Shopify’s business model puts the merchant first, not the customer, unlike Amazon. This positions Shopify uniquely as a buoy for retailers to stay afloat against the rising tides of price-cutting models seen in payments and other online marketplace platforms.

What is Shopify

Not to be confused with Spotify (ticker: SPOT), Shopify (ticker: SHOP) launched 15 years ago in Canada, to help small businesses go online. Much like what Zoom is to work from home, SHOP is to brick & mortar businesses around the world. Today, Shopify has sold its software to more than 2 million merchants, in due part to the pandemic. SHOP allows its merchants to run websites for as little as $30 to $2000 a month, with about a dozen perks and services – that range from running the actual online store to the inventory management and payment processing.

Big business of small business

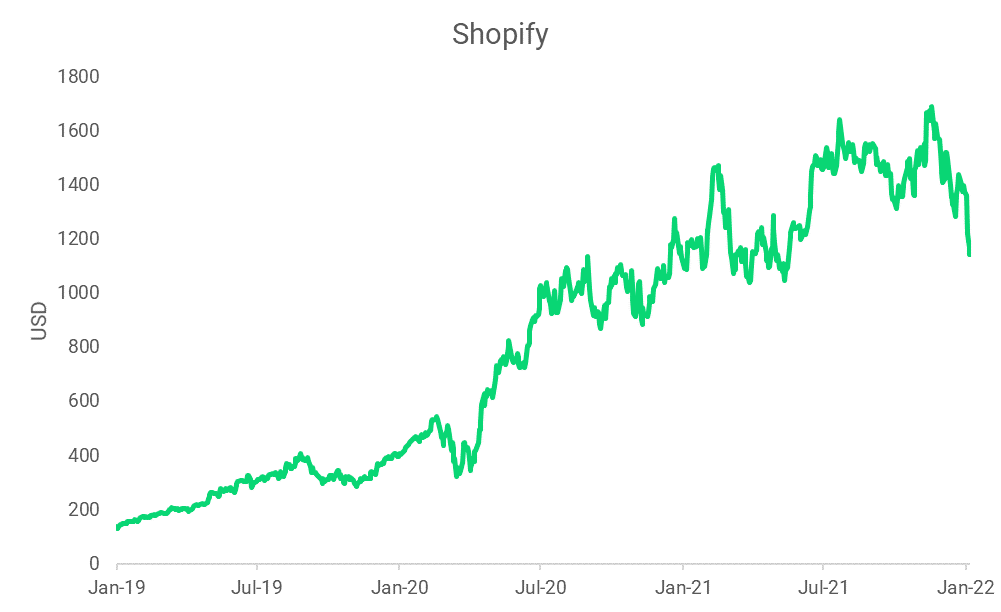

While it took 15 years for Shopify to make a gross merchandise volume (GMV) of $200 billion, it only took them the last year and a half to double this GMV and surpass $400 billion. Merchants are subscribing to Shopify’s service like never before, making SHOP one of the lucky winners of the pandemic. The pressure to survive the lockdown measures saw a surge in small businesses going online which SHOP was able to convert. Q3 2021 GMV alone was $41.8B, which was more than the entirety of 2018’s GMV of $41.1B. While other pandemic winners, like Zoom and Peloton, begin to question how they will sustain their gains, Shopify too must continue living up to high expectations.

Competition with Amazon

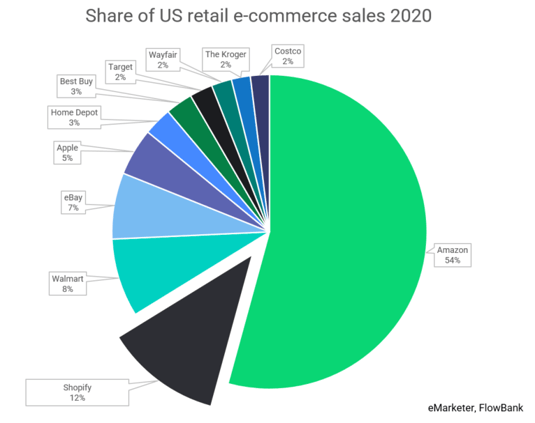

Shopify is in a competitive space, but it is already second by share of US e-commerce sales, behind Amazon. However, Shopify is not interested in sitting on its laurels. It wants to remain relevant, and weave itself into the fabric of small businesses for years to come, according to its CEO. An example of this effort is seen with plans to enter the NFT space and develop influencer programs with people like Martha Stewart and Pharrell Williams. For Shopify, the next stage will be a ruthless marketing battle to seize more attention.

In a way, Shopify is already well positioned against the current business models in the payment space, a space that profits by charging merchant fees, like Visa. Also, contrary to Amazon, who is customer centric and will cut any price it can, Shopify is taking another approach: help merchants sell more. Considering that 50% of America’s economy is made up of small and medium sized enterprises, this puts Shopify in an attractive position for the long run. Even beyond America, a rising number of businesses are pressed to digitalize, regardless of size, and Shopify will need to spend to capture more demand.

Shopify looks ahead

After 2020 and 2021, Shopify is now facing a blurry future, especially as it attempts to maintain its momentum. SHOP is yards away from Amazon by market share, but not necessarily by any other measure. SHOP is a profit-making machine: Q3 2021 saw a 50% YoY surge in gross profit to $616M, and Shopify is able to sustainably make this type of profit since 2016, in large part because it continues to spread its costs.

SHOP management recently said that investors should expect an acceleration in operating expenses because they will aim to grow investments in their infrastructure. The near-term objectives mainly revolve around shipping, payments and growing their lending solutions. Merchant cash advances and loans at SHOP are a lucrative business segment which reported a 56% Q3 YoY rise to $400M, as customers utilize the full scope of Shopify products. The medium- and long-term strategy is focused on expansion and integrating new markets such as wholesale and B2B. The most difficult, and perhaps lucrative goal of Shopify is its long-term international expansion, logistics, point of sale products and 6 River Systems (i.e. more advanced logistics products).

Investment highlights

While past success does not guarantee future gains, here’s the bottom-line thesis for Shopify. While they are second in line behind Amazon, the world’s largest marketplace, SHOP exerts a noticeable e-commerce presence. This is in due part to its world-class product, a multichannel commerce platform that enables merchants from anywhere in the world to sell to anyone. SHOP also has a very healthy and growing balance sheet with a successful capital allocation approach and a vast ecosystem. The customer base is super engaged, invested, and the platform is hard to replicate by new entrants. Like many top tech companies, SHOP leverages merchant data to constantly enhance and create new products whose goal it is to both improve the retailer’s experience and bolster bottom lines.