At the time of disruptive business models, “uberization” of the economy and “everything-on-demand”, similar revolutionary capital raising models are being developed within the financial industry. There is one niche within Private Equity which is developing at a very fast pace while staying under the radar of most generalists.

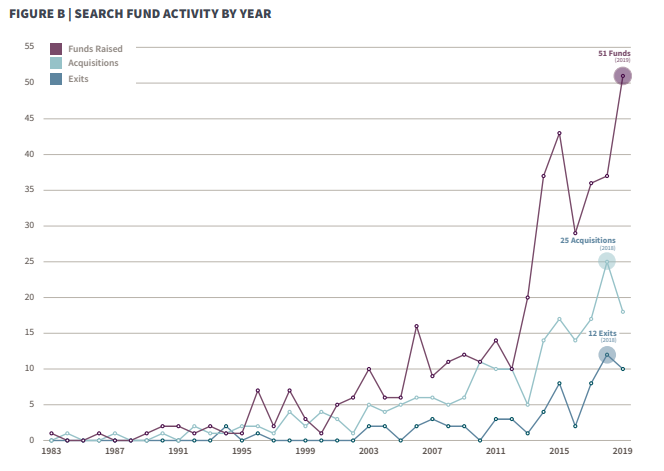

Indeed, an increasing numbers of talented entrepreneurs are raising acquisition capital to buy lower middle-market businesses using Search Funds. There has been a record number of launches and acquisitions in 2018 and 2020, according to a Stanford study.

In 1984, H. Irving Grousbeck, the Director of the Center for Entrepreneurial Studies at the Stanford Graduate School of Business, pioneered a new investment model, commonly termed a “search fund”. The objective of this first Search fund was to provide a vehicle for young, aspiring entrepreneurs to search for, acquire, manage, and grow a company.

Search funds picked up steam in the ’90s and 2000s. After a slowdown in 2016, the number of new searchers expanded again, to reach a record high of 51 new searchers at the end of 2019.

Search Funds have become one of the fastest-growing niches in the alternative asset management space, rising dramatically both in terms of the number of funds in the market and the capital available to back them.

What is a Search Fund?

A search fund is a two-stage investment model used by entrepreneurs to raise funds from investors to search for and eventually acquire a small-size company. As the most popular model in the entrepreneurship through acquisition (ETA) category, search funds attract many young business school students who are interested in both private equity and entrepreneurship.

The main difference between search funds and other investment instruments, such as venture capital or private equity, is that they are created expressly to capitalize on the entrepreneurial and leadership potential of young executives or recent MBA graduates.

Search Funds have carved out a niche in the private equity space – the category is almost exclusively focused on acquiring lower middle-market businesses earning $1M-$3M of EBITDA. The fund searches for a high growth, high-margin businesses, valued at $5-20 million.

Acquisition targets are typically businesses that have an older founder looking to retire, a middle-aged founder looking to turn over the reins, or a warring pair of co-founders that elects to bring in new management.

As “Searchers” have usually no experience as CEO, Search Funds target companies that have straightforward operations, a margin of safety in profitability, and feature few “red-flag” risk factors like high customer concentration or non-recurring revenue.

The lifecycle of a Search Fund

Search Funds typically go through four stages:

Obtaining Capital to Create the Fund

The aim is to raise enough money to pay the entrepreneur’s salary while conducting the search, as well as cover the costs (travel, due diligence, etc.) incurred throughout the process. Typically, the initial search capital can range from around USD 400-600K;

Search and Acquisition

The search for the right company to acquire can take up to 2 years which involve:

- Generating deal flow and screening potential candidates;

- Assessing seller interest and performing due diligence on the target company;

- Negotiating the terms of the acquisition;

- Raising debt and acquisition equity capital.

The entrepreneur identifies a promising target and makes a buyout offer. The decision-making process leading up to the acquisition is guided by variables such as geographic location, industry, earnings before interest, taxes, depreciation, amortization (EBITDA) and other standard business valuation indicators.

In exchange for this up-front equity, the entrepreneur (or “Searcher”) is obligated to give his investors a right of first refusal on any deals. Each investor in the Search Fund has a right to invest his pro rata share of the equity tranche required to close the transaction.

As compensation for this risk, investor initial equity is usually stepped up by 50% - for example, an investor who seeds the Search with $30,000 will get $45,000 of equity in the acquired company independent of his decision to invest further, if and only if the transaction goes through.

Operation and Value Creation

The searchers take over management of the company usually for up to 5-7 years (no fixed time limit). He/she assumes a key operational role in the acquired company, usually as CEO, in which he/she will theoretically remain until an opportunity to exit arises. Typically, the seller watches over the transition of management while acquisition capital investors form and advisory board to the searchers.

Exit

Towards the end of the investment horizon, the company is being sold to realize value created by the management team. The search fund promoter provides investors with a substantial cash return on their investments by selling to a strategic buyer or launching an IPO.

The complete life cycle of these funds is normally upwards of 5-8 years, and thus demands a strong commitment by the entrepreneur.

Growing popularity

Since the Great Recession, increasing numbers of talented MBAs are forgoing careers on Wall Street in favor of paths with greater autonomy, even at the cost of sign on bonuses.

Acquiring a business is attractive to many entrepreneurs who don’t want the risks associated with start-ups and/or have immediate cash flow needs to support young families or student debt.

Most important to the discussion of Search Fund growth, however, is the inexorable aging of the U.S. population. Indeed, equity represents almost 20% of the volume of wealth that needs to be transferred by Baby Boomers. The economy has developed Search Funds as just one of the tools required to handle the biggest intergenerational wealth transfer event ever.

Bandwidth as the biggest constraint

Search Funds are more than just a tool for buying small businesses. They are invested in by a small number of serial investors, and for a good reason.

Searchers, lacking comprehensive CEO and deal sourcing experience, rely on their investor group for mentorship and guidance, many times to great degree.

The time demands on Search Fund investors is so great, in fact, that many view bandwidth, as opposed to capital, as the biggest near-term constraint facing the Category.

Investors are counted on to provide feedback on candidate transactions, assist in due diligence, help negotiate deal terms, and oftentimes serve on the acquired company’s board.

All of this is expected in exchange for the opportunity to invest an amount of money that, by traditional private equity standards, is absurdly low.

Investors in Search Funds will be hard pressed to deploy over $1 million in any one opportunity.

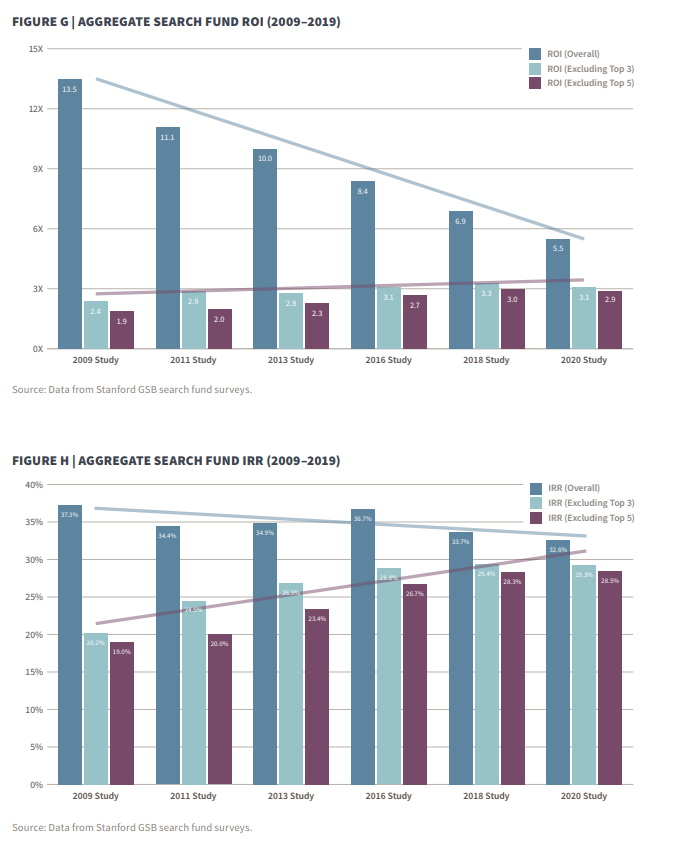

Strong historical performance

A study by the Graduate School of Stanford Business shows that in 2019, Search Funds in the United States and Canada have formed one of the best performing asset classes in terms of returns, producing in aggregate a pre-tax IRR of 32.6% and an aggregate, pre-tax return on invested capital of 5.5x. Note that returns tend to be rising when we exclude the top 5 returning funds.

So why is this tiny little niche of the investment universe performing so well?

The Search Fund category reaps the benefits of being sponsored by academic institutions with a penchant for research. They are extremely well-defined in their terms and syndicated by rule, leading to easy access to data. Another reason for success is that the Search Fund structure creates more opportunities than is enjoyed by other similarly sized investment firms to find solid companies to acquire outside the auction process.

The most credible reason for this success is probably alignment. Searchers must run the company they acquire and run it well if they want to make up for the opportunity cost of having chosen the entrepreneurial path to life. Investors, for their part, must bring more to the table than just a check. Effective feedback and ongoing guidance are required.

Search Funds are likely to stay niche. Among the 40-50 serial investors in Search Funds sit around a dozen fund platforms which is considered to be small. Deploying capital in the category is rather difficult and most of those platforms are managed by Search Funds veterans. There are only a few newcomers and outsiders; this scarcity can be explained by the fact that Search funds are very demanding in terms of manager’s time and energy. While the traditional Private Equity universe favors large investments to improve margins, this cannot be applied to Search Funds investing.

Search funds offer a compelling set of value propositions to investors

The first is access to proprietary investment opportunities. Search Fund principals predominantly source proprietary deals by screening the world for companies that fit the financial criteria of the Model. For LPs often the most dramatic investment gains can be realized through direct co-investment alongside the fund into portfolio companies.

The unique two-stage investment process attending Search Fund affords this option better than other private equity fund investments: first, at the point of acquisition there is an opportunity for co-investment, and second, at future points when the acquired company needs growth capital, there are further opportunities for direct investment.

The second value proposition is diversification at an attainable investment amount.

Most high-net-worth-individuals (HNWI’s) have a private equity portfolio containing one or two “special situations” they were referred by friends or business associates. Most private equity fund portfolios will contain no more than a dozen investments sourced through competitive but expensive processes. In contrast, Search Fund portfolios typically consist of dozens of minority interests in profitable businesses.

Finally, the unique Search Fund model also provides protections against downside risk. First, when a Search Fund investment fails it is usually pre-acquisition, thus mitigating the amount of capital that could have been lost. Second, the investment focus is on already solid, profitable companies: all the Search Managers need to do to return the invested capital (without investment gain) is not actively destroy value.

When executed properly, the Search Fund strategy’s primary risk is not a failure of enterprise, but a failure of growth.