S&P Global, the Data giant, agreed to buy IHS Markit in an all-stock deal, a London-based data company for the decent amount of $44 billion.

IHS Markit

Alright yes, we must say that they probably have the worst name in the company name history. An acronym followed by a misspelled word, what a shot.

The company became IHS Markit in 2016 when IHS bought Markit for around $13 billion, combining IHS's expertise on automotive and technology industry and Markit's expertise in derivative pricing.

They have a market value of around $36.88 billion with a share price increase of 22% this year, according to Reuters.

S&P Global

Back in the days, S&P Global Inc. used to be a firm that provided bond ratings and railroad data. Today, it is one of the biggest financial info resources, in the likes of Bloomberg or Reuters. It is one of the leading providers of credit ratings, analytics and indexes used to assess the financial markets.

It is the parent company of S&P Global Ratings, S&P Global Market Intelligence, S&P Global Platts and the majority owner of the S&P Dow Jones Indices. Needless to say, they have a pretty good grasp on the financial information market.

They’re the one of the bibles of financial intelligence, which they provide to analysts and fund managers alike. They are also the main provider of benchmark prices for commodities.

Data companies and market

These companies trace it all, from the price of stocks, bonds, derivatives, commodities, futures and CFDs, to the movements of ships and cargo airplane sailing and flying around the world. Basically, any data you see (in every articles and financial reports) is coming from companies such as HIS Markit and S&P Global.

The global spending on market data has grown 6% over the last year to $32 billion, as financiers are always looking for more data and the possibility to get an edge that comes with it, especially with our fast-paced computerized market.

“Data is the lifeblood of markets,” said Roman Ginis, chief executive officer of Imperative Execution, an equities-trading venue. “Diversifying into data makes a lot of sense, and the more people need this data, the more you can charge for it.”

The acquisition

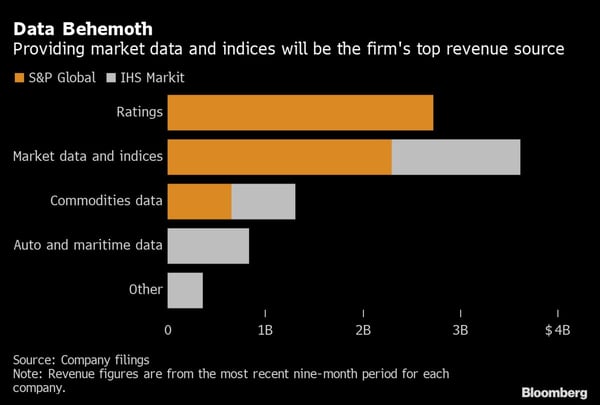

The acquisition makes sense: S&P Global is eliminating a competitor and keeps on creating a massive financial information power. The transaction would bring together Wall Street's biggest financial data providers.

S&P has a strong expertise in ratings and indexes, but the purchase of IHS Markit could give them a stronger edge in the world of derivatives such as Credit Default Swaps (CDS) and Collateralized debt obligations (CDOs). Being already strong in the pricing of raw and refined materials, an access to IHS Markit's maritime products such as ship tracking, trade flows and port data will be a valuable addition.

Overview of the combined capabilities (Source: Bloomberg)

“With IHS Markit, they’ve got benchmarks and data on battery metals, hydrogen, wind, solar, biofuels, as well as information that’s coming out of every single car in the United States,” said Doug Peterson, S&P Global’s CEO in a Bloomberg Television interview. “That is a real exciting growth area.”

Nevertheless, the deal has yet to be approved by regulators, who might see so much information power as too much for one entity to control. However, Bloomberg Intelligence analyst Larry Tabb said he does not see significant antitrust risk in the S&P deal. The primary competitive overlap between the companies’ businesses is in energy research and data, but otherwise they have different specialties, he said.

The deal should close in the second half of 2021 if it does not run into any unexpected obstacles. S&P Global shareholders will own roughly 67.75% of the combined company and the rest will be held by IHS shareholders.

"Through this exciting combination, we are able to better serve our markets and customers by creating new value and insights," said Mr. Peterson. "This merger increases scale while rounding out our combined capabilities, and accelerates and amplifies our ability to deliver customers the essential intelligence needed to make decisions with conviction. We are confident that the strengths of S&P Global and IHS Markit will enable meaningful growth and create attractive value for all stakeholders. We have been impressed by the IHS Markit team and look forward to welcoming the talented IHS Markit employees to S&P Global."

"This transaction is a win for both IHS Markit and S&P Global as we leverage our respective strengths in information, data science, research and benchmarks," said Mr. Uggla, IHS Markit’s CEO. "Our highly complementary products will deliver a broader set of offerings across multiple verticals for the benefit of our customers, employees and shareholders. Our cultures are well aligned, and the combined company will provide greater career opportunities for employees. We look forward to bringing together our teams to realize the potential of this combination."

A profitable move

Following the news, S&P shares rose 3% and IHS shares rose over 7%.

The combined company expects to deliver annual run-rate cost synergies of $480 million, with $390 million of those expected by the end of the second-year post-closing. This means, as in many mergers and acquisitions, job losses.

This will lead to generate a cash flows of over $5 billion by 2023 with a targeted dividends payout ratio between 20% and 30%. The earnings of the combined company would be dispatched in many industry segments and provide a certain financial flexibility to create new business opportunities. They expect a 6.5%-8% organic revenue growth in 2022 and 2023.

The takeaway

Data can offer a competitive advantage, especially if it is well treated, complete, and arrives on time. As we always say, "knowledge is power", but on Wall Street, knowledge is money. The fact that a company would pay so much for another illustrates the importance of data for financial markets. The S&P stock is ultra-high because people are well aware that investors are ready to pay a lot to get the latest data and market insights.

Such acquisition will not fail to put pressure on other competitors like Bloomberg, ICE, FactSet or Moody's to only name a few, who might be looking to enter such deals to stay competitive and create synergies.

Sources :

S&P Global’s $39 Billion Deal Shows Market Data’s Dominance, in Bloomberg Quint

This $44B acquisition is the biggest of 2020 — it's all about the market data, in Robinhood Snacks

UPDATE: S&P Global merging with IHS Markit in all-stock deal, in S&P Global Intelligence

S&P Global announces $44 billion purchase of IHS Markit, in CNN Business

The business of information: IHS and Markit agree $13 billion merger, in CNN Business

S&P Global and IHS Markit to Merge in All-Stock Transaction Valuing IHS Markit at $44 Billion, Powering the Markets of the Future, in PR Newswire