A recent report published by Art Basel and UBS showed that art gallery sales fell 36% on average in the first half of 2020. In general, smaller galleries were hurt the most, while online selling platforms take on a growing importance.

The survey was conducted by Clare McAndrew – founder of Arts Economics – and examines data from a pool of 795 contemporary and modern art specialists. The median decline of sales, higher than the average, reached 43%. The report does not cover auctions, but another report showed that leading auction houses – Sotheby’s, Christie's and Bonhams – reported a 49% decline in the first half of the year.

The art market mainly depends on close relationships, in-person contact and travel, and therefore, the industry is suffering from a pandemic requiring complete lockdowns. In general, almost all galleries had to close for an average of 10 weeks during the first half of the year.

Sales

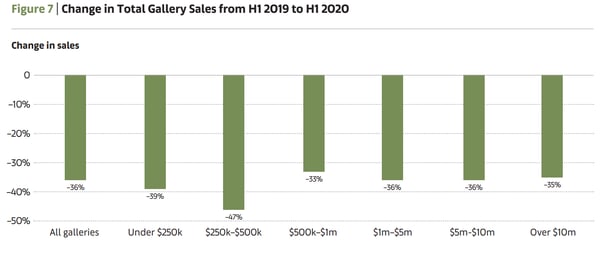

As previously mentioned, sales dropped 36% in comparison to the first 6 months of 2019, with a median decline of 43%. In general, it is the small galleries – with a turnover of $500’000 or less – which reported the greatest losses, as you might see in the graph below:

Source: Art Economics (2020)

Interestingly, most galleries expect even lower sales in the coming quarters. Only 21% expect better numbers for the second part of 2020, and no more than 45% estimate that sales will go up next year. As you can see, the majority is more inclined towards pessimism.

Online sales

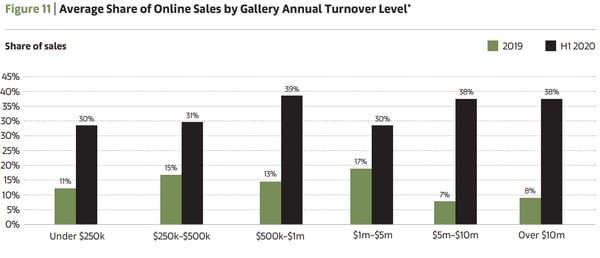

If the future of physical sales is looking grim, online sales are here to lighten up the mood. If it already grew in importance last year with a 10% increase, the first half of 2020 saw a 37% increase. Important galleries with a $10 million+ turnover rate had the smallest increase in 2019, but experience a booming growth of 38% in 2020.

Source: Art Economics (2020)

In addition – and this might even be the most interesting detail – galleries reported that among those online buyers, 26% of them had never had any personal contact with the gallery before purchasing. A very interesting fact indeed when you know the importance of personal contact in the business. Unsurprisingly, it is smaller galleries who experienced the greatest growth in online sales, with 35% of total online sales being attributed to galleries with a turnover of less than $250’000. It's not hard to imagine that one might take bigger risks for a smaller investment.

We must still note that even if online sales are rising, 70% of collectors reported that they preferred seeing a work of art in real life. In the end, nothing replaces the direct contact with an artwork.

Art fairs

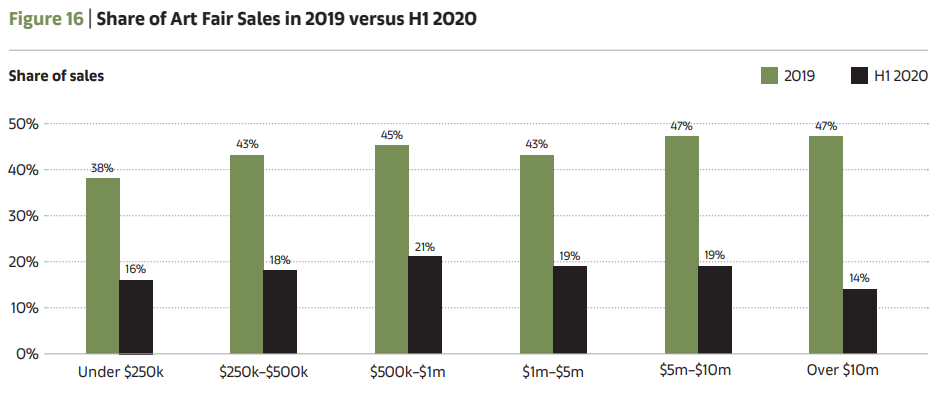

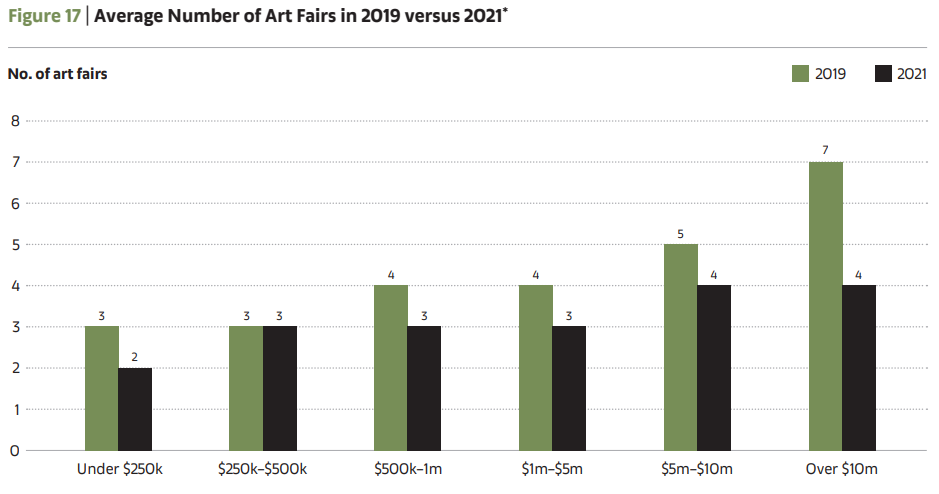

As you might know, art fairs are a very important sales channel for galleries. It is the place and event where they showcase their trendiest artists and benefit from extra exposure. Hundreds of galleries all gather in the same place, attracting thousands of buyers over the course of a few days. If in 2019, galleries had made 46% of their sales in art fairs, this number went down to 16% in 2020. The near future of art fairs does not look bright either: 91% of galleries predicted that art fair sales will not go up this year, and only a third of them think that it might get better next year.

Source: Art Economics (2020)

Source: Art Economics (2020)

One thing we should note, though, is that art fairs are also the highest cost unit for galleries, totalling 29% of their yearly expenses – even higher than payroll or rent. The cancellation of these events lowered sales, but the costs that accompanied them also went down drastically, which compensated for the lack of sales for some sellers.

High Net Worth Collectors (HNWC)

Although it is true that Covid-19 distracted many collectors from their collections, most stayed active, with 92% of them reporting buying a piece of art in the first 6 months of the year. A majority had spent more than $100’000 and 16% spent over $1 million. It is interesting to note that most worked with galleries they knew, with only 16% looking to buy from new galleries. Once again, it seems more difficult to engage in important investments through a screen.

Despite heavy restrictions on travel and events, 82% of collectors were still actively planning to attend exhibitions in the next year, most of them willing to travel overseas. Last remark: 59% of them reported that the pandemic had even increased their interest in art.

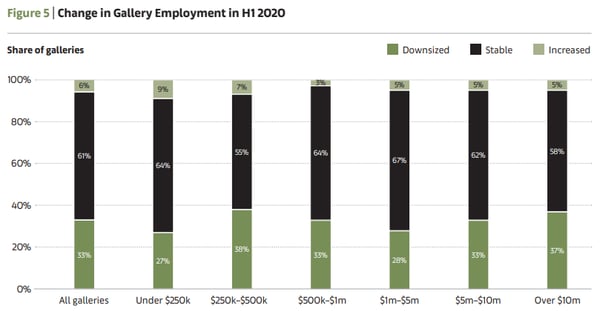

Employment

Employment in the art market was also cruelly affected by the pandemic. Although galleries generally have few employees, they still had to downsize, as many had to diminish their activities or close altogether. A third of all galleries reported having no choice but to downsize. Smaller galleries had to lay off the most people, with an average of 38% in downsizing. Galleries who where forced to let people go lost an average of 4 employees, with half of them being full-time employees.

Source: Art Economics (2020)

Closing remarks

Although the art market is not doing amazingly well, there are still some bright spots in these troubled times. As Noah Horowitz – Director of Americas for Art Basel – says “Crisis yield some of the best art we’ve seen”. Troubled periods are often the starting point for great art. In a struggling market, innovation is to be expected, and we should trust both artists and gallerists to come up with disruptive elements.

Paul Donovan – Global Wealth Management Chief Economist at UBS – is also optimistic. He ensures that even if the economy is not doing well, many people did save a lot of money during the lockdown, especially high net worth individuals. Many stores have reported new records in sales when they reopened. Let us say you did not get a haircut in 4 months. When you get out, you get one haircut, not four. So you still have the money from the other 3 haircuts in your pocket, and you want to spend it.

Also, Sotheby’s recently showed that some new innovations have a huge payoff. For example, they reported having sold $2.5 billion only in July through their live-auctions. This, in addition to their new “buy-now” marketplace, helped them to generate $285 million in online revenue this year, in addition to their $757 million from their so-called “private sales”.

In any case, if you would like to learn more about this, I strongly suggest you have a look at McAndrew’s report, available for free on Art Basel’s website. Concise and well-designed, it is worth a read.

Sources:

McAndrew, Clare (2020) The Impact of Covid-19 on the Gallery Sector, a 2020 mid-year survey. https://d2u3kfwd92fzu7.cloudfront.net/The_Art_Market_Mid_Year_Survey_2020-1.pdf

https://www.ft.com/content/ff6530b4-1c40-497c-bd23-c5a70e552401

https://www.finews.asia/high-end/32699-fine-art-ubs-art-basel-corona-sothebys

https://www.artbasel.com/stories/the-impact-of-covid-19-on-the-art-market

Read our next article: Meet the team behind FlowBank