The time has come to address a taboo subject: the inclusion of cryptocurrencies in diversified portfolios.

The market capitalization of cryptocurrencies surpassed $2 trillion last month. At the same time, some digital tokens are starting to be accepted as payment with renowned institutions such as PayPal and Square. Major US banks (JP Morgan, Morgan Stanley, etc.) have decided to include funds invested in cryptocurrencies in their lists of authorized instruments. Last week, NYDIG, a crypto custodian, announced that hundreds of U.S. banks would soon allow their customers to store and transact in digital tokens.

The world of cryptocurrencies is indeed becoming "institutionalized". But can we still talk about an asset class? Is it time to break a taboo, that of a possible inclusion of cryptocurrencies in a diversified management mandate?

Most portfolio managers have certainly not had the opportunity to take advantage of the incredible performance of cryptocurrencies over the last 12 months: +500% for Bitcoin; +1450% for Ethereum. A tiny allocation of 0.5% in Bitcoin and Ether in a balanced portfolio would have generated a contribution of almost 10% to the performance over one year.

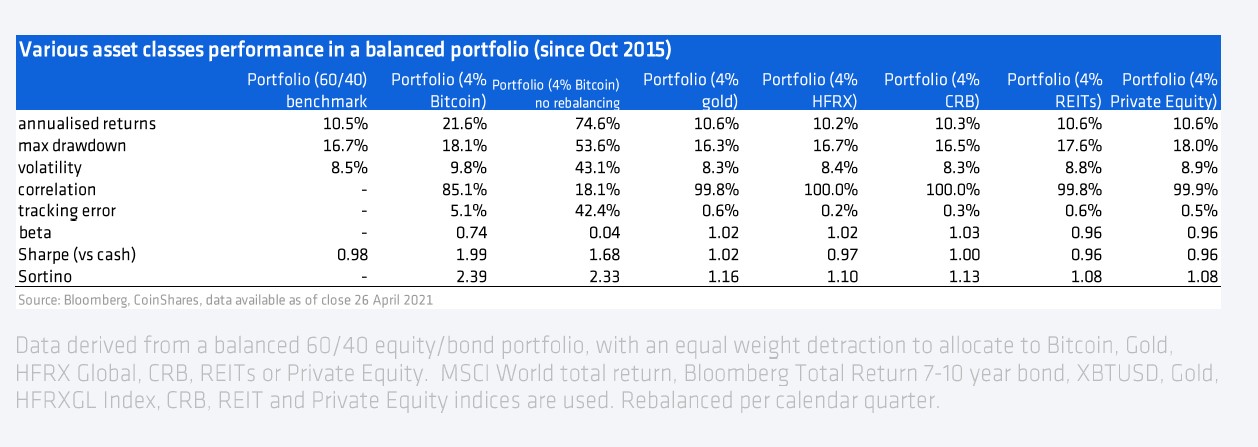

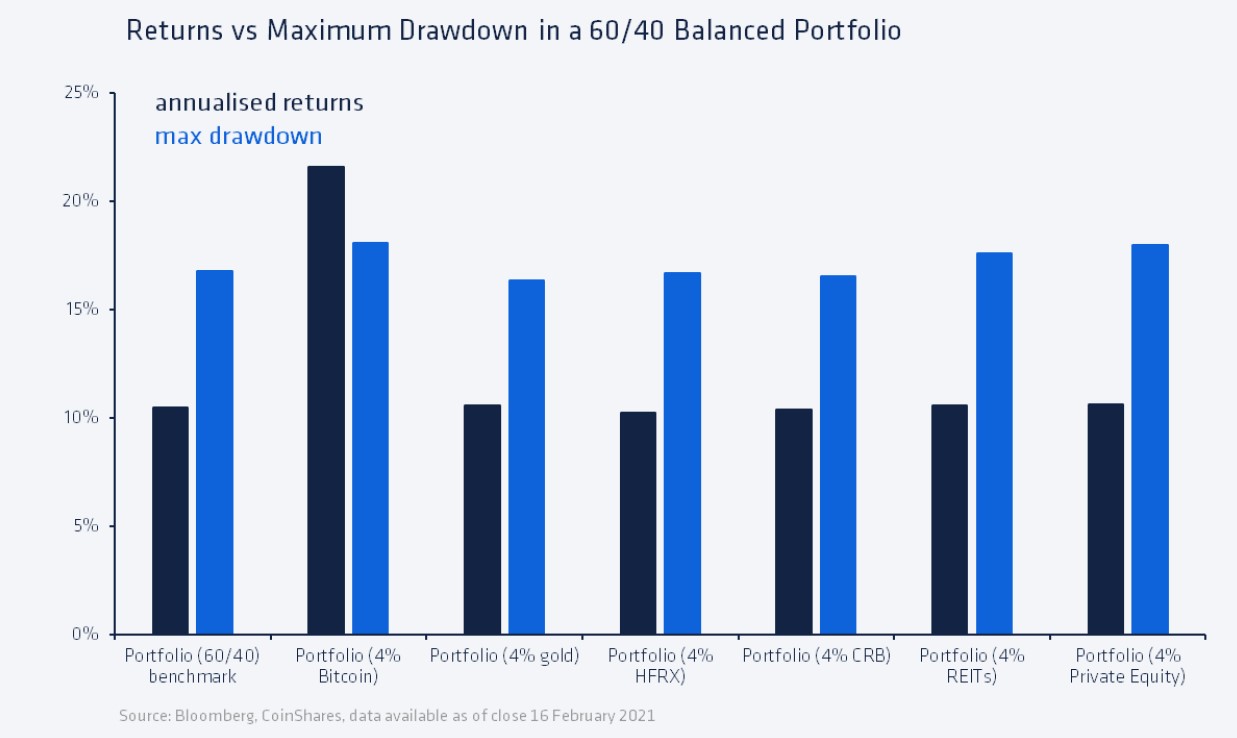

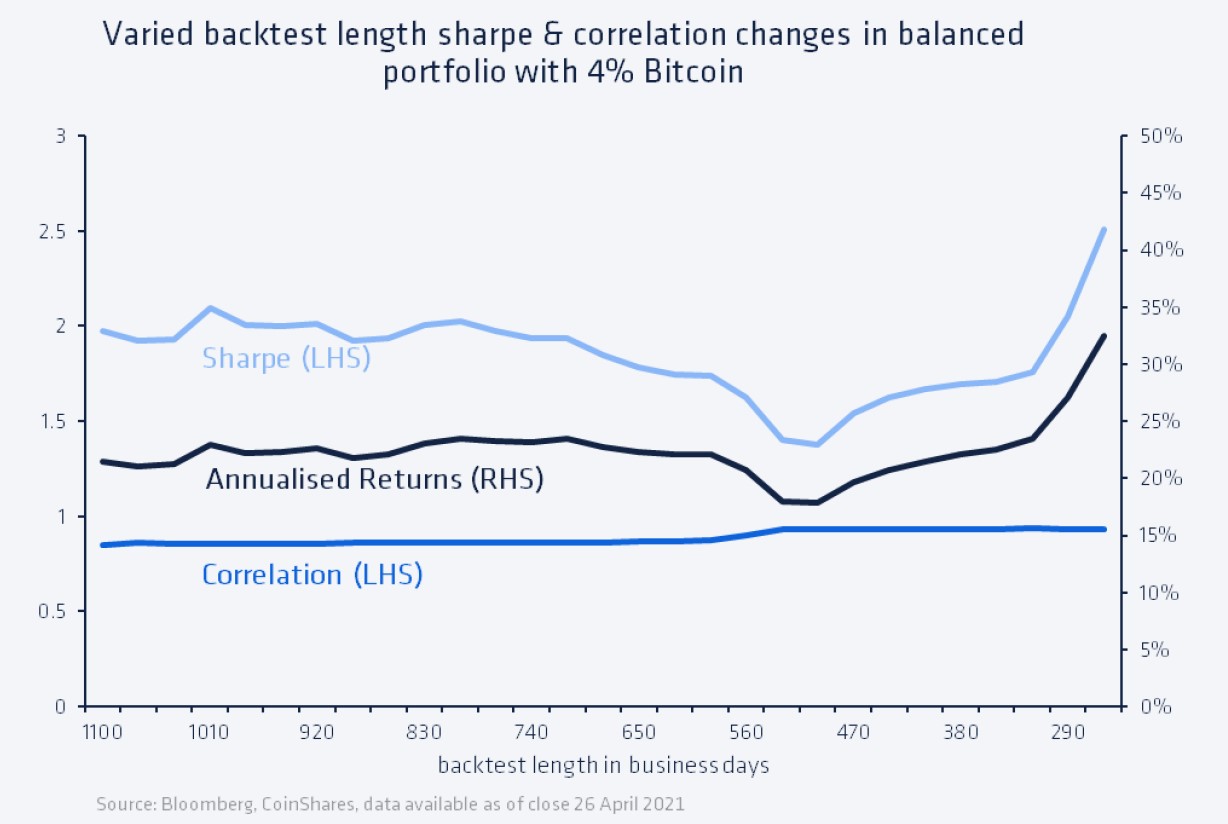

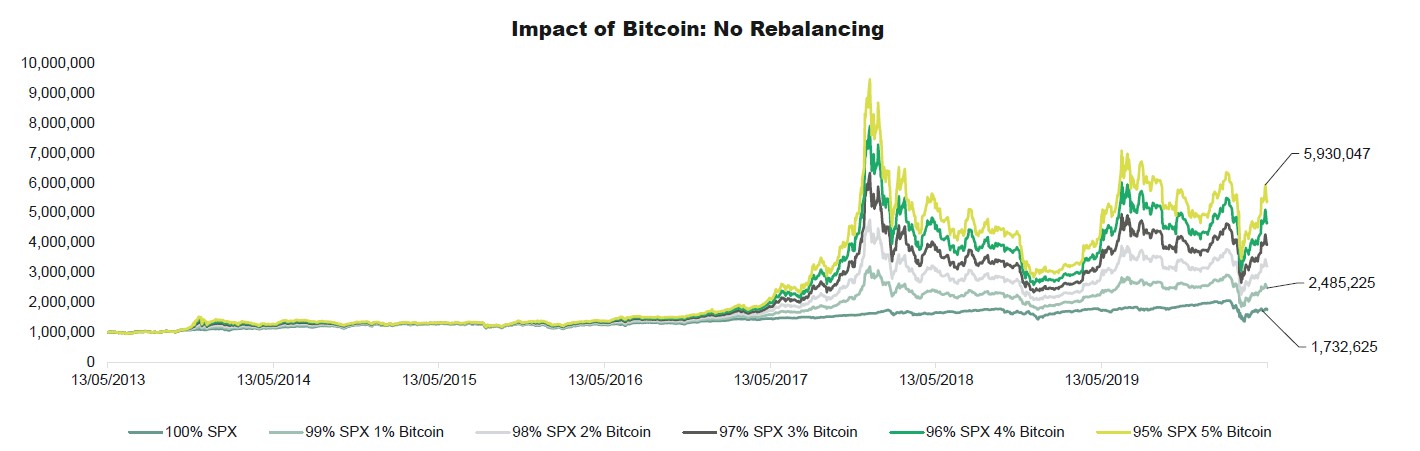

As showing the appendix, historical data analysis shows that a small allocation to Bitcoin in a global portfolio had an exceptional contribution to absolute returns and risk-adjusted returns.

Should discretionary portfolio managers be blamed for having missed this phenomenal bull market? Not necessarily. Indeed, they had at least four "good" reasons ex-ante to exclude cryptocurrencies from their investment universe.

The first is access. The ability to trade and store cryptocurrencies did not exist at most banks and asset managers. Sure, it was possible to invest in Grayscale Trusts, but the premiums to pay relative to net asset value were prohibitive.

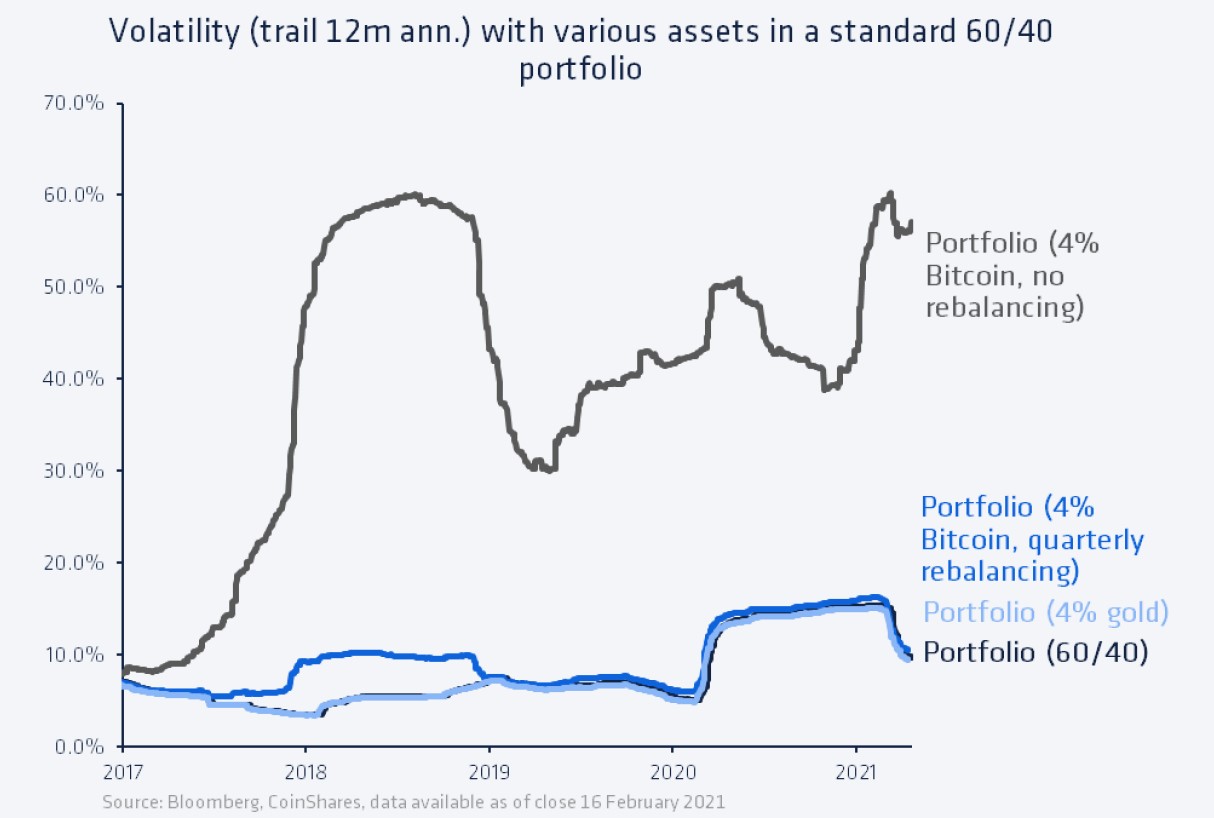

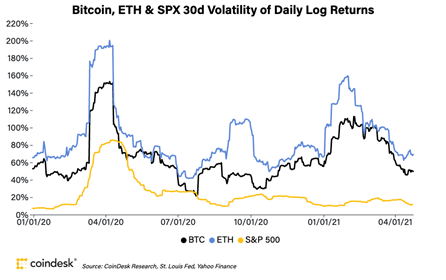

The second reason is the level of volatility. A year ago, the daily 30-day standard deviations for Bitcoin and Ether were 150% and 200% respectively. Unless you were creating micro-positions, it was very complicated for a manager to justify a position in assets that exhibited this level of volatility.

There is also the question of the fundamental justification for such an investment. A professional, to whom a client delegates a management mandate, has a fiduciary duty. How to value assets that pay no dividends, generate no profits and for which it is not possible to establish a book value?

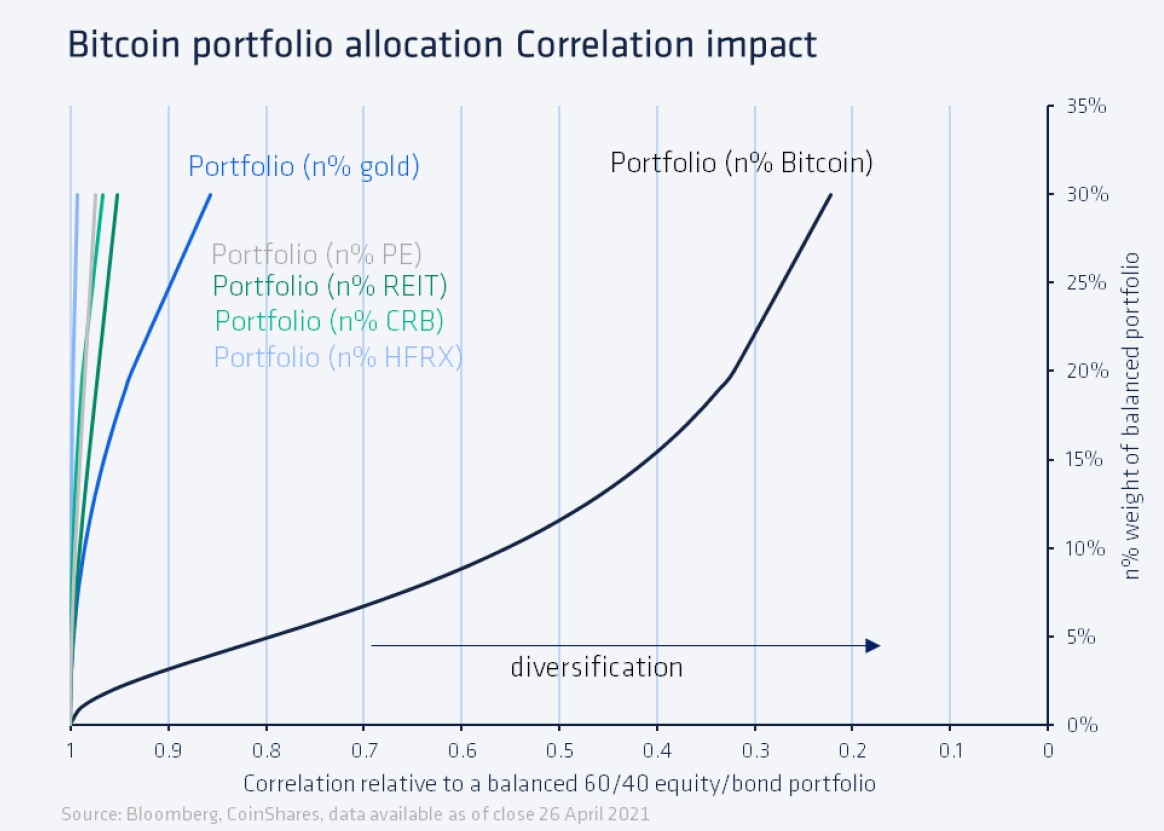

A final point of obscurity for managers: what role do cryptocurrencies play in a diversified portfolio? Investing in stocks allows you to participate in economic growth. Corporate bonds pay coupons. Long-duration government bonds and gold provide risk diversification. What about bitcoin and ether? In 2018 and then in the 1st quarter of 2020, cryptocurrencies had literally collapsed and therefore did not play the role of a safe haven.

After this lengthy plea flying to the rescue of managers "accused" of missing out on one of the biggest rallies in history, what is the situation today? Are conditions more favourable for the inclusion of cryptocurrencies in discretionary portfolios?

I would venture to say yes.

First, access to this asset class is being simplified. It is possible to invest in bitcoin or ether via ETPs (Exchange Traded Products), the same instruments used for commodities. These ETPs are traded on the SIX and are therefore easily tradable, a condition for being part of the investment instruments allowed by the management mandate. ETFs already exist in Canada and may soon be launched in the United States. Note that there are also collective investments, invested in a basket of cryptocurrencies. For mandates restricted to stocks and bonds, it is possible to consider companies linked to cryptocurrencies such as MicroStrategy, PayPal, Square or mining companies like Marathon or Riot. Eventually, banks and asset managers will be equipped with adequate infrastructure (digital vault, etc.) that will allow them to have live and segregated exposure for each client.

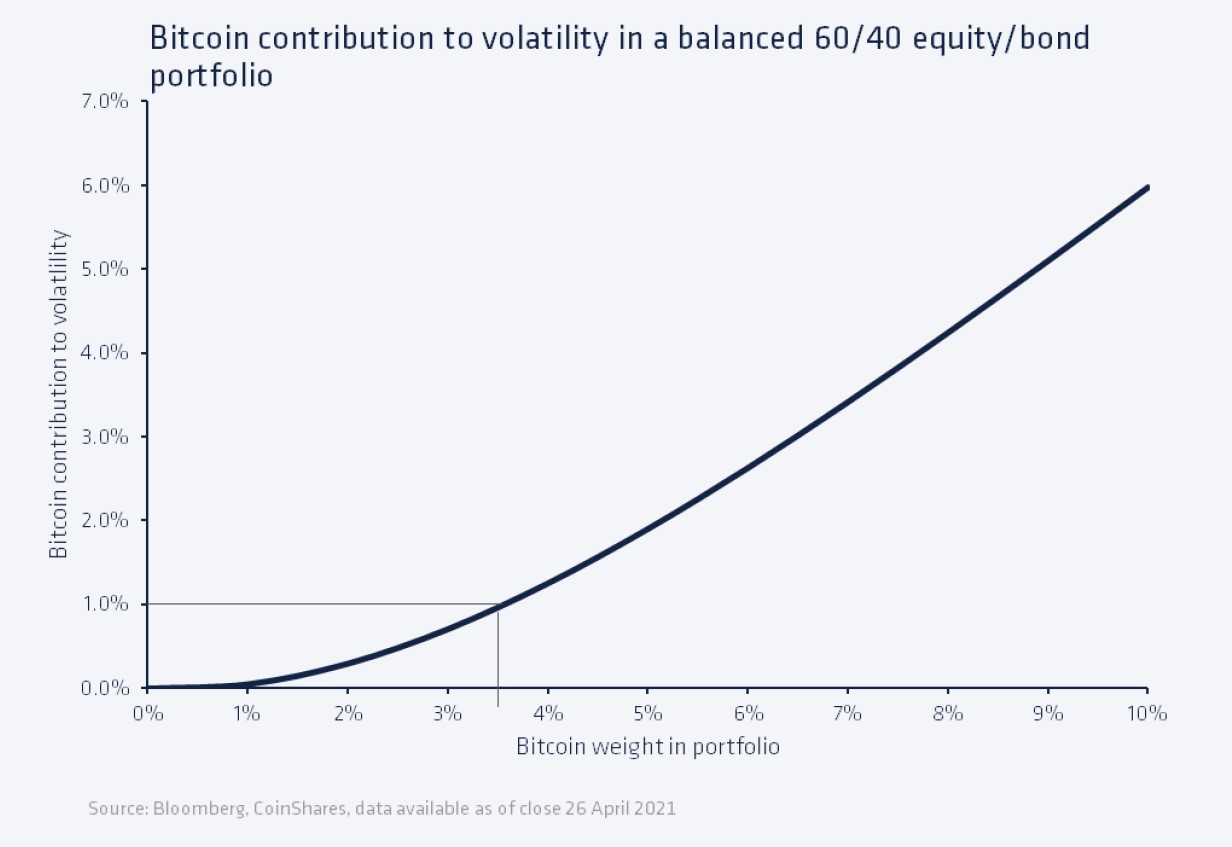

Regarding volatility, it remains high but has been divided by three since the crisis of 2020. And why not allocate weights in cryptos according to a risk budget? Simply put, the riskier an asset is, the lower its allocation in the portfolio. For example, a portfolio will allocate 5% to precious metals but only 1% to cryptocurrencies because they are more volatile. And if cryptocurrencies were to become even more institutionalized, this volatility would decrease, allowing for a higher allocation.

Now comes the thorny question of the fundamental rationale and the role played in wallets. To do this, I propose to segment the universe: on one side Bitcoin, which can be likened to digital gold. On the other hand, protocols such as Ethereum, Cardano, etc., which can be considered as very fast-growing technological companies. As for "stablecoins" (such as Tether), at this stage they are not of great interest since they replicate instruments already in the portfolio. We will also leave aside the "shitcoins" such as Dogecoin because of their immense volatility and their ultra-speculative side.

Like gold, Bitcoin is seen as a safe haven from central bank money printing abuses. Bitcoin already has this status in some emerging countries that are facing hyperinflation and a sharp devaluation of their currency. Like commodities, it is conceivable to invest in bitcoin based on supply and demand predictions. The increase in demand in a context of limited supply over time can indeed justify a position in this asset. For example, one can deduce that there are only 0.4 bitcoins available per millionaire today. Even though the number of millionaires is growing faster than the supply of bitcoin.

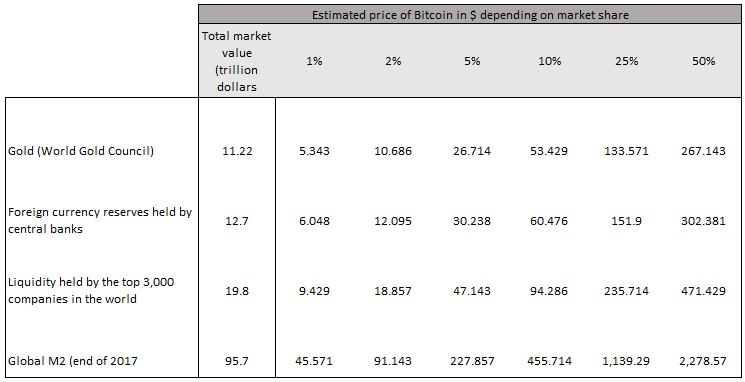

Other references can be used. As the table below shows, by considering the terminal supply of bitcoins (21 million) and making assumptions about the market share of bitcoin relative to certain monetary aggregates, it is possible to simulate a future value. All that remains is to apply a discount rate according to the level of risk considered.

While Bitcoin may find a place in a wallet next to gold, the other protocols should be viewed quite differently.

Ethereum has been distancing itself from Bitcoin for the past few years by presenting itself more as an exchange token rather than a safe haven. One of the reasons for Ethereum's growing success is its position as the blockchain of choice for many products and services that use DeFi – or decentralized finance – applications. These applications generate three times more revenue for the network than Bitcoin.

Analysts therefore had the idea of comparing Ethereum to a technology company and comparing the valuation multiples and revenue growth rates on Ethereum with those of software companies active on the Cloud. We see below that the multiples of these stocks (the dots on the left) range from 5x to over 80x. But the expected growth of their sales is in no way comparable to that of Ether. On this basis, Ethereum can be considered as an asset whose growth potential justifies the very high level of risk (volatility).

Conclusion

We believe that it is possible to take a constructive approach to cryptocurrencies. A new crash is of course possible, but "crypto skeptics" also risk missing out on a high potential theme. Our proposals: use the right instruments, allocate a very low allocation (due to high volatility) and avoid treating cryptocurrencies as a homogenous and isolated asset class. Bitcoin should be seen as digital gold while protocols such as Ethereum can be equated to very high growth technology companies. As far as dogecoin is concerned, the cat got my tongue (or rather, the dog) …

Appendix

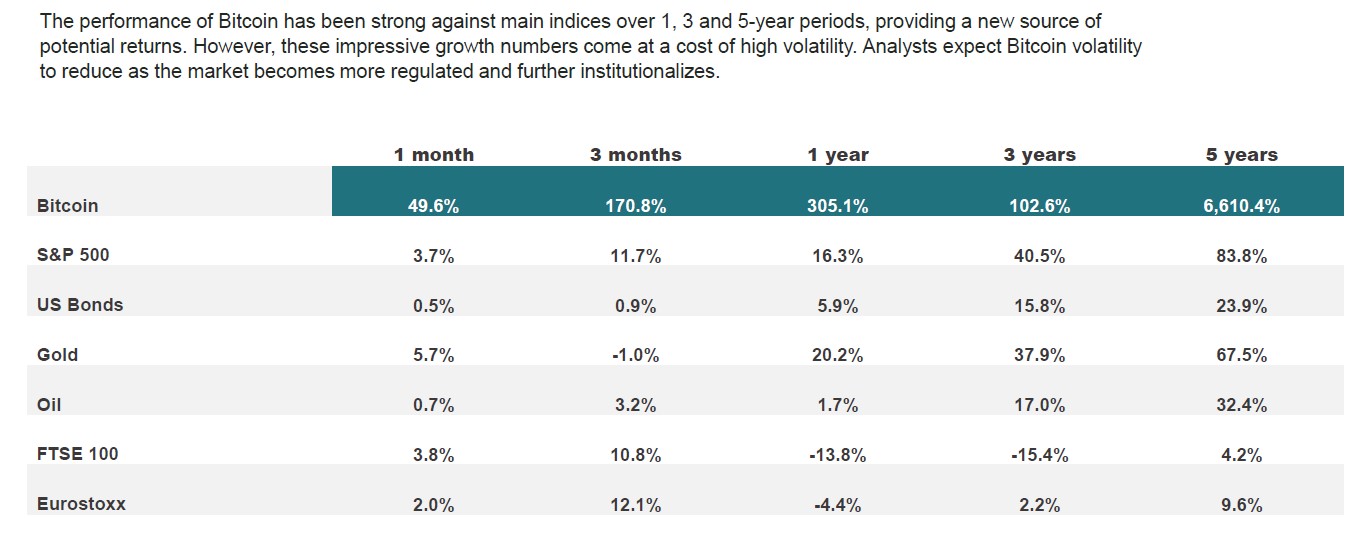

Bitcoin historical performance vs. other assets classes (source: HanETF)

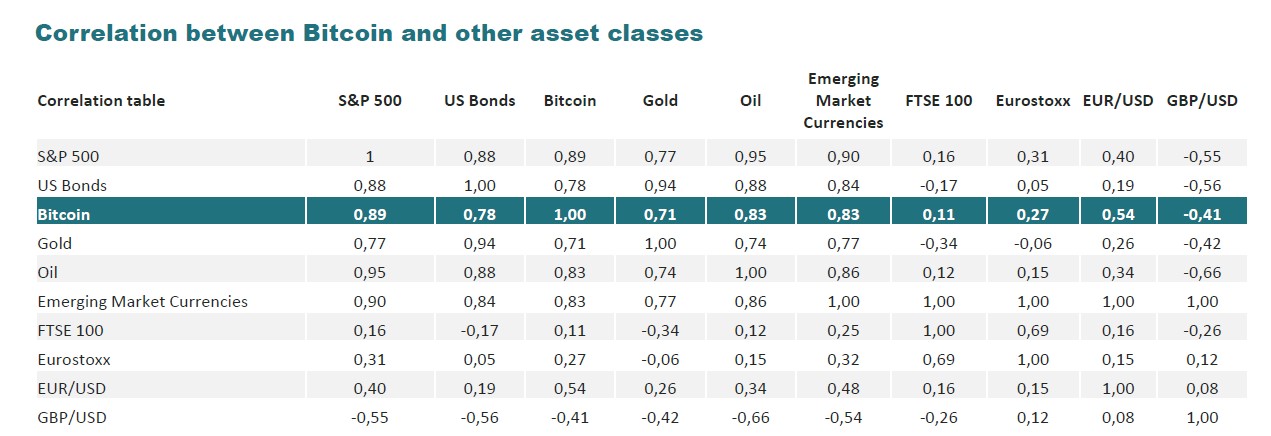

Bitcoin correlation with other assets classes (source: HanETF)

Bitcoin correlation with other assets classes (source: HanETF)

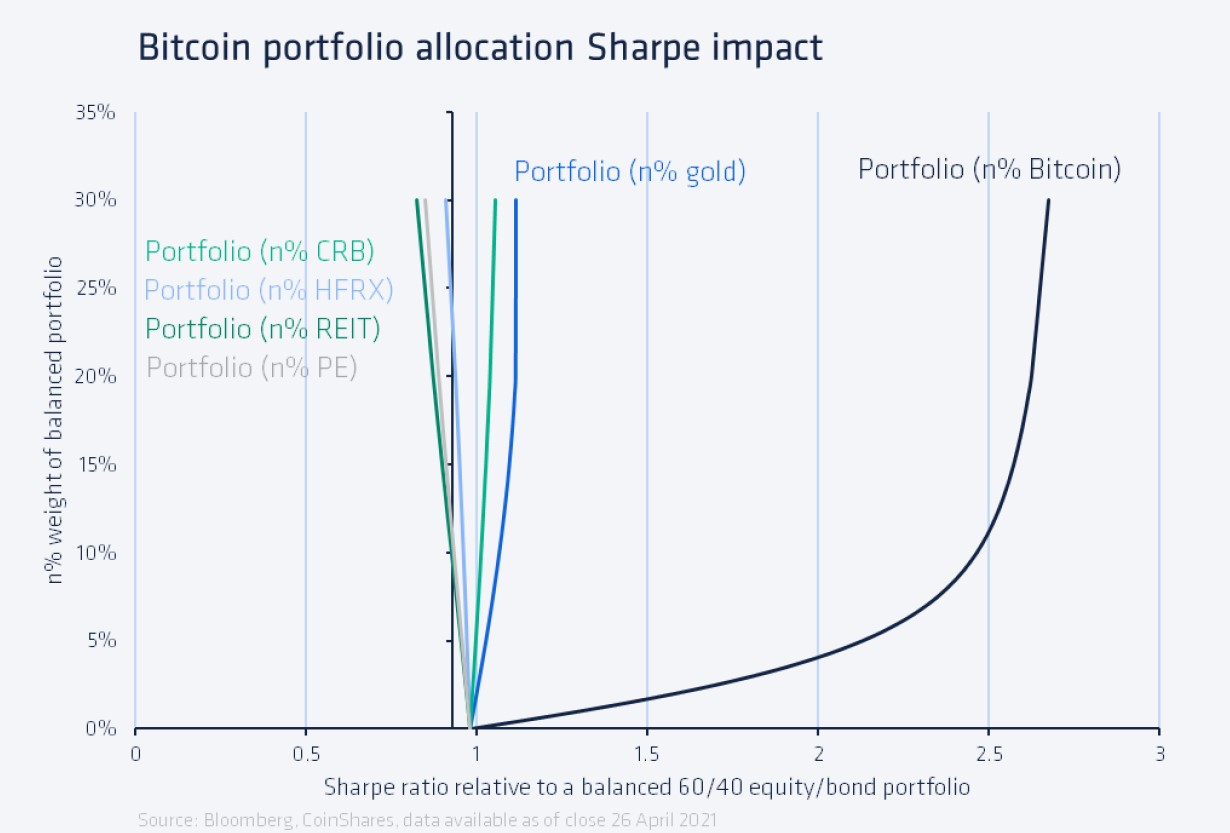

Adding 4% of various instruments to a 60/40 portfolio (source: CoinShares)