Amidst the semi-conductor shortage, impairing car production and consumers electronics, countries like the US and Germany have written letters to the Taiwanese government, asking for help. What will Taiwan do to face this massive demand?

Key takeaways

- The world is victim of a global semiconductor shortage, as demand for chips increased with consumer electronics and car production.

- The global semiconductor market grew 6.8% in 2020 to $440.4 billion.

- Taiwan’s semiconductor industry specifically will increase by 8.6% to a new high of $125.27 billion.

- Higher than usual exports could increase the Taiwan Dollar value, more than desired.

- TSMC is the world’s largest contract chipmaker. The company accounts for more than 50% of the global contract chipmaking market by itself.

- Capital expenditures of the company were raised to $25 billion for 2021, from $17 billion in 2020.

The semi-conductor shortage

For those of you who may not know, chips (or semiconductors) are the backbone of electronic devices. They power just about everything, from your smartphone and computer to your dishwasher.

This year was special for the consumption of electronics and it may have had a direct impact on the demand for semiconductors. No one could expect the surge in demand for consumers electronics. This "wifi-ing" of everything with the work from home trend has lighted up the need for more Chromebooks, wireless headsets, PlayStations, Apple TV's and cloud computing of everything. This pandemic called for an increasing number of semiconductors.

This shortage first affected the car industry, but today, it is starting to affect the consumer electronics segment as well. Companies like VW, Ford, Porsche and many others had to partially stop part of their production. Now, companies like Apple and Sony are starting to fear for their supply chain.

Manufacturers are fighting hard to augment production capacity and are increasing capital expenditures.

Overall, the global semiconductor market grew 6.8% in 2020 to $440.4 billion. Taiwan represents a quarter of the market, with a semiconductor industry valued at $107.53 billion in 2020.

Taiwan provides, putting its dollar in danger

The country more than doubled its export forecast for the year. Taiwan’s semiconductor industry specifically will increase by 8.6% to a new high of $125.27 billion. While this is generally good for the commercial balance of a country, the risk is that it adds pressure on the local dollar. Worse even, the US could flag the country as a currency manipulator if they try to diminish this effect, much like with what happened with Switzerland a couple months ago.

Taiwanese exports will likely rise 9.58% this year, up from a previous forecast of 4.59% according to the statistics bureau. When it was one of the only countries to register growth, their expected gross domestic product growth was 3.11%, but it is now up to 4.64%.

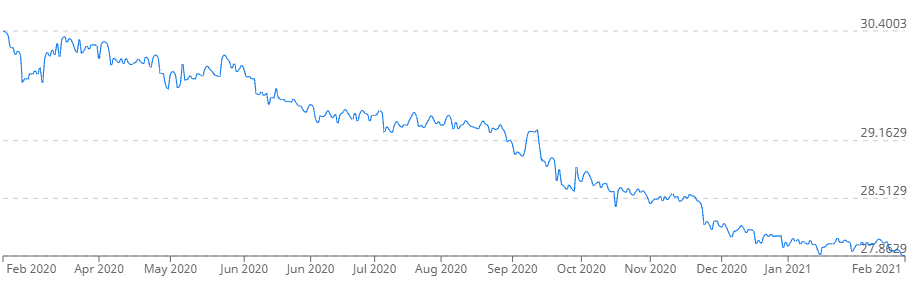

The Taiwan dollar has already seen a 7% appreciation vs. the American dollar in the past 12 months, due to the high demand in chips used for smartphones, cars, artificial intelligence, and other complex computing applications. The central bank worked hard to slow the gains but could not stop the appreciation fully.

The Taiwan Dollar is appreciating against the US Dollar

By and large, the country manages the pandemic better than many countries, with only 9 deaths and fewer than 1,000 cases since March.

The country’s champion: Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company is the world’s largest contract chipmaker. The company accounts for more than 50% of the global contract chipmaking market by itself. They plan to increase their capital expenditure to $28 billion from $25 billion expected this year to address the ongoing shortage, vs. $17 billion in 2020.

According to Bonsai Partners, these expenditures are a key indicator for an important medium-term growth rate, and we should await excellent returns on these massive investments. This is ensured by expansions in the US, a great technology and a rising demand due to the lack of current supply.

Their stock price rose 23% year to date, adding to the 60% jump it experienced throughout 2020. It is now the world’s 10th largest company, with a $577 billion market capitalization.

Stock price of TSMC