Square is doing extremely well this year, with revenues beating expectations and an adoption rate which could be the source of envy. What is the business model of this company and why may it be undervalued?

What is Square?

Square is an American financial services and payment company based in San Francisco, California. Founded in 2009, with the launch of the first app in 2010, the company provides software and hardware solutions for medium and small businesses to accept all kinds of payments. This was their idea: in a world where the means of payment multiply, no small business should be left aside.

Their goal was to provide a solution fit for everyone, a way for smaller businesses to accept all types of payments without having to break the bank, breaching the barriers of cost and complexity. Their app and services take care of the sales system, the creation of digital receipts, the inventory and of the sales reports and analytics.

Square's adaptor to pay through a simple smartphone (Source: Square's website)

The value proposition in 5 arguments

- The ability for shops to accept more payment methods

Whether it is a bookshop, a flower shop or a café, clients want to pay with an increasing number of payment methods. They simply have the choice, and they all have specific preferences. Square offers a solution for small businesses to accept all types of payment, from credit cards to Apple and Android payments, all the way to Bitcoins. There is even the possibility to generate an invoice to be paid later. Finally, the merchant has the choice between getting the money instantly transferred to his account in exchange for a small fee, or the following business day for free.

- Getting paid everywhere

Square is a solution that can adapt to any environment. Payments can be made through your website, shop’s computer or even smartphone, they provide a solution for it all. There is even an offline payment solution if the network is down – we have all been there with the shop owner raising the card machine up in the air.

- Save not only time, but also money

Getting a credit card subscription can be rather expensive for small businesses, and they are often stuck in over expensive long-term contracts. Square offers very transparent and flat fees. Forget about any surprise costs, the rule is the same for everyone: 2.6% + $0.10 per swipe. It’s that easy.

- Increased protection for the shops and their customers

Data security is one of the most discussed topics in our times, so no mistakes are allowed anymore. Square focuses on providing the highest security possible. Oh and, in the case of a payment dispute, the shop owner does not even have to bother: Square takes care of the talks with banks.

- Increased growth for businesses

Aside from the fact that business owners can accept more forms of payments, which naturally means more sales, Square also offers analytics solutions to give small businesses fresh insights about the state of their commerce. They also have partnerships with multiple delivery services such as Postmates or Doordash. They even offer support with building online stores, automatically syncing with the shop’s inventory.

Square functionalities on the app for businesses (Source: Square's website)

Cash App: The motor of success

Although the previously mentioned solutions work well and see an important adoption rate, the cash cow is Cash App. A payment solution developed by Square as an extra feature, it quickly became one of the pillars of the business. Cash App allows easier transfers of money via smartphones (for Swiss readers, the offer is similar to TWINT). In 2015, they also opened the service to shops, which meant that consumers could pay in the same way that they could transfer money to friends, using a unique $cashtag.

The service also comes with a stylish, black cash card, which is a Visa debit card allowing the withdrawal of money at any ATM. Clients can also transfer the money from their Cash App to any bank they like. Everything flows and is made easy.

It is indeed quite rare that a company’s specific feature becomes the core of its business, but it does happen (think of Amazon Web Services – do you think that Amazon still makes money selling books?).

About the stock and its valuation

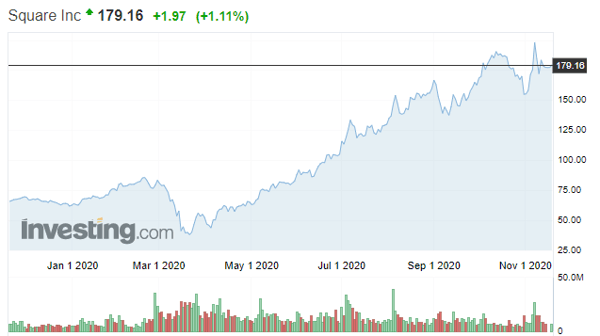

With a market capitalization of $81 billion, Square Inc (NYSE:SQ) is already quite a giant. The stock is currently sitting at $179.16, a 172% increase compared to a year ago. While this may seem high already, some analysts suggest that the stock may be grossly undervalued. KeyBank analyst Josh Beck argues that investors are underestimating the value of Square’s mobile payment service app Cash App. So much so that he even readjusted his price forecast of the stock from $215 to $250, suggesting an undervaluation of almost 40%.

Square's stock over the last year (Source: Investing.com)

Beck argues that a product like Cash App will continue boosting the company’s retention rate and that the long-term value of each customer will keep increasing as the average revenue per customer is increasing. Beck suggest that Cash App’s revenues growing 70% by 2020 could already justify a $200 valuation, but he also argues that the growth rate for the business as a whole could pick up the same pace and go touch the $300.

Very positive 3rd quarter results

Square is one of the fastest growing payment company in the US, and its third quarter shows it well. Revenues climbed 140% year over year, reaching a whooping $3 billion. Quite an impressive number when we know that Wall Street was only expecting $2 billion. The gross profit was of $794 million, a 59% increase year over year. The gross payment volume is up totaling $31.7 billion, vs. $28.2 billion in the same quarter last year. Earnings per share went up from $0.06 to $0.07 and are expected to climb 52% next year.

All in all, a very interesting company to keep an eye on, especially as we are now gradually abandoning cash, both for practical and hygiene reasons.

Sources:

Square, Inc., in Wikipedia

CEO Dorsey Says Square Will Accept Bitcoin, in Bank Innovation

Cash App, in Wikipedia

5 Reasons You Should be Using Square Payments, in Entrepreneur

Square Stock Will Soar 40% to $250, According to This Analyst, in the Motley Fool

4 Tech Stocks That Should Continue to Soar into 2021, in Stock News

Square Earnings: Online Transactions, Square Card Spend See Gains, in PYMNTS

Square vs. Paypal: Which Stock is a Better Buy?, in Stock News

Square stock soars after earnings ‘beat by a mile,’ analysts applaud growth in Cash App, in CNBC

Read our next article: What is Bitcoin?