Bachem holding is rarely talked about, but it is one of the great performing companies in the Swiss pharma industry. Market leader in the production of peptides, they have continuously beaten earnings expectations and their stock grew 102% year to date.

Key takeaways

- Bachem holding is a Swiss company active in the production of components used in the pharma industry, such as Active Pharmaceutical Ingredients (API).

- It is the global leader of the production of Peptides, a specific API useful to treat metabolic diseases, cardiovascular and heart conditions.

- The company was founded in 1971 in Liestal, near Basel, and has since then expanded to sites all around the world and employs over 1’200 people.

- The company is liked by growth investors, as it keeps beating earnings expectations and shows a strong EPS growth.

- The stock is up 102% year-to-date, and 642% over the last 5 years.

- For more detailed information about Bachem Holding, go have a look at their website.

Company’s profile and mission

Bachem Holding is a Swiss company active in the field of biochemistry, chemistry, and pharmaceutical components. They develop products and services linked to the pharmaceutical and biotechnology industry, with a specialization in the production of peptides – for which they are market leaders – and other complex organic compounds such as Active Pharmaceutical Ingredients. Not only do they produce these elements, but they also help in the development of manufacturing processes to craft them.

- Active Pharmaceutical Ingredient (API):are part of any drugs and are meant to produce an effect on the body. Some drugs have multiple ingredients to treat either different symptoms or act in different ways. Drugs are made of two core components: the API, which is the central ingredient, the active chemical, and the excipient, which is the element made to help deliver the API to your system.

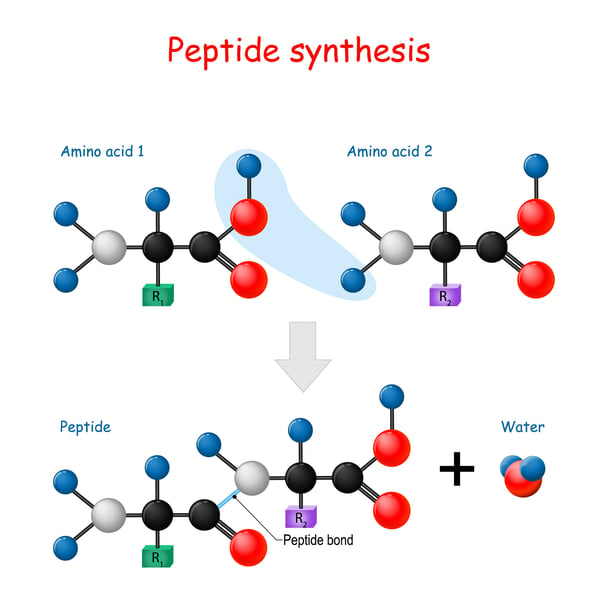

- Peptides: are amino acids making up certain proteins needed for the skin. They can block and/or enhance signal transfers in the human body. When used as an API, they can treat many metabolic diseases, cardiovascular and heart conditions.

The bounding of 2 amino acids creates a peptide, which also releases a water molecule

Bachem have a continuously expanding range of new products meant to help clients in their research purposes. Additionally, they have over 5’500 different biologically active peptides, amino acid derivatives and biochemicals ready to deliver. Finally, they also offer custom synthesis for customers looking for a very specific component.

Today, they have the capacity to produce peptide APIs from gram scale up to hundreds of kilos, and other small molecules API from gram scale to tens of tons. They have facilities in Switzerland, Great Britain, USA and Japan, and over 1’200 employees as of 2019.

Bachem Holding’s history

Bachem started in 1971, when Peter Grogg founded the company with two employees in Liestal, a small town near Basel, wanting to focus on peptide synthesis. By 1995, the facilities had expanded to over 15’600m2, counting almost 190 employees. The company then expanded outside of Europe, with the establishment of Bachem Bioscience, Inc. in Philadelphia USA, in 1987. They then kept expanding, opening different facilities throughout Europe, before going through an IPO in 1988 on the Swiss Stock exchange under the ticker “BANB”.

In 2011, after further expansions and acquisitions, Bachem celebrated its 40th anniversary, placing itself as one of the leaders of the production of research ingredients and active pharmaceutical ingredients for the pharmaceutical industry. In 2014, Bachem was the leading peptide manufacturer. In 2018, the company expanded in Japan, and started to position itself as a provider for the development and production of active agents in the field of oligonucleotides, which are short DNA or RNA molecules.

The company’s very first building in 1971 (Source: Company website)

The company’s very first building in 1971 (Source: Company website)

Bachem’s growth and stock analysis

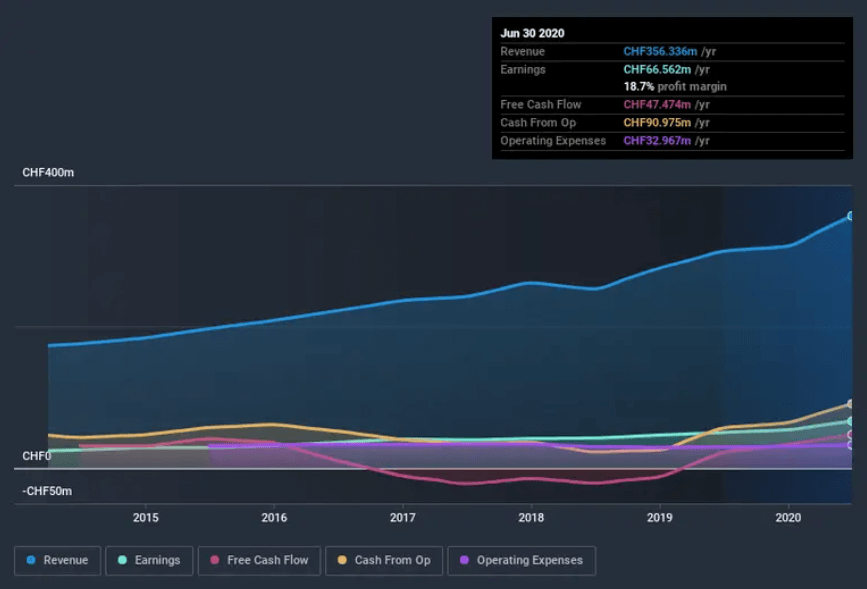

Bachem holding can proudly show a compound EPS growth rate of 17% for the last three years, which has no doubt fuelled the optimism of investors. While EBIT margins were flat over the last year, their revenues grew 16% to CHF 356 million.

Earnings vs Revenue as of June 2020 (Source: Simply Wall Street)

A decent share of the stocks is owned by insiders, which means that the company will be managed in their interest. Insider investors currently hold 63% of the company, for a total of CHF 3.2 billion. This will likely encourage a long-term managing model. According to Simply Wall Street analysts , this makes the stock an interesting buy for growth investors, who are interested in the success of a business over the long term. The Bachem swiss stock, which is currently priced at CHF 368 at the time of writing, showed a 642% growth over the past 5 years. This can be partly explained with the above-mentioned EPS growth, but it is most likely largely due to a strong investor’s enthusiasm, as the P/E ratio is fairly high at 76.69.

These analyses are further supported by Standard & Poor’s, which classifies the stock among their best growth stock. The company keeps beating earnings expectations, which encouraged analysts to raise their expectations.

Among their weaknesses, we still have to mention a strong resistance at CHF 406, as well as the lack of dividends, making yields low or non-existent, taking aside stock valuation growth.

The stock went up 642% in the last 5 years