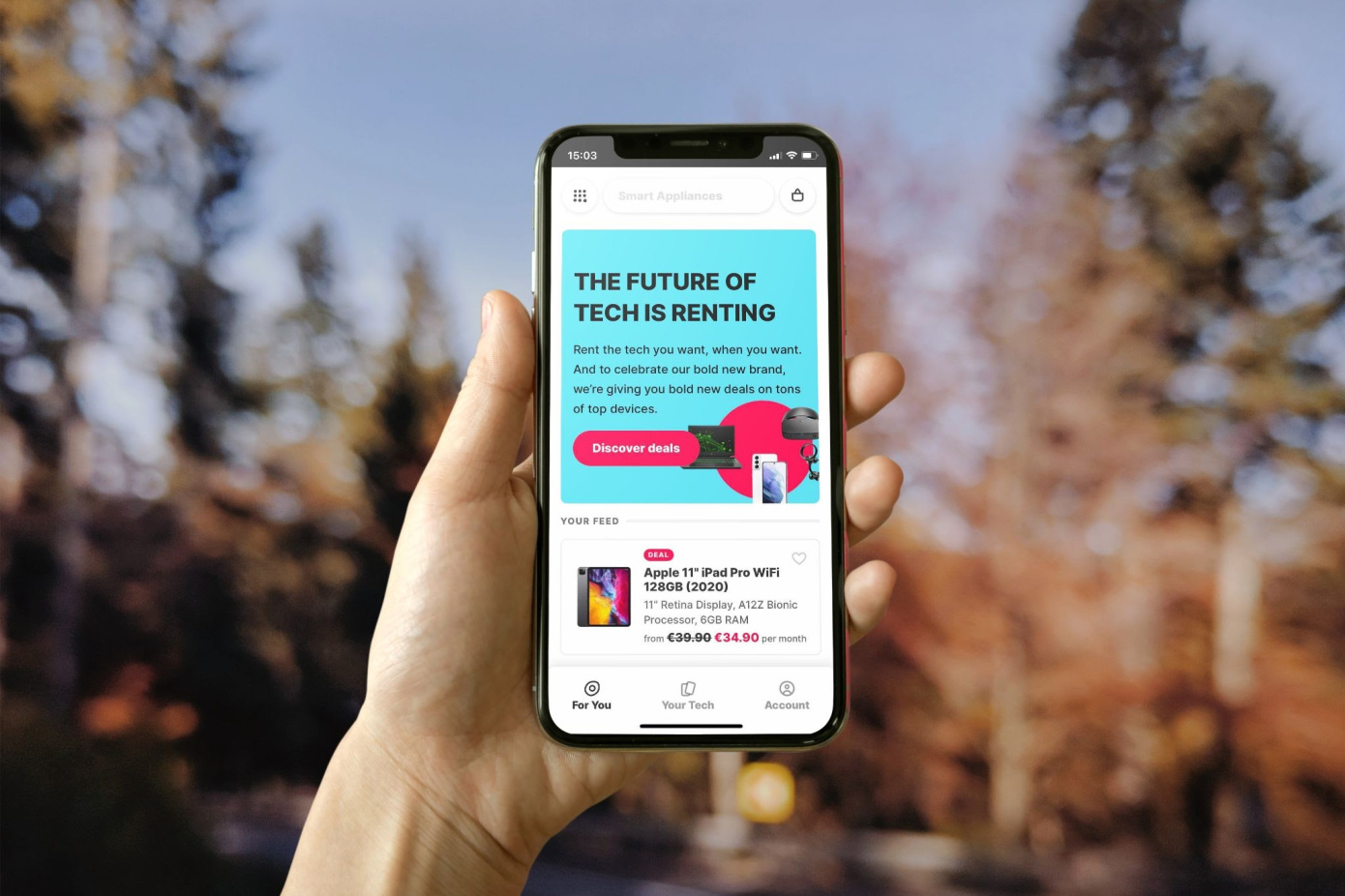

One barely has time to buy a mobile phone and enjoy it before it is already outdated. Customers are looking for ways to get maximum flexibility and to always enjoy the latest technological progress. For many it would be amazing if we had a “Netflix for gadgets”, where they could pay to have and use a device and give it back for something new when they are done with it. There is a start-up which allows you – in exchange for a premium – to always have the latest tech in your hands. It is called Grover.

Grover’s business model: answering to upgrade-hungry customers

German start-up Grover offers a monthly subscription plan which allows users to rent their smartphones, laptops, or other costly gadgets instead of acquiring them fully. “The whole idea of hardware as a service model detaches the payment from the asset—you don’t put people into debt but give them the flexibility to return a product they no longer find useful,” said Michael Cassau, founder, and CEO of Grover. In a world where customers constantly want to upgrade to the latest generation, the proposition has value.

The usual pains from renewals are either a big upfront expenditure or piling up debts. Once you bought a TV, a laptop and a smartphone with credit, the customer’s debt becomes a source of worry. Grover gives the flexibility to give back your goods every month, taking away the feeling of being stuck with one’s growing debt.

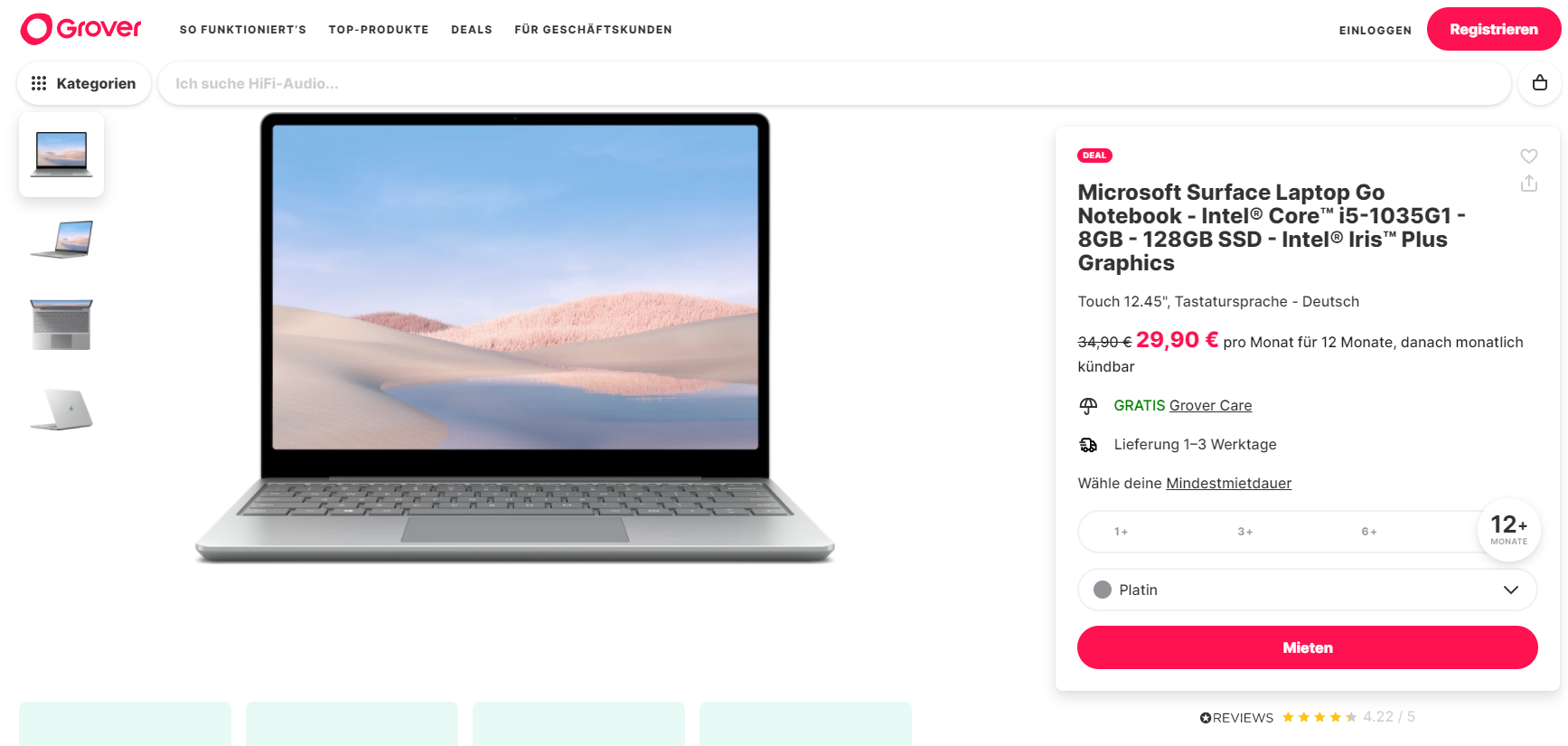

This flexibility does come at a price though. If you look at how much it would cost you to rent a MacBook air for 2 years, the € 55 monthly bill would amount to € 1,320 for 2 years, compared with the € 1,129 upfront cost on the Apple website. This makes the service interesting for customers looking to update regularly, as it shows: rental periods are starting at only a month, and last 10 months on average.

Example of a Grover article (source: Grover website)

Fierce competition for Grover

The start-up already has over 165,000 customers in Germany, Austria and the Netherlands who rent or have bought a product from one of their retail partners. They are aiming to reach 450,000 subscriptions by the end of 2021.

But the renting of expensive goods is becoming fashionable. Grover will face competition from both already solidly established tech giants such as Apple who already offers its own instalment plans and loans, but also from fintechs offering “buy now, pay later” solutions like Klarna in Sweden.

Uses of the new funding: Grover has many plans

The company has just raised $71 million, $53 million of which is from new and existing investors which include JMS Capital-Everglen, Viola Fintech and Assurant and around $18 million from venture debt. This adds up to the € 250 million in debt they raised right before the pandemic and the € 44 million Series A and € 48 million pre-Series B. The company did not disclose its full valuation.

The recent Series B funding will help Grover to launch a more global expansion in Spain and in the US, fuel growth in existing markets as well as develop its own financial services. The new service could include friendlier rates for customer with proven payback capabilities, or even cashback rewards for those who have subscribed for more than one product loan.

They will also try to expand the range of the products offered, adding health and fitness devices, consumer robots and smart appliances.

The main challenges for Grover will be to grow while keeping their supply chain management, shipping, and reception of goods in order, as well as taking care of the refurbishing step when necessary. Maintenance of quality will be key to develop a global, trusted service. Having a good idea is only the first step, execution is often the real challenge.

According to Grover, they are barely scratching the surface of a $1 trillion market. There is tremendous growth potential if indeed we are entering a time where ownership is an outdated concept.