Unity software made a raging debut on the New York Stock Exchange with a rise of 44% on its stock price.

Who is Unity?

Unity is a software company that creates the software used for the development of video games. Their goal is to democratize gaming development and make it more accessible to users. Their platform is coded in C++ and C# - for the techy nerds reading this article – and offers many functionalities meant to make development easier, such as drag and drop features. The app permits 2D and 3D development as well as immersive virtual reality (VR) and augmented reality (AR). Games you might know that were developed through the platform are Pokémon Go, Call of Duty and Trinity.

The company was founded in a basement in Copenhagen in 2004. 16 years later, they have helped develop 50% of all mobile, pc and gaming console games in the world. Today, Unity is involved in 60% of augmented reality and virtual reality content, as well as 90% of the emerging augmented reality platforms. They were first available exclusively on the MacOS Appstore, but they are now present on over 25 platforms, including iOS, Android, Tizen, Windows, Mac, Linux, PlayStation 4, Xbox 1, 3DS, Oculus Rift, Fire OS, Magic Leap and so on. They have over 1.5 million monthly active creators.

The company provides tools for 53% of the top 1000 mobile game companies and to 94% of the largest studios per revenue. They sell their software through a subscription plan which ranges from $399 to $2’400 depending on the size of the company using it. Needless to say, they have a very solid grasp on the market.

About the IPO

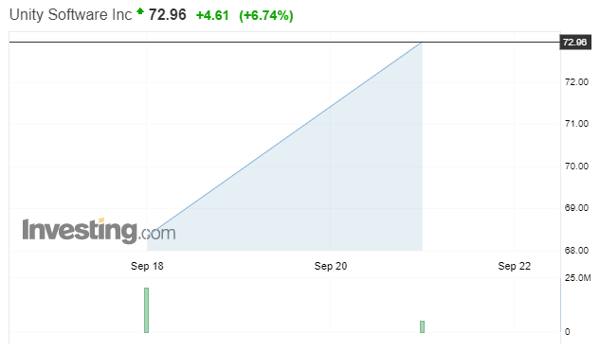

This was yet another successful IPO in the tech industry. The stock price was initially set to be at $52 per share. It reached $75 dollars when the market opened and fell back to $68.35, which still gives it a solid 31% growth. The IPO was underwritten by banks Goldman Sachs and Crédit Suisse.

Growth-orientated software equity is highly in demand and Unity is no exception. With revenue growth at over 40%, gross margins between 70% and 80% and diminishing losses, it offers all the promises an investor wants to hear, aside from the fact that it is not yet profitable.

Unity stock at closing price 21.09 (Source: Investing.com)

The company had raised $125 million in mid-2019 and was then valued at around $6 billion. In the same year, it cashed in a net loss of $163 million, and continued by loosing $54 million in the first half of 2020, less than last year. “We have showed improvement in our profitability over the last few years. We see longer term that his can be a very high gross margin and profitable business,” says Kim Jabal, the company’s CFO. Indeed, once the development is made, every additional software unit can be sold at no cost, unlike physical products.

At the end of its first day on Wall Street, the company reached a valuation of $18 billion, 3 times as much as less than 2 years ago. It is joining the successes of Snowflake and JFrog, the first of which was the biggest software IPO ever and the second who’s shares took 50% on its first day on the market.

More than just a gaming development platform

But Unity is not only a game engine proprietor and is looking to the future for development. It also has a strong interest in the development, powering and innovation of 3D, VR and AR content creation – as mentioned, they have 60% market share in AR and VR.

The Fortune 500 companies are globally more aware of the growing importance of these technologies and customers come from different areas such as automotive, architecture, engineering, manufacturing as well as the film and TV industry.

The company is also the leader in the future of digital twin: the copying of our world into VR. The new aisle of the Hong Kong airport already has its twin on a VR software. This could help architects to design and have a better grasp of volumes and renderings.

“We believe all the digital creators around the world will at some point need our real-time 3D technology,” said Clive Downie, the company's CMO.

Competitors?

One of their main competitor is Epic Games, but they are now in a fight with Apple about Fortnite – Epic Games wanted to charge players in-game fees in order to bypass Apple’s store, and of course, Apple was not happy. Some analysts say that this could make Unity more attractive to investors.

The other kind of competitor Unity could face are “first-party technologies”, companies that build in-house tools and other companies moving in the AAA space (AAA is an informal classification for video games developed by major publisher with important financial and development means.

In any case, it will be interesting to see how the stock moves in the next months and how the company can leverage its advance in technologies such as AR and VR. Many things are to coming in this new space, things that might change the way we work and live.

Sources:

https://www.morningbrew.com/emerging-tech/latest

https://www.pcgamesinsider.biz/news/71533/unity-hits-18bn-market-cap-following-ipo/

https://en.wikipedia.org/wiki/Unity_(game_engine)

Read our next article: Why did silver just crash 11% in a day?