The US dollar has been on a surge in recent times, and this has raised concerns in the financial markets about the implications for global economic growth and the performance of other currencies, such as the euro and the Japanese yen. Let’s dive in and explore the reasons behind the recent dollar's surge, its outlook and its implications for the stock market.

Reasons behind the recent dollar's surge:

The dollar index has been gaining ground since last week as strong economic data are raising prospects that the Federal Reserve may have to continue raising interest rates to curb inflation.

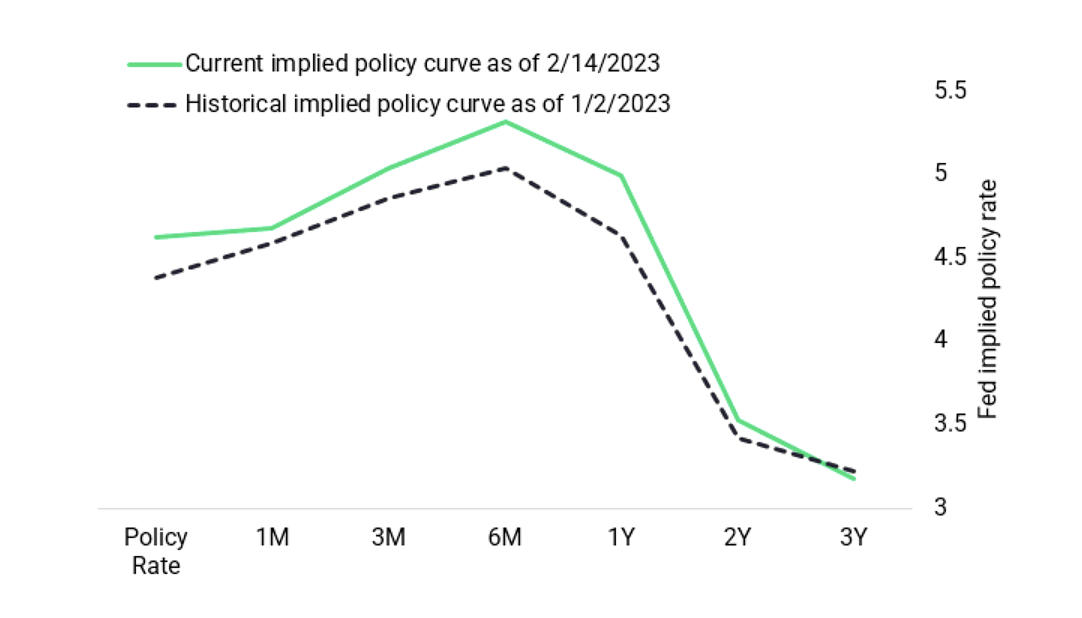

There are several reasons underpinning the recent strength of the US dollar that is being overlooked by many market observers. Firstly, policymakers have been particularly worried by increases in services prices driven in part by a shortage of workers exacerbated by the Covid-19 pandemic. The latest inflation data from the US shows that consumer prices rose 6.4% in January from a year earlier, far above the Federal Reserve's target of 2% annual inflation. Dallas Fed President Lorie Logan said that they must remain prepared to continue rate increases for a longer period than previously anticipated if such a path is necessary to respond to changes in the economic outlook or to offset any undesired easing in conditions. Fed officials had pencilled in a peak interest rate of about 5.0% this year based on the median forecast. However, expectations for where interest rates will peak have risen following stronger-than-expected jobs figures and continued signs of persistently high prices.

Secondly, economic growth could be more resilient than expected or even accelerate. The Atlanta Fed’s tracker has put an early estimate of first-quarter gross domestic product growth at a 2.2% annualized rate as of Feb. 8. And the latest consumer data showed retail sales rebounded more than expected in January, and rose the most since March 2021, highlighting the strength of the economy even in the face of high inflation and interest rates.

Outlook versus EUR and JPY

There is room for JPY to come off versus USD and other G10 FX over the next few weeks. It is unlikely that Kazuo Ueda, who was nominated for the Bank of Japan governorship, will surprise markets by giving hawkish comments before taking the office. Still, elevated inflation in the US and strong data will keep upward pressure on global rates as the Federal Reserve rate reductions “are further priced out of the US curve”.

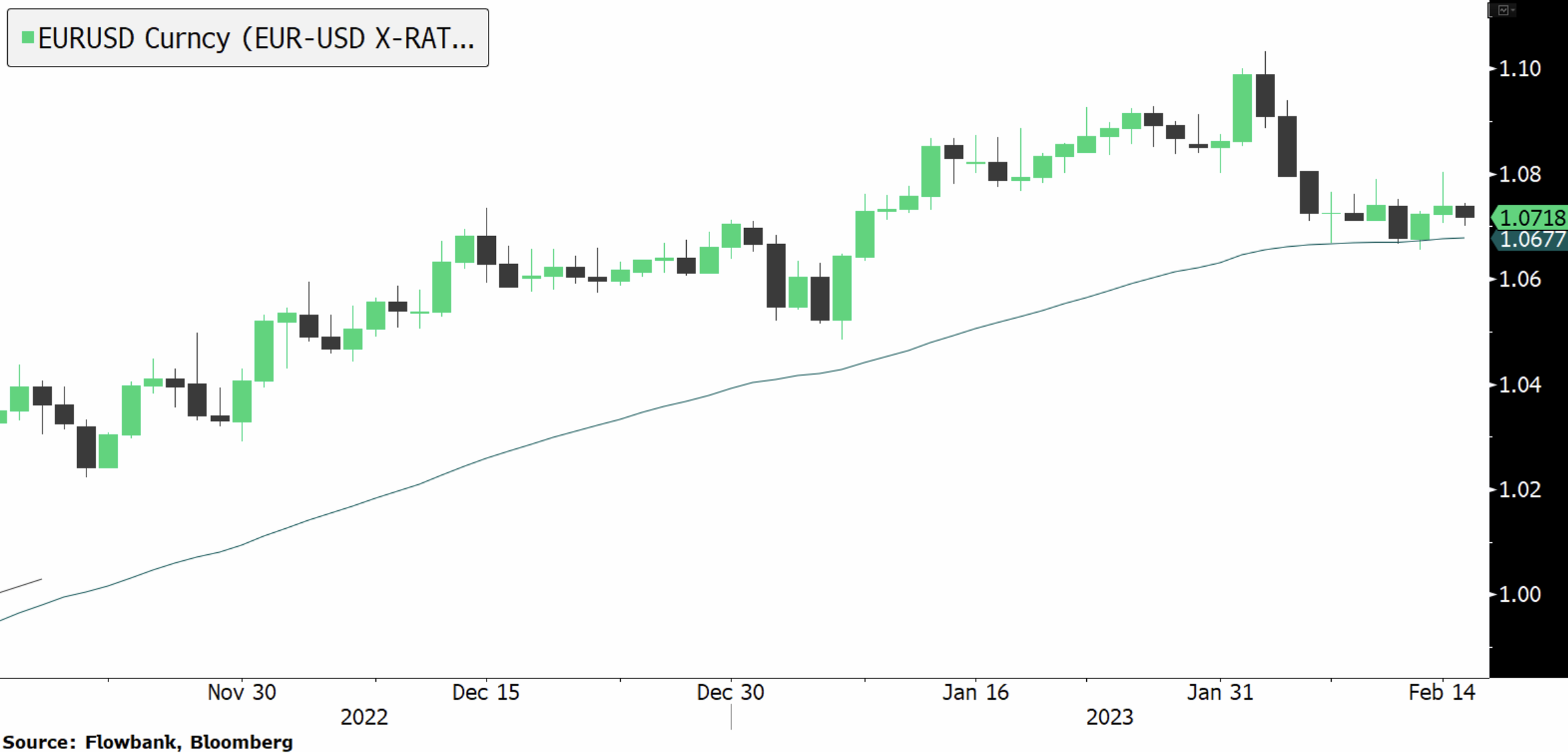

The EUR/USD hangs in balance as markets remain tense due to Fed actions. On Friday, the University of Michigan reported that inflation expectations of Americans for the next year increased in early February to 4.2% from 3.9% in January. This data release together with this week’s US inflation and retail sales are helping the US dollar overtake other major currencies.

Implications on stocks

The recent surge of the US dollar could have implications for the stock market. One assumption is that it reduces the appetite for risk. The market reaction to the latest inflation data shows that the S&P 500 Index fell and Treasury yields jumped, as investors now give near-even odds that Fed officials will raise rates by a quarter percentage point in June.

As shown in the latest earnings reports, a strong dollar could lead to lower earnings for US companies that have significant overseas operations. This is because a stronger dollar can make US goods more expensive for foreign buyers, which could hurt sales and earnings for US companies.

Investors are also worried about doing too little and causing an inflation comeback, or doing too much and creating excess pain in the labour market. As such, as long as these uncertainties remain, risk-asset prices are likely to remain volatile.

Conclusion

The recent surge in the dollar's strength is being driven by strong economic data and concerns over inflation, leading to expectations of continued interest rate hikes. Implications for the stock market are non-negligible as it could increase illiquidity among risk assets and lower the appetite for risk in general. As a result, investors should remain vigilant and consider the potential risks and benefits of the dollar's surprising comeback.