An old but succinct argument for a higher price of silver has been made. The difference this time is that the Reddit WallStreetBets retail investor army is listening.

Summary

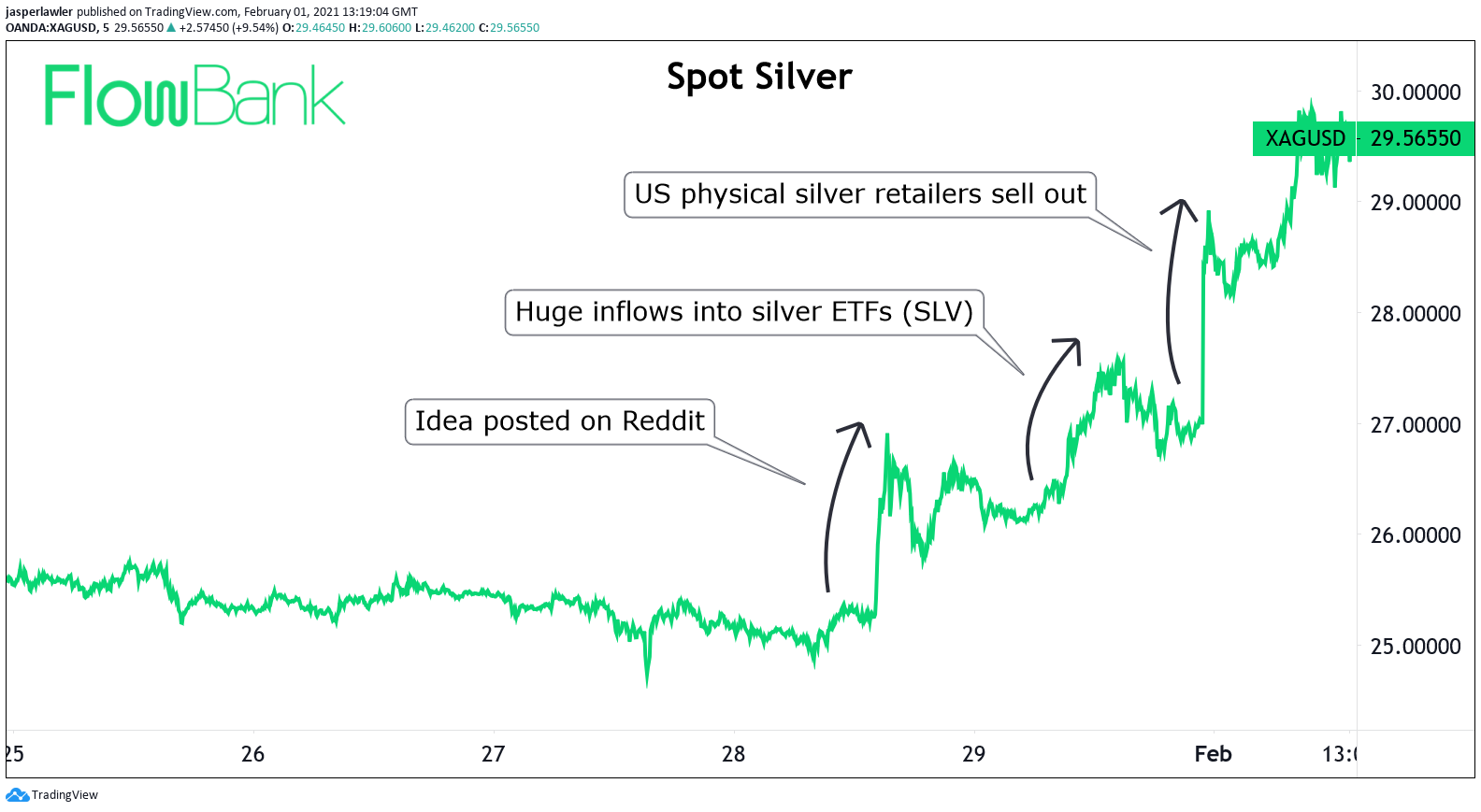

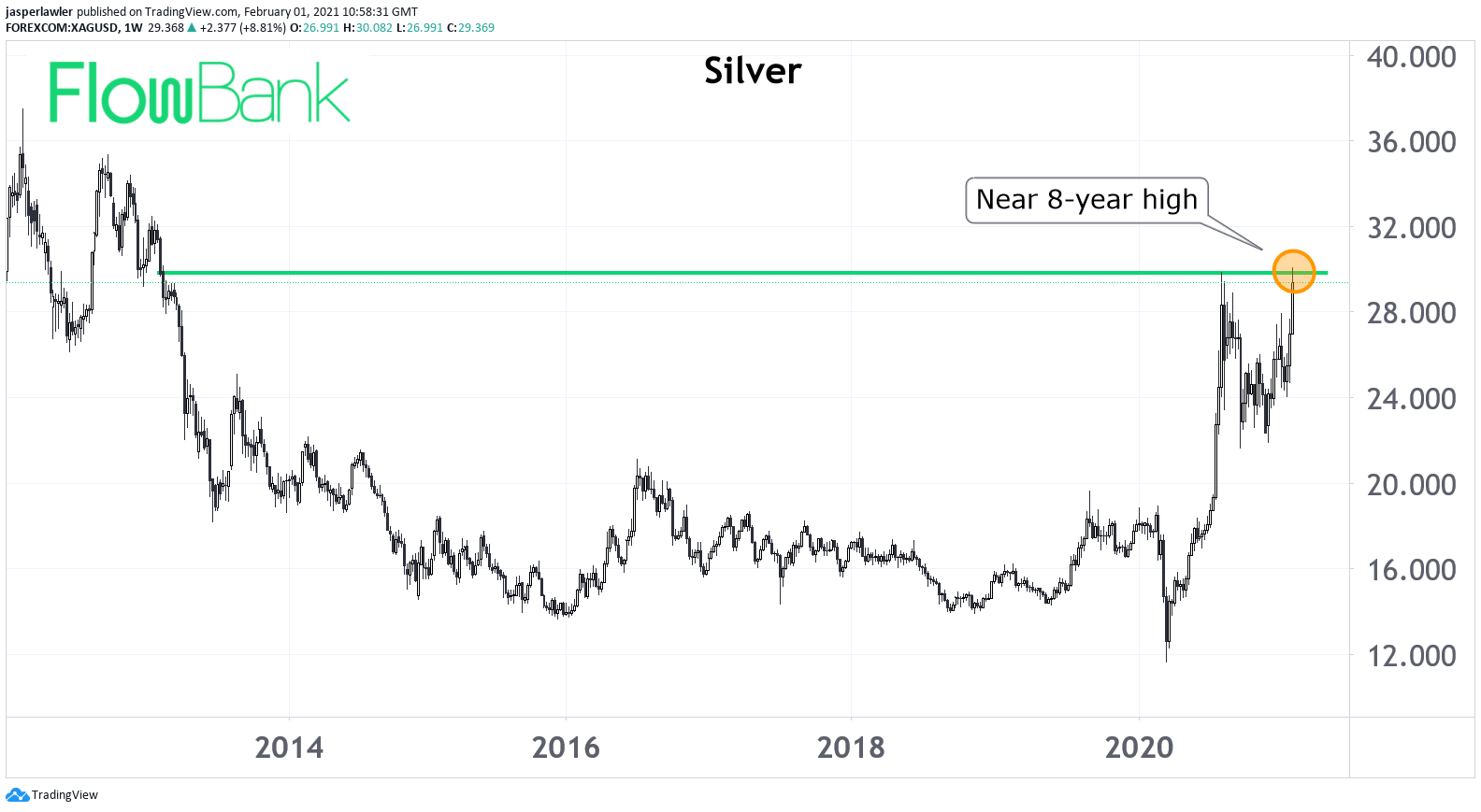

- The price of silver jumped 6% on Friday and gapped open another 8% to cross $29 on Monday morning, its highest since February 2013

- Supplies of physical silver have seen a large drawdown over the weekend

- The gains come after a comment on the WallStreetBets Reddit thread said that silver is an ideal ‘short squeeze’ target

- How would the short squeeze work?

- What’s the bullish case for silver outlined on WSB?

- What are the risks?

What’s happening with trading silver?

The price has leaped higher in the past 3 trading days, buoyed on by heavy retail trading volumes, cheerleaded by the WallStreetBets thread on Reddit

The gains took the price of silver over $30 to its highest since February 2013, close to an 8-year high. The price has already more than doubled since it reversed off multi-year lows in March.

Physical silver supply

The major retailers of physical silver in the US have seen their live inventory drop to almost zero amid unprecedented demand. The websites for SD Bullion, JM Bullion, Money Metals and APMEX were all struggling amid a surge in demand. Tyler Wall, the President and CEO of SD Bullion told Bloomberg that his company sold ten time the usual weekend amount of silver with very few people looking to sell, causing the Premium for physical silver over spot prices is now over 30%. So while, spot prices are printing at around $30 per oz, people are paying $40 and upwards for silver bars and coins.

Source: Pressburg Mint

The price for buying an ounce of physical silver has a rather disjointed relationship with the so-called ‘paper price’ i.e. futures markets. However, the two should move more or less in lockstep and the move higher in physical silver would imply futures are on the verge of a similar move- or that physical prices will quickly drop back to nearer futures. The mitigating factor is how many futures traders expected to take delivery on their orders and how many ounces of silver those sellers actually have available. This takes us to the bullish thesis put out on the WSB thread.

WallStreetBets Comment

One WallStreetBets user commented that “Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in paper shorts would be EPIC.” This was backed up by other Reddits with extra information that convinced enough new buyers to push up the price.

The Short squeeze

There is somewhere between 250 and 500 ‘paper’ ounces of silver traded for every 1 ounce of physical silver actually available. This is possible because most traders are short term speculators betting on changes in price rather than looking to take physical delivery. The large dealers in the market are potentially taking advantage of this higher paper:physclal silver ratio by ‘naked shorting’ paper silver. That means they are selling silver without having the underlying physical silver in possession.

The silver market could therefore be in theory squeezed by forcing more delivery of the physical from the paper. COMEX is the largest futures market in the world for silver and could be where the squeeze takes place. The process could work as follows:

- Trader sells silver in naked short sale

- Buyer demands physical delivery of the silver

- Seller buys another futures contract to take delivery from another naked short seller

- The second seller now buys more silver (at higher price) to enable physical delivery

- It continues- driving up the price in the process

The iShares Silver Trust ETF is backed by physical silver. Everyday the custodian of the trust must ensure that there is enough physical silver in the vaults to cover a certain percentage of the value of the silver held in the ETF.

Silver fundamental analysis

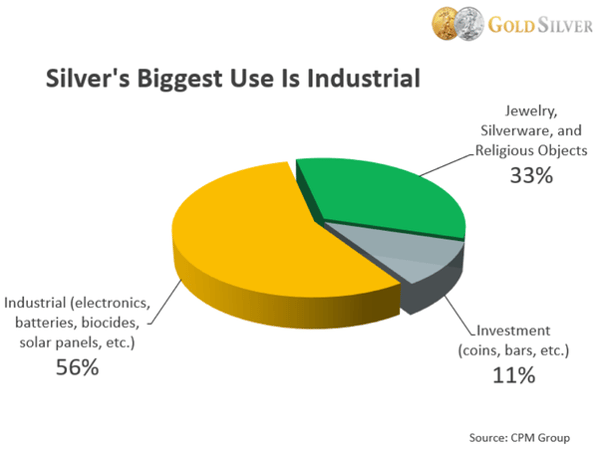

Short-squeeze aside – there are some fundamental reasons to be bullish on silver including its importance in solar panels and electronics and its low price by historical standard relative to gold.

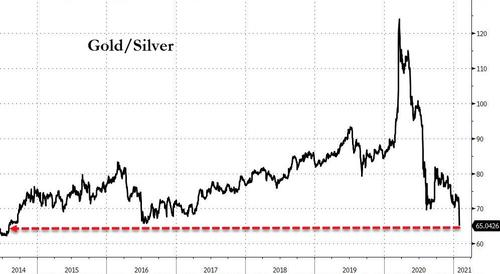

The gold silver ratio

Gold price = $1865 per oz

Silver price = $30 per oz

Gold / silver ratio = 62:1

Source: Zerohedge

Naturally occurring silver is 18.75 times more common than gold, silver was once pegged to gold at 15:1 and current global production is about 8 ounces of silver for every ounce of gold. If we are judging price purely on the basis of scarcity, then a ratio of 62:1 is much too high and either price of gold needs to come down relative to silver or the price of silver needs to go up relative to gold.

By this logic, the gold silver ratio normalising towards 20:1 and allowing for any simultaneous appreciation in gold, brings about one Reddit user’s target of near $75 per oz. (more on this later).

Silver production

Silver is usually mined as a by-product of other metals like gold and copper. This is why there are almost no ‘pure’ silver mining companies. The result is that mining cannot quickly accelerate production to increase supply to match the new demand. Silver mine supply has also been on the wane recently, something that is arguably not relfected in the price.

Solar panels

Most of the demand for silver is not as an investment asset but for its use as an industrial commodity -and its industrial uses are rising because of our dependence on electronics, and more recently the switch to green energy sources including solar power, which needs solar panels that use silver components.

Money printing & inflation

Gold and silver are the oldest forms of money and have held their value over time. Right now, central banks are increasing the money supply at rates between 10% and 20% per annum by purchasing government bonds and other assets with newly created money. While gold and silver are proven stores of value for wealth, fiat currencies including the US dollar are being devalued by government policy.

The risks

Firstly, silver has already more than doubled since the lows it reached in March so the trade is not starting from a point of deep value. However, the major squeeze in GameStop didn’t happen until around $20, while the shares had reached $3 at the lows.

Silver is a much larger market than shares GameStop, which has a relatively small float. A bigger market will take a lot more buying power to squeeze the big shorts, especially well-capitalised money-centre banks which have much more capital than multi-billion-dollar hedge funds. However, banks are theoretically more tightly regulated than hedge funds so cannot take on the same levels of risk (e.g. a 50% haircut like Melvin). Still, the thing to understand is that the basis for this short squeeze is the ratio of physical to paper silver, which is unreasonably high. If you were to consider the size of the physical silver market, it would be much lower in value.

Additionally, were broader markets to sell off for other reasons, perhaps risk-aversion from hedge funds who have been squeezed or concerns about the covid-19 vaccine rollout, silver would likely not be immune to the selling.

How to play it

The suggestion on Reddit is to trade the iShares Silver trust (SLV) or call options on SLV. One Reddit user (u/TheHappyHawaiian) suggested 50% of the trade into SLV shares and 50% $35 strike SLV calls with a target price of $75.

Secondary options include silver futures with the intention to take large delivery – or physical silver.

Buying a spot silver CFD (XAG/USD) will allow traders to participate in any upside in the price but may not itself contribute to the short squeeze, thus reducing the effectiveness of the overall trade.

Sources:

https://www.reddit.com/r/wallstreetbets/comments/l6novm/the_real_dd_on_slv_the_worlds_biggest_short/