In her novel ‘’Robotics through Science Fiction’’, Professor Robin Murphy says that in engineering, form follows function. Time has come to forget humanoid robots and think about robots as intersectional technologies you can invest in!

What is Robotics…

When we talk about robotics, we refer to a technology that performs tasks with or without the assistance of human interaction. Those task operators are what we call robots and while it is tempting to refer to old movies and stereotype robots, today’s applications are far vaster than previously depicted on screen.

Professor Robin Murphy, in her book Robotics through Science Fiction, says that in engineering form follows function or in other words we should forget humanoid looking robots, and look towards less human-like and more efficient robots as the opportunity...

Aside from a robot’s form, it is naïve to talk about robotics without talking about what is inside; artificial intelligence, and other technologies all work together in defining what a robot is. For robots to perform programmable tasks, they need both hardware, and software running through their metallic veins which means many sub-categories of tech are working in unison.

You may have heard of things like computer vision, natural language processing (for voice control), reinforcement learning, and GANs (Generative adversarial network, or simply machine learning). While Boston Dynamics robots replicate the dance moves of humans with uncanny degree of precision, there is a much broader and exiting world out there you can invest in today.

Industries disrupted by Robotics…

When I ask you to think about a non-humanoid robot, what do you imagine? Remember, these are machines that can perform programmable tasks with, or without human support! Here’s one short list: drones, arms, and rover like explorers for mars...

While the list goes on, these highly mobile and versatile mechanical forms come up again and again in the way they are applied to disrupting industries. We say industries, not to say academia where most of this stuff is being developed because it is easier to break down by industry to envision an investment strategy.

The industries that are already being disrupted by robotics are the following: agriculture, medicine, military/space, and manufacturing/industrials. Agriculture will gain from automated tractors, sensors, and drones and while some argue this could cut jobs, most farmers will agree that it will simply make them more efficient, not less useful.

Doctors will also gain in efficiency as machines helps them sort out complicated surgeries, and enable them to perform remote surgery (talk about working from home!). The military will continue to be the largest buyer of unmanned systems technology (drones) and the space community will keep building and using similar systems for space missions. Lastly, the manufacturing world is and will continue to be shaped by robots to build cars, and process metals.

Robotics Future Outlook…

The future is now! You can see it taking place at an increasingly quicker pace in the EV space with self-driving firms Cruise and Waymo and, flying taxi firm Volocopter soon to be in your neighborhood—stay tuned!

The industries presented above will be net beneficiaries of disruption due to the scaling and falling costs leading to efficiencies for workers and consumers. Something we hear a lot in the technology space is that something like 99% of technologies have not been invented and that moreover, 85% of jobs that will exist in 2030 have not been invented yet either!

All this has got to have a monetary value! While predictions are probably smaller than what we will actually see when millennials turn 50 (and run most of the economy), here are some figures to get your head spinning and wanting more:

The global robotics market could grow at a CAGR of 19% between now and 2025, reach revenues of $160-200 billion, and create a net 58 million jobs. Industrials and manufacturing are forecasted to reach a $75 billion market opportunity by 2024, military applications should see a $50 billion offering by 2027, the medical field could see $22 billion intake by 2027, and about the same could be expected in agriculture though it would see a larger CAGR of 34.5% over the next five years compared to medicine’s 15% CAGR.

The regions seeing the largest momentum for robotics are the United States, Japan, China, and Germany. One correlative reason for this could be that they are the largest car producing and exporting nations and that such levels of manufacturing require loads of robotics.

Between Volkswagen, Toyota, Ford, and SAIC motor, ignoring Kia and Volvo, and side-stepping Tesla and other Chinese EV groups, these hubs command the robotic demand for car manufacturing. Of course, the medical space, agriculture, and robotic retail consumer electronics is not limited to those regions but tend to see a high degree of market penetration.

Investing in Robotics via ETFs…

If you do not want to commit to a single pair of stocks, but still want broad exposure to the future offerings of robotics you could consider the Robo Global Robotics & Automation ETF (ticker: ROBO) or the Global X Robotics & Artificial Intelligence ETF (ticker: BOTZ) or the ARK Autonomous technology & Robotics ETF (ticker: ARKQ) or the iShares Automation & Robotics ETF (ticker: RBOT). All these ETFs are different but some of the holdings do intersect so you should be mindful of studying their holdings.

Investing in Robotics…

There are many ways one can invest in robotics because it touches upon four broad industries and has so many sub-component technologies that all play an essential role in developing this growing industry.

We focus on publicly traded firms below, but remember that some of the companies that will rule the robotics future, have not been invented yet! Nonetheless, you can get started with some of these firms, firms chosen mainly by market size, one indicator of market ranking.

German company KION group is a leader in the field of industrial trucks, warehouse technology and supply chain solutions. It sees a market cap equal to $6 billion and employs 34,000 employees.

Intuitive Surgical has a $93.2 billion market cap and sees revenues nearing $5 billion per annum. They are based in California, and develop the Da Vinci surgical system, a system that allows surgeons to perform minimally invasive surgery with robotic assistance.

ABB, a swiss based company employing 144,000 people is a leading manufacturer of robotics and machine automation solutions including controllers, software, cells, PCs, and programmable logic controllers. Their market cap is just shy of $400 million.

Zebra Technologies has a market cap of $21 billion, and employs 8,000 people in Illinois. They make a retail robot called SmartSight that helps automate the retail experience for both customers and retailers, but also runs data and retail automation software for inventory optimization.

AeroVironment is mainly focused on unmanned aerial vehicles (drones), it has a market cap of $2.6 billion and works very closely with the US government who is its largest client regularly ordering unmanned systems from the Californian firm. As of January 2021, the firm saw a 27% increase in sales growth, but net income has fallen at the start of 2021.

iRobot--yes just like the movie, but not as cool--is a consumer robot firm founded by MIT alumni. The products they make include vacuum cleaners ''Roomba''s and moppers ''Braava''s. The firm is net income positive and has shown steady growth as they become more recognized by the public.

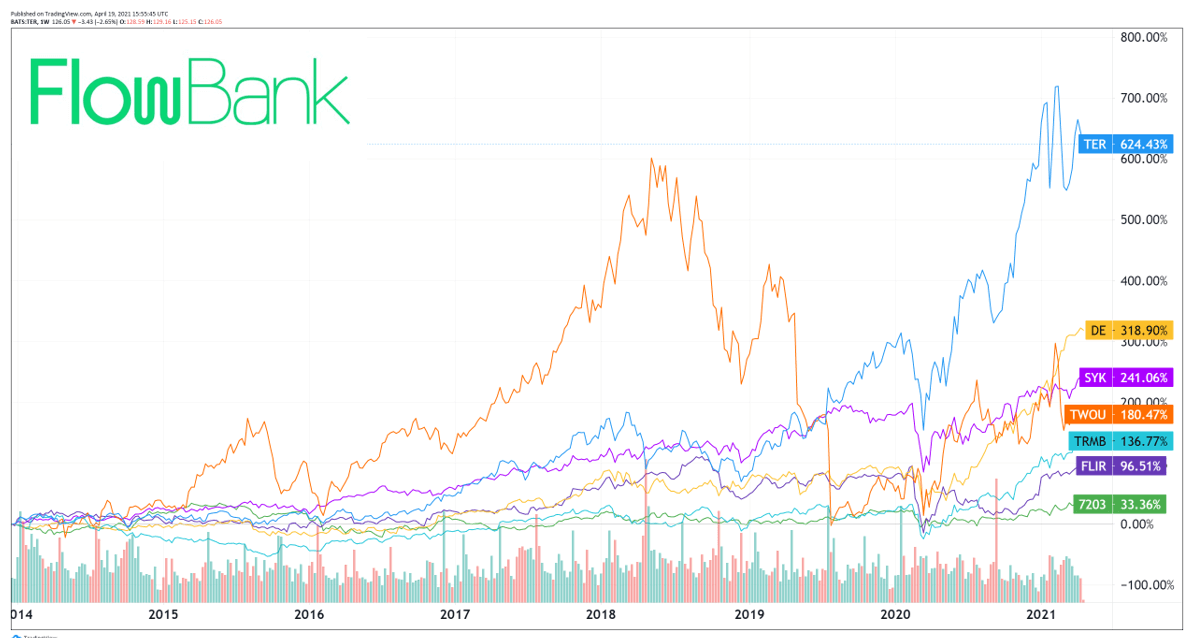

Figure 1: Stock performance of well-known robotic companies

More stocks related to robotics are listed next:

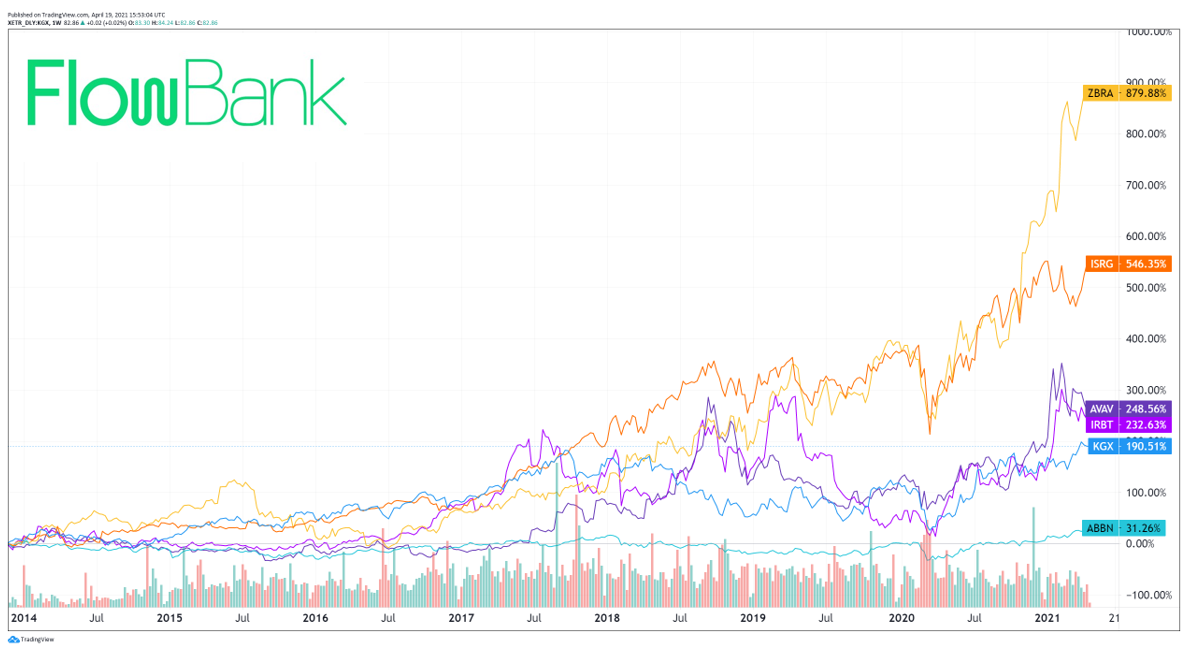

Figure 2: Stock performance of the above list of robotic-related firms