This is a deep dive into Japanese conglomerate Softbank’s ‘Nasdaq whale’ strategy, which appears to be one of the principal causes of the summer 2020 melt-up and subsequent drop in tech stocks.

The first thing to appreciate is that this trading strategy is twofold. The main position was in the stock market in mega cap tech stocks. But the means with which to take profits in the underlying stocks was via the options market.

The Trading Strategy

The investing strategy from Softbank is not complicated. It involved taking a position in the stocks of the largest most popular tech stocks, and then buying individual stock call options on those same investments. Buying options has become very popular with YouTubers like @biaheza giving it a go and showing his hundreds of thousands of viewers!

The Japanese conglomerate bought $4 billion-worth of options premiums, which implies a notional exposure in the actual stocks of around $30 billion (leverage of around 7.5x). Hedging might have meant it was smaller than this but nonetheless it is a huge market-moving position.

The trades were focused on the biggest and most popular US tech stocks for options trading including AMZN, TSLA, AAPL, NFLX and FB - as well as MSFT, GOOGL, BABA, NVDA and SHOP.

Buying call options as well as the stocks would not result in profits for a typical investor. The options are just leveraging the original position, meaning they will not affect whether the trade is a win or a loss but will just affect the size of the win or loss.

For Softbank and the reported architect of this strategy former Deutsche Bank executive Akshay Naheta to make it a success, it required a deep understanding of market structure and how other market participants would respond in the current market conditions.

6 Reasons for a $4 billion profit

According to the Financial Times, Softbank is sitting on an unrealised profit of about $4 billion. We note six key underpinnings that has made the strategy successful (so far).

1. High retail options market activity

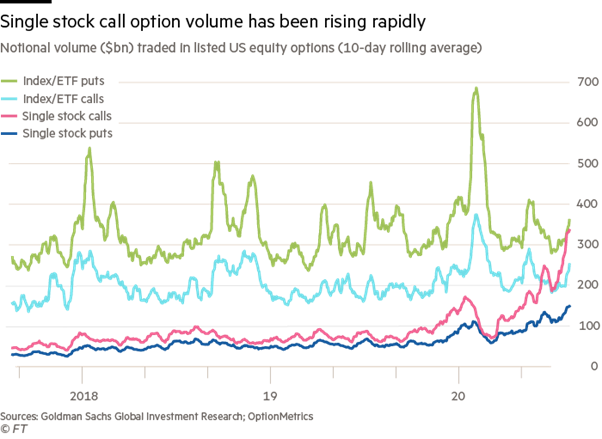

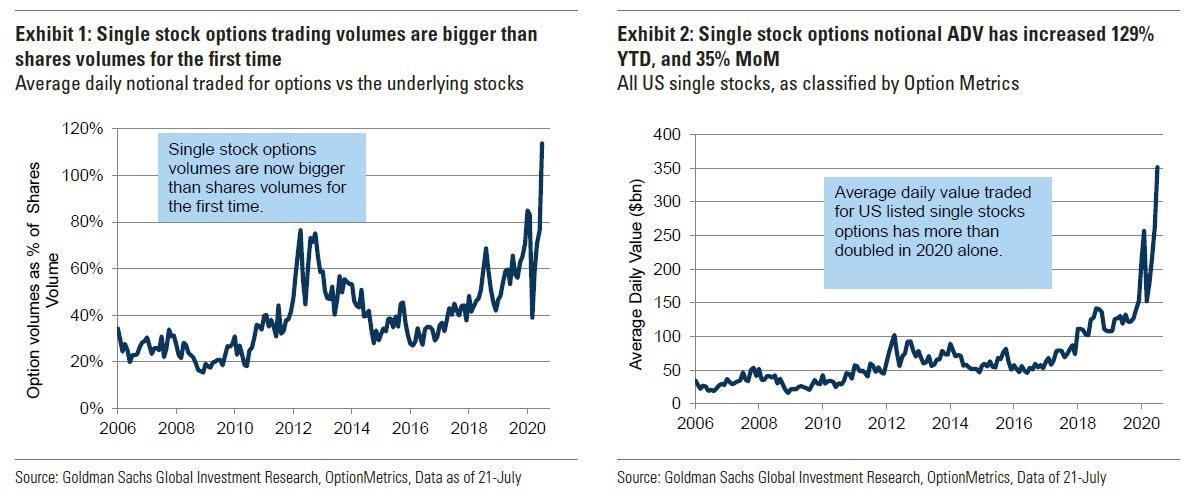

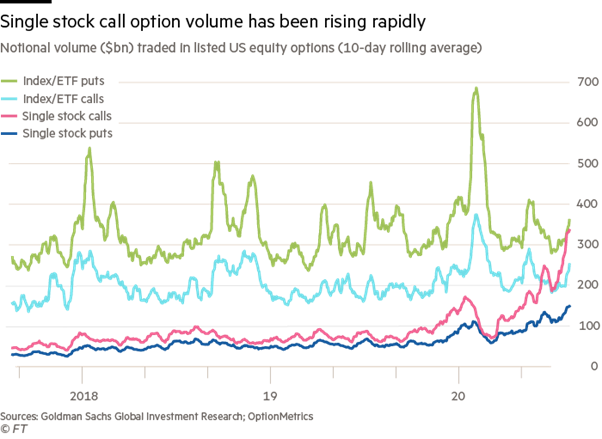

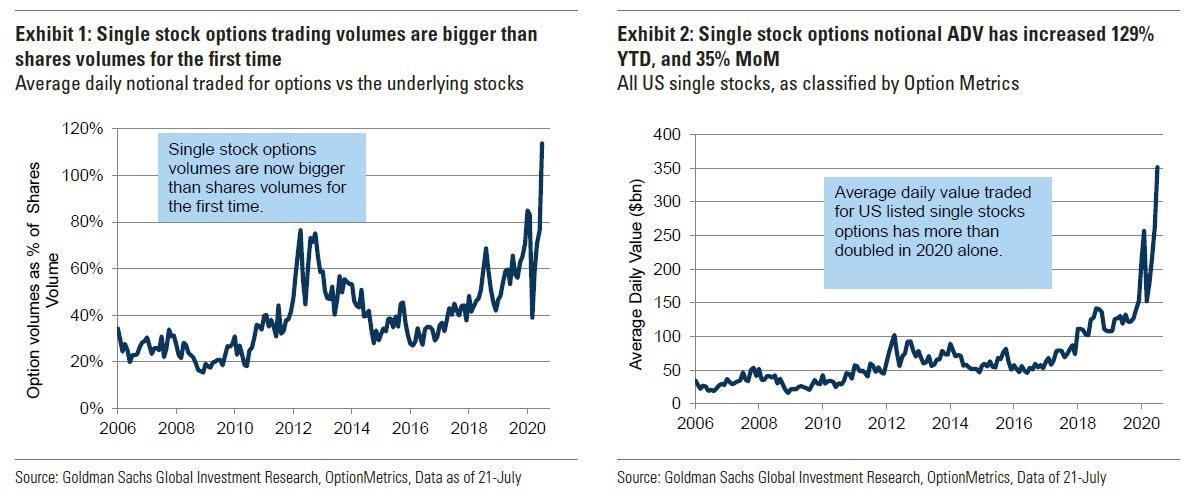

Retail or individual investors have been getting increasingly active in stock options trading. Individuals currently account for 30% of options trading volume in popular tech stocks like Google and Shopify and the volume for single stock options with less than 2 weeks to maturity now comprises 75% of total option volume, according to Goldman Sachs.

More specifically, the growth in call options trading (positioning for a rise in prices) has been more than twice as high as the growth in put options trading (positioning for falling prices). This was also demonstrated by a big drop in volatility skew, which helps show whether fund managers prefer to write calls or puts.

Additionally, implied volatility was rising at the same time as price, when typically the opposite relationship is observed because prices tend to be more volatile when investors are selling because its driven by fear. The VIX index, which shows the implied volatility of the S&P 500 had risen to its highest relative to the price of the index since the day the dotcom bubble burst.

[Definition] Implied volatility is the market's forecast of a likely movement in a security's price. It is used to price options contracts: the higher the implied volatility, the higher the premium.

To conclude, option contracts were essentially being used as a leveraged instrument to buy into the short-term upwards momentum in tech stocks.

2. Very narrow breadth in US stock indices

Investors have been betting in the outperformance of a smaller and smaller group of stocks as a proportion of the wider market. Measures like the advance/decline index, percentage of companies above their 50-day moving average and the relative market cap of the top five stocks in the S&P 500 have all pointed to narrowing breath.

The result is that the performance of these stocks has had an overly large impact on the direction of stock markets to the extent that the S&P 500 would essentially only rise on days when Apple shares were up and fall when Apple shares dropped.

This means that when Softbank bid up these huge tech stocks, it pulled ETFs, hedge funds, pension funds and the rest of the S&P 500 and Nasdaq indices along with them, adding to the bullish euphoria.

3. Individual stock options easier to corner

Softbank focused on individual stock options, which are much smaller markets than options in stock indices. Portfolio managers typically use index options to hedge their portfolio of stocks rather than buying an option for each specific position because its cheaper and similarly effective if they have a balance portfolio.

Total volumes traded in individual stock options has reached the highest ever in the past two weeks according to Goldman Sachs.

Naturally, markets are a function of supply and demand. The huge $4 billion extra demand for call options pushed up the price of the call options in of itself. Then in today’s modern markets and in the current pandemic-FOMO market conditions, this huge demand created a feedback loop of extra demand.

4. Zero commissions & HFT front-running

As retail investors saw the price of call options moving higher because of Softbank’s buying, they piggy-backed onto the higher prices by buying more call options-hoping to either sell their premiums at higher prices or exercise the option.

Retail stockbrokers now offer commission-free stock trading. Without the commissions, these companies instead make money by being paid for ‘order flow’ by large trading companies. These large trading companies reportedly use High-Frequency Trading (HFT) to place trades ahead of the orders coming from the retail brokerages to frontrun the profits. The HFT adds a 3rd layer of buyers on top of the original call-buying from Softbank.

5. Dealers in summer trading conditions

There is a 4th layer too, added by dealers at large sell-side institutions, typically the big multinational money-centre banks. Because trading conditions were light during summer, dealers were not able to offset as many of the trades as normal.

[Definition] Dealers (or flow traders) are buying and selling shares to investors, hoping to make the spread while minimising their own exposure to market swings while doing so.

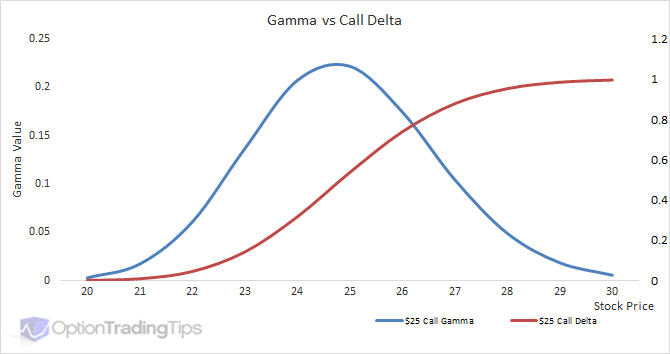

The huge call option buying had left dealers both very short the mega-cap tech stocks which were all ripping higher- and very short gamma. I.e. selling the call options to Softbank made the dealers short the calls and the resulting higher gamma.

[Definition] Delta is the ratio that compares the change in the price of an asset to the corresponding change in the price of its option. E.g. if a stock moves by $1 and option on that stock has a delta of 0.8, then the option should move by 80c.

[Definition] Gamma is the rate of change for an option’s delta (above) based on a single-point move in the delta’s price. You can say gamma is the first derivative of delta and the second derivative or the stock price.

Putting the two ideas together, you can say the delta of an option is equivalent to its speed and gamma is its acceleration.

To stop this big exposure, dealers needed to either take on the risk in-house by holding large losing positions in skyrocketing tech stocks- or hedge their short positions in the open market by buying the underlying tech stocks. By buying the individual shares the dealers were going long, leaving them with two offsetting positions and a net neutral position.

But of course as some or perhaps most of the dealers managed their own risk by buying the underlying shares, the price of the underlying stocks went up even more.

6. Social distancing and FOMO

By this time, retail traders who had previously bought call options were sitting on large profits and likely telling their friends and co-workers (all of whom were bored in their homes in lockdown or social distancing) how big their profits were.

The fear-of-missing out (FOMO) effect will have led to more options buying to ride the price momentum even higher.

Then the whole feedback loop starts all over-again creating a self-perpetuating melt-up in the stock price, completely independent of any fundamental change in the value of the company because of earnings or new product development and growth prospects etc.