Small caps had a great run in 2020. Because the underlying companies are closely knit with their domestic economies, we could expect more of the same going into 2021 assuming we see a steady recovery.

The Russell 2000 and Small Caps

The Russell 2000 is a US index composed of 2,000 small capitalization companies, companies in the bottom two thirds of its bigger brother, the Russell 3000. The Russell 2000 is considered a ‘lighthouse’ of the American economy because it measures the performance of smaller capitalization, domestically focused firms. One may invest in firms found in the Russell 2000 through index futures, mutual funds, and ETFs. The Russell 2000 has risen 28.3% over the past year going above the S&P500 and mid-caps. Since the underlying assets are closely tied to the US economy, some say the euphoria could keep going for small caps as the economy recovers.

Keeping rates low and steadily growing over time and adding a new stimulus package in the United States strongly favors small cap firms because those two actions bolster local spending. Despite potentially higher corporate taxes, a Biden administration with control of the senate could also support the infrastructure sector, and thus improve performance for small caps; 15% of the Russell 2000 is composed industrial companies, and 16% is consumer discretionary. Small caps are interesting from an investment standpoint right now because they are usually better diversified and see tailwinds during recoveries; so far this year, small caps are up 8% on average.

There are many options for investing in small caps through diversified portfolios. We showcase some of the top ETFs that are small cap focused. We will see world-wide small caps, foreign small caps, mutual fund micro-caps, growth small caps, value small caps and blended small caps:

Famous small cap ETFs:

- iShares Russell 2000 ETF by BlackRock is an ETF that has seen a total return of 19.89% in one year, 37.80% in 6 months, and 31.35% in 3 months. If you had invested $10,000 six months ago in late July, you would have $14,648.28 right now (assuming reinvestment of capital gains and dividends).

- Vanguard Small-Cap Growth ETF by Vanguard. This growth small cap ETF showed decent returns; in the 2020, it saw returns of 35.40%, and in the last three months, returns equaled 24.72%. If you had invested $10,000 at the start of 2020, you would have $13,528.66 today.

Small cap growth

- SPDR S&P 600 Small Cap Growth ETF: This fund usually invests at least 80% of its assets in the securities comprised in the S&P small cap 600 growth index. In just one month of 2021, it returned 10.54% after an already strong annual return of 29.86%. It is composed of net assets equal to $2.1 billion and pays roughly one quarter per share quarterly. Its largest weight is in the technology sector with 21.12% of total firms being tech related. Its second largest segment is in industrials at 19.02% and the third is in healthcare at 17.69%. Most of this ETF is based in the United States. Its top holding is Cleveland-Cliffs Inc (CLF), an iron ore mining company, at 1.36% of the entire portfolio.

Small cap value

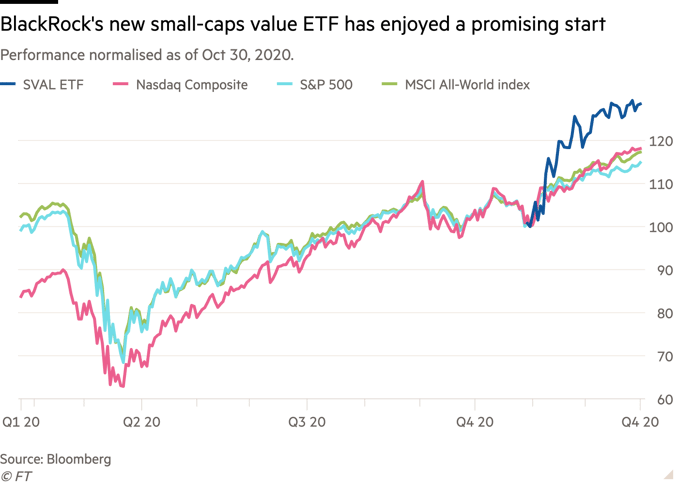

- The most recent and impressive ETF that focuses on small cap value stocks is the recently launched SVAL ETF by BlackRock. When BlackRock launched SVAL in autumn, it came as a bit of a surprise in the investing community. Both value and small cap, and especially the two together, did not belong to the favored club of growth, tech, and large companies that were making a killing. The performance you see below has been attributed by some analysts as SVAL catching a wave at the bottom and benefiting from timing solely. SVAL has however climbed 38% since its launch at the end of October, a decent return.

Mutual fund micro-cap ETF:

- The Dorsey Wright Micro-Cap ETF. In one year, the actively managed fund that invests in ADRs and US firms, saw a 41.14% return. This January alone, it generated an excess 16.83% return to investor and all this with a tiny portfolio of $2.90 million. 6% of the portfolio is focused on non-US firms, in regions like the middle east, the eurozone, Canada, and Asia. Its top holding standing at 3.55% of the portfolio is Celsius Holdings inc (CELH), a firm that engages in developing, marketing, and distributing calorie-burning beverages.

Small cap blend:

- Goldman Sachs ActiveBeta US small cap ETF saw 27.31% annual returns in 2020 with about $271.12 million in net assets. This month alone, they generate 9.96% returns on investment. Its portfolio is well balance between consumer cyclical, financial services, healthcare, industrials, and tech where tech takes the fourth largest position. Its largest position is in Redfin Corp (RDFN) at 0.40% of portfolio. RDFN provides real estate brokerage services by buying and selling homes. They compete aggressively through low listing fees and digital seamless process.

Global small cap:

- The ROBO Global ETF, is one of the highest performing smallish cap global ETF right now with annual returns of 54.68%. This month alone, the ETF could have returned you 11%. This fund is quite large at almost $2 billion in net assets. Half of its portfolio is in technology but considering its name, this is no surprise. The second largest segment is close to 40% in industrials. The fund is heavily invested in Japan, the Eurozone, and Asia. 3% of its portfolio is made up of 3D systems corps (DDD), a company that engages in the provision of three-dimensional printing solutions.

Emerging Markets small cap:

- The WisdomTree Emerging Markets ex-State-Owned Enterprises fund returned 40.54% last year and 10.19% this month. Most of the firms in this portfolio are in emerging Asia (55.2%) and developed Asia (30.4%). Only 4% are firms in Africa and 5.6% in Latin America. The largest holding is Alibaba (BABA), followed by Tencent. Its largest African holding is Naspers, a large South African conglomerate. The fund is large at $3.42 billion in net assets. For an ‘emerging markets’ portfolio it is underweighted in Oil & Gas, industrials, consumer goods, and basic materials and by the look of its top holdings, it could be debated whether or not this ETF honorably holds the EM sticker.

Foreign small cap:

- Our last ETF is the Schwab International small cap ETF. If you are looking for something mainly not in the United States, this will be a refreshing ETF for you, as only 0.4% of holdings reside in the US. However, 18.6% of holdings are in Canada. Otherwise, Japan, the Eurozone, the UK, and Asia are well represented. Its focus is on industrials, where one fifth of the portfolio sits. Its net assets at above $3 billion and its annual return was a small 13.12%. Its largest holding is Open Text Corp (OTEX), an enterprise information management software company.

Sources:

https://finance.yahoo.com/news/red-hot-small-cap-etfs-210909117.html

https://www.ft.com/content/d7053a58-9f48-4887-bc70-337a5f462451