Roku is a key player in the video streaming services market. They offer users a way to access various apps like Netflix, Hulu, and Amazon Prime Video through their device, and they monetize subscriptions through advertising cash flows.

Roku Business Overview

Roku sells streaming devices and operates a TV streaming platform for users, content publishers and advertisers. Central to its platform, the Roku operating system (Roku OS) is built for TV to run on low cost hardware. Roku's TV brand partners license Roku OS and utilize its smart TV hardware reference designs. Roku's devices, enable consumers to access a selection of content by connecting their Roku device at home on their broadband network. Roku also provides content publishers and advertisers with access to billing services and data insight.

Roku Revenue Segments

-

Platform

Sales consists of digital advertising, fees earned from the use of the company's platform, content distribution services, subscription services, sale of branded channel buttons on remote controls and licensing agreements with TV operators. Revenue from advertising is mainly generated through video and display ads and ads are sold on a cost-per-thousand basis. The subscription fees are paid monthly for varying fees depending on premium selection. For the button, Roku gets a fixed fee for each remote control. -

Player

Sales consist of their streaming media devices (like audio and media products and other such accessories) directly to consumers through their website or via retailers and distributors. Players also include embedded software. The majority of the products are sold through retail distribution channels.

Roku Subscribers and Viewership prowess

Roku's January 6th, 2021 press release stated that the firm had surpassed 50 million active accounts on its streaming platform in the past quarter. Estimated data for the latest quarter ending December 31st showed 50.2 million total active accounts which represents an increase of 14 million accounts for 2020 or a growth of 43% year over year. The streaming giant also added 17 billion streaming hours in the last quarter of 2020 for a total of 58.7 billion hours in 2020 which equals a 55% year over year rise.

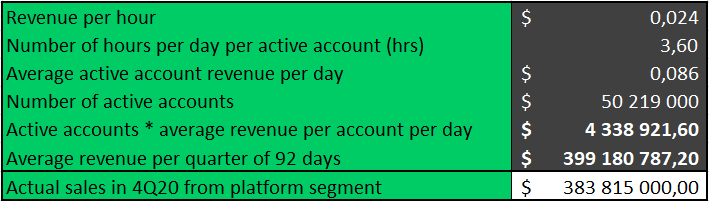

In the last quarter, the revenue earned by Roku per hour streamed was $0.024. That means that per account, Roku makes 2 pennies an hour. On average, 3.6 hours were streamed per day per account in the latest quarter. In one day, one account makes Roku 3.6 times 2.4 pennies or 8.6 pennies an active account. In a period of 92 days (one quarter) 335.8 hours were streamed per active account on average. On a given average day, Roku's 50,219,000 active users generated $4,338,922 in revenue which is $399,180,787 in the last quarter. In reality, sales from the platform were closer to $383,815,000, but we were not completely off, only so because we used averages. The point being, Roku makes a ton of cash each day, but they still are not profitable this quarter.

Roku Sales and Marketing

Roku marketing's goal is to drive sales growth in its two aforementioned segments. The firm sells advertising to a range of advertisers aiding them in reaching their KPIs so think B-2-B-2-C. Roku divides up its sales into six categories: agency holding companies, fortune 500 brands, independent agency and mid market clients, content publishers and entertainment brands, performance and B-2-C brands, international and domestic advertising businesses.

The company's acquisition of DataXu in 2019 enables them to optimize their ad business and offer data performance analytics to their clients. Clients are empowered to plan and maximize their areas of interest to reduce costs and increase revenues. Clients are able to program, and improve their bids for TV ads and digital ads campaigns through Roku.

Roku's Deal with HBO means business

The new addition of HBO Max on the Roku player (not to mention WarnerMedia) will continue to drive viewership forward as consumers can now watch new movie releases from home while theatres remain closed. While the exact terms of the deal were not made public, one can assume that Roku would benefit from a cut of every new HBO subscriptions purchased through Roku, and any additional advertisement revenue. In terms of new revenues generated from subscriptions, analysts indicate that Roku could hypothetically grab 20% of the $14.99 monthly HBO subscription fee. This means that an additional 1 million users subscribing to HBO from a Roku device would generate $30 million in revenues for Roku.

To estimate the real value of this deal let's think about the Disney+ user growth rate as a proxy variable for calculating the real yearly benefit to Roku from this deal. Roku was a meaningful driver in Disney+ account growth, and we will assume that 30% of new Disney+ subscribers came from the Roku, Amazon, Apple and Google group. Of this 30%, Roku easily provided 40%. This implies 10 million subscribers from Roku alone.

We think Roku will perform similarly with HBO just on a smaller new subscription base. We'll assume that in the end Roku they will generate a third of the users, about 3 million. While HBO+ is more established than Disney+, which implies a slower growth potential, it will still grow and could see the 3 million new subscribers from Roku to the HBO platform generating three times the $30 million seen above thus reaching $90-100 million per year. If the math is right, this type of revenue would represent about 6% of Roku's 2020 revenues. Good deal.

Roku Revenue breakdown by Segment

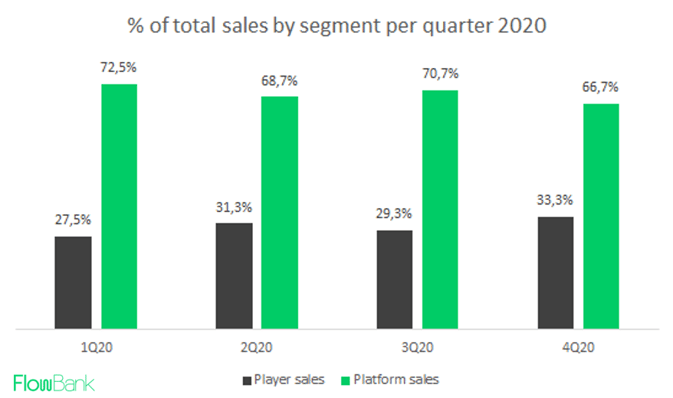

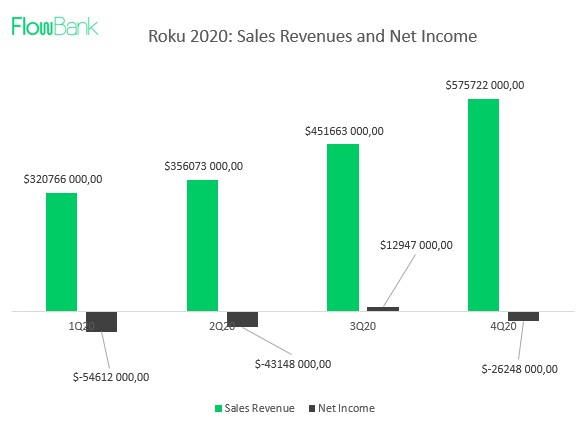

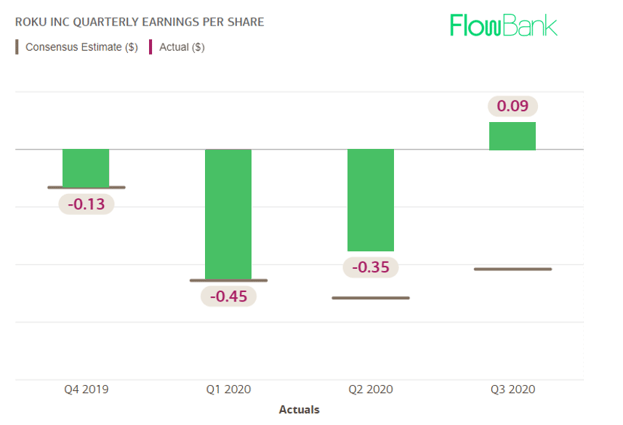

We're going to visualize some of the revenue figures for the player and platform segments. Revenue figures are found on what is called the income statement (think money earned from the sales of your products and the expenses incurred from building them, all on one page). Roku is commanding a high stock price close to $340, but their basic earning per share is negative all of 2020 except for the third quarter. This indicates that the ''market'' or Wall Street in general is forward looking on this company. They are willing to pay a premium on a company with negative accounting profits because their models for valuation are considering positive earnings in the future (more of what they saw during the third quarter). This net positive switch can happen with increasing sales, but mostly decreasing costs and economies of scales through market share dominance.

Let's compare player vs. platform sales in a percentage form, for a more standardized footing. What we identify is an extremely steady and consistent allocation of revenue. The platform business offers around 2 / 3 of the sales revenue and the rest is achieved through selling players in retail stores and online. It's also worth mentioning that in percentage terms, the player segment used to cost Roku more than its platform revenues until the last quarter of 2020 where they converged (in percentage of revenue form).

In reality however, Roku's platform segment is much more profitable than its player segment with the player segment showing a negative gross profit of -$960,000 in the last quarter versus a gross profit of $222,858,000 from their platform revenues. The cost of producing their player devices last quarter were basically more expensive than what they could sell them for. So either they lowered their prices on players and lost money, or more likely, the production prices and delays in production from abroad increased. As we see below, Roku needs to fix this problem if it plans on going global.

Roku as an Ad business

The underlying dynamic behind a growing ad business in streaming is driven by 'cord-cutting'. Cord cutters are households that cut the cord on their TV providers to transition to a tech streaming solution (such as Roku). The number of these cord cutting households are estimated at around 46.6 million by the end of 2024, offering still more wallets to dive into. This means it is not too late for other players to enter the stage and compete against Roku and this means Roku is set for yet more ad revenue.

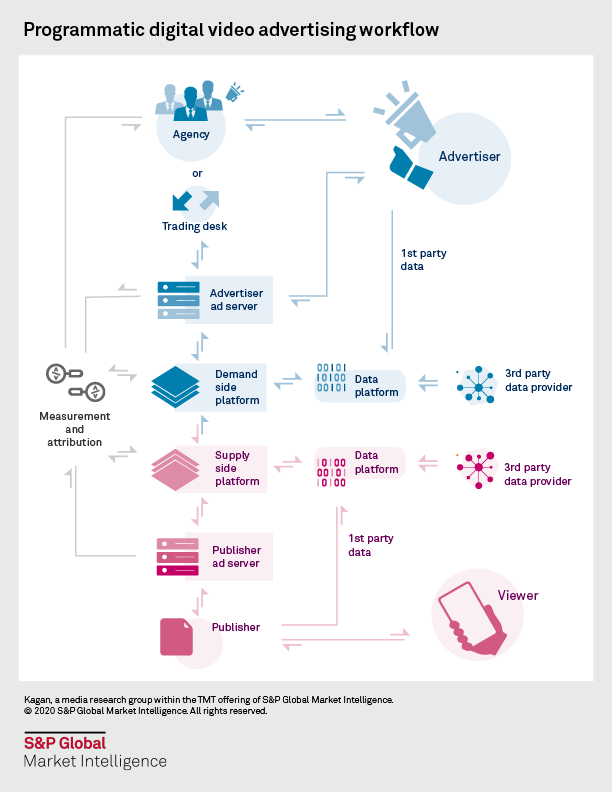

As advertisers are shifting to streaming, also called Over The Top (OTT), they are seeking more and more optimization in their advertisement bids. This is why Roku's acquisition of DataXu last year matters (now called OneView). OneView is a programmatic buying tool which allows advertisers to manage who sees their ads and how frequently their ads are shown. This year Roku offered incremental guarantees meaning that advertisers are guaranteed to hit audiences that have never seen their ads. This is a huge value add and a unique competitive advantage for Roku because it enables them to charge advertisers a higher cost per 1000 views. As we have seen above, Roku's main source of money is through ad revenues.

Roku's Financials Overview

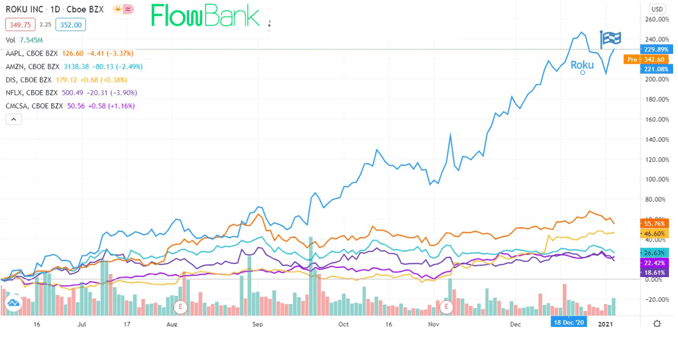

Roku stock performance relative to peers is wild:

Revenue (sales) vs. Net Income (profit) in 2020 shows a blowout fourth quarter, but increased costs saw Roku miss a profitable quarter to repeat Q3 and begin 2021 net positive:

Quarterly Earnings per share surprised investors in the third quarter of 2020, and this makes sense considering that quarter saw a positive net income figure, something rare for Roku considering the firm is not profitable generally speaking:

Roku Risks and International Expansion

Data from Strategy Analytics suggests that Roku TV OS had 5% of global market share in the first quarter of 2020 while their main rival, Samsung's Tizen OS accounted for more than twice that figure. However, Roku plans to increase its penetration rate in new markets abroad as the amount of TVs sold globally went up this year about 15%. TVs and Roku streaming devices seem to be real complimentary goods in standard economics talk. This might suggest any additional purchases of TVs going into 2021 as beneficial to Roku's business growth.

Roku is mainly operational domestically in the United States, but they plan to reach an international audience in 2021. In their latest quarterly report they mention the difficulty of expanding abroad as a key risk to their business growth. The downside of expanding abroad is that in doing so, the business would expose itself to new risks and volatilities that they are sheltered from today. It is a bit of a conflict of interest for the company as the next step to their dominance is worldwide expansion. They also note that there is a slow adoption rate for their products in international testing regions, but this could be due to many factors; regulation, barriers to entry, competition legislation, and export taxes.

As any growing business, Roku faces many other risks related to supplier forces (see Porter's five laws) in that suppliers exert power over their prices. Suppliers also have capacity constraints, delivery timelines, quality imperfections, delays and interruptions which in our estimate has shown to be a pain point for their player segment.

Roku also faces challenges with regards to their advertising revenue business. The advertising revenues face timing issues with money owed to them often times falling behind the money they owe others. Apparently, this is common in the advertisement business world, and is called ''sequential liability'' i.e. when the agency does not need to pay the business if the ad firm does not pay the agency first. There is a double marginalization issue here to innovate on! These timing dislocations means Roku often has to remit certain payments with equity which exposes their business to the risk of credit losses incurred from the part of the agencies business practices. Here is a workflow of the digital advertising ecosystem with agencies, advertisers, viewers, and payment flows represented:

Conclusion

A lot has been said, but in a few words Roku is a company that needs to fix a couple of things before it can become the Apple of streaming. It is however well on its way and perhaps more so on its platform segment than its player segment. The share price is a bit overvalued in our estimates, but not far from its intrinsic valuation considering the recent increases in cashflows, active accounts, and latest announcements to go international.

Sources:

Capital IQ Market Intelligence

Roku Financial Statements

BoA Global Research

Disclaimer:

Blogposts, newsletters, podcasts and any other content published by FlowBank SA (hereinafter “FlowBank”) reflect the opinions of the authors only and do not reflect the views of Flowbank or any of its subsidiaries or affiliates. These contents are meant for informational purposes only and aim to offer new ideas and perspectives. They are not intended to serve as a recommendation to buy or sell any type of financial instrument, whether that be through a Flowbank account or any other trading account. They are not to be considered as research reports and are not intended to form the basis of any investment decision. Any third-party opinion expressed, and information provided therein do not reflect the views of Flowbank or of any of its subsidiaries or affiliates. We emphasize that all investments involve risk, and past results are not a guarantee of future performance. While diversification does help to lower and spread the risk, it does not ensure a protection against loss. Investing in securities or other financial products always involve a risk of losing money. Prices fluctuate with the market in sometimes unpredictable ways, and investors should be aware that their losses might exceed their initial deposit. Flowbank SA, a FINMA regulated company.