Over the past years, tens of billions of new investment dollars have flowed into the ESG (Environmental, Social, Governance) and sustainable space.

Interestingly, the vast majority of equity ESG and sustainable investments ETFs today have some exposure to fossil fuel users and producers, even if those funds have carbon-emissions-related screens in place (source: www.etf.com). In this blog, we look at a tool which helps you to invest into the “cleanest” sustainable funds and ETFs.

Finding Fossil-Fuel-Free Funds

The website https://fossilfreefunds.org/ offers investors a free tool which allows them to search thousands of mutual funds and ETFs for “dirty energy” companies. Fossil Free Funds also offers screens for involvement in deforestation, civilian and military weapons, tobacco and gender equality initiatives.

Fossil Free Funds designates stocks as "fossil fuel companies" using Morningstar industry classifications and third-party proprietary research on emissions output, fossil fuel reserves, business activity and more. Flagged stocks include coal miners, oil/gas producers and refiners, oilfield services companies, fossil-fuel-fired utilities, and more.

The database can flag if the funds are member of The Forum for Sustainable and Responsible Investment (USSIF) and if they are part of the Sustainability mandate as classified by Morning Star.

A “Fossil Fuel Grade” is also assigned to each fund with A being the best and F the worst. An “A” grade is assigned for fossil fuel exposure of 0%. The funds can also earn “badges” (up to 5) for avoiding stock investments in different fossil fuel sectors.

The database also provides for each fund a relative carbon footprint which is based on the tonnes CO2 per $1 million invested. It then tells if it is high or low compared to benchmarks. The relative carbon intensity is calculated based on tonnes CO2 per $1 million of revenue.

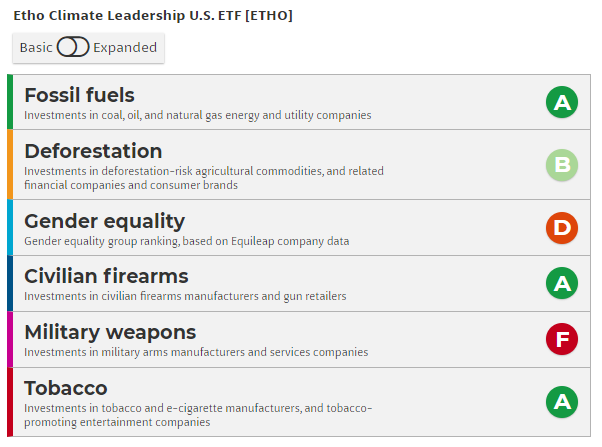

Last but not least, a Sustainability report card is provided for each fund. It includes a rating on Fossil Fuels, Deforestation, Gender equality, Civilian firearms, Military weapons and Tobacco – see below such a scorecard for the Etho Climate Leadership fund.

The ‘Clean list’

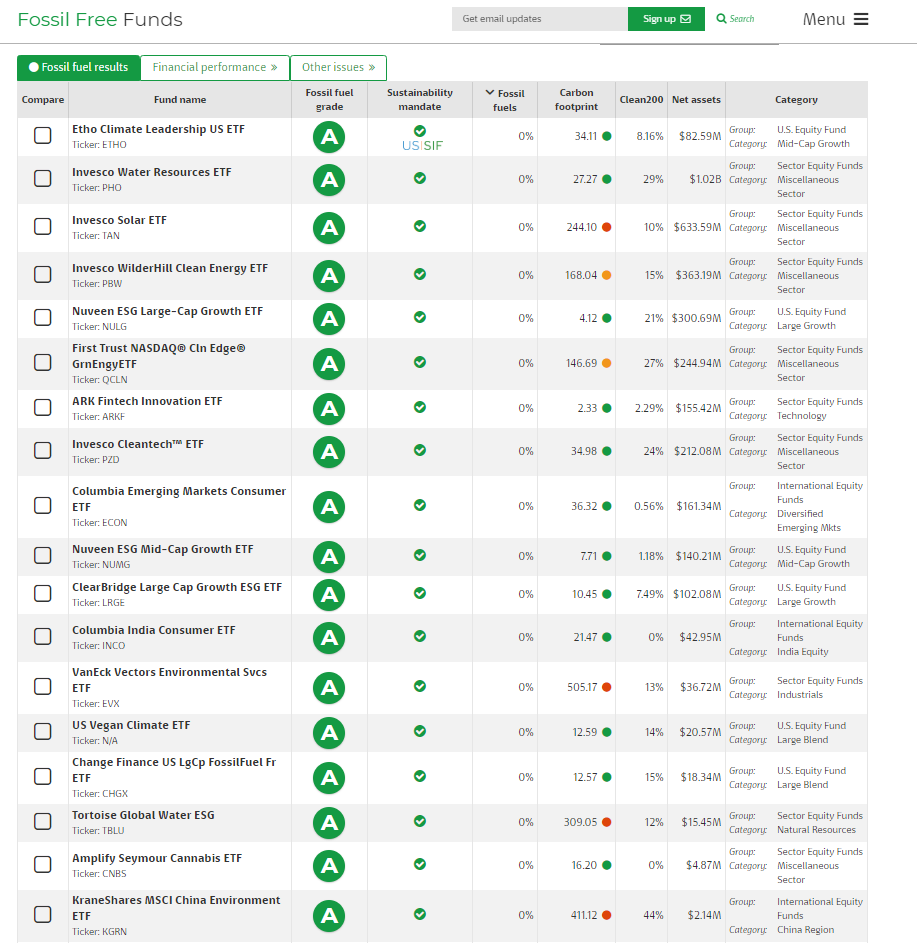

Out of the 38 ESG ETFs screened for greenhouse gas emissions and/or company involvement in the fossil fuel industry, 18 ETFs were completely free from fossil-fuel-related activity.

The "clean list" is provided are listed in the table below:

Investors and fund selectors can also apply other filters and work on an exclusion basis. Historical performance and length of the track-record can also be part of the selection process.

Read our next article: Weekly Market recap: 10 stories to remember