Those days when you used to go to the store to buy DVDs and CDs are long gone. People want entertainment right from the comfort of their couch, and they require quality production. The streaming war has begun: who will win?

Key takeaways

- Streaming is both cheap and convenient, which are key factors of choice for consumers today and particularly the younger generation.

- The main challenge remains to keep producing quality and differentiated content.

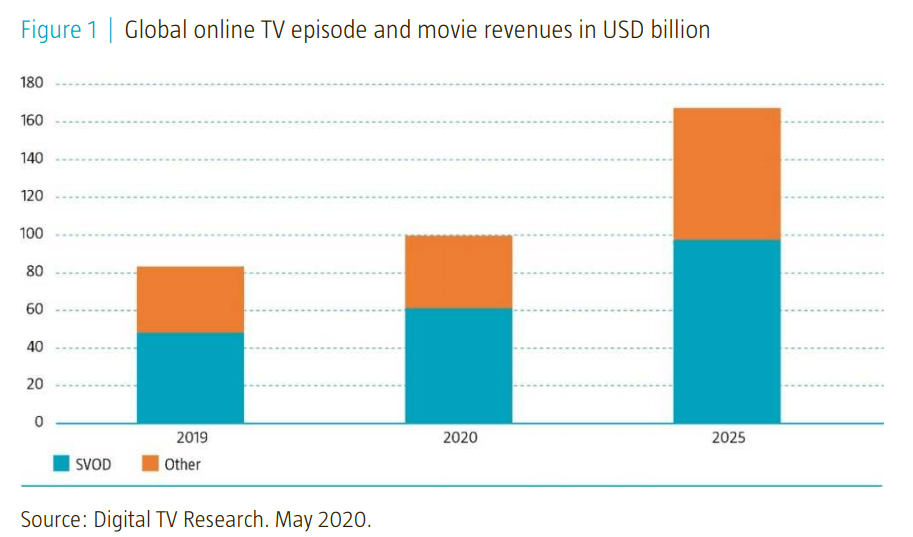

- The value of the SVOD (subscription video on demand) industry, is expected to climb from $50 billion in 2019 to $100 billion in 2025.

- The pandemic saw SVOD subscriptions soar, with Americans now averaging 4 subscriptions each.

- The Roundhill Streaming Services & Technology ETF ("SUBZ ETF") is designed to offer exposure to the streaming industry, both video and audio.

Why is streaming so great?

We do not buy and own TV series, movies, and music nowadays. We stream it. Why is that?

This question brings us to the first success factor of the model: convenience. Customers can easily register and cancel their subscriptions in a few clicks and have access to content available 24/7. Subscribers can watch whatever they want, whenever they want, on the device of their choosing. This flexibility and constant availability have become crucial to satisfy customers, especially the younger generations.

The second important driving factor is low cost. Subscribing to Netflix is far less expensive than the annual contract for cable TV, buying physical movies, or going to the cinema.

Finally, video streaming companies have made a dedicated effort to produce high quality exclusive content, in the form of movies, TV series or documentaries. This helps each service to differentiate itself from the others, while at the same time being a constraint for new incumbents.

Although the streaming trend has taken industries like music and gaming as well, video streaming remains the most interesting one for investors, given its size and opportunities.

Early phases of the video streaming industry: studios and platforms splitting up

The early stages of video streaming were taken by Netflix, who, after having had their physical stores – I swear, they had some – and distributed DVDs by email, developed its own streaming platform.

At first, SVODs like Netflix used to have relatively good relationships with established movie studios, which saw them as additional ways of distributing their productions with high margins – you do cut the cost of producing physical copies, for example. This greatly helped Netflix’s popularity rise.

However, this friendship soon ended when SVOD viewership grew, and clients started cancelling their cable subscriptions. Studios and conventional TV networks felt betrayed and started to take off their content from the platform. Netflix and other platforms had no choice but to start producing their very own content, an element that would be key to their success in order to differentiate themselves.

While some studios tried to launch their own platform, only very few managed to gain traction against Netflix, which held the first mover’s advantage. While there are exceptions like Disney, which made an incredible comeback this year with Hulu and Disney+, most players could not achieve the scale sufficient to cope with the high production costs associated with the exclusive and differentiated content needed to attract new and existing customers subscribed.

State of the video streaming industry and COVID-19 boom

After years of impressive growth, the streaming boom is expected to continue in the coming years, largely carried by video streaming specifically. In fact, global online TV episode and movies revenue could double from $83 billion in 2019 to $167 billion in 2025. A large part of this market is the SVOD (subscription video on demand), which is expected to climb from $50 billion in 2019 to $100 billion in 2025.

A new J.D. Power survey revealed that the majority of Americans were subscribed to four separate streaming services on average, versus three in April 2020. 81% of the surveyed people said they had a Netflix account, closely followed by Amazon Prime with 65%.

The adoption was already high, but the pandemic hit the “fast forward” button. During the lockdown, Netflix added over 37 million new subscribers, surpassing its previous record of 28.6 million in 2018, making it pass the 200 million subscribers’ threshold. Disney also showed an incredible performance, going from 26.1 million subscribers in the first quarter of 2020 to almost 100 million in 2021. Such growth is expected to slow down as the economy recovers and sanitary measures loosen up, but it does translate to a strong SVOD adoption.

Nevertheless, such enviable numbers do not come without their challenges, namely, to continue producing exclusive content to beef up their arsenal, to keep luring new customers and to keep existing ones entertained. Especially during COVID-19, the content production was an increasingly difficult challenge, with many shows and movies being pushed to next year or even cancelled.

So who will win? It seems that only services with a differentiated offer will prevail. Netflix is hiring international directors to make real cinema, Disney is also capitalizing on its existing catalogue as well as new franchises such as Lucasfilm, and Amazon Prime is working on buying sports rights.

How to play it

This booming sector in constant movement can offer interesting opportunities for investors. In fact, there are a few ways one can play it either through stocks or with a dedicated ETF:

Key players in the industry

Netflix

The rental DVD service has grown to become one of the pioneers of SVOD. They have just passed the 200 million subscribers count, a sustained growth which is insane considering that they kept raising prices and competing against cheaper rivals. The company is now even more diversified in its customer base, with more subscribers outside than inside the US. Netflix has capitalized on its first mover’s advantage, with already substantial consumer data, most likely larger than any rival. The company expects to have 78 million US subscribers and 300 million international subscribers by 2025. Lastly, Netflix’s strongest weapon is its high quality content, with many TV series and movies that are starting to feel like Hollywood productions.

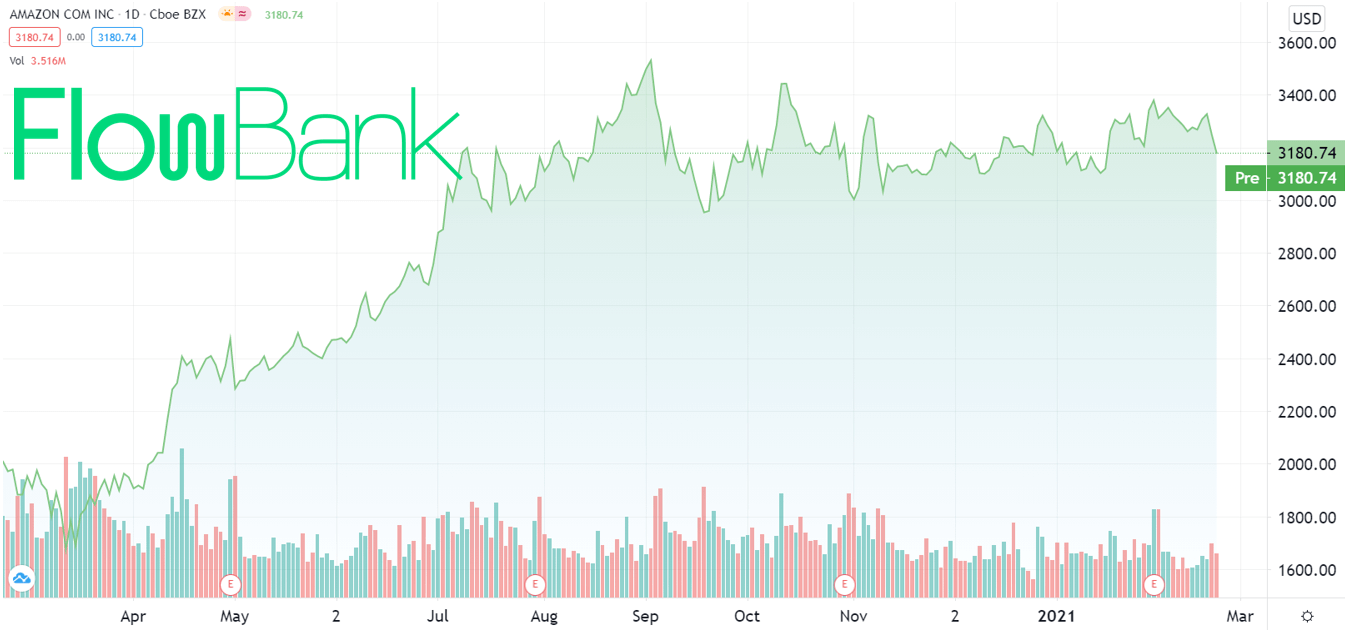

Amazon Prime Video

Amazon Prime is the second largest video streaming provider in the US, with over 175 million global Prime members – when you subscribe to Prime, you get the video streaming service in the package, making it more like a marketing extra rather than a service you pay for itself. Nevertheless, the company keeps expanding its customer base, with a large stream of subscribers joining during the pandemic. They are also working on buying sports rights to keep diversifying their offer. With Prime Video and all its other services, Amazon boasts a strong competitive position in the consumer sector and is likely to reshape retail, digital media, and other categories for years to come.

Disney+

The company that became famous with Snow White diversified, now owning Pixar, Marvel and Lucasfilm, operating ESPN and various TV production studios. They also jumped into SVOD with ESPN+ and Disney+. Their service is mainly geared towards a younger audience, and emotion remains a strong argument for clients that grew up with classic Disney movies. If you add up the total subscriber counts of its platforms (Disney+, Hulu, ESPN+), you got a combined total of 137 million at the end of 2020. This is a massive growth, as it took Netflix over 6 years to reach this number, and less than 2 for Disney+. There is still much to be expected from the House of Mouse.

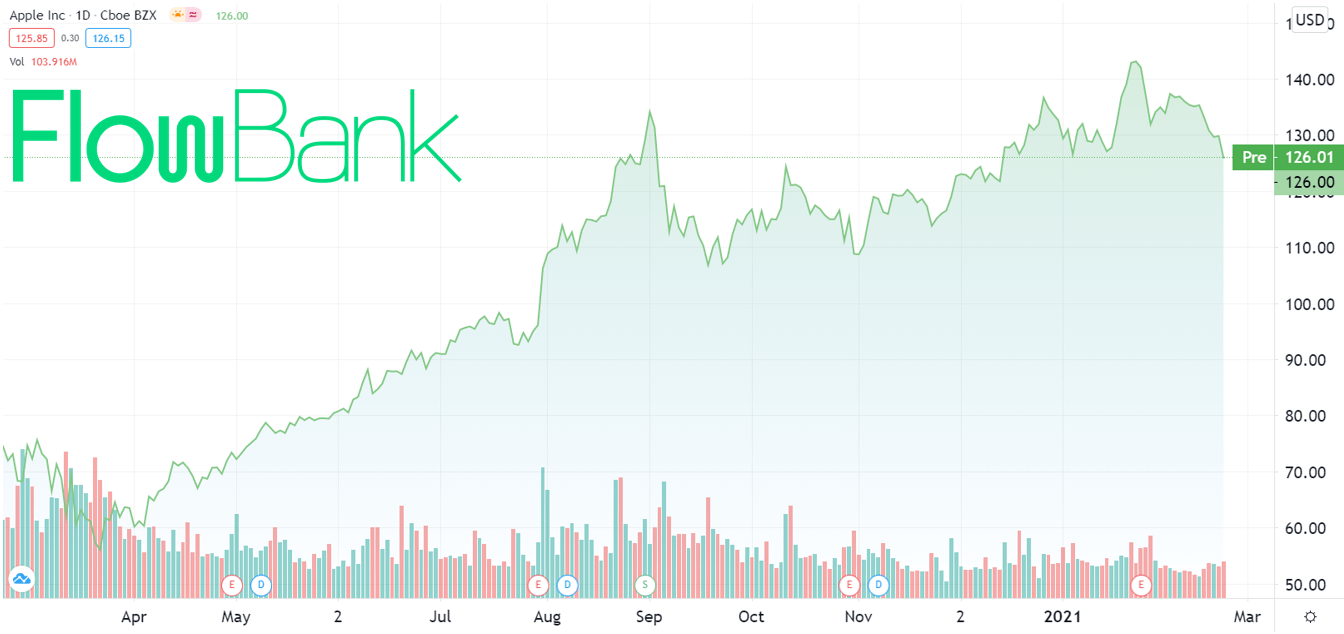

Apple TV+

Apple also wanted to enter the streaming war, but it seems that they are at a distinct disadvantage compared to their rivals. The majority of its subscribers were on a free offer (62%) and when asked, only 30% said they would renew the $5 per month plan. Apple has not disclosed its number of customers, but they will need to find a fix to keep them in line, otherwise they will not stand a chance against more established players in the market.

Viacom CBS

Viacom is a cable TV company that made the switch to streaming. The stock has been performing well with a 160% return over the last year. They were also the first service to launch addressable impression, meaning that people watching the same program will see different ads depending on who they are. They also launched the Paramount+ streaming service, giving them a foothold in the SVOD segment.

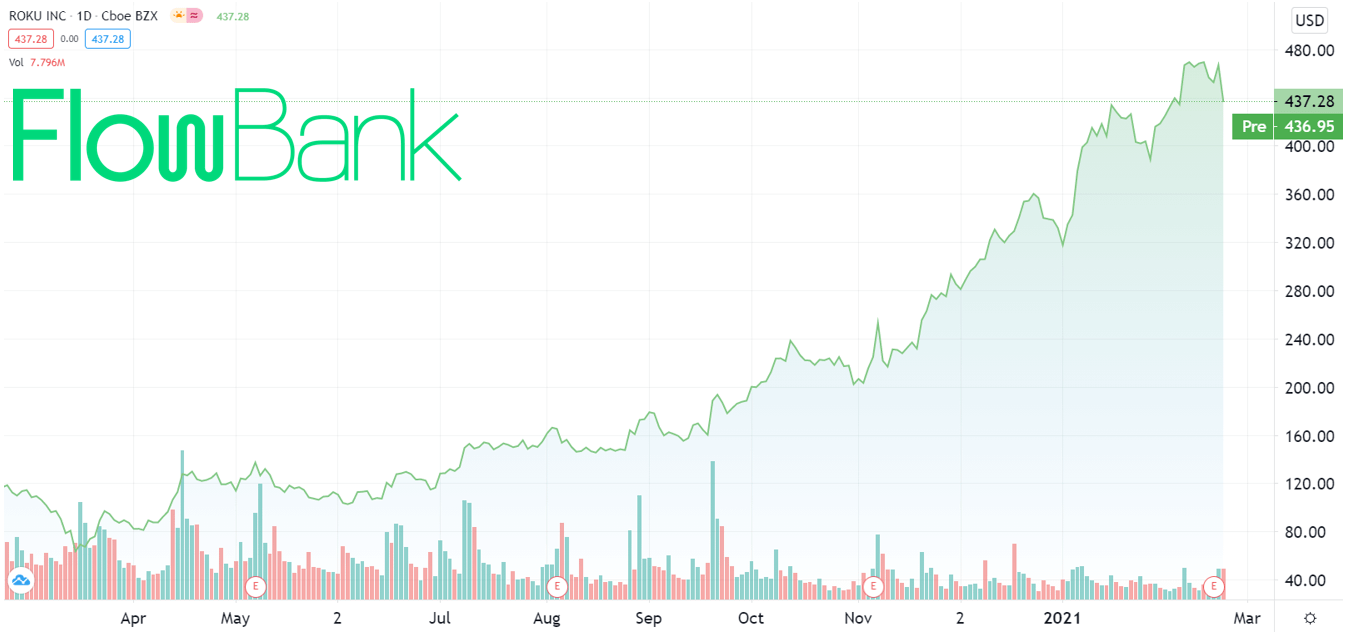

Roku

Roku is technically not really a streaming stock, but it commercializes a successful device to stream other platforms. The company’s share price jumped 158% this year, as the company combined great sales of its digital media players as well as a steady revenue from its advertising platform. HBO Max, the streaming service owned by AT&T, has recently been made available on Roku’s hardware. The company is not yet close to seeing profits, but its revenues keep soaring with a 78% increase year over year. Roku does not seem to slow down anytime soon, will its stock follow?

The Roundhill Streaming Services & Technology ETF

Finally, for investors who cannot decide on a particular stock, there is an ETF to have a more global and diversified play. The Roundhill Streaming Services & Technology ETF ("SUBZ ETF") is designed to offer exposure to the streaming industry as a whole, both video and audio. Its major holdings are Spotify, Netflix, Roku, Tencent and Kuaishou, among others. These holdings include companies that operate direct-to-consumer streaming as well as companies that work towards creating the necessary infrastructure and technology for streaming.

Summary of the mentioned instruments

| P/E ratio | EPS | 52-week range | Market cap. | YTD % | |

| 87.79 | 6.08 | 290.25-593.29 | 236B | 2.09% | |

| Amazon | 76.04 | 41.83 | 1,626-3,552 | 1.062T | - 0.18% |

| Disney+ | N/A | -2.74 | 79.07-194.02 | 348.1B | 7.92% |

| Apple | 34.17 | 3.69 | 53.15-145.09 | 2.115T | -2.64% |

| Viacom CBS | N/A | N/A |

10.10-67.20 |

40.817B | 80.71% |

| Roku | N/A | -0.14 | 58.22-486.72 | 55.5B | 37.55% |

| SUBZ | N/A | N/A | 15.15-16.46 | N/A | -3.44% |